Defensive stocks have long been the cornerstone of a conservative portfolio, providing stability during times of economic uncertainty. These securities tend to maintain their worth, even when the stock market generally drops.

In this blog post, we delve into understanding defensive stock and their role in investment portfolios. We’ll examine how they perform during recessions and expansions, shedding light on traditional as well as emerging defensive sectors.

We will also take you through case studies of top-performing defensive stocks like Catalyst Pharmaceuticals and Cal-Maine Foods Inc., along with an analysis of New Jersey Resources Corporation’s resilience.

Furthermore, we explore the defense industry from a unique perspective – looking beyond conventional military equipment manufacturing.

Lastly, we analyze Boeing’s impressive growth stock rate and Raytheon Technologies’ declining profits within Defense Equities for 2023. The final section offers insights into investing strategically in both traditional and non-traditional defenses amidst geopolitical uncertainties.

Understanding Defensive Stocks

Investing can be a rollercoaster ride, but have you heard of ‘defensive stocks’? These are established companies that offer stable earnings and consistent dividends, regardless of the overall stock market state.

In the UAE and the Middle East, these types of investments can be a smart addition to your portfolio.

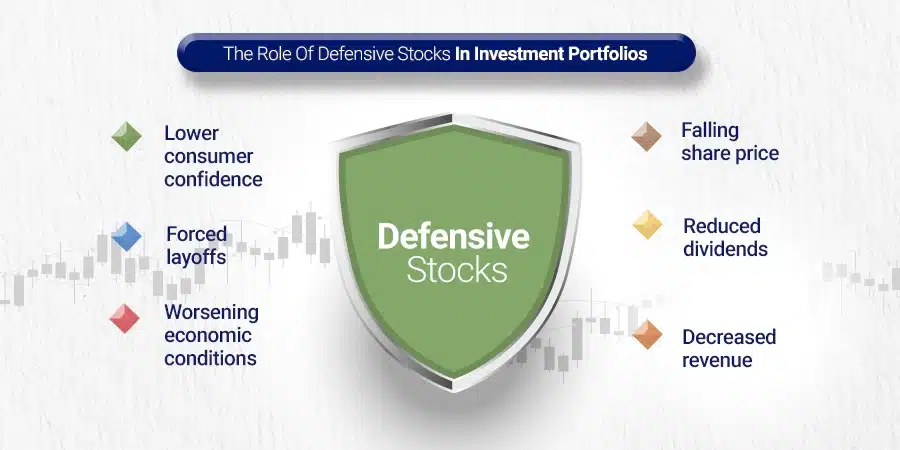

The Role Of Defensive Stocks In Investment Portfolios

A defensive stock plays a ‘defensive’ role in your portfolio, acting as insurance against economic downturns or market instability.

They don’t fluctuate dramatically with changes in economic conditions because they operate in industries where demand remains relatively constant.

Think of utilities like water and electricity providers or consumer staples such as food producers.

pros

- Stability

- Dividend income

- Diversification

cons

- Lower growth potential

- Interest rate sensitivity

- Limited protection

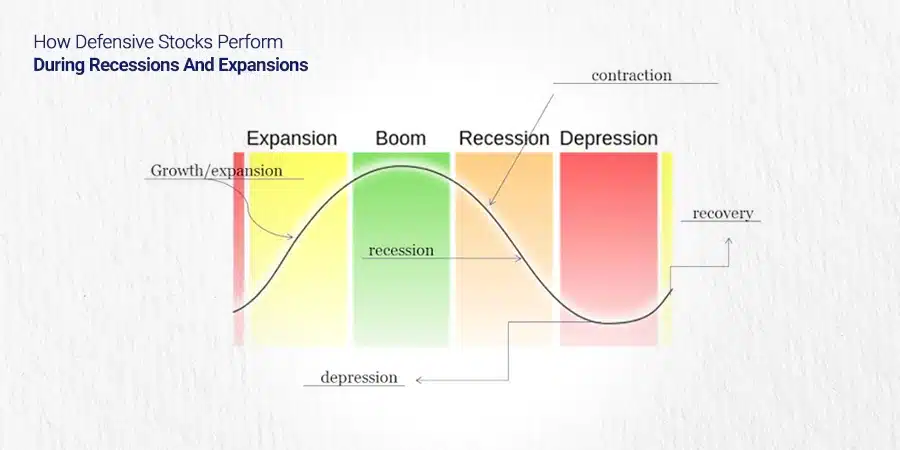

How Defensive Stocks Perform During Recessions And Expansions

Different investments have varying performances depending on the phase of the business cycle. Cyclical stocks can outperform during expansions but may lag during recessions.

A defensive stock, on the other hand, typically performs better than most other assets when markets turn bearish due to their steady income streams even amidst broader financial turmoil.

Adding some defensive positions to your portfolio mix at Quadra Wealth can be a smart move.

Our team has extensive experience guiding expatriates toward achieving financial independence through structured notes while providing consistent growth on their portfolios over time.

Want to learn more about defensive stocks? Check out Investopedia for additional information.

Key takeaways

Investing can be unpredictable, but defensive stocks may offer stability in uncertain times.

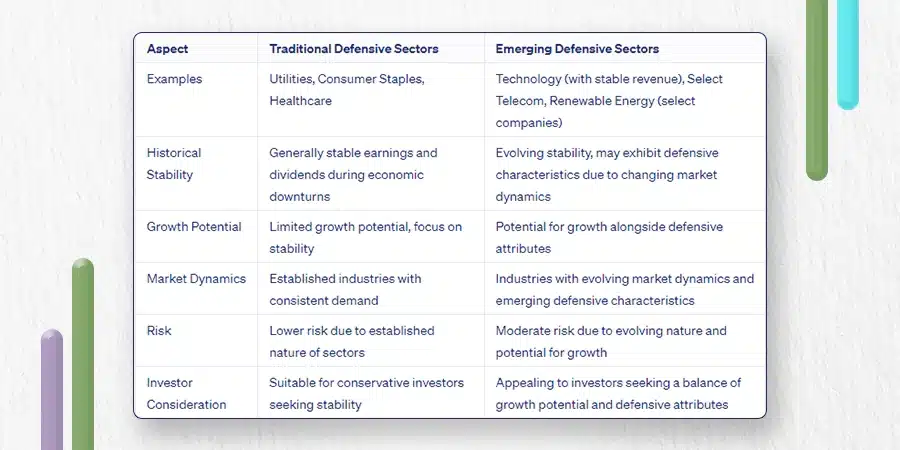

Traditional vs Emerging Defensive Sectors

When investing, a defensive stock is typically seen as a reliable option. These are shares in companies that provide essential goods and services, things people need no matter what’s happening in the economy.

Traditionally, defensive sectors include utilities like water and electricity companies, healthcare providers, and consumer staples firms.

Overview of a traditional defensive sector

Classic examples of defensive stocks come from industries such as utilities and consumer staples. Water companies like American Water Works Company Inc., and electric utility corporations such as Duke Energy Corporation or Southern Company are prime examples due to their steady demand and predictable revenue streams.

Similarly, food manufacturers like The Kraft Heinz Company or tobacco giants Altria Group Inc., despite being subject to regulatory risks, can be considered part of this category due to the constant demand for their products.

Healthcare also falls under the umbrella of traditional defenses with major pharmaceutical companies like behemoths Pfizer Inc., Johnson & Johnson, or medical device makers Medtronic plc providing consistent returns even during recessions thanks largely to ongoing demands for medicines/treatments irrespective of economic conditions.

Shares of major pharmaceutical companies and medical device makers have historically been considered defensive stocks.

pros

- Stability

- Dividend income

- Resilience

cons

- Lower growth potential

- Interest rate sensitivity

- Cyclical Risks

The emergence of new industries as a potential defensive sector

In recent times, we’ve seen an emergence of certain non-traditional areas becoming increasingly attractive options when considering investments into ‘defense’.

For instance, technology has become so ingrained in our lives that it’s now almost unthinkable not to have access thereto hence why tech-giants Apple Inc.,

Microsoft Corporation etcetera could potentially be viewed favorably by risk-averse investors seeking stability amidst volatile markets since chances remain high about continued patronage towards these brands notwithstanding broader financial uncertainties looming large on horizons worldwide today.

Besides IT, another industry worth mentioning here is renewable energy because global warming concerns continue mounting up thereby prompting governments across continents to push hard to promote cleaner alternatives over fossil fuels leading consequently towards greater adoption rates overall especially among developed nations making players involved therein – e.g.: NextEra Energy Resources LLC – viable candidates worthy consideration within portfolios aiming long-term growth without compromising much on safety aspects either way round going forward indeed.

pros

- Growth Potential

- Diversification

- Market Demand

cons

- Volatility and Uncertainty

- Lack of Track Record

- Regulatory and Competitive Risks

Key takeaways

Defensive stocks are a safe investment option, with traditional sectors including utilities, healthcare, and consumer staples. However, emerging industries such as technology and renewable energy are also becoming attractive options for many investors seeking stability amidst volatile markets.

Case Studies on Top Performing Defensive Stocks

In the unpredictable world of stock market investing, a defensive stock often provides a sense of stability and predictability.

These are typically companies that consistently perform well regardless of economic conditions. Let’s explore some of the leading stocks in defensive investing.

Performance analysis of Catalyst Pharmaceuticals

Catalyst Pharmaceuticals is a biotech company that has shown consistent performance over time. Despite market fluctuations, it continues to deliver solid results due to its robust product portfolio and strategic growth initiatives.

This stock is a great option for investors looking for stability in the biotech sector.

Reviewing Cal-Maine’s business model & performance

The food industry also offers several promising defensive stocks including Cal-Maine Foods Inc.. As the largest producer and distributor of fresh eggs in the U.S., Cal-Maine’s earnings remain stable even during periods of financial turmoil.

This stability makes it an attractive option for investors seeking steady returns.

The resilience showed by New Jersey Resources Corporation

The energy sector also houses resilient players such as New Jersey Resources Corporation (NJR). NJR exhibits strong resilience during downturns thanks to its diversified operations spanning natural gas distribution, clean energy investments, and midstream assets which ensure steady revenue streams despite volatile market scenarios.

All these case studies underscore how carefully chosen defensive stocks can serve as reliable pillars within your portfolio – providing both consistency and protection against wider market volatility.

However, remember that while they offer relative safety compared with other types of equities due to their inherent stability aspect, no form of equity-based investment comes without inherent risks.

So always exercise prudence when making any investment decisions.

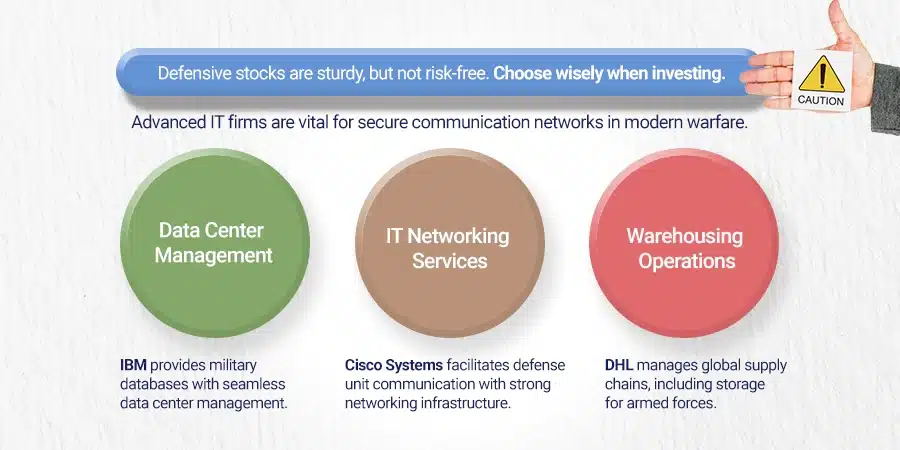

Defense Industry – A Unique Perspective

The defense industry, often associated with military equipment manufacturing, offers a unique perspective on defensive stocks.

This sector extends far beyond conventional arms production and includes diverse areas such as data center management, IT networking services, warehousing operations for inventory control, and administrative tasks.

These seemingly mundane sectors present wide-ranging opportunities for profit generation that go beyond mere arms sales.

The Scope & Diversity within the Defense Industry

Contrary to the general opinion, the defense sector is not just about constructing tanks or aircraft. It encompasses an array of businesses offering products and services essential to national security.

For instance, firms providing advanced IT solutions play a crucial role in maintaining secure communication networks necessary for modern warfare.

- Data Center Management: Companies like IBM offer sophisticated data center management services ensuring the smooth operation of military databases around the clock.

- IT Networking Services: Firms like Cisco Systems provide robust networking infrastructure supporting seamless information flow across various defense units.

- Warehousing Operations: Logistics companies such as DHL are involved in managing complex supply chains including storage facilities required by armed forces worldwide.

Investment Opportunities Beyond Conventional Military Equipment Manufacturing

In addition to traditional defense contractors like Lockheed Martin or Boeing who manufacture aircraft and missiles, there are also ample opportunities within non-traditional defenses that can be explored by investors seeking steady returns amidst market volatility.

As technology continues advancing at breakneck speed – particularly AI – new avenues have opened up within this space too where one could potentially invest strategically, thereby building wealth sustainably over time while mitigating inherent risks typically associated with equity-based investments.

- Cybersecurity: Firms specializing in cybersecurity such as Palo Alto Networks are increasingly important given rising threats from cyberattacks globally.

- Satellite Communication: Satellite communication providers like Viasat Inc. ensure reliable connectivity even under challenging battlefield conditions.

- Drones Technology: Drones manufacturers including AeroVironment stand out due to their growing relevance, especially for surveillance purposes during conflicts.

To sum it up succinctly – if you’re looking towards diversifying your investment while simultaneously hedging against potential downturns, then considering both traditional plus non-traditional ‘defenses’ might just prove beneficial indeed.

Key takeaways

The defense industry offers diverse investment opportunities beyond conventional military equipment manufacturing, including data center management, IT networking services, warehousing operations, cybersecurity, satellite communication, and drone technology. Investors seeking steady returns amidst market volatility can explore both traditional and non-traditional defenses to diversify their portfolio while mitigating risks associated with equity-based investments.

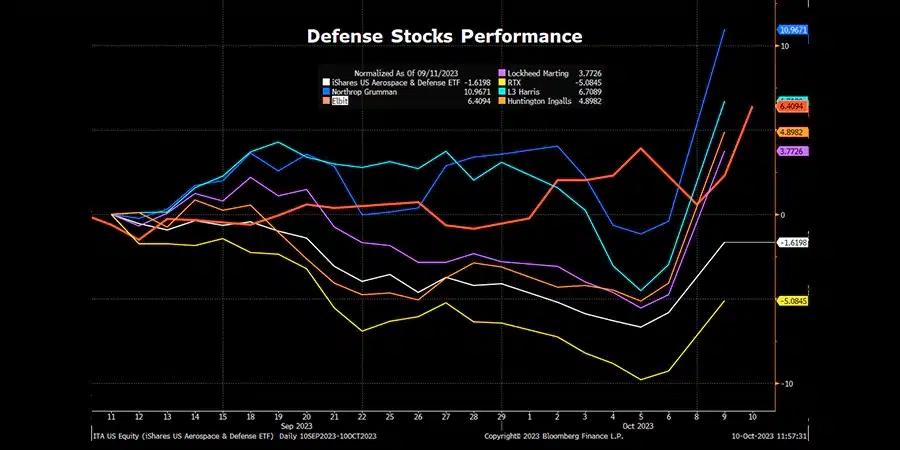

Performance Analysis of Defense Equities in 2023

In 2023, defense equities proved to be a safe haven for investors, with some stocks outperforming the broader market. These stocks tend to hold up well even during periods of economic uncertainty or market decline.

Analyzing Boeing’s Impressive Growth Rate

Boeing’s share price skyrocketed by 58% in 2023, despite the overall market volatility. This growth can be attributed to the strong demand for commercial aircraft and a steady stream of contracts from defense departments worldwide.

Boeing’s investment in cutting-edge technologies such as AI and UAVs has enabled them to maintain a competitive advantage over their rivals.

A Closer Look at Raytheon Technologies’ Declining Profits

On the flip side, Raytheon Technologies saw a decline in profits, leading to lower share prices (-7.65%). Despite being a major supplier of aerospace and defense products, Raytheon struggled due to rising material costs, pandemic-induced disruptions, and increased cybersecurity threats.

- Rising material costs: Increased production expenses due to a surge in raw material prices.

- Pandemic-induced disruptions: Manufacturing activities were affected by widespread lockdowns, while travel restrictions hit demand for commercial aviation services.

- Cybersecurity threats: As digital transformation accelerates globally, companies like Raytheon are investing heavily in cybersecurity measures, impacting their bottom-line results.

This case study serves as a reminder that while defensive stocks are generally resilient against market downturns, they are not immune to business-specific risks or broader macroeconomic headwinds.

Investors must exercise caution when selecting individual companies within this sector for investment purposes.

Investing Strategically Into Both Traditional And Non-traditional Defenses

In today’s uncertain times, it is essential to construct a portfolio that incorporates both traditional and non-traditional defenses for long-term wealth creation while reducing exposure to market volatility.

This approach can help build wealth sustainably over time while mitigating risks associated with equity-based investments.

Balancing Your Portfolio with Traditional & Non-traditional Defenses

Spreading investments across different asset types is the key to mitigating risk and creating a successful portfolio. Balancing your portfolio with a combination of traditional defensive stocks, such as utilities or consumer staples companies, along with emerging sectors like technology or healthcare can provide stability during market downturns.

Non-traditional defense sectors, such as data center management, IT networking services, and warehousing operations, offer the potential for stable returns due to their resilience against market volatility.

These sectors are increasingly becoming integral parts of our digital economy.

Navigating Geopolitical Uncertainties through Strategic Investments

Geopolitical events can significantly impact financial markets, making it essential for investors to stay informed about global affairs.

However, instead of reacting impulsively based on news headlines, it’s crucial to maintain a long-term perspective and stick to your investment strategy.

A well-diversified portfolio comprising both traditional defensive stocks (like utility companies) and non-traditional ones (such as tech firms specializing in artificial intelligence) could serve as an effective hedge against these uncertainties.

For instance, Bloomberg suggests that even amidst trade wars or political unrest, certain industries tend to remain resilient due to their inherent characteristics – providing goods/services whose demand remains relatively constant irrespective of prevailing

macroeconomic conditions.

This balanced approach towards investing will not only protect you from short-term market fluctuations but also position you well for long-term growth by capitalizing on the ongoing technological revolution while simultaneously benefiting from the consistent performance delivered by conventional defensive sectors.

Key takeaways

Investing strategically in a mix of traditional and non-traditional defenses can help build wealth sustainably over time while mitigating risks associated with equity-based investments. Balancing your portfolio with both defensive stocks like utilities or consumer staples companies, along with emerging sectors like technology or healthcare, is key to successful investing. Non-traditional defense sectors offer the potential for stable returns due to their resilience against market volatility, making them an integral part of our digital economy.

Conclusion

Stick to summarizing what was covered in the outline and reiterating its importance in the conclusion – no new info!

Defensive stocks are a must-have in your investment portfolio for stability during economic downturns.

From traditional sectors like healthcare and utilities to emerging industries like technology, we’ve got you covered.

Check out top-performing defensive stocks like Catalyst Pharmaceuticals, Cal-Maine Foods, and New Jersey Resources Corporation.

And don’t forget about investment opportunities in the defense industry beyond just military equipment manufacturing.

FAQs in Relation to Defensive Stocks

What are some examples of defensive stocks?

Defensive stocks belong to industries like utilities, consumer staples, and healthcare, and examples include Catalyst Pharmaceuticals, Cal-Maine Foods, and New Jersey Resources Corporation.

Is investing in defense stocks a good idea?

Defense equities can be solid investments due to their steady demand regardless of economic conditions, but it’s crucial to conduct thorough research before investing also building a defensive investment strategy might help protect you from greater losses during a recession or economic downturn.

What are some defensive stocks to consider buying now?

The choice depends on your risk tolerance, investment goals, and market research, so it’s always best to consult with a professional advisor for investment advice before making any decisions.

Are defensive stocks a safe investment?

No investment is entirely “safe,” but defensive stocks tend to be less volatile during downturns, although they might underperform during expansions, so diversification across different asset classes can help manage risk effectively.

What is defensive vs cyclical stocks?

Defensive stocks are nearly always in demand because they provide essential products and services while cyclical stocks are affected by consumer demand and systemic changes like market downturns.