A bank is a financial institution that accepts public deposits, creates demand deposits, and lends money. The Bank’s lending activities could be carried out directly or indirectly through capital markets.

Banks are heavily regulated in most jurisdictions because they play a crucial role in financial stability and a country’s economy. In most nations, a system known as fractional reserve banking has been established, in which banks keep liquid assets equivalent to a percentage of their current liabilities.

Banks are often subject to minimum capital requirements based on international capital rules, the Basel Accords, and other laws to ensure liquidity.

The best source to get additional information about banks and investments in Dubai may be to visit Quadra Wealth, an organization that works for your banking benefits.

Top 10 Banks in Dubai (UAE)

In this post, we’ll explore some of the most well-known and best banks in the UAE and their history. We will also look at the types of services they provide to citizens and expatriates living in or doing business with Dubai.

The current economic state in Dubai is unique among the U.A.E. regions, as it has weathered global events relatively unscathed so far.

Banking in Dubai sounds a little shaky, but the city has quite a few top banks in Dubai for you to choose from. To help you figure out which is best for your needs, we at Quadra Wealth have identified below a list of the best banks in Dubai.

1. First Abu Dhabi Bank is the largest bank in the United Arab Emirates, founded in 2017 by merging two banks, the National Bank of Abu Dhabi (NBAD) and First Gulf Bank.

This prestigious Bank offers corporate, retail, private, and Islamic banking services based in Abu Dhabi. As of 2017, the Bank’s assets totaled $ 183 billion.

2. Emirates NBD: It was formed in October 2007 after a merger between Emirates Bank International (EBI) and the National Bank of Dubai (NBD), creating one of the largest groups in UAE. The bank has a strong presence in the UAE, whose headquarters are in Dubai.

Retail Banking and Wealth Management, Wholesale Banking, Islamic Banking, Investment Banking, Mortgages, and Credit Cards are only a few of the services provided by the banks to their consumers.

3. Abu Dhabi Commercial Bank (ADCB): The headquarters of Abu Dhabi Commercial Bank is in Abu Dhabi. The Abu Dhabi government owns a 65 percent share in the Bank, which was created in 1985 by merging three banks.

ADCB is the third-largest bank in the UAE in terms of balance sheet size and offers a range of commercial and retail banking services to its customers. The Bank’s numerous business segments provide retail, commercial, Islamic Banking, and financial services, with total assets of U.S. $ 70.32 billion.

4. The first Islamic Bank to incorporate Islamic precepts into its financial processes was Dubai Islamic Bank, founded in 1975. It is also the U.A.E.’s most prominent Islamic Bank. Dubai is the headquarters of the Bank. As the world’s first Islamic Bank, it serves as a torchbearer for Shariah-compliant banking supplied by other banks worldwide, promoting a diverse range of Shariah-compliant goods.

Consumer banking, corporate banking, real estate development, and Treasury are just a few of the Bank’s main segments.

5. Union National Bank is a significant domestic bank in the United Arab Emirates, founded in 1982 and based in Abu Dhabi. The government of Abu Dhabi and the government of Dubai jointly own the Bank.

The International and Financial Institution Divisions and the Treasury and Investment Divisions make up the Bank. In the United Arab Emirates, the Bank offers a variety of financial goods and services to salaried individuals, self-employed persons, high-net-worth individuals, and commercial entities.

In addition, the Bank has offices in Egypt, Qatar, Kuwait, and a representative office in China.

6. Abu Dhabi Islamic Bank (Abu Dhabi Islamic Bank): It’s an Islamic bank in Dubai. It is a public joint-stock company. The Bank, founded on May 20, 1997, is a Shariah-compliant lender that offers personal, business, private, and corporate banking services.

Its business segments include Global Retail Banking, Global Wholesale Banking, Private Banking, Treasury, Real Estate, etc. The Bank has offices in Egypt, Iraq, Saudi Arabia, and the United Kingdom.

7. National Bank of Ras Al-Khaimah (RAKBANK): RAKBANK is the marketing name for the National Bank of Ras Al-Khaimah. The Bank was established in 1976 and is based in Ras Al-Khaimah, the emirate of Ras Al-Khaimah.

The Government of Ras Al-Khaimah owns 52.8 percent of the Bank. Individuals and businesses in the U.A.E. can use the Bank’s retail and commercial services. The Arabian Business StartUp Awards 2016 named the Bank S.M.E. Bank of the Year, and The Asian Banker called it the most acceptable internet banking product of the year in the Middle East.

8. National Bank of Fujairah is a commercial bank headquartered in Fujairah, United Arab Emirates, founded in 1982.

At the 2017 Banker Middle East UAE. Product Award, the Bank and its subsidiary got the following awards.

Corporate and Investment Banking has the best customer service. Treasury Management, Best S.M.E. Internet Banking Service, Best S.M.E.

Trade Finance Offering, and Best Corporate Advisory Service were winners.

9. Mashreq Bank was established in 1967 and is based in Dubai. It is the U.A.E.’s oldest and largest privately held top Bank. The Bank is an HSBC Bank associate company.

Customers can use its services for retail banking, commercial banking, investment banking (including corporate financing and investment advisory on mergers and acquisitions, initial public offering and underwriting), asset management, Islamic banking, and brokerage.

The Bank was the first to issue debit cards, install A.T.M.s, and offer consumer loans in the U.A.E. It operates in several countries worldwide, including Qatar, Kuwait, Egypt, and Bahrain.

10. Commercial Bank of Dubai (CBD) is a Dubai-based bank established in 1969 and headquartered in Deira. Corporate banking, commercial banking, personal banking, Islamic banking, and other financial support services are among the services offered by the Bank.

The 29th International Bank is one of the biggest and oldest private banks in the Middle East. It offers a variety of services from loans and mortgages to debit cards and ATMs.

And don’t forget all those customer service numbers! So if you need any help, pick up the phone! The Bank also provides online banking services as well as Internet banking facilities (iBanking).

Different types of banks in Dubai

The U.A.E. Central Bank is the country’s primary financial regulatory body. In Dubai, there are 22 local and 30 international banks.

The country’s banking business is dominated by larger banks, with the top five accounting for over 60% of the sector’s assets. In Dubai, Islamic banking consists of eight full-fledged Islamic banks and 23 Islamic windows established by conventional banks, accounting for 19 percent of total banking sector assets.

In Dubai, there are four different types of banks:

- Banks specializing in commercial transactions

- Banks that deal with industry

- Merchant banks are financial institutions that specialize in providing services to

- Islamic financial institutions

According to Quadra Wealth, the Dubai banking system is stable because of the expectation that, given the vast size of Dubai’s financial buffers and the government’s track record of adjusting to worse-than-expected environments, Dubai’s fiscal strength will remain resilient to downside risks to the oil market posed by global pandemic developments and management.

1. Banks

Banks or savings institutions are financial intermediaries that accept deposits and lend money to customers. Banks provide a wide range of financial services, including taking deposits, lending money to businesses, exchanging currencies, investing in securities (shares of companies), and providing credit cards.

Banks offer borrowers the convenience involving quick service for their money. It is often said that banking manages one’s monetary assets with all the resources provided by a bank. The balance in most banks includes accounts such as current accounts (checking), savings accounts, etc.

Depending on its size, it operates using either traditional banking or a fractional reserve system

2. Investment banks in Dubai

Dubai is one of the world’s fastest-growing and financially sound countries. So with new financial opportunities opening up every day, it’s no surprise that the U.A.E., particularly Dubai, has a thriving investment banking industry.

Investment banks in Dubai are not the same as traditional banks that offer their customers financial services such as deposits and loans. Instead, it’s a company that provides investment banking services.

It locates or organizes money for other companies with whom it is affiliated. If a firm needs finances or wants to sell stocks or bonds, investment banks in Dubai locate possible investors who will invest in the company.

After that, it will take care of everything, from the paperwork to the legal team.

Investment banking firms work on either the seller’s or the buyer’s side. They work on the buyer’s side, determining how much profit a stock can make or how valuable it is.

On the seller’s side, investment banks in Dubai and the U.A.E. boost a stock’s capital.

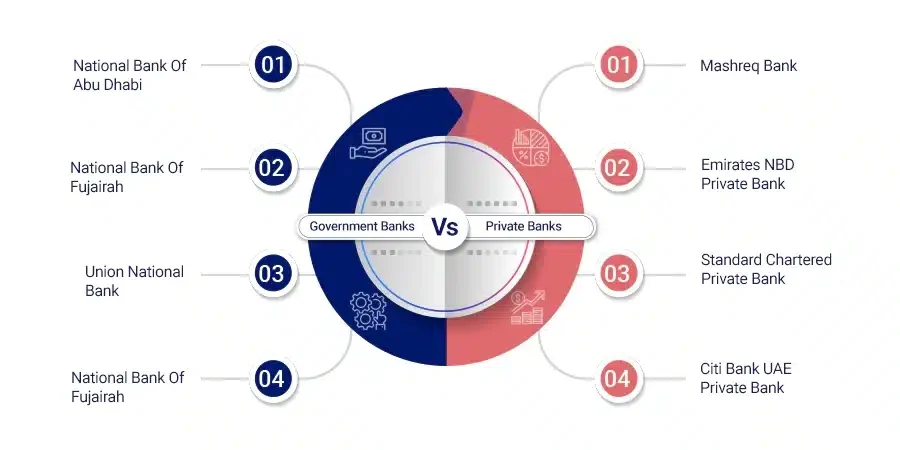

3. Government vs Private Banks in Dubai

The financial sector in Dubai is inextricably related to the economy. Dubai banks function as financial conglomerates that support businesses of all sizes and types. Therefore, opening a bank account in Dubai Bank is a transparent and straightforward process that is highly advantageous for foreign citizens doing business in the city.

According to statistics, Dubai has 23 domestic and 28 foreign banks. The banking industry in Dubai is fiercely competitive.

The majority of overseas branches are in Dubai, the state’s financial capital. The U.A.E.’s Central Bank is the country’s largest government bank.

When the U.A.E. Dirham entered circulation in 1973, it was founded. Its key responsibilities include:

- Overseeing the functioning of other banks, both public and private.

- Monitoring monetary policy and the national currency.

- Ensuring the state’s economy grows sustainably.

National Bank of Abu Dhabi, National Bank of Fujairah, Union National Bank, National Bank of R.A.K., and National Bank of Ajman are among the government banks in Dubai.

Representative offices are located in Dubai for the bulk of the U.A.E.’s public sector banks. The Emirates NBD is a semi-government financial institution. It is one of Dubai’s most powerful financial institutions, topping the list of local banks in terms of assets and market capitalization.

It was formed in 2007 when Emirates Bank International and the National Bank of Dubai merged. It has more than 220 locations around the state and is well-known as a dependable, fast-growing bank. Emirates NBD has offices in Saudi Arabia, Egypt, Singapore, the United Kingdom, India, and the United Arab Emirates.

4. Investment bank online

A financial service is an investment bank online. Investment banks provide online advice services to consumers and businesses. It does not accept deposits, unlike retail or commercial banks.

Instead, they work in corporate finance and may act as clients’ agents when issuing securities. On the buy-side, investment banking is separated into the buy-side and sell-side, with the buy-side selling assets for cash and giving investment advice to institutions.

They could also assist with mergers and acquisitions, financial capital raising, and FICC services.

Investment bankers offer guidance, provide investment services, and become involved in the operations of private and corporate investments.

However, regulations in existence for a long time keep these advising services apart from retail and commercial banking activities. Personal and commercial banking, including savings and checking accounts, wealth management, and issuing debit and credit cards, are provided by the Dubai government and semi-government institutions.

In addition, they offer digital banking services as well as personal and commercial loans. The banking system in Dubai, particularly its public sector institutions, has a bright future.

Annually, the share prices of U.A.E. banks rise by 13-15 percent. It is, in fact, one of the world’s highest rates.

As a result, the banking sector in UAE is expected to expand and grow, serving more clients and transforming Dubai into a truly global financial center.

5. International banks in Dubai

Dubai is a sophisticated economic center in the United Arab Emirates, and international banks make it easier for individuals and businesses to move money internationally and locally.

In Dubai and other significant locations across the U.A.E., foreign banks established branches and a representative office. The following is a list of worldwide central banks provided by Quadra Wealth and contact information (Address and Phone Number).

- HSBC Middle East;

- Standard Chartered Bank:

- Royal Bank of Canada;

- BNB Paribas Middle East;

- Citibank N.A.;

- Credit Suisse AG;

- Habib Bank A.G. Zurich;

- Arab African International Bank;

- BanqueLibanaise Pour Le Commerce.Private, corporate, consumer, retail, and investment banking services and wealth management and transaction services are all offered by international banks in Dubai, United Arab Emirates. In addition, they provide loans and credit cards, as well as online banking services. You can also open an international bank account with one of Dubai’s foreign banks.

Industrial bank

Industrial banks in Dubai give loans to people and businesses for industrial growth. Both large and small businesses can borrow money from industrial banks.

Industrial banks offer specialized loans for various companies, including construction, educational institutions, pharmaceuticals, and information technology.

An individual or a group of industries can apply for an industrial loan. To be qualified for an industrial loan, you must meet specific requirements.

A loan can be used to start a business or purchase equipment. It can also be used to develop, expand, or upgrade an existing business.

You will find no better firm than Quadra Wealth to help you give advice and state plans to tackle your bank status in a better way.

Commercial Bank of Dubai

Commercial Bank of Dubai is one of Dubai’s top banks, providing innovative and personalized personal and commercial banking services via cutting-edge digital channels such as mobile and internet banking, as well as a substantial branch and A.T.M. network.

CBD has been managing the financial needs of some of the country’s top corporates and businesses for over 50 years, helping to drive the Dubai economy.

Over the years, CBD has evolved into a progressive and modern banking organization, earning numerous honors for its digital initiatives, credit cards, bank accounts, and mobile app features and services.

Merchant bank

Your Relationship Manager will develop a solution that offers the perfect combination of Commercial and Business Banking services expert advice, and direct access to decision-makers because Dubai Merchant Bank is backed by a team of experts in critical industries and specific areas of finance.

- Purchasing a vehicle

- Take charge of your money.

- School fees must be paid.

- Increasing the value of your home

- Increase the amount of money you have in your budget.

- Renovate your residence

- Get a new credit card.

- Take a vacation.

- Obtain a Policy

- Take a journey

- Take out a loan

Islamic Bank of Dubai

The world’s first entire Islamic Bank, Dubai Islamic Bank, is a pioneering institution that has merged the best of traditional Islamic ideals with the technology and creativity that characterize modern financial institutions.

Since its inception in 1975, Dubai Islamic Bank has established itself as the unchallenged market leader, setting the bar for others to follow as the worldwide trend toward Islamic banking gains traction.

Islamic banking and finance have grown to become one of the world’s fastest-growing economic sectors, with over 400 institutions managing assets worth over $1 trillion (US$1,000 billion).

The Bank stays true to its roots as a customer-focused company that values close personal attention and understanding in all of its dealings. Tradition and heritage are combined with a commitment to flexibility, creativity, and technology to provide comprehensive solutions to our customers’ financial needs.

Conclusion

A well-functioning financial system is critical to the contemporary economy, and banks play crucial roles in society. As a result, they must be safe. In both up and down markets, banks should be able to lend money to people and businesses.

Payments for goods and services should also be processed quickly, securely, and affordably.

If banks fail to carry out these responsibilities, the ramifications for the entire economy might swiftly grow so widespread that the financial system itself could be subjected to large shocks. As a result, banks must be able to withstand losses while still meeting their present payment obligations.

To do so, banks must adhere to stringent regulatory restrictions. The capital and liquidity (money that can be paid quickly) standards that banks must meet to ensure that they can meet their present payment obligations are among them.

The security and efficiency of the banks’ internal payment systems are also necessary.

Thus, to make your and your family’s future safe and tension-free, contact Quadra Wealth now.