In This Article

What is an Offshore Investment? A Guide for UAE Expatriates

What is an offshore investment? Offshore investing is a technique that enables individuals and businesses to put their money in foreign jurisdictions, providing potential advantages like tax benefits and access to various financial instruments.

This advanced method of investing allows investors to capitalize on the opportunities presented by international markets, offering benefits such as tax advantages and access to diverse financial products.

In this comprehensive guide, we will delve into the intricacies of offshore investments, exploring their legality and the various strategies employed.

We’ll also discuss domestic laws affecting offshore accounts, providing you with a well-rounded understanding of offshore investment.

We’ll further explore how expatriates can incorporate global investments within their pension plans and examine the costs associated with setting up an offshore account. In addition, we will highlight some potential risks that come with expanding portfolios via offshoring.

The importance of compliance aspects when going global will be addressed too, along with attractive fiscal statuses provided by certain locations like Luxembourg-based funds.

By the end of this guide, you’ll be well-equipped to make informed decisions about global portfolio expansion.

Understanding Offshore Investments

Offshore investing means putting your money in entities located outside your home country. It’s legal and legit, offering unique financial opportunities not available domestically.

Investors are attracted by incentives like tax breaks or secrecy legislation. Despite being hosted overseas, these accounts are subject to domestic laws.

What is an offshore investment. Defining Offshore Investments and Their Legality

An offshore investment refers to keeping money in a jurisdiction other than your own country. It’s not just for the wealthy or illicit businesses.

Many individuals and companies legally take advantage of investing offshore every day.

Benefits of Offshore Investment Strategies

- Tax Advantages: One of the main reasons people invest offshore is to take advantage of tax benefits, which can significantly increase net returns on investments.

- Diversification: Another benefit includes portfolio diversification, which helps reduce risk by spreading investments across different economies and markets worldwide.

- Currency Diversification: It also allows you to hold funds in different currencies, offering another layer of asset protection against currency fluctuations at home.

- Favorable Regulations: Several offshore jurisdictions offer less restrictive regulations on business operations, making them attractive destinations for setting up businesses or trusts.

Domestic Laws Affecting Offshore Accounts

The perception that all offshoring activities are illegal stems from instances where they’ve been used unethically for evading taxes or hiding ill-gotten wealth.

Despite potential misuses, when done in compliance with all applicable laws – including FATCA regulations for US citizens – offshoring is not inherently unlawful.

FATCA, enacted by the U.S., requires foreign banks to report information about financial accounts held by U.S. taxpayers directly to the IRS, thereby reducing chances for evasion via non-disclosure.

Despite being located abroad, these entities must comply with certain domestic rules, particularly around taxation, ensuring fair play while preventing misuse.

This provides economic benefits both locally and globally through increased capital mobility leading to higher growth rates overall.

Remember though: Always consult experienced professionals before venturing into unfamiliar territories, especially when dealing with complex issues such as international finance.

Key takeaways

Investing offshore is something legal and offers unique financial opportunities not available domestically. They provide tax advantages, portfolio diversification, currency diversification, and favorable regulations for setting up businesses or trusts. However, they must comply with certain domestic rules to ensure fair play while preventing misuse. It's important to consult experienced professionals before venturing into unfamiliar territories like international finance.

Setting Up an Offshore Account

Offshore investment is something not a walk in the park. It requires careful planning, due diligence, and significant initial capital. The process of setting up an offshore account involves certain costs, including minimum investment requirements ranging between $100,000 to $1 million, along with additional expenses related to legal fees or corporate registration charges.

The Costs Associated with Setting Up an Offshore Account

The first step towards offshore investing is understanding the financial commitment involved. These accounts often require a hefty minimum deposit, which can range from six figures upwards depending on the jurisdiction and type of financial products you’re interested in.

In addition to this, there are setup costs such as legal fees for establishing an offshore trust or corporation, ongoing management fees for maintaining your investments, and potential exit charges should you wish to withdraw your funds.

Besides these direct costs associated with offshore accounts, investors must also consider indirect expenses like tax implications that may arise from their overseas investments.

While one of the key benefits of investing in offshore investment funds includes potential tax advantages compared to domestic alternatives, it’s crucial that investors understand their home country’s laws regarding foreign income and capital gains.

The Importance of Engaging Reputable Firms and Specialists

To navigate through these complexities effectively while ensuring compliance with both domestic and international regulations surrounding offshore jurisdictions, it’s advisable to engage reputable firms specializing in this field.

These companies have extensive knowledge about various investment opportunities available globally, giving foreign investors unlimited access to the international market where they can diversify their portfolios beyond what would be possible domestically.

In addition to guiding clients through the setup process smoothly without any hiccups along the way- whether it’s selecting suitable mutual funds or structuring assets optimally for tax purposes – these experts provide invaluable advice tailored specifically according to the investor’s needs and preferences, thereby maximizing returns while minimizing risks associated with global ventures.

Apart from hiring professional help when venturing into unfamiliar territory like offshore investing, individuals need to conduct thorough research themselves too before making any investment decisions involving large sums of money.

Ultimately, the responsibility lies with them to ensure the legality and legitimacy of all transactions undertaken abroad, despite being hosted outside the borders of their own nation-state.

This means staying updated on the latest changes in laws affecting cross-border dealings, especially those pertaining to taxation matters, to avoid falling foul of authorities later down the line due to ignorance or negligence on their part.

Key takeaways

Offshore investment requires careful planning and significant initial capital, with minimum investment requirements ranging from $100,000 to $1 million. You can normally open an offshore investment account which involves costs such as legal charges or corporate registration charges, along with ongoing management fees for maintaining investments. It's important to engage reputable firms specializing in this field and conduct thorough research before making any decisions involving large sums of money to ensure compliance with both domestic and international regulations surrounding offshore jurisdictions.

Expatriates and Pension Plans

As an ex-pat in the UAE, you might already be offshore investing without even realizing it. Many pension plans invest globally, providing access to international markets and diversifying portfolios across various offshore jurisdictions.

Global Investments in Pension Plans

Pension funds invest in various offshore financial products, including foreign companies and mutual funds, and offer fairly secure investment opportunities for capital gains from diverse economies worldwide. If you have a pension plan, some of your fund’s assets are likely invested overseas.

Investing offshore promotes a healthy investment environment by spreading risk across different markets and sectors. It also offers potential tax incentives due to different taxation policies among countries.

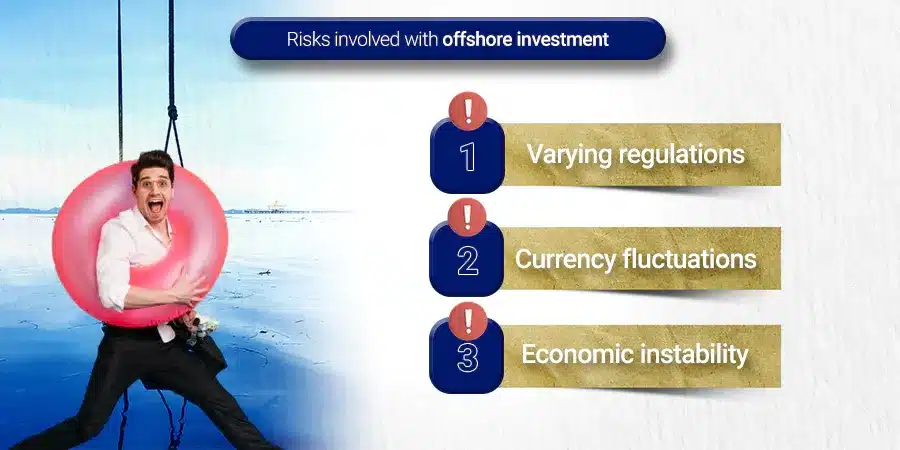

Risks of Offshore Investing

While offshore investing has its benefits, it’s essential to consider the risks involved:

- Varying regulations: An offshore bank account operates under different legal systems that may offer less protection than domestic ones.

- Currency fluctuations: Investments held in foreign currencies expose you to exchange rate risks.

- Economic instability: Some countries where investors reside might have unstable economies that could impact returns on investments.

To mitigate these risks while still reaping the potential rewards offered by offshore funds, seek advice offered by reputable offshore companies specializing in wealth management services like Quadra Wealth.

Their expertise can help navigate complex regulatory environments and develop a robust range of investment strategies tailored to individual needs, ensuring an optimal balance between risk tolerance levels and expected return rates, thereby helping achieve long-term financial independence goals more effectively than traditional approaches available domestically.

International Diversification Through Offshoring Strategies

As an experienced blog editor with a knack for SEO, I know that international diversification through offshoring is a strategy that can maximize returns for seasoned investors.

By investing in markets outside of their home country, investors can spread risk and potentially enhance returns.

The Benefits of International Diversification via Offshoring

International diversification provides a safety net against domestic market volatility. By spreading investments across different geographical regions, investors can mitigate risks associated with economic downturns or political instability within a single country.

This strategy is particularly appealing for expatriates residing part-time outside the UK. Investing offshore may have favorable tax implications depending on individual circumstances and residency status.

Tax Implications for UK Residents Investing Overseas

UK-based funds typically deduct taxes at source, which could reduce overall investment profits. However, some equivalent counterparts operating outside of your home country do not have this requirement, potentially enhancing overall returns under specific scenarios.

It’s important to note that while offshore accounts might offer an initial tax advantage, they’re still subject to taxation upon repatriation into the investor’s home country. Novice investors venturing into global markets often overlook this aspect.

For example, a UAE resident investing in a Luxembourg-based fund – known for its favorable fiscal status – may earn substantial dividends over time without immediate deductions at source, unlike local UK-based funds.

However, if this income gets transferred back into their native country (say, the UK), it becomes liable towards applicable taxes thereupon despite having initially enjoyed preferential treatment abroad.

Understanding how both domestic and foreign laws interact is critical before making decisions regarding cross-border transactions. If done right, such strategies could help optimize after-tax profits, contributing positively towards achieving financial independence goals set forth by Quadra Wealth.

Key takeaways

Offshore investments can provide international diversification and potentially enhance returns while mitigating risks associated with economic downturns or political instability in a single country. Expatriates residing part-time outside the UK may find favorable tax implications depending on individual circumstances, but it's important to understand both domestic and foreign laws before making decisions regarding cross-border transactions.

Compliance Aspects of Overseas Investment

When offshore investing, it is important to be aware that any growth achieved may still be subject to taxation by your home country. Your home country may still levy taxes on any growth realized through your overseas investment.

Understanding Tax Liabilities When Going Global

Investing globally can be tempting, but without a clear understanding of tax liabilities, you could be in for a rude awakening come tax season.

Taxes on foreign income are complex and vary depending on factors like residency status and international agreements between countries.

Here are some key points to consider:

Familiarize yourself with double-taxation treaties: Many countries have established treaties to prevent individuals from being taxed twice on the same income by two different jurisdictions.

- Avoid illegal tax evasion: Minimizing taxes is legal, but evading them is not only unethical but also punishable by law. Always operate within legal boundaries when managing your offshore investment accounts.

Each jurisdiction has its own unique rules regarding foreign income, so professional advice is essential for anyone considering an offshore investment strategy.

Maintaining Compliance with Home Country Regulations

Compliance with domestic laws is crucially important, no matter where you choose to invest your money. This includes accurately reporting any earnings or assets held abroad during tax season back home.

- US citizens or resident aliens living abroad must report all income, regardless of whether they received any US-issued Form W-2s.

Professional services like tax preparation services can assist you in remaining compliant at all times, giving you peace of mind and allowing you to focus solely on growing your wealth securely.

Attractive Fiscal Status For Global Clientele

When it comes to offshore investment, some destinations are more favorable than others. Two of the most attractive options are Jersey and Luxembourg, both offering unique benefits that appeal to global investors looking to maximize their after-tax profits.

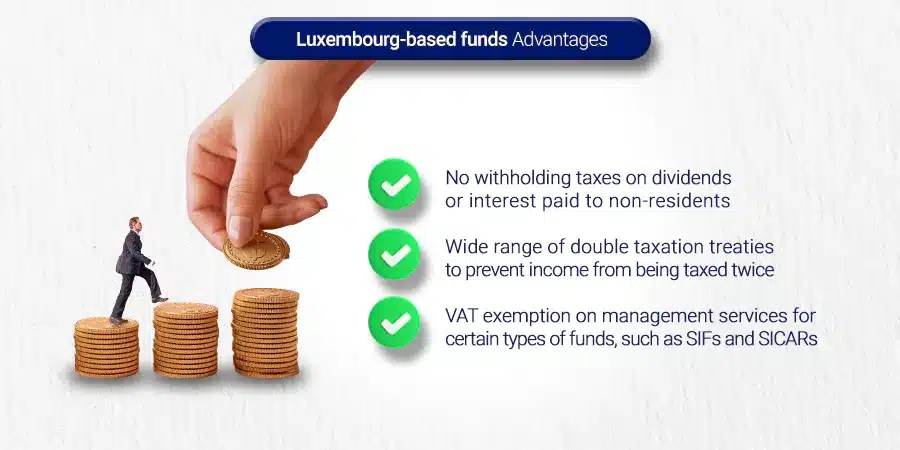

Advantages of Luxembourg-based funds

Luxembourg’s investor-friendly tax regime and strong regulatory framework have made it an attractive option for global investors looking to maximize their after-tax profits. Here are some of the key advantages:

- No withholding taxes on dividends or interest paid to non-residents

- Wide range of double taxation treaties to prevent income from being taxed twice

- VAT exemption on management services for certain types of funds, such as SIFs and SICARs

These factors have made Luxembourg-based funds an attractive option for expatriates living in the UAE and other parts of the Middle East who want to achieve consistent growth in their portfolios while minimizing their tax liabilities.

Firms like Quadra Wealth can help investors navigate the complexities of investing in Luxembourg-based funds.

HSBC Expat bank accounts under the Jersey Bank Depositor Compensation Scheme

For offshore investors looking for financial security, HSBC Expat bank accounts covered under the Jersey Bank Depositor Compensation Scheme (JDCS) are an attractive option. Here’s why:

- Individual depositors can claim up to £50,000 in compensation if their bank fails (£100,000 for joint account holders)

- Dividends earned from foreign shares are taxed similarly to other regular income streams, simplifying the filing process

These features make HSBC Expat bank accounts an appealing choice for investors looking for peace of mind and simplicity. For more information, visit the HSBC Expat website.

“Maximize your after-tax profits with Luxembourg-based funds and secure your investments with HSBC Expat bank accounts covered under JDCS.

Conclusion

Stick to the outline when summarizing what was learned about offshore investing, avoiding new topics.

Investing offshore can offer global diversification and potential tax benefits but requires careful consideration of domestic laws and reputable firms.

Legalities, benefits, costs, and risks associated with investing offshore were covered, as well as international diversification strategies, pension plans for expatriates, tax implications for UK residents investing overseas, compliance aspects of overseas investment, and attractive fiscal status offered by Luxembourg-based funds.

Understanding tax liabilities while going global is crucial to ensure compliance with regulations.

Investopedia provides more information on investing in offshore.

FAQ

An offshore investment is when you keep your money in a different country than your own, often in the form of offshore stock, bonds, mutual funds, or real estate.

One example of investing offshore is depositing money into a bank account located in another country, or buying property or shares in foreign companies.

Offshore investing can provide diversification and a potential tax advantage, but it also carries risks like currency fluctuations and geopolitical instability that investors need to consider. Money Advice Service has more information.

- Advantages include potential tax benefits and asset protection.

- Disadvantages could be legal complexities associated with different jurisdictions and increased risk due to economic conditions abroad.

Should I talk to a Financial Advisor When Buying a House?

In This Article Are you planning on purchasing your first home? Or thinking of splurging

Master Robert Kiyosaki: 10 Keys to Financial Freedom

In This Article Have you ever felt the earn, spend and save trilogy too mundane?

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIPs make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way