Introduction

As you can best explore the trend it is out here, AI and automated software are ruling the world today. Therefore personalized software can be a boon for a lot of investors who do not want the hassle of traveling down to an investment office or working with a broker every day to know the latest trends with stocks or bonds or to help them with financial planning.

A Personalized software is therefore going to come to your advantage wherein you have chatbots or automated software helping you gauge market trends and explore volatilities in the market without you having to manually sit in front of your laptop or desktop reaching for details.

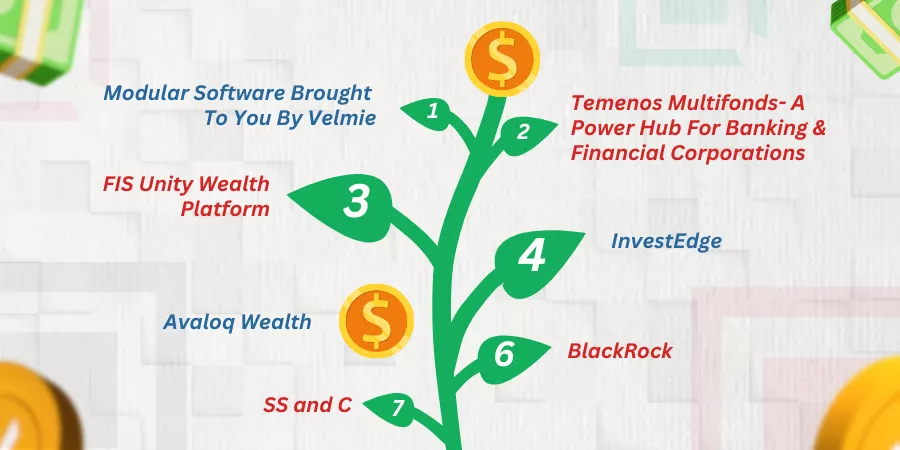

On this parlance, let us explore the top 7 Best Wealth Management Software For Individuals for the year 2024:

Modular Software Brought To You By Velmie

Velmie offers a modular Wealth Management software that is ideal for financial advisors, bankers, investment advisors, and wealth management companies on the whole. This software can be highly customized because of the platform’s engaging API orchestrations. The software facilitates excellent client engagement by allowing customers to access multiple payment channels for finance-aided transactions through its posh and viable wealth management tools.

The UI design of the Velmie software is so intuitive and user-friendly that the banking transactions can be streamlined in a smooth and engaging manner. Therefore, the modularity of the software supports seamless integration amongst independent wealth managing practitioners or can be used on a massive scale by banking corporations or wealth management service providers on the whole.

Temenos Multifonds- A Power Hub For Banking And Financial Corporations

Temenos Multifonds is a powerful platform that provides customized software solutions for banking and financial corporations. Using this platform, you can avail tailor-made financial goal solutions to serve the intricate needs of asset/ financial management and investment management sectors. You can use the software solution as a one-shop-one-stop hub that takes care of finance, administration, accounting, and investment servicing capabilities in one single go.

This is software that can automate and simplify complex investment solutions and provide a wide range of performing your banking cum financial iterations. These include facilitating the best in-house solutions for investment funds, hedge funds, and mutual funds. In a nutshell, the software that is offered by Temenos Multifonds helps wealth management firms improve their operational efficiency by mitigating risks while also ensuring smooth compliance with regulatory standards.

FIS Unity Wealth Platform

FIS Unity Wealth Platform provides seamless integrations for wealth management firms or independent practitioners who would want to thrive on their own. Here, you get a seamless experience to serve customers or clients for front office and online operations. The software helps you cater to wealthfront needs of high-net-worth retail as well as institutional investors on a comprehensive scale indeed. This is the software that provides customized as well as tailor-made solutions for wealth management companies on the whole.

Data leveraging happens via AI bots. The seamless API integrations help you automate mundane financial operations and help wealth managers or advisors present a clearer picture to the clients and stakeholders. The software also helps in varied forms of decision-making through the recommendations or cues it provides via predictive analysis the online bots perform across the software platform.

InvestEdge

InvestEdge is a pioneering software that optimizes wealth management operations with cutting-edge solutions. This is the software that helps advisory firms provide tailor-made solutions and cater to the personalized requirements of clients and customers. The sophisticated portfolio management tool the software is embedded with view at your clients and customers in a 360-degree view. This way, you would be able to engage with clients in a meaningful manner indeed.

The software automates client profiling and onboarding using AI-aided tools. The software further expands into helping relationship managers enter their iterations with clients and stakeholders and their conversations get recorded on the ‘Relationship Manager’s dashboard’. You get customized news feeds that can empower advisors or financial managers to provide powerful and insightful guidance adding to the betterment of their customers whom they get in touch with.

Avaloq Wealth

Avaloq Wealth is a comprehensive financial software that enhances and simplifies complex investment advisory functionalities across investment and wealth management firms. This is a full-fledged software that automates four different functionalities on a broader spectrum. These functionalities include:

- Applications that aid the operations of investment analysts

- Intuitive interfaces for portfolio managers

- Personalized financial account solutions for investment bankers and

- Comprehensive solutions for wealth management firms.

The automated software portfolio you get from Avaloq Wealth ensures that you have smooth conversations with your clients and stakeholders. The collaborative software integration of AI tools helps you coordinate within departments of a Wealth Management team in a systematic manner wherein you know strategic advices or get cues on financial recommendations that you can share adding fiancial success amongst your clients and customers.

BlackRock

BlackRock is brought to you by the Aladdin Wealth Management team. Your wealth management team can revolutionize its set of operations with the cutting-edge technology that the BlackRock software offers to institutional and retail investors and companies worldwide. The software provides you with a powerful and intuitive Central Processing System that delivers powerful solutions to banking, investment companies, and wealth management hubs on the whole.

The software integrates crucial functions that diminish the need for human intervention on a constant basis. These operations include portfolio management, trading, compliance, risk management, and other investment-related functionalities. By seamlessly integrating people, processes, and data management systems, this is a software that leverages seamless communications between clients and customers on the whole. Therefore, the software adds to the financial success of wealth companies and help their clients achieve financial goals at the end of it.

SS&C

SS&C is a global wealth management software that helps you transition between investment and trading transactions in a seamless and comprehensive manner indeed. Clients and stakeholders get customized solutions with respect to:

- Portfolio Management

- Performance Analytics

- Accounting operations and

- Reporting of employees in the organization

By deploying in-house software management on the above-mentioned functionalities in a wealth management office or in an investment advisory firm, you can integrate back office and front office operations in a smooth and hassle-free manner indeed. The software is named ‘Advent Portfolio Exchange’. The software streamlines important operations for teams and individuals helping wealth management firms and financial enterprises provide customized and comprehensive investment solutions to their clients, customers, and other stakeholders on the whole.

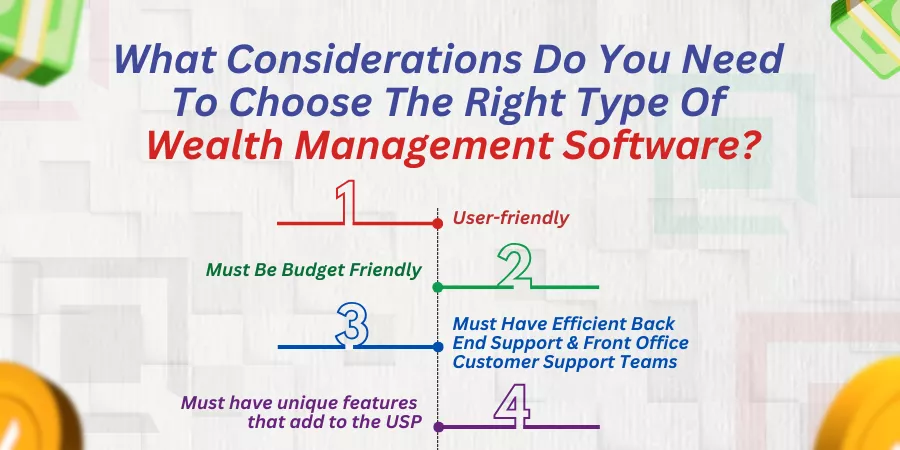

What Considerations Do You Need To Choose The Right Type Of Wealth Management Software?

These are the important considerations you have in mind when you want to invest or choose wealth management software. Let us have a run-down on pointers with respect to the same:

User-friendly

The software must have easy-to-use plugins or addons for an easier degree of navigability and customer engagement. Even an amateur investor or a newbie who has started their investing journey afresh must have easier hands-on working with the software. Therefore, you look for software that is easy to use and work around. For instance, A robo-advisor enabled feature helps investment tracking, retirement planning, and allocation of net worth assets in a goal-based manner indeed.

Must be budget friendly

The software must be a budget-friendly one for independent or individual wealth management practitioners who have hands-on to the same. Investment companies or huge financial corporations may have a capital-intensive budget to invest in wealth-managing software but independent practitioners might find it a little difficult to afford to buy or investing in one. Therefore, the pricing of the software must suit the budget requirements of independent players as well as financial enterprises on the whole.

Must Have Efficient Back End Support And Front Office Customer Support Teams

A Wealth Management software must be well-equipped with an efficient front-office as well as a back-end support team to help individuals who want to get their setup done in an end-to-end manner. Help support teams must adhere to new customers in assisting them to get their software up and running. And, the customer support teams of investment software providers must be prompt to address the grievances or queries of their customers to be able to build their brand image and sustainability in the longer run.

Must have unique features that add to the USP

The software must align to the independant requirements of wealth based companies and independant practitioners to ensure advancement in terms of catering to the personalized requirements of independant clients and investment firms too. This way, you do not have to get the oversight done in a detail-oritneted manner. And, the firms and advisors can have hands-off their mundane checks yet manage finances of their clients or customers on the whole.

The Bottom Line

Wealth Management software can be chosen via online and offline service providers. This should be done after you carefully analyze the pros and cons of the workability of the software. You can look at the websites of these service provider firms to understand the USP features of every software that is on display for sale. And then, when you make a purchasing decision for that particular software, you would ideally know what you are signing up for. What are your thoughts on this? Do mention it in the comments below!