Are you seeking an investment option with high returns and controlled risk? Autocallable coupon buffer notes may be the solution you are looking for. They provide a buffer above which the investor gets the principal amount back.

In this blog let us learn about autocallable buffer notes, their features, how they work, their payout structure, and risks.

Autocallable Coupon Buffer Notes

Autocallable coupon buffer notes are structured products that provide periodic fixed coupons (usually semi-annually or annually) linked to the performance of an underlying asset or reference asset and also provide contingent principal

protection at maturity.

These notes have a call feature where the note can be automatically called if the underlying asset return is at or above the predetermined initial level on an observation date (usually observed on an annual or semi-annual basis)

If a note is not called prior to maturity, the investors have the opportunity to receive coupons and a payment at maturity, linked to the performance of an underlying interest /asset (that is as long as the performance of the underlying asset or reference asset is above the predetermined downside buffer at maturity).

Autocallable coupon buffer notes are usually short-term market-linked notes. The product can only mature on the auto-call / observation dates or at maturity.

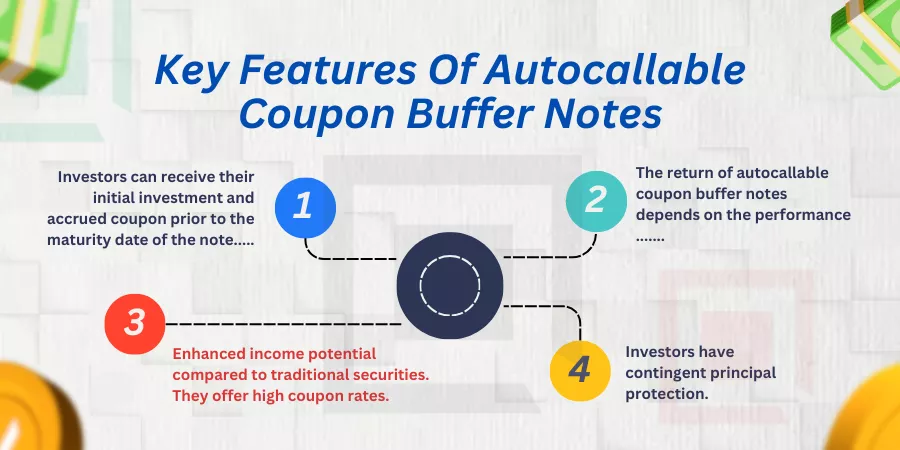

Key Features Of Autocallable Coupon Buffer Notes

These are the key features of Autocallable Coupon Buffer Notes.

- Investors can receive their initial investment and accrued coupon prior to the maturity date of the note if the underlying asset or reference asset reaches or exceeds a predetermined initial level.

- Investors have contingent principal protection. That means the principal is protected only if the underlying asset does not fall below a specified barrier level at maturity. Up to the barrier level, the investor has downside protection.

- Enhanced income potential compared to traditional securities. They offer high coupon rates

• The return of autocallable coupon buffer notes depends on the performance of an equity, index, commodity, currency, or basket of stocks. (the reference asset).

• The fixed coupon is paid to investors if the reference asset is above the coupon buffer on an observation date. (typically observed on an annual or semi-annual basis)

• The call feature of the notes is based on a predetermined level of the reference asset. If the reference asset return is at or above the predetermined initial level on an observation date during the term of the note (or the maturity date), the note will automatically be called by the issuer and the investors will receive their initial investment plus the coupon payment.

• The contingent principal protection of the notes depends on a predetermined downside buffer percentage. If, at maturity, the reference asset return is negative but it is at or above the downside buffer, investors will receive their initial investment. If, at maturity, the reference asset return is negative and the downside buffer is breached the investors will have to bear the loss by the amount the reference asset return is less than the downside buffer percentage, multiplied by a participation factor. In this case, investors will have a loss of a portion of their initial investment.

Payout Overview

Case 1: Reference asset return is greater than or equal to the coupon buffer/ barrier and the call threshold on an observation date before maturity. The note will be called. Investors will receive their initial investment in addition to a predetermined fixed coupon amount.

Case 2: Reference asset return is greater than the coupon buffer/ barrier at maturity and the downside buffer is not breached. Investors will receive their initial investment in addition to a predetermined fixed coupon amount at maturity. The note was not called before maturity since the reference asset return was below the threshold during the term on the observation date.

Case 3: Reference asset return is less than the coupon buffer/ barrier at maturity and the downside buffer is breached. Investors will receive initial investment reduced by incremental losses below the buffer and therefore incur a loss of a portion of their initial investment. The note was not called before maturity since the reference asset return was below the threshold during the term on the observation date.

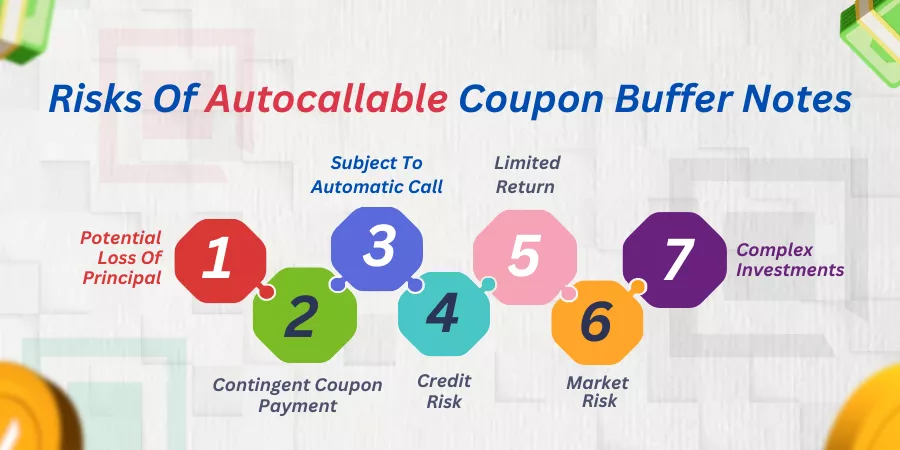

Risks Of Autocallable Coupon Buffer Notes

Below are the risks of autocallable coupon buffer notes.

Potential Loss Of Principal

Investors could lose some portion of the initial investment if the reference asset falls below the buffer level at the time of maturity.

Contingent Coupon Payments

Investors may not get coupon payments if the reference asset is below the buffer level on the observation date.

Subject To Automatic Call

Notes can be automatically called if the reference asset reaches a predetermined level before maturity. This may make it difficult for the investors to re-invest during that time.

Limited Return

The return on the notes is limited to coupons so it may be significantly less. It does not include the appreciation of the reference asset or the dividends.

Limited Secondary Markets

The notes to be sold on the secondary market may be at a discount if the underlying asset is not performing well. It may be difficult for the investor to sell on a secondary market.

Credit Risk

Notes are unsecured debts of the issuer. The creditworthiness of the issuer should be analyzed before investing in the notes.

Market Risk

The performance of the underlying asset or reference asset is based on the market volatility and so the coupon amount is also dependent on this.

Complex Investments Vis-a Vis Tax Implications

Autocallable coupon buffer notes are complex to understand and may not be suitable for all investors. Investors should consult tax advisors to know the tax implications of the autocallable coupon buffer notes.

Conclusion

Autocallable coupon buffer notes are suitable for investors who are looking for high-yield returns and also if they are willing to risk all or some of the principal amount. It is also suitable for investors looking to diversify their portfolios.

Autocallable coupon buffer notes may look appealing to investors, but they should carefully analyze the features and the risks and make an informed decision. To understand better the autocallable coupon buffer notes you can take the help of a financial advisor before investing in these notes.