Introduction

Change is the drive for innovation and advancement. And, a fleet of changes is sweeping the world of finance and investments.

As an investor who is starting your journey ahead, you may have an overwhelming range of products, interest rates, returns on investment, and jargon that sweep your mind away.

On a similar note, we have a foray of investors who want sugar-coated investment plans that not only take care of their capital investment but help them through yield-enhancement strategies too.

In this parlance, let us get you started on what the different features are, concerning autocallable barrier notes.

Autocallable Barrier Notes- Meaning And Conceptualization Explained

Autocallable barrier notes are structured products wherein promissory bonds are created in the name of primary investors. The notes are linked to underliers that can be assets in the form of independent stocks, shares, and currencies.

You may have pre-designed tools and options that lie embedded with the notes. For instance, the auto-called notes have a preset call or put options that drive the performance of underlying assets in one or the other direction.

At the same time, the initial barrier limits are also designed on autocallable notes. When the prices of underlying assets breach the initial barrier limits as have been set, the product-issuing firms trigger an auto-call option upon these notes. And, the notes can be redeemed instantly.

The investor can get the principal amount back plus yields on the investments in the form of coupon payoffs upon maturity of these notes. The potential returns on these notes is therefore way better as compared to what you may earn via traditional bonds or mortgages.

In case the underliers are not able to breach initial purchase prices or barrier limits as set, we move on to the next auto call or observation period. And then the assessments are made on the sale points of underlying assets before the credit-issuing firms decide whether to initiate an auto-call trigger or not. The performance slumps due to the volatility of the underlying assets. There can also be other developments affecting the underlying securities or risks that the issuer faces with respect to capital redemption.

The callable order for the autocallabe notes helps investors redeem their principal investments prior to maturity. As you have barrier limits set, the investors get buffer protection against losses via direct investment in the underlying assets. The terms of interest and principal are embedded as pre-determined levels of the investment portfolio.

Features Of Autocallable Barrier Notes

These are the primary features that are connected with autocallable barrier notes. Helping you through a run-down into the same:

Principal Amount

These autocallables are primarily bought and sold for the middle-class segment of retail investors. Therefore, each note is sold at $1000 or multiples of $1000 each. The initial level of underlying assets is also determined at this point in time. The principal amount and interest earnings as limited to the coupon amount are what the investor receives at the time of maturity.

Reference Assets

You can choose reference assets like stocks, securities, currencies, and market indexes to name a few. Choosing the reference assets can be done based on the Net Asset Values or NAVs. You can also correlate NAVs with the initial strike prices of contingent assets.

The banks or financial institutions will display the NAVs of the notes. Investors can choose stocks or shares that have good NAVs. The notes are then embedded with the chosen reference assets. NAVs can also determine the contingent income levels the notes can earn over the tenor of the asset.

Determining The Features Of The Auto-call

You must understand that the notes can be auto-called if the sale points of the underlying assets reach the par value or go higher than the initial values. The periodic assessment of the underliers is don

e at pre-determined observation dates and this is done by product issuing firms as such.

Suppose the initial pricing of an autocallable note is $1000, when the notes are auto-called, they are eventually redeemed by product-issuing firms. The investment holders receive their principal amount even before the notes mature.

Plus, some yields are calculated on the initial investment plans. These are payoffs that can be redeemed in the form of coupon payments. In a nutshell, the investment holders receive their principal investment plus coupon payments.

You also look for the creditworthiness of the issuer at this stage of evaluation. In other words, it is the credit rating of the product issuer that clearly indicates if investors can receive their equity portfolio the notes are linked to.

How Are The Coupon Payoffs Calculated?

There is a fixed rate of returns that is determined while autocallable barrier notes are designed for the retail segment that buys the notes from the secondary markets.

Suppose for a $1000 note, the rate of returns is valued at 10.50% per annum and few quarters have elapsed from the number of observation dates wherein the underliers or underlying assets are assessed by product issuers, and on an approximate note, the notes get auto-called within 2.5 years as against the term-maturity of 5 years, then the coupon interest payments will vary between 2.5% to 2.65% on the principal amount or across the initial investment offering.

As the notes are auto-called, the investor receives the principal amount plus coupon payments as calculated above. The investors must realize that these predetermined percentages help them gauge their return on investment with respect to these autocallable notes. The principal protection

Barrier Levels Or Barrier Limits As Have Been Set

The barrier levels are mainly set so that the underlying assets get downside protection against capital loss or complete erosion of the investment values that have been made.

The mechanism as to how the barrier limits work can be explained using two main scenarios. Let us have them worked out here:

Upper Limits Of The Barrier As Has Been Achieved

In this particular 1000-dollar note, the barrier limits have been set at 60%. Therefore, even if the worst-performing assets do not reach 100% of their initial values but only reach 60% as sale point values at the time the notes are supposed to mature, then the investor still gets 100% of his principal back and the coupons for the corresponding intervals are also paid out to the investor.

As you can now see, despite the value of underlying assets going below the threshold limits, it is the initial barrier limit as set at 60% that is acting as a soft cushion thereby providing downside protection to the investor’s principal money.

In a nutshell, you can fairly conclude that the barrier limits that are set on investors’ notes lend downside protection to capital funds despite the volatility of performance with respect to the underlying assets that the notes are linked with. This is a far better proposition over a direct investment capital loss.

Lower Limits Of The Barrier As Has Been Achieved

This can be yet another scenario that works a little contradictorily to what was said before. Here, you find that the performance of the underlying assets has slumped so badly that their values reach only 40% of the initial purchase value. What happens now?

As the auto-call triggers are not initiated until the notes mature, there can be two possible scenarios the investors may have to deal with:

- The investors may not receive their coupon payments as the call premium trigger has not been initiated.

- The investors may lose 100% of their principal amount or what is otherwise known as their capital investment.

- In a nutshell, you can fairly conclude that autocallable notes are suitable for investors who want to diversify their asset Vs debt call prices and utilize the investment as a yield-enhancing strategy.

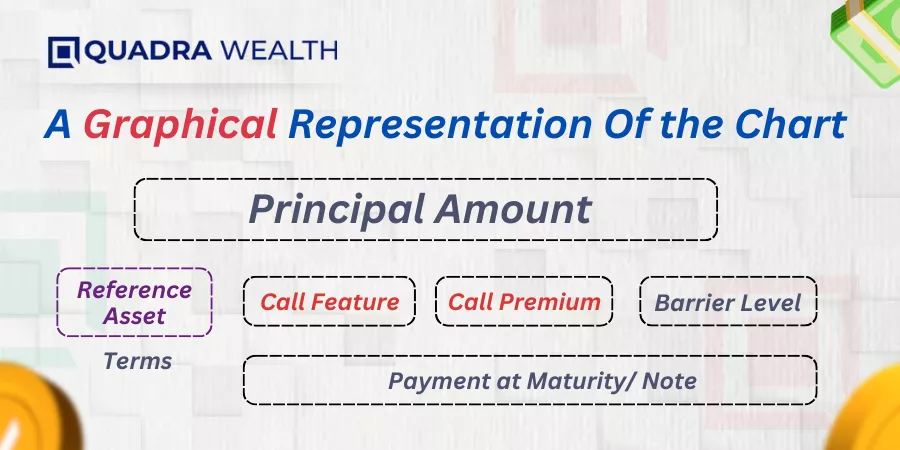

A graphical representation of the chart

Here is a graphical representation of the chart you can have as a point of reference:

Image Courtesy: https://sec.gov.in/

The Bottom Line

It may be understood that the value of notes can diminish badly if the performance of the underlying assets goes below the barrier limits as have been set on the trading instruments.

However, it can also be argued that investors get downside capital protection despite witnessing a slump in the performance of the underlying assets the notes are linked to. The autocallable feature protects investor’s capital and provides upside potential for enhanced yields.

Therefore, your capital investment is at least protected to the extent of the barrier threshold limits that give you a soft-care cushion against losing all of your capital money at once. In a crux, the autocallable notes are not designed for investors with over 100% capital return even if the assets perform badly. An investor can only get a contingent downside protection against capital erosion.

As an investor, you must understand that all investment products may have their market, credit and liquidity risks to name a few. Therefore, one must read the offer documents carefully before trusting your instincts on what the products offer.

What are your thoughts on this? Do let us know in the comments!