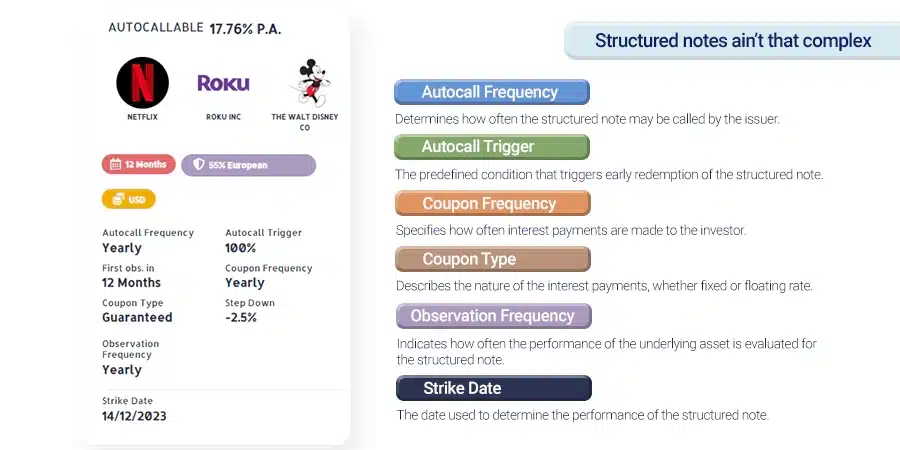

Complex, but not so complex

Structured notes are usually perceived to be complex financial instruments that only financial wizards would understand. They’re not quite bonds, not quite derivatives, but a fascinating blend of both.

This unique nature leaves investor scratching their heads and not considering investing in them. However, understanding structured notes and their working pattern will be the first step to getting acquainted with these low-risk but high-return potential instruments.

So, what are structured notes?

Imagine a financial instrument that combines the safety of a bond with the growth potential of a derivative component. That’s essentially what a structured note is.

It’s a debt obligation issued by a bank or financial institution, with its returns linked to the performance of underlying asset classes like a stock, index, mutual fund, commodity, or even interest rates.

Think of it as a piggy bank that’s not just sitting there collecting coins, but also has a little side hustle going on in the stock market.

Why do structured notes exist?

Structure notes cater to a specific breed of institutional investors– one who seeks a balance between capital protection and potential for growth.

Structured notes offer limited downside protection, often guaranteeing the return on your principal investment, while also presenting the opportunity for some additional gains if the underlying asset performs well.

They’re like the safety net at the Trapeze Act but with the possibility of soaring even higher if you grab the right bar.

What are examples of structured notes: A few from real-life

Principal-protected notes:

These are the least risky variants of the structured note world. They guarantee the return of your principal investment, come rain or shine while offering a fixed or capped return based on the performance of the underlying asset.

Imagine you and your friend decide to open a lemonade stand together. You each invest $100, and you agree that at the end of the day, you’ll get your $100 back no matter how much lemonade you sell.

You also decide that if you sell more than a certain amount of lemonade, you’ll each get an extra $20 bonus.

The lemonade stand is like the PPSN, your investment is like the principal protection amount, and the potential bonus is like the additional payout based on the performance of the underlying asset.

Reverse convertible notes:

Reverse convertible notes (RCNs) are like a financial rollercoaster, offering high returns but also a steep drop potential. Think of them as short-term investments (3 months to 2 years) that pay you attractive interest rates, often exceeding 25%. But the twist?

They’re tied to an unrelated asset, like a stock or index. If that asset rises, you get your money back with interest, a sweet deal.

But if it falls, the issuer can “put” it back to you, paying you less than you invested. It’s like a high-yield loan with a built-in “get out of jail free” card for the issuer.

RCNs are complex and risky, best for experienced investors who understand the potential losses. But for those willing to take the ride, they can offer a thrilling way to boost your returns.

Leveraged notes:

Leveraged notes are a type of investment that uses borrowed money to amplify the potential returns of an underlying asset or index. They are essentially like complex bonds that are linked to a specific asset or basket of underlying assets, such as stocks, commodities, or currencies.

Think of it like this: You have $100 and you want to invest in a stock that is currently trading at $10 per share. You could buy 10 shares with your own money.

But with a leveraged note, you can borrow an additional $90 from the issuer of the note, and have a total of $190 to invest. This would allow you to buy 19 shares of the stock.

If the stock price goes up, your gains will be magnified because you have a larger position in the stock. For example, if the stock price increases to $11 per share, you would make a profit of $19 per share, or $361 in total (19 shares x $19 profit per share).

This is a much higher return than you would have made if you had only invested your own $100. However, the flip side is equally risky. If the stock price goes down, your losses will also be multiplied by the same factor.

In the same example, if the stock price falls to $9 per share, you would lose $19 per share, or $361 in total. This means you could lose your entire investment, plus the interest on the borrowed money.

Leverage notes are a risky bet and if you are investing in it, make sure you understand the leverage amount.

Are structured notes suitable investments for you?

Like any financial instrument, it is important to understand that structured note investing involves risk.

Some of the risks associated with structured investment products include:

Complexity:

Structured notes can be complex, and it is important to understand the terms and conditions of the note before investing.

Most of the investors have minimal or no understanding of derivatives, and commodity markets which are underlying investment assets here. It is important to take advice from the right financial advisors before investing.

Liquidity:

Structured notes may not be as liquid as other investments, such as stocks and traditional bonds. It may be difficult to sell the note before it matures.

Also, the initial ticket size for investment is higher and lumpsum payment is required. So understand your finances thoroughly before investing.

Counterparty risk:

The issuer of the note is responsible for making payments to investors. If the issuer defaults or mismanages, investors may lose their money.

The complexity of the product demands efficient asset management and strict adherence to regulatory guidelines. Be diligent as to which issuer you are subscribing to.

If you are considering investing in structured notes, it is important to speak to a financial advisor to make sure that they are a good fit for your investment goals and market risk tolerance.

Parting Thoughts

Structured notes can be a useful investment tool for some investors. They can add diversification and potential growth to an investment portfolio. However, it is important to understand the risks involved before investing.

If you are considering investing in structured notes, be sure to do your research and speak to a financial advisor. Remember, never invest more than you can afford to lose.