Introduction

As a newbie in the field of insurance domain, you might be on the lookout for insurance policies that can fetch you a maximum value for money. At the same time, you may as well want to double up your insurance policy as a regular source of investment.

The premiums here may be collected as a lumpsum just similar to your bonds or fixed deposits. And, you might garner better rates of returns as monthly, quarterly, or annual coupon payouts that add to a reasonable level of passive income indeed.

Retirees, pensioners, and the old age population are always on the look out for investment options that help them with regular payouts of coupons or interest earnings. This way, they get a viable source of income to help them carry out their ends as they do not work for standard 9-5 jobs that can fetch them paychecks month on month. And, this passive source of income is going to help them sail through.

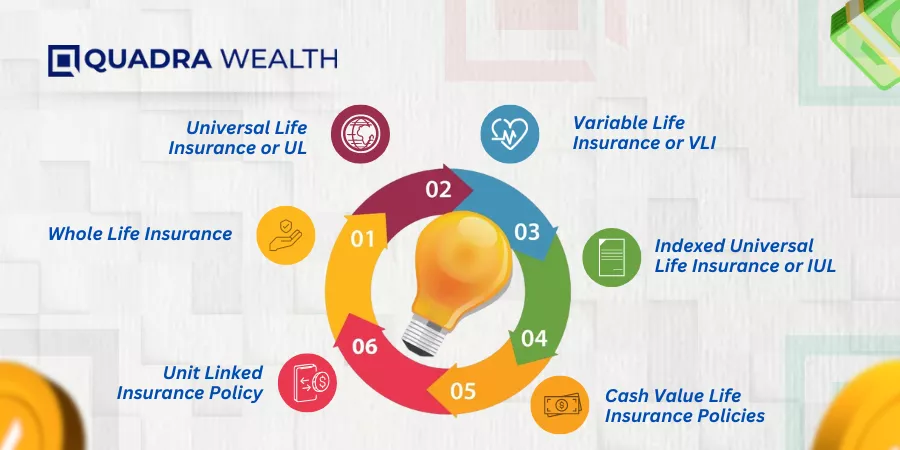

On this parlance, let us discover some of the Best Life Insurance Policy With High Returns. Helping you get started further:

Whole Life Insurance

Whole Life Insurance is a type of insurance policy that provides you with a whole range of insurance benefits covering your entire lifetime indeed. In this policy, you can avail a life insurance coverage lasting your entire span of life as long as you pay premiums on time in lieu of the same.

You also get a cash value component that is usually 4% to 8% pa of your overall policy coverage amount and although the returns are modest, you get the money credited into your bank account from time to time.

You certainly allow your death benefit go to your nominated family members who may need this amount during grave times of need wherein you are no longer alive to sustain the expenses of your family members.

You can avail loans against the cash value growth and withdraw money during times of need. Therefore, this is an insurance component that sustains cash, growth and life insurance benefits that you and your family members can extensively make use of.

Universal Life Insurance or UL

Universal Life Insurance is yet another value-added insurance component that you can ideally look for. Universal Life Insurance also abbreviated as UL offers you with a flexible cash value benefit along with years of life insurance coverage you can make the best use of.

UL offers its customers a modest rates of returns ranging 5% to 10 % and the coupon payouts are dispensed to members on a yearly basis indeed.

UL policies generally offer policyholders with better rates of return over whole life insurance policies. This is because the insurance component is also linked with an investment derivative.

With the hybrid two-in-one feature UL offers you, you get stabilized rates of return on your capital investment while you could also encash on a wide range of life insurance benefits that could cover you and your family members on the whole. As the performance of UL linked investments spike up in the markets, you get higher potential returns on your policy coverage plans too.

Therefore, this is another superlative life insurance policy that include cash value benefits to its subscribers on the whole.

In a nutshell, you have flexible life coverage benefits and the potential to earn higher rates of returns over traditional investment options.

Variable Life Insurance or VLI

Variable Life Insurance can also be abbreviated as VLI.

The VLI Policy allows its policyholders to invest their premium amount via separate investment options such as stocks, bonds and shares. You can also allocate your premium amount towards opting for mutual funds.

While you do so, you can allow your investment portfolio grow exponentially. This is because, the separate investments can garner better rates of return adding to a lucrative returns on the overall investment plan.

The VLI offers ROI ranging from 10 percent onwards and can go upto 20% or even more. However, the performance of the investment cum insurance plan primarily depends on how the linked-in derivatives perform in the markets as such. Insurance holders of VLI policies garner higher returns on investment due to the expsoure of their capital investment that gets traded inside the market actively.

Depending on your linked-in assets, you can allow your death benefit as well as returns on investment on a comprehensive scale indeed.

In a nutshell, VLI policies are therefore suitable for those of you who want investment options alongside insurance coverage as a double income cum insurance component.

Indexed Universal Life Insurance or IUL

Indexed Universal Life Insurance or IUL is a type of a life insurance policy that allows the policyholder to get his capital investment get tied to an indexed stock such as the S&P 500.

Although the IUL policy guarantees a minimum return of investment on your capital sum, you can also expect hiked potential returns on your capital investment as the performance of your linked-in index hikes up at the market place.

On a general note, you can expect anywhere between 5 to 10% returns per annum across your overall principal investment you allocate in lieu of this insurance programme. However cap limits or ceiling limits are also set by service providers on how much investor holders can earn from IUL policies.

Floor limits of even 0% can be guaged in the the index stocks perform poorly in the market which means you may not get your interest or coupon payouts for that particular year or so.

Therefore, this is a type of insurance linked investment option for those of you who may expect potential returns of capital and get you a safety net even against market downturns. The option is also suitable for risk averse investors who cannot afford to lose out their capital sum or principal investment as against Variable Linked policy structures.

Cash Value Life Insurance Policies or CVL

Cash Value Life Insurance policy also abbreviated as CVL is a kind of life insurance policy that has a lucrative number of cash benefits that are added to the policy based portfolio as such.

Here, the policyholder can improve his cash dispensables and this amount grows over time with interest added to the cash component value of the life insurance coverage.

Here, you can also avail a whole lot of life insurance benefits lasting your whole life or universal life as such. The rate of returns on CVL policies usually range from 4% to 8% depending on the investment options you link with the main policy coverage.

You can borrow or withdraw cash for your impending financial obligations which adds to the flexibility of the CVL policy type as such. Therefore, CVL is a type of dual policy that combines insurance as well as investment growth on an even platter indeed.

Unit Linked Insurance Policy or ULIP

A Unit Linked Insurance Policy or ULIP is another popular financial product that seamlessly combines life insurance coverage with multiple investment options for policyholders as such.

This is a popular investment-linked insurance product that is famous amongst veteran investors in growing economies like India and Singapore, primarily because you get an option to grow or enhance your savings account while quintessentally you also enjoy a wide range of life insurance benefits that can cover you and your family members too.

Here, a portion of your premium amount is utilized for providing you with an insurance component while the remaining portion of your income is diverted towards stocks, bonds or other investment options. You get a better rate of returns ranging 10-15% via ULIP policies and the margins are higher here as compared to traditional types of insurance policies.

Therefore, ULIP policies suit those investors who are looking for potential income opportunities and also want to enjoy insurance benefits for their entire life time as such.

What are the factors you must consider while choosing investment linked insurance policies?

These are the factors you must consider while you want to book investment linked insurance policies. Taking you through a run-down into the same:

Cost of premiums

The life insurance policies that are backed with investment components usually come to you with higher premium sums. As a policyholder, you must see if these premium amounts can be afforded by your wallet or not.

Looking at the risk factor when it comes to taking up investment linked insurance policies

You must look at the level of risk your portfolio has when you plan signing up for investment-linked insurance policies.

For instance, your Variable Life Insurance Product comes to you at a higher risk as most of the portfolio covers linked-in assets like stocks or shares whose prices get impacted in volatile markets. On the other hand, whole life insurance or UL policies can offer you with guaranteed growth with lesser risks.

To consider the amount of fees you may levy for investment-linked insurance policies

Usually, the incubator or the product issuer may charge you a little extra in the name of processing fees or income generation fee in case of investment-linked insurance policies. This is something you must plan in advance before you sign up for this kind of a portfolio.

Suitability for investment-linked insurance policies

You must understand that investment-linked insurance policies are not meant for all types of investors.

For instance, Whole Life Insurance policies or Universal Life Insurance policies offer guaranteed return of the principal amount or investment over the term period although they offer modest rates of return on the investment. This is an investment plan that suits risk averse investors

On the contrary, variable linked policies or Index Linked Policies offer higher returns on investment owing to performance of stocks, shares or indexes at the market place. However, if the linked-in assets fare poorly in the market, then the investment value of the portfolio may also decline to that extent.

Therefore, variable policies or Indexed policies are not meant for highly risk averse or fragile investors. In a nutshell, you must understand if an investment linked insurance policy is suitable for you or not.

Other factors that are involved here

Investment linked insurance policies are meant for those of you who are looking at a more holistic and long term financial planning as your primary objective. The investment amounts are held in reserves over a longer duration of time. Therefore, you look at tenor periods, rate of interest, time-horizon goals and changing interest rates when you want to sign up for investment-linked insurance policies on the whole.

The Bottom Line

To sign off, you must clearly understand what you want from an investment linked insurance policy. For guaranteed returns and repayment of principal money, whole life insurance or universal life insurance policies are the best.

For those of you who want better returns of investment from growing markets, then you pick index linked policies or variable linked policies on the whole. In a nutshell, you must determine your financial obligations vis-a-vis your time horizons before you fixate on one particular policy.

What are your thoughts on this? Do mention it on the comments below!

Frequently Asked Questions or FAQs

Can you save tax on endowment or retirement friendly insurance policies?

Answer: Yes, pension aided assurance policies come with a number of tax saving benefits that local governments offer to protect the old age population or the senior citizens of developed economies like the US, UK, Dubai and Australia.

Insurance service providers also offer lucrative money back or cash back offers reducing the burden of premium payments on the retirees.

Can you explain a little bit on how insurance riders work?

Answer: Yes, you have the main coverage policy that covers the primary features of the medium or branch of insurance the requirement is ideally applicable for.

You can avail additional riders or benefits under the same policy that can act as a reward for taking up a comprehensive policy scheme.

For example, a health assurance policy can offer disability allowance to its subscribers as an insurance-based rider.