Are you seeking steady growth in your investments, but the thought of wild market swings leaves you cold sweat?

You get scared in the whirlwind of the stock market, but still want to be there and ride on smaller waves?

You want to preserve your capital but still yearn for a little better earning to beat that inflation. Your retirement funds, emergency funds, and insurance covers are all in place.

With the savings, you want to invest long-term in companies with convincing balance sheets and robust business models. Well, you just got identified as a ‘moderate risk investor’.

However, there is no official or agreed-upon definition of a moderate investor (or any kind of investor).

Investing is personal finance, and one’s ability to take risks depends on several factors.

Even professional investment managers, financial advisors, and large firms have different views on how to do asset allocation for moderate-risk investors.

But more or less it’s like, not very conservative or very aggressive mindset.

What is Asset Allocation In Investing?

In investing, asset allocation refers to the strategy of dividing your investment portfolio among various asset classes, like individual stocks, bonds, cash, and even alternative assets like real estate or commodities.

It’s essentially about spreading your eggs across different baskets to manage risk and optimize your overall returns.

Think of it like building a balanced meal.

You wouldn’t just eat protein all day, right? You’d include carbohydrates, vegetables, and some healthy fats for a well-rounded diet.

Similarly, in investing, you wouldn’t want to put all your money in one asset class, like just stocks, because that could expose you to too much risk if the stock market crashes.

Diversifying across different asset classes with varying risk profiles helps smooth out your diversified portfolio performance over time.

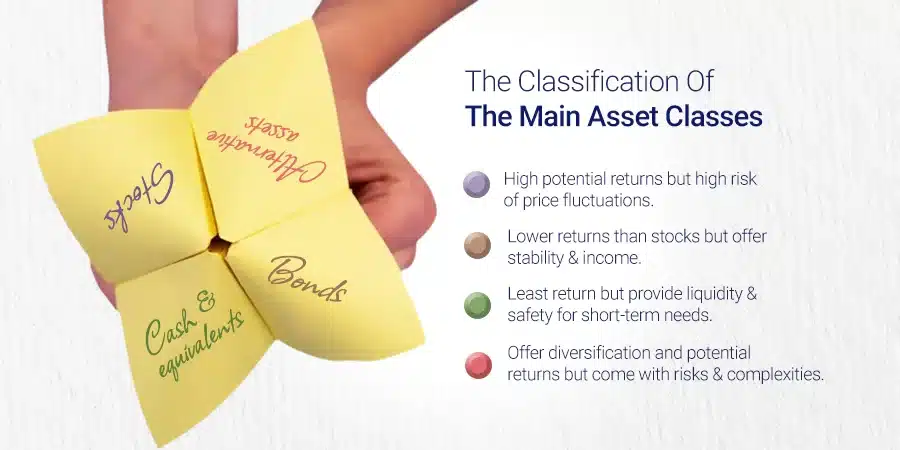

Here’s a breakdown of the main asset classes:

- Stocks: Generally offer the highest potential returns but also come with the highest risk of price fluctuations.

- Bonds: Generally offer lower returns than stocks but provide more stability and income generation.

- Cash & equivalents: Offer the least return but provide liquidity and safety for short-term needs.

- Alternative assets: These can offer diversification and potentially enhance returns but also come with their own set of risks and complexities.

Ideal Asset Allocation For Moderate Risk Investors

Finding the “ideal” asset allocation fund depends on your specific circumstances, but as a moderate-risk investor, here are some general guidelines:

Understand Your Risk Tolerance:

- Conservative: You prioritize stability and are comfortable with lower returns. Consider a 40/60 or 30/70 allocation (stocks/bonds).

- Balanced: You seek moderate growth with some risk tolerance. Aim for a 50/50 or 60/40 allocation.

- Growth-oriented: You are comfortable with more volatility for potentially higher returns. Consider a 70/30 or 80/20 allocation.

Consider Your Time Horizon:

- Short-term (less than 5 years): Prioritize stability with more bonds (60-70%).

- Medium-term (5-10 years): Balance growth and stability with a mix of stocks and bonds (50-60%).

- Long-term (10+ years): Embrace more growth potential with a higher stock allocation (60-80%).

Explore Different Asset Classes:

- Stocks: Allocate across sectors and geographic regions for diversification. Consider large-cap, small-cap, and international stocks.

- Bonds: Choose a mix of government and corporate bonds with varying maturities to manage interest rate risk.

- Cash & equivalents: Keep a small portion (5-10%) for emergencies and short-term needs.

- Alternative assets: Consider real estate investment trusts (REITs) or commodities for potential diversification and inflation protection, but be mindful of the risks.

Samples of moderate risk portfolio

Here are some examples of moderate-level risk portfolios, keeping in mind that the “ideal” allocation depends heavily on your circumstances and risk tolerance:

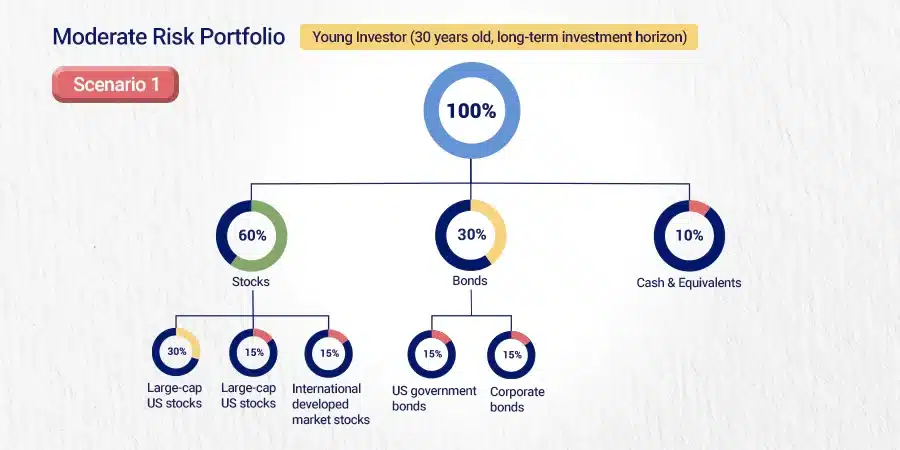

Scenario 1: Young Investor (30 years old, long-term investment horizon):

- 60% Stocks: Divided into 30% Large-cap US stocks, 15% Small-cap US stocks,15% International developed market stocks.

- 30% Bonds: Divided into 15% US government bonds (mix of maturities),15% Corporate bonds (investment-grade, mix of maturities)

- 10% Cash & equivalents

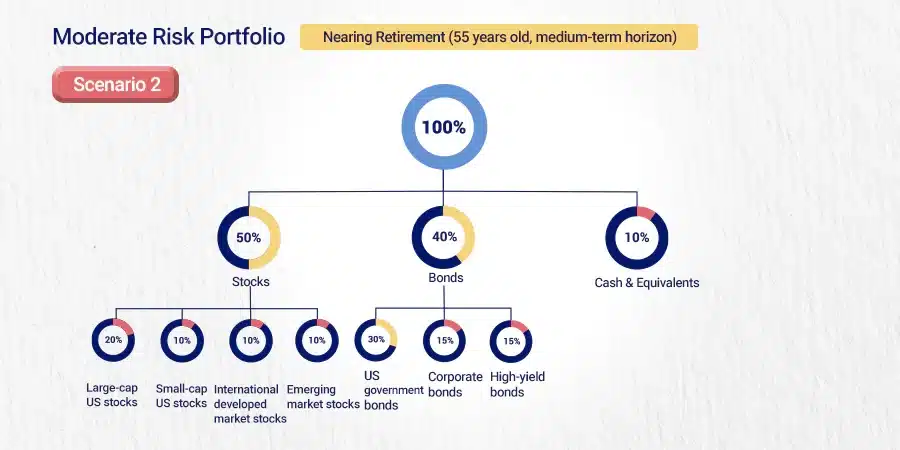

Scenario 2: Nearing Retirement (55 years old, medium-term horizon):

- 50% Stocks: Diversified into 20% Large-cap US stocks, 10% Small-cap US stocks, 10% International developed market stocks,10% Emerging market stocks.

- 40% Bonds: Diversified into 20% US government bonds (shorter maturities),10% Corporate bonds (investment-grade, shorter maturities), 10% High-yield bonds (smaller allocation for higher potential returns)

- 10% Cash & equivalents

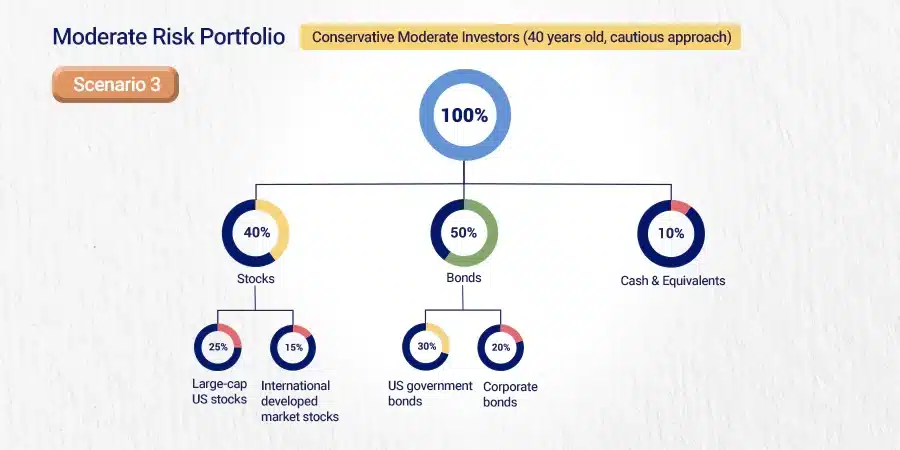

Scenario 3: Conservative Moderate Investors (40 years old, cautious approach):

- 40% Stocks: Diversified into 25% Large-cap US value stocks, 15% International developed market value stocks.

- 50% Bonds: Diversified into 30% US government bonds (mix of maturities), 20% Corporate bonds (investment-grade, mix of maturities)

- 10% Cash & equivalents

Additional Tips:

- Start with a simple and right asset allocation model and gradually add complexity as you gain experience.

- Don’t chase hot trends or get swayed by emotions. Stick to your long-term investment plan.

- Focus on quality over quantity when choosing an investment vehicle.

- Continuously educate yourself about different asset classes and investment strategies.

Parting Thoughts

By diversifying across equity funds, fixed-income investments securities, alternative investments, and cash, moderate-risk investors can build a well-balanced portfolio.

They can achieve both growth and stability over the long term.

However, it is important to adjust based on your individual risk tolerance, goals, and financial situation.

Regularly rebalance your portfolio to maintain your desired asset allocation as markets fluctuate.

Consult with a financial advisor for personalized guidance tailored to your unique needs.