Introduction

As a young adult, you must have landed your first job by now. Your mind is fresh and creative as you have gotten out of college.

However, your adrenaline rush to spend it all spikes your mind, isn’t it? It is quite natural to spend your first paycheck buying the glitzy glammy stuff that you may have wanted to buy as a preteen or so. After all these years, you have lived under the shadows of your parents, and do not get me wrong here.

But, have you ever thought of saving your money for a rainy day? You may have to shell out money in lieu of a family member’s hospitalization or may have to undertake the expenses of your newborn.

So, unless you think of ways and means of investing money via investment havens, you cannot cope with heavier expenses way down the line. That is why taking an insurance policy is of utmost importance indeed.

When you take an insurance policy, you can cover your health expenses, hospitalization, education, fire accident losses, and your business losses too. You can choose comprehensive policies so that you cover situations of contingency in a hassle-free manner.

Although you may have to shell out premium amounts every month or quarter, you would cover for emergencies or contingencies that lie ahead of you and sail your life on a smoother platter indeed.

On this parlance, let us address the blog titled ‘What Is The Best Life Insurance For Young Adults?’ and move on to discover more detailed insights with respect to the same:

Types of Best Life Insurance Policies for Young Adults

When you apply for insurance policies during the start of your working career, you can cover multiple insurance policies that come to you with added insurance benefits or riders as such.

And when you are younger, the premiums cost you lesser and are more affordable on your wallet. Above all, since you have taken up a policy at the start of your career, you can be rest assured that you can cover paying assurance policies as you have a long working career ahead of you.

On this parlance let us help you through a run-down of insurance policies that suit young adults on the whole:

Health Insurance Plans

As a young adult, you must take health insurance policies, to cover for a wide range of health hiccups you or your family members might suffer in the future. Here are affordable health insurance plans you can opt considering:

A- Under 26 plans

You can either place your name into your account or place the name of a parent or your guardian while you opt for an Under 26 Health insurance plan. The premiums are quite affordable and you can also nominate your parent or guardian to pay up for the premium amount. This is for those of you who have started your career or job afresh.

B- Income-based Health Insurance Plans

There are a variety of health plans or micro-minis of the actual plan you can afford to pay from the income you receive on a month-on-month basis.

As a young adult, you may not have a hefty sum of money to bank under your savings account. You live on a paycheck-to-paycheck basis. Therefore, you can choose insurance plans that suit your monthly income cheques on the whole.

C- Short-term health insurance plans

You can opt for quite several short-term health insurance plans to meet your health coverage norms seamlessly. These plans are quite affordable for those of you who are on the verge of switching jobs or maybe in the middle of your notice period where you may transition from an existing firm to a new company. You can allow your parent or guardian to cover the costs during the interim period too.

D- Catastrophic health insurance plans

You can opt for affordable health insurance plans that cover catastrophic scenarios like accidents, emergencies, or other terminal illnesses like cancers or so. As these are treatments that require impending visits to hospitals or daycare centers, you need health insurance plans that cover you for the same.

Property and Liability Insurance

You can take up insurance plans for personal property damage like say a fire accident or a theft case scenario. This is for those of you to cover losses due to personal property damage in case you reside using rented premises.

You can also opt for personal liability insurance to cover those of you who get injured in accidents within the rented premises. The plans are quite affordable insurance policies for young adults who belong to the working class.

Auto Insurance for young working adults

Auto insurance for drivers who would want coverage from accidents alone would belong to the category wherein the premiums are priced on more economic slabs indeed.

Although the insurance plans here are not comprehensively designed, the affordable auto insurance packages cover accidents and protect the overall condition of the vehicles on the whole.

These insurance packages are affordable mainly because it is a mandate to own auto insurance in most of the state laws across the globe.

If you can afford a more comprehensive auto insurance, then you can expect the policy to cover the following:

- liability arising from accidents

- damages arising from collisions back to back and

- Comprehensive coverage to take care of the overhauling expenses for the car like repainting, replacement of engines, etc

What kinda life insurance would young adults need?

Young adults may opt for term life insurance plans that come to you with a specific number of years. The term can be for a period of 10/ 20/ 30 years. Term life insurance plans can be taken up by individuals to cover expenses, debts, and many other impending financial obligations that can impact you during the term period.

This is because most term life insurance policies come to you with cash withdrawal facilities and this way, you can handle your financial obligations in a streamlined and organized manner indeed.

And, in case the principal holder or the primary insured meets with untimely demise during the tenor of the term life insurance, the nominated family member can get the death benefit amount in the form of a cheque/DD or a wireless settlement into the bank account. This way, your family members can enjoy their current lifestyle after your untimely demise as well.

For a young individual, the premiums are lower and more affordable than against taking up the same policies post 40 or 50 years of age.

On the contrary, whole life insurance policies provide you with lifetime insurance coverage and come to you with a savings component but may turn out more expensive as against term life insurance policy premiums.

Term life insurance policies on the other hand turn beneficial even for young adults who do not have dependants and the policies can cover student loans and several other debts that fall within the term cover.

And, as working individuals, the premiums are affordable as you can pay using your paycheck amounts quite seamlessly.

Would you opt for disability insurance as a young adult?

As a young adult who has career years ahead of you, getting your hands or limbs impaired due to a factory accident or a road accident is not something that is completely out of the cards.

When you contemplate an impending illness or injury you might be unavailable for work for a temporary period of time.

Say, for instance, you have lost your limbs in a road accident, it may take at least 6 months to 1 year for you to help mobilize yourself using prosthetic limbs or too. Who would be able to replace your income then?

It is your disability insurance that protects the coverage amount for your period of absence from work due to illnesses, accidents, or terminal medical ailments, to name a few.

You must opt for disability insurance and pay premiums accordingly so that the period between your absence from work and getting back to work is well taken care of.

For more severe or long-term disabilities like spinal damage or so, it takes even 3-4 years for a complete recovery for you as such.

Some insurance companies provide wheelchairs or palliative nursing care as a part of insurance riders in case you opt for comprehensive disability insurance as such.

Dental and Vision Insurance packages for young adults

Those of you who might need dental and vision care periodically can take a comprehensive Dental cum Vision Insurance package to get yourself covered against a host of dental and eye-related problems young adults might come across.

For instance, a regular dental checkup costs around $200 at a reputed dentist while a clean-up can cost around $150-180 on average. A root canal treatment costs anywhere between 250-300 US Dollars.

Similarly, for vision checkups the minimum tariff you must shell out every time you head out to an eye doctor, you may have to spend $150-180 for every single consultation. To get eye checkups done, the costs can add up. And for those of you requiring eyeglasses or contact lenses, you may have to shell out something between $280-$350

By taking a comprehensive dental and vision insurance package, you get simple coverage from most of the above expenses. As the insurance service provider might have tie-ups with opticians or dentists across your city, you can also expect regular discounts every time you take a visit with your doctor.

Going in for an Umbrella Insurance

Young adults may require an additional layer of protection if they encounter major accidents in their cars or limousines. That being said, you may not get ample coverage from renters or auto insurance plans alone.

For instance, if an accident collision between your vehicle and the other party’s vehicle has incurred a major form of accidental damage, you may have to meet lawyers to prove your point of view if the other driver is in denial mode while you have not done the accident at your end.

To afford potentially expensive legal suits, things may run out of your hands leaving you high and dry. Or, you might encounter bigger accident damage leading to potentially riskier body ailments for which hospitalization might be required. To cover for all of these riders, you can opt for umbrella insurance that could cover these extras and protect you through worse rainy days that stand ahead of you.

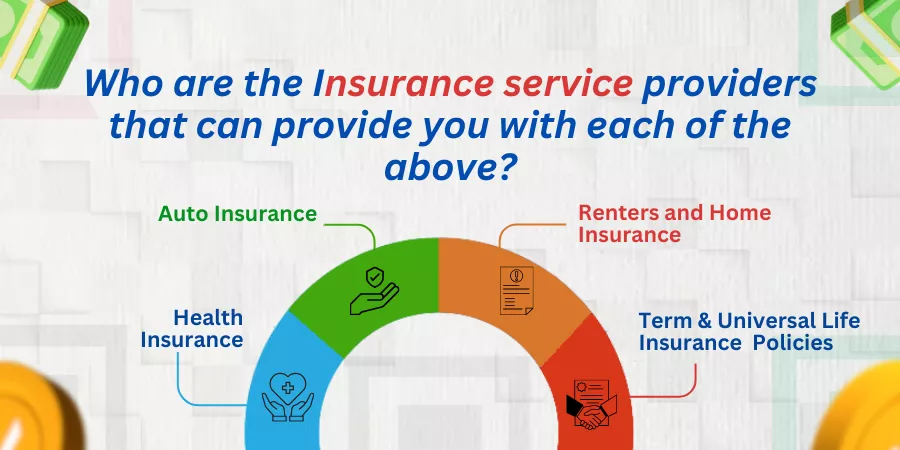

Who are the insurance service providers that can provide you with each of the above?

Although there are so many different types of insurance policies we have covered so far, you must still be wondering where you can procure these policies from.

Here are insurance brands wherein you can procure affordable insurance plans that fall under different genres. Helping you get started here:

Auto Insurance

As a young adult, you might be on the lookout for affordable premium plans on auto insurance policies. You can look for the following brands with respect to the above:

- Geico

- State Farm

- All State

- Progressive Alliance

Renters and Home Insurance

Are you on the lookout for renowned plans covering renters and home insurance policies? Then these are the brands you can try out :

- Lemonade

- State Farm

- Nationwide

Health Insurance

For providing young adults with affordable plans on health and medical fitness, these are the brands you can look for:

- Blue Cross Blue Shield

- United Health Care

- Kaiser Permanente

Term Life Insurance And Universal Life Insurance Policies

For those of you who live on shoe-string budgets but want to look for affordable term insurance and life insurance plans, these are the brands you can choose from:

- Met Life

- Guardian

- North Western Mutual

A word of Caution: These are brands that operate out of the US and UK. You can activate your local internet searches to get names of brands your city or neighborhood is famous for and then get connected with service providers.

Tips for choosing the right insurance service providers

Here are essential tips by which you choose the right insurance providers in a streamlined manner.

Helping you through with a run-down of pointers pertaining to the same:

Online and Offline Shopping around

You can open your internet browser and look for insurance service providers across the net. You can compare rates and do shopping around via online mediums. You can use smartphones, iPads, or other digital devices to enable your internet-based search options.

To go an offline mode of operandum, you can active your local searches via your mobile phones and get details of your nearest service provider. You can get connected to a bunch of them if you can cover more brands from the same area you reside in.

When you do a thorough shopping around, you can discuss plans, policies, pricing and features with insurance exponents and these professionals can help you step on your best foot forward. You can also connect to independent insurance practitioners via Zoom or Google Meets to have an online discussion with them.

Consider bundling options

Instead of choosing one insurance policy and paying hefty premium options, you can try having bundled-up offers so that you can make use of cash discounts while you sign up with the same insurance provider.

For instance, you can ask if you can get compensation for purchasing a wheelchair if you have already taken up disability insurance with a health care insurance provider. The service provider might have tie-ups with wheelchair companies that can offer you sizeable discounts on a brand-new purchase.

Or, if your policy already has an insurance rider pertaining to wheelchair access, you can get the entire wheelchair’s cost covered by the insurance company. This way, you can club offers and insurance riders that could work out to your cost advantage on an exponential scale.

Creation of customized insurance solutions for your diverse needs

You must understand your needs better and then create customized insurance solutions for what you are exactly looking for. This way, you could choose a policy that caters to your specific needs.

Whether you are doing your college studies or just started work, you must have a tailor-made solution that is customized to the independent requirements you have in lieu of what are doing currently.

Only then do you find yourself a customized solution that takes care of your needs seamlessly.

The Bottom Line

You must contact insurance providers to look for specific quotes, make price comparisons, and then choose wisely.

You must also read the offer documents carefully before investing.

What are your thoughts on this? Do mention it in the comments below!

Frequently Asked Questions or FAQs

How can you get life insurance from a service provider?

Answer: You can contact insurers who deal with different types of life insurance policies via online and offline mediums and get connected instantly.

You can opt for term life insurance as a young adult or go in for permanent life insurance that provides cash value benefits in case of contingency situations.

Explain what you can get from comprehensive life insurance coverage.

Answer: Instead of opting for a stand-alone policy that only provides you with the basic minimum features, it is always a wise idea to look for comprehensive insurance packages. As a young person, you can get varied insurance options to provide for add-ons or insurance riders too.

You can get financial protection against impending debts like student loans or home rental deposits as you can withdraw cash from the policy assurance money. Look for insurance rates, and analyze different types of policies before buying life insurance packages from the right service provider.

Are certain life insurance policies pricier?

Answer: Yes, whole life insurance and universal life insurance policies may result in costlier premiums as compared to the term life insurance policies that cover you or your dependents in your 30s.