Introduction

The terms ‘Insurance’ and ‘Assurance’ are acronyms that can be used interchangeably and can often confuse investors on the same. However, these two terms can be used for different contextual scenarios after all.

When you say, you have applied for an insurance scheme, it conveys a different meaning vis-a-vis you come across the policy that states that you have an assurance policy that gets covered by an ‘XYZ’ amount.

Let us unveil the key points of difference between insurance and assurancewhile also giving you a touch-down into the revolving specifics connected with both of these terms or acronyms. Helping you get started here:

What is Insurance- Meaning and Conceptualization Explained

Insurance is a calamity-protecting commodity wherein the partnership is done between an insurance service provider and the members who avail of subscription products from the company.

You can opt for a whole life insurance cover, a general insurance, a comprehensive health insurance plan, term insurance life cover, fire and accidental coverage insurance, burglary insurance, and travel insurance policies. Here, a subscriber chooses a policy and pays subscription amounts in lieu of the same.

Then when you arrive at health hiccups, or involve a contingency the insurance policy deals with, you can avail for a coverage amount from the insurance company. This way, you get unforeseen circumstances covered via insurance policies.

What is Assurance- Meaning and Conceptualization Explained

Assurance is a type of coverage that offers a solution to a type of calamity that can happen in a sure-shot manner. In this case, the death of any individual is inevitable.

Therefore, life assurance typically refers to the assurance of an individual’s life. Life assurance policies are usually long-term in nature. Here, the policy amount is collected in the form of premier subscriptions.

The amount can be paid out as a lump sum or as quarterly, half-yearly, and annual reimbursements. And the subscription amounts that are collected pool in as the policy coverage money on the whole.

This is the corpus amount that gets paid out to the nominee once the individual is no longer alone. The main aim of life assurance policies is to cover the expenses of families post the demise of their family member who is either working or retired.

Mostly retirees or pensioners deposit their lifetime savings into assurance policies with the aim of supporting their nearest kith or kin in the event of their timely or untimely demise.

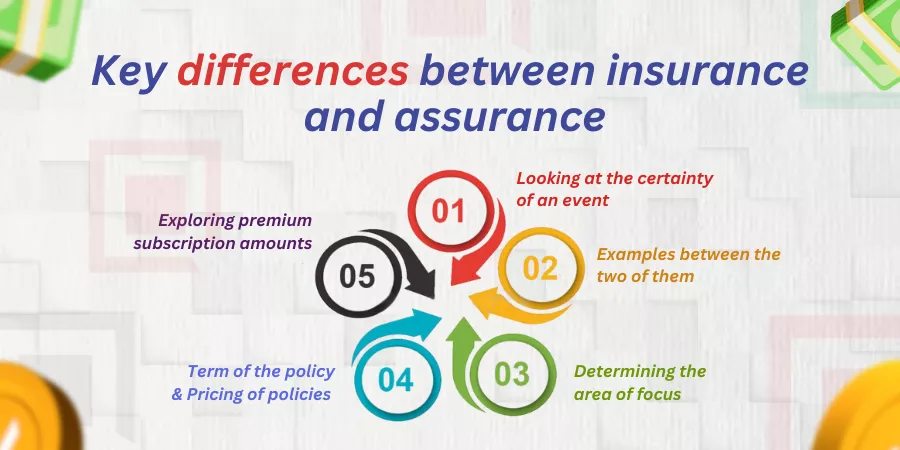

Key differences between insurance and assurance

These are the key points of difference between insurance and assurance. Let us have an overview on a run-down of pointers that are connected with the same:

Looking at the certainty of an event

Insurance policies are mainly taken for contingency situations or events that mankind can least expect or contemplate on what is going to happen next.

Whereas, with respect to assurance policy, the likeliness of a situation is guaranteed or is bound to occur in life. Life assurance policies are devised with events that can be predicted or guaranteed in life.

Examples between the two of them

Insurance policies can be health insurance, auto insurance, or travel insurance. You take up these policies and you do not know that these are the type of contingency situations you might have to tackle in life. However, you must foresee these situations while you contemplate medical emergencies, accidents, or travel-related contingencies.

Whereas, with respect to life assurance policies, the death of an individual is certain and is most likely to happen at some point in your life or on your journey into your living eco spaces. The life assurance policies are tailored that way. Therefore, life assurance policies or endowment policies are perfect examples of assurance-based policies.

Determining the area of focus

Insurance policies can be taken up by individuals, corporate companies, or even start-up enterprises wherein the possibility of contingencies the policies are taken up for might or may not happen. For instance, even if you take an auto insurance policy for your vehicle, you may end up not getting involved in an accident at all.

Whereas, in the case of life assurance, the area of focus lies on events that are most likely to happen. For instance, you can predict the death of an individual or inevitably foresee the retirement age of a working member of your family like your dad or mom. Life endowment policies or life assurance policies are designed or tailored that way.

Term of the policy

Insurance policies can be short-term, medium-term, or long-term policies. They are typically designed just to cover the designated contingency scenario the policy aims for. Say, for instance, travel insurance is a short-term travel policy that is taken up by individuals for a tenure ranging from three to six months when the individual departs from the home town into a foreign country over a travel visa and is back home.

Whereas, in the case of life assurance policy, the policies are designed over a long-term tenure ranging from 10-15 years or even more. Lifetime assurance or Universal life assurance policies cover the individual’s entire lifetime indeed.

Pricing of policies

Insurance policies are priced over short-term, medium-term, or long-term tenure indeed. The pricing therefore differs for the term wherein the policies are designed.

Whereas, life endowment or life assurance policies are costlier as the premium amounts are curated over a longer tenure period ranging from 10-15 years or even lasting the subscriber’s lifetime.

Exploring premium subscription amounts

Insurance policy premium subscriptions can be levied monthly, quarterly, half-yearly, or even annually.

Whereas, in the case of life endowment policies or life assurance policies, the amounts are collected over lumpsum with staggering subscriptions wherein the payments are rolled out annually or too.

What are the factors you must consider when you choose insurance policies with a service provider?

These are the factors you must consider when you choose insurance policies with a service provider. Let us have a run-down into the same:

Look for the credibility of the brand

While you choose a brand for taking up an insurance policy, you must typically look for the credibility of the brand. You must ensure that the service provider you choose has decades of experience in serving customers with the best and most customized solutions with respect to taking up different insurance products on the whole. Therefore, the service provider you choose must enjoy a long-standing credit rating and industry excellence rating in the marketplace.

Customer testimonials

You can look at customer testimonials to determine how effective the insurance provider you want to choose is. When you get an opportunity to visit the websites of top-class insurance providers, you can read through customer testimonials members or previous clients have put up sharing their experiences with the said insurance provider. By reading customer testimonials of insurance providers, you can make more well-informed choices when it comes to choosing the best insurance provider to help you further into the process.

Connect with customer support teams

You can connect with customer support teams of insurance service providers you may want to choose for your financial or investment protection needs. Here, you can connect with customer support teams to know more about the types of policies a service provider can offer to you.

You can also make further inroads with respect to pricing policies of varied insurance products you may have in mind. If you find that the customer support teams are prompt in getting back to you with comprehensive solutions or allow relationship managers to get in touch with you at the earliest, you can rest assured that this is the service provider you would be in a position to go in for.

Getting positive recommendations from friends or colleagues

You can connect with your friends or business colleagues to enquire whether they have been using insurance products for a while. If yes, what are the brands of service providers they have been using or giving their green thumbs up to? A positive recommendation from your friends or business colleagues doubles the trust you have to go in favor of a particular insurance-based service provider as such.

What are the features of a good insurance policy?

Here are the features you can look for in a good or optimal insurance policy. Let us have an overview of the same:

Flexible premium payment policy

When you look for an ideal insurance policy, you look for flexible pricing of premium payments on the whole. Most insurance service providers allow their subscribers to make payments monthly, quarterly, half-yearly, or annually. You can choose one accordingly.

Minimal paperwork

When you look for an ideal insurance policy, you do not want to fill out a bundle of forms and add to a bulky paperwork process to tag along with. You would love to fill most of your forms online with some of the tech-savvy insurance companies allowing you to attach your ID or verification documents digitally too. This way, you make your paperwork easy while signing up for a said insurance policy as such.

Compatibility with different digital devices

You may not always have the laptop with you. You may carry your mobile phone or a smart tablet while thriving out on the go. Therefore, you do not want to get stuck without being able to contact your insurance company, fill out forms, or even pay premium payouts. Therefore, an ideal insurance policy must be digitally compatible to work on iPads, smartphones, or mobile phones on the whole.

Must have multiple retail outlets across the city

When you look for an ideal insurance policy vis-a-vis the service provider, you do not want to experience woes over getting across to retail outlets or have trouble arranging for logistics from your neighborhood to the insurance office outlet. Therefore, your insurance policy must support you with multiple retail outlets to and fro the city premises.

Why are insurance products preferred- Detailed insights into the same

Insurance products are preferred for a number of reasons. Let us have a run-down of primary reasons why investors prefer adding an insurance component to their investment products.

Calamity protecting product

Insurance is a calamity-protecting product that provides you with coverage on different kinds of unforeseen emergencies or contingencies you may contemplate in your life as such. You have life insurance, automobile insurance, fire damage insurance, health or medical insurance, or burglary coverage insurance policies.

This way, you can lead a stress-free and relaxed life when you cover most of your emergency situations through a wide range of insurance policies you have to choose from.

Doubles up as a lucrative source of investment

When you sign up for an insurance policy, it doubles up as a lucrative source of investment for you to count back on. Most insurance policies provide a modest rate of return on your capital investment. For a life assurance policy, you may park a lumpsum amount with an insurance service provider. This money is then given to your family members in the event of your untimely demise wherein your savings can further be utilized by grieving family members who were dependent on your earning source of income alone. Therefore, insurance product serves as an ideal form of investment for individuals or families.

The Bottom Line

Insurance products must be taken up after reading disclosure documents at length. These products are also subject to a fleet of market risks. One must therefore read offer-related terms and conditions of policy documents before proceeding to sign in on the dotted lines.

Frequently Asked Questions or FAQs

Define a life insurance policy

Answer: A life insurance policy is a type of assurance policy that covers the life of an individual. In case the primary subscriber demise, the entire policy assurance amount gets credited to the family member whose name has been referred to as ‘nominee’ on the policy document by the primary or principal insurance holder.

Define a term insurance plan

Answer: A term life insurance plan is a type of life insurance plan that covers a specific term period of your life. It can range from 10-15 years. Here, you get the policy amount over the expiry of the term period or over the demise of the primary insurance holder, which ever even takes place earlier.

How does an insurance policy help you?

Answer: The insured get financial security and peace of mind against unforeseen events or contingencies that life may throw at you. You get a financial protection against unforeseen financial losses against a sudden fire break out happening at your factory outlet or in lieu of an unforeseen medical emergency. A property insurance can cover the repairs and refurbishments you undertake on your property from time to time. Therefore, a policy can help financial dependents by covering each of the above calamities if you have insurance policies taken in lieu of each situation as explained here.