Some financial rules of thumb are excellent resources for budgeting and investing. They offer a rough estimation of how you should expand investments, how much life insurance you may need, or how much you can probably get back out of your savings.

They are not a replacement for simply your numbers and situation in life (debts, assets, what you absolutely have to spend then on!) So, do not go by these when making big financial decisions. However, they simplify the things and provide a better understanding of money and investments.

That said, let’s have a closer look at the best rule of thumb for personal finance in this article:

Understanding the Rule of Thumb for Personal Finance

Most investors might have heard of financial “rule of thumb.” It acts as a financial tool to help you how to invest, buy a home, or save for retirement. These personal finance rules are made for a wide audience. But that doesn’t mean they work for everyone. Because investors’ financial situations vary from person to person.

One notable example is the Rule of 72. It’s a quick way to determine how long it will take for your money to double. All you need to do is divide 72 by your annual return rate. That gives you a rough estimation of the years needed to double your invested money.

Some apps and calculators can also help you get the exact answers. But the Rule of 72 is great when you want a fast, mental shortcut.

Examples of Personal Finance Rules

Following are some of the great budgeting rules and saving tips for investors’ long-term financial well-being:

- A home purchase cost should be less than the amount equal to two and a half years of your annual income.

- You should save at least 10-15% of your net earnings for retirement.

- Have at least five times your gross salary in life insurance death benefits.

- Prioritize to pay off your highest-interest credit cards.

- The stock market offers a long-term average return of 10%.

- Your emergency fund should be equal to your six months’ worth of household expenditures.

- Your age indicates the percentage of bonds you should have in your portfolio.

- Your age minus 100 demonstrates the percentage of stocks your portfolio should display.

- A balanced portfolio means 60% stocks and 40% bonds.

There are also rules of thumb to figure out how much savings you must have to retire comfortably at a normal retirement age.

Here are the formulas commonly used to find out your net worth:

- If you are on the job and earning money: ((your age) x (annual household income)) / 10.

- If you are a student or you are not employed: ((your age – 27) x (annual household income)) / 10.

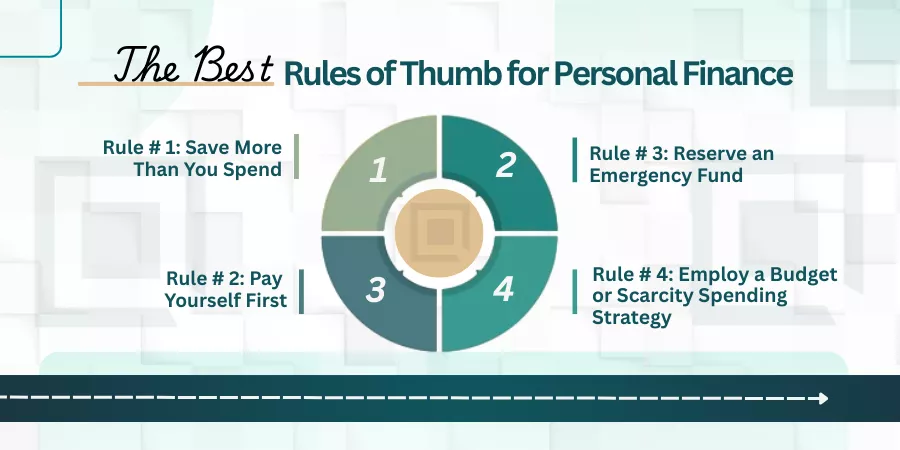

The Best Rules of Thumb for Personal Finance

Here’s a synopsis of smart savings and investment guidelines for your financial stability:

Rule #1: Save More Than You Spend

According to the FINRA Financial Capability Study, 2021, only 43% of Americans save more than they spend. Saving money is a great habit, but you can’t save if you spend more than you earn. Small savings can benefit you a long way.

For example, you save just $50 (183. 65 AED) a week. Consider skipping a few takeout meals or daily coffees. That might not seem like much, but over time, it really adds up.

If you invest that $50 (183.65 AED) a week and earn a 6% return, you could end up with around $63,000 (231,399 AED) in 15 years. That’s the power of smart money habits and smart investing.

Rule #2: Pay Yourself First

This financial management rule allows you to allocate 10-20% of your monthly income for your future self before paying bills or other unexpected expenses. Consider this a non-negotiable expense, like a monthly bill.

This saving can be used for your down payment of home, emergency fund or college savings. It can also help you achieve your long-term financial goals which exist in the form of account or even just hanging around your couch. This can also be useful if you have less day-to-day financial stress, and having a buffer that you can count on is always good.

Rule #3: Reserve an Emergency Fund

Manage 3-6 months of essential living expenses in an easy-to-access account. This backup savings protects you against unexpected incidents, such as medical emergencies, job loss, or major repairs, enabling you to avoid high-interest debt in critical situations.

Rule #4: Employ a Budget or Scarcity Spending Strategy

There are countless budgeting guidelines and investing principles out there. It is advisable to pick the one that suits your way of daily living. If you are a beginner, you can apply a conventional income allocation method, such as the 50/30/20 budgeting rule. That means 50% necessities, 30% wants, and 20% savings that can prove a safety net at the time of need.

Another simple strategy is the “artificial scarcity” model, where you automate savings and investments and rely on what remains in your checking account. Interestingly, a survey of millionaires reported that 45% don’t apply conventional budgets but instead make artificial scarcity by automating their savings (The Millionaire Next Door).

Rule #5: Avoid Lifestyle Inflation

As your wealth increases, repel the longing to raise your spending proportionally. That does not mean you can’t treat yourself once in a while. But try not to spend more just because you have extra money at the moment. Instead, keep your spending steady and use your extra money to increase your savings or invest that money, hoping to get returns in the future.

Rule #6: Devise a Financial Plan

Creating a comprehensive financial plan is associated strongly with financial security. According to a 2021 Schwab survey, “Planners are significantly more likely to have emergency funds (65% vs. 33%), be aware of investment costs (71% vs. 45%), regularly rebalance portfolios (87% vs. 63%), and avoid credit card debt (47% vs. 29%) compared to non-planners.”

Rule #7: Understand Compound Interest

Compound interest is like earning money on your money. This means the money you’ve already earned. This rule can help achieve financial freedom faster over time. But with debt, it works differently. You end up paying interest on top of interest, which can accumulate quickly.

Want to know how fast your money can double? Use the Rule of 72. Just divide 72 by your expected return rate. For example, if you’re receiving 8% returns, it is likely that your money will double in about 9 years. This rule offers a quick and easy way to see the power of compounding.

Rule #8: Avoid High-Interest Debt

Paying off high-interest debts first is one of the most beneficial financial habits. This is an example of where compound interest holds you back. So, pay off balances in full each month or as soon as possible to avoid high-interest debt.

Rule #9: Use Insurance as Protection

Select the right insurance coverage for you like home/rental, health, auto, identity protection, life, disability, long-term care, and umbrella policies. Most people have different insurance needs and those needs can change.

Try to create a balance, ensuring you’re sufficiently covered but not over-insured or create needless expenses.

The Bottom Line

A rule of thumb for personal finance is just like a crude tool used to measure your financial health. However these financial rules cannot replace tailored financial planning.

Focusing on working closely with a financial advisor that knows you and your circumstances best, will help craft your financial compass of income, expenses and goals.

For more information, contact Quadrawealth now!

FAQs

Q1. Should Taxes Be Included in the Calculation of the 50/30/20 Rule?

A: Taxes are generally not included in the calculation of the 50/30/20 rule because it is concerned with income after taxes. So, you can apply this rule to your after-tax income.

Q2. Can People Modify the Percentages in the 50/30/20 Rule to Fit Their Circumstances?

A: Yes, people can change the percentages in the 50/30/20 rule according to their priorities and circumstances. Modifying the percentages helps personalize the rule to meet your basic needs and financial goals.

This rule is particularly helpful for people residing in regions with a high cost of living or those who have planned for long-term retirement saving goals.

Q3. What is the Basic Rule of Thumb for Financial Freedom?

A: This is a simple rule of thumb for saving and spending limits. It allows you to spend no more than 50% of your take home pay for essentials and save a nice little percentage (15% pretax for retirement accounts RRSP) and save 5% of your income for short-term savings purposes.