A visionary entrepreneur who has been a consistent disruptor in the way the world functions, whose technological innovations can have a profound impact on the way we live our lives in the future.

He is the fuel to mankind’s vision of staying on another planet. His tech innovations are centered around curbing or uprooting global challenges.

His success and personal style puts him in comparison to entrepreneurial legends like Steve Jobs, and Henry Ford. He is perseverant meets excellence meets audacity.

Add to this a dash of humour we witnessed in a recently witted jibe he took on Metaverse when their servers went array for a few hours. In case you are still guessing, we are speaking about none other than Elon Musk.

Who is Elon Musk?

Elon is an immensely successful entrepreneur and investor. He is at the helm of the tech frontiers of the world. He’s the founder, CEO, and CTO of SpaceX, a company that’s revolutionizing space travel with reusable rockets.

Yes, reusable rocktes! He’s also the CEO and product architect of Tesla, the leading manufacturer of electric cars.

He even owns the social media platform X, earlier known as Twitter. His ventures are all directed towards his ambitious vision for the future, which includes sustainable transportation on Earth and colonizing Mars.

With his wealth and drive, Elon Musk is a major player in shaping the world around us.

The early life of Musk

Elon Musk was born on June 28, 1971, in Pretoria, South Africa. Since childhood, he has shown signs of his future brilliance and innovation.

As a child, he displayed a remarkable aptitude for computers and technology and sold his first software at the age of 12. Despite facing challenges such as bullying and familial discord, Musk found solace in books, particularly science fiction, which set the spark of his imagination and ambition that we see today.

After completing his education in South Africa and Canada, Musk moved to the United States to attend the University of Pennsylvania.

His entrepreneurial journey began with ventures like Zip2 and PayPal, setting the stage for his groundbreaking work in electric vehicles, space expansion, and sustainable energy solutions later in life.

Musk's philosophy

Elon Musk’s money making philosophy is driven by his ingenious outlook and relentless pursuit of innovation. He believes in investing in ideas and technologies that have the potential to transform industries and address pressing global challenges fundamentally.

Musk prioritizes long-term goals over short-term gains, often pouring resources into ambitious projects with uncertain outcomes, such as electric vehicles, renewable energy, and space expansion.

He is known for taking bold risks and disrupting traditional markets with groundbreaking innovations, exemplified by his companies Tesla, SpaceX, etc.

Musk’s strategy is characterized by a combination of audacity, perseverance, and a commitment to advancing humanity’s technological frontier.

Why investments of Elon Musk matter

Musk’s best investments have made the company’s and board of directors of the companies that he founded very happy as it made the share prices rise soaring high in the stock market and made a name for themselves at the Nasdaq.

The net worth from 1999 – 2023 has had a massive change due to it’s one of the company’s first tsla or tesla stock coming into the market along with the new invention. Elon Musk’s investments matter, because,

- Influence on Disruptive Technologies: Musk often focuses on companies at the forefront of innovation. Musk owned Stocks provide funding to foster and accelerate innovation. For instance, SpaceX’s reusable rockets have drastically reduced the cost of spaceflight, opening doors for more space exploration ventures.

- Market Movement: Musk enjoys immense social media following and a reputation as a inspiring leader. His tweets have the power to influence certain market movements. For example, his tweets about Dogecoin have caused its price to surge, showcasing his ability to sway market sentiment.

- Long-Term Vision: With the wings of audacity, Musk’s vision takes great flight. Many of his assets go beyond short-term profits. His vision encompasses solving pressing global challenges and shaping the future. His companies like Tesla and Neuralink tackle issues like climate change and human-machine interaction, with potential benefits for society.

- Risk and Reward: Musk isn’t afraid to venture into the unknown. While some of his ventures, like the Boring Company, are still in their early stages, their success could revolutionize entire industries. However, these risks also come with the potential for failure, something to consider when analyzing his strategies.

- Inspiration for Others: Musk’s success story inspires other entrepreneurs and investors to pursue ambitious goals. Seeing him take calculated risks and achieve breakthroughs in various fields motivates others to think outside the box and push boundaries in their endeavours.

Elon Musk's Investment Portfolio

Elon Musk, the world’s richest person, has invested beyond his ventures. He has a keen eye for disruptive technologies. Where he sets his sights and invokes the interest of the world Let’s explore his portfolio and invest like Elon Musk.

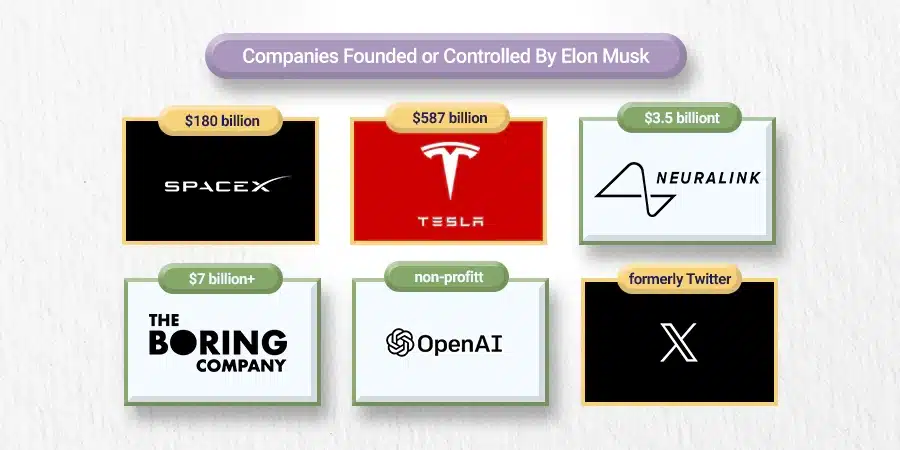

Companies Founded or Controlled:

- SpaceX ($180 billion valuation): The crown jewel of Musk’s portfolio, SpaceX is revolutionising space exploration. Founded in 2002 with the ambitious goal of colonising Mars, SpaceX has disrupted the aerospace industry by developing reusable spacecrafts and launching missions for NASA and private companies alike. The whole of the earth is not enough for this man.

- Tesla ($587 billion valuation): Another game-changer, Tesla, founded in 2003, is synonymous with vehicles (EVs). With climate change woes increasing by the day, EV resonated well universally, or rather he was the frontrunner to make EV a commonplace amongst the masses. Under Musk’s leadership, Tesla has not only become a leading EV manufacturer but also a pioneer in clean energy solutions like solar panels and battery storage.

- Neuralink ($3.5 billion valuation): This neurotechnology company, founded in 2016, is developing brain-computer interfaces (BCIs) with the potential to treat neurological conditions, enhance human capabilities, and even merge minds with machines. Do you see yourself as a cyborg soon? Yeah, it is becoming.

- The Boring Company ($7 billion+ valuation): Established in 2016, this unconventional company focuses on creating underground tunnel networks to combat traffic congestion in major cities. Their innovative tunnelling technology aims to make transportation faster and more efficient.

- OpenAI (non-profit): Founded in 2015, OpenAI is a research company dedicated to developing safe and beneficial artificial intelligence (AI). Though non-profit, Musk was an early investor and remains a prominent figure in the organisation. AI is gradually becoming the mainstay of our lives, rapidly changing the work dynamics in our world. AI will be there forever and have an ever-increasing scope.

- X (formerly Twitter): In 2022, Musk made a controversial yet impactful move by acquiring Twitter and rebranding it as X. His vision for X is to transform it into a platform for free speech and innovation, though the specifics are still unfolding.

Cryptocurrency Investments

While the exact details of his holdings are not public, Musk has been a vocal advocate for cryptocurrency, influencing markets with his tweets. Here are some digital currencies he’s shown interest in:

- Bitcoin: For many uninitiated crypto is Bitcoin. The world’s first and most valuable cryptocurrency, Bitcoin has gained significant traction with Musk’s endorsement. Tesla and SpaceX, both have invested in Bitcoin. However, their holdings may have fluctuated.

- Ethereum: The second-largest cryptocurrency by market cap, Ethereum is known for its smart contract functionalities. While Musk’s holdings are unclear, his companies’ involvement hints at a possibility of private equity.

- Dogecoin: This meme-based cryptocurrency has seen wild price swings, and it usually swings after Musk’s tweet. While it is not yet in the Ivy League as Bitcoin or Ethereum, it underlines Musk’s playful and unpredictable fortune style.

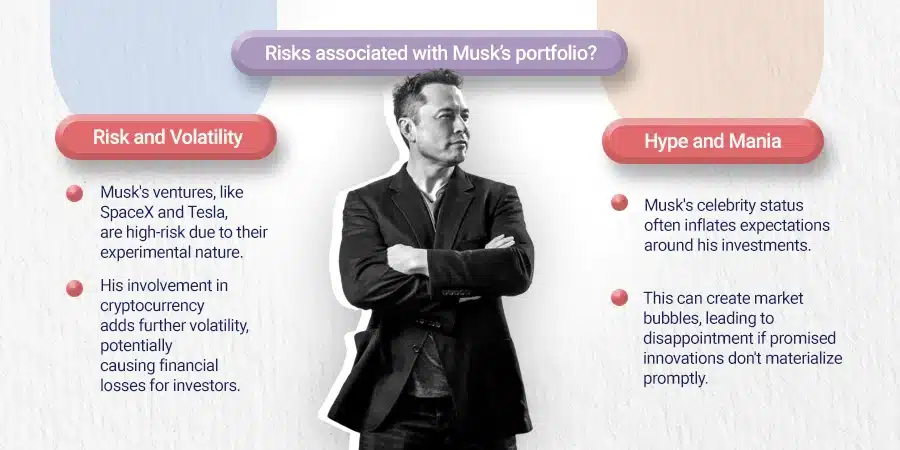

What are the risks associated with Musk’s portfolio?

Despite the visionary leader he is, there’s a reality also to be met. While we can get inspired by his asset acquiring philosophy, we need to primarily inculcate financial goals while making investment decisions for us. It’s important to consider some potential downsides:

Risk and Volatility: Many of Musk’s ventures are ambitious and unproven, carrying a high degree of risk. His investments in cryptocurrency can also be volatile, leading to potential financial losses for those who follow his lead.

Hype and Mania: Musk’s celebrity status can sometimes create unrealistic expectations and hype around his investments.

This can lead to market bubbles and disappointment if the promised innovations don’t materialise as quickly as anticipated.

Parting Thoughts

Overall, Elon Musk’s investment portfolio reflects his audacious vision for the future. His investments matter because they shape the future of innovation, influence markets, and inspire innovation. The all round plan of america’s tesla’s station was to reach 1.5 billion value but later they were able to hit the mark of the trillion.

Elon Musk’s co-founding of x.com merged with Confinity, which later became PayPal, does represent an indirect link, as PayPal was acquired by eBay in 2002. Additionally, there have been instances of individuals who served on the boards of both eBay and companies associated with Elon Musk.

While Musk’s focus has primarily been on ventures like Tesla, SpaceX, and others, eBay may indirectly feature products related to his ventures through sellers on its platform.

He prioritises companies pushing the boundaries in space plans, clean energy, artificial intelligence, and human-machine interfaces. Additionally, his interest in cryptocurrency adds another layer of intrigue to his investment strategies.

While his approach may be unconventional, his focus on long-term disruption makes him a significant player in the investment arena. In Early Days, entrepreneurial endeavors are often difficult to navigate through due to which people also start off with a co-founder but remain the largest shareholder to emerge and proceed conveniently with the set goals.