Retirement planning is a concern for many, and the fear of running out of money often looms large. Did you know that healthcare costs are a leading cause of bankruptcy among retirees? This blog post will guide you through holistic retirement planning, an approach that takes into account health expenses, longevity, legacy, and financial stability.

Keep reading to secure your golden years!

Key takeaways

●Holistic retirement planning considers more than just money and includes health, longevity, legacy, and financial stability.

●Healthcare costs are a leading cause of bankruptcy among retirees, so it's important to plan for medical expenses and consider health insurance and long-term care insurance.

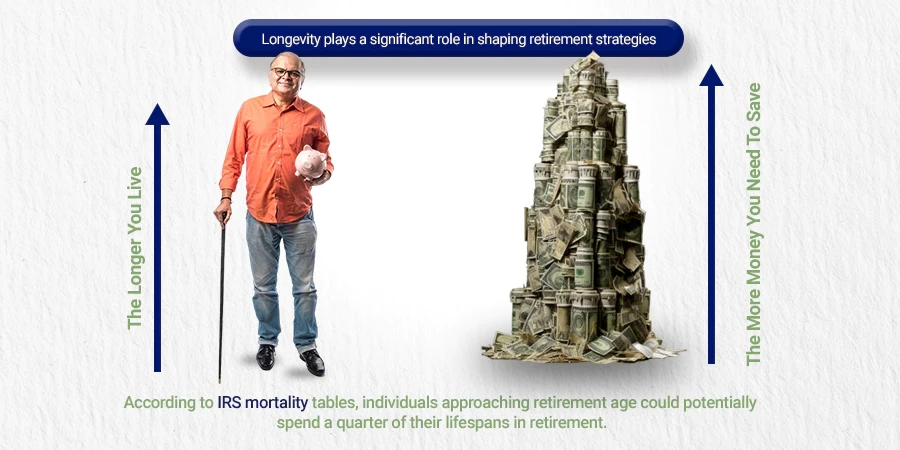

●Longevity should be factored into retirement plans as the longer you live, the more money you will need to save.

●Legacy planning allows individuals to determine how they want to pass on their assets or make charitable contributions after they are go.

Understanding Holistic Retirement Planning

Holistic Retirement Planning looks at the total financial picture. It is about more than just money. This plan thinks about health, how long we live, our goals after death, and cash needs as well.

Medical bills can take a lot of your savings if you don’t plan right. About 68% of people who have no cash left say it was because they had to pay for medicine or doctors.

For most people getting older, the cost of long-term care is a big worry too. Nearly 70% of those over 65 years old are anxious about this problem. The aim of Holistic Retirement Planning is to handle all these areas in one go so that there are no surprises later on today’s retirement realities and generate lifelong income.

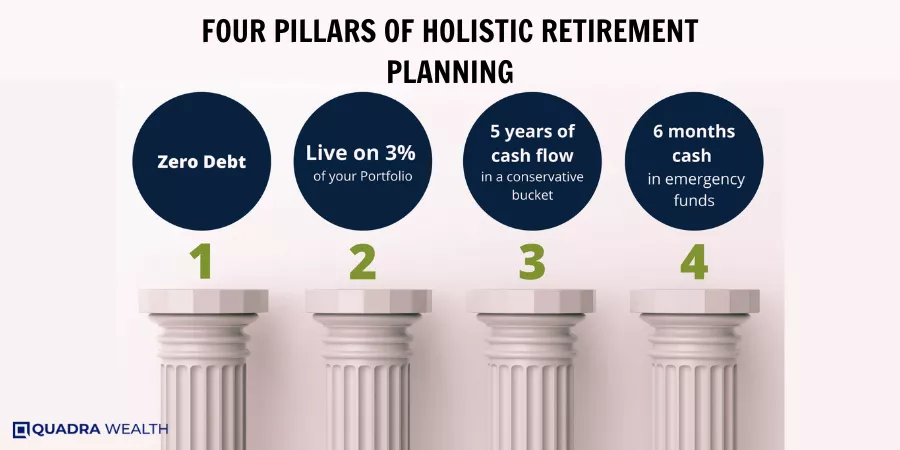

Four Pillars of Holistic Retirement Planning

The four pillars of the holistic approach include health considerations, longevity, legacy planning, and income and financial stability.

Health considerations

Health is a big part of planning for retirement. You need to stay fit and well. But, you may get ill in the future. Many people face high medical bills that they didn’t plan for. In fact, unplanned medical bills cause 68% of all bankruptcies.

Thinking about health insurance can help lower costs if you get sick. It’s also wise to think about long-term care insurance (LTC). In recent years around 70% of people over the age of 65 will need some form of long-term care.

These services can cost a lot of fees, so having coverage from LTC can be helpful.

Longevity

Living long is a big part of retirement plans. It’s simple, the longer you live, the more money you need to save. IRS mortality tables show that pre-retirees may spend one-fourth of their lives in retirement.

A plan for a secure future has to factor this in.

Legacy planning

Legacy planning is an important aspect of holistic retirement planning. It allows individuals to determine how they want to pass on their assets or make charitable contributions after they are gone.

A holistic retirement planner can help create strategies for legacy planning, such as utilizing life insurance and maximizing tax planning advantages.

By incorporating legacy planning into their overall retirement plan, individuals can ensure that their wishes are carried out and leave a lasting impact on future generations.

Income and financial stability

Income and financial stability are crucial aspects of holistic retirement planning. It is important to have a steady income stream during retirement to cover daily expenses, unexpected costs, and healthcare needs.

Healthcare expenses can be quite high, with unplanned medical bills causing around 68% of all bankruptcies. Many individuals are forced into early retirement due to medical conditions, which can have a significant impact on their retirement income plan and financial stability.

In addition, long-term care is a concern for the majority of individuals aged 65 or older and can become a major financial burden. By considering these factors and working with experts in holistic retirement planning, individuals can better prepare for their future financial security and ensure that they have sufficient income throughout their retirement years.

Advantages of Holistic Retirement Planning

Holistic retirement planning offers improved financial security, better health, and longevity, and ensures a legacy for individuals in their retirement years.

Improved financial security

Improving your financial security is one of the key advantages of a holistic retirement plan. By working with a holistic retirement planner, you can develop a comprehensive strategy to ensure that your finances are well-managed during your retirement years.

This includes creating a detailed budget, diversifying your investments, and identifying potential sources of income beyond Social Security and pensions.

With careful planning, you can have peace of mind knowing that you have enough funds to cover your living expenses and any unexpected costs that may arise.

Planning for future healthcare expenses is also crucial in maintaining financial security. By considering factors such as long-term care insurance and leveraging other insurance policies like life insurance to fund these costs, you can protect yourself from potentially catastrophic losses that could lead to impoverishment during retirement.

Better health and longevity

Taking care of our health and ensuring longevity is a crucial aspect of holistic retirement planning. It’s important to consider how our overall well-being can impact our quality of life during retirement.

According to the American Journal Of Public Health, healthcare costs account for around 68% of bankruptcies in the United States, which highlights the significance of prioritizing good health.

By focusing on maintaining good physical and mental health, we can improve our chances of enjoying a fulfilling retirement and avoid potential financial burdens caused by unplanned medical bills.

Additionally, long-term care is a concern for many individuals as they age – approximately 70% of those aged 65 or older worry about it. Being proactive in addressing this issue can help protect our assets and ensure that we receive proper care when needed.

Ensured legacy

Legacy planning is an essential part of holistic retirement planning. It involves strategies like life insurance to ensure that individuals can pass on their assets to their heirs or make charitable contributions in a tax-advantageous manner.

By including legacy planning in the overall retirement plan, individuals can secure a better future for themselves and their successors. This way, the money saved for retirement can be used effectively to create a lasting impact beyond one’s lifetime.

So, whether it’s leaving a financial inheritance or supporting causes close to your heart, legacy planning plays a crucial role in ensuring that your legacy lives on even after you’re gone.

Tips for Finding a Good Holistic Retirement Planner

Look for a holistic retirement planner who specializes in health and life insurance, Medicare, and long-term care certification.

Ensure that the retirement expert is licensed and certified to handle all aspects of retirement planning.

Consider working with a fiduciary who is legally obligated to act in your best interest.

Research the advisor’s background, qualifications, fee-based structures, and client reviews to ensure they have a good track record.

Schedule an initial consultation to discuss your goals, financial situation, and expectations before committing to a particular planner.

Remember that finding the right holistic retirement planner is crucial for ensuring a secure future.

- Comprehensive Security

- Reduced Financial Stress

- Clear Roadmap

- Comfortable Lifestyle

- Effective Legacy Planning

- Adaptability

- Financial Instability

- Outliving Savings

- Missed Legacy Opportunities

- Limited investment growth

- Higher Financial Stress

- Unprepared Health Expenses

- Limited Tax Efficiency

- Inadequate Legacy Planning

Conclusion

In conclusion, holistic retirement planning is crucial and highly recommended for a secure future. By venturing forward into a new age of retirement planning we need to consider health, longevity, legacy, and income planning, individuals can protect themselves from unexpected medical costs, ensure financial stability in retirement, and pass on their assets to loved ones or support charitable causes.

With the help of qualified holistic retirement advisors, individuals can create a comprehensive plan that takes into account all these important factors for a worry-free retirement journey.

FAQs

Holistic retirement planning is important because it takes into account all aspects of your life, including your financial situation, health, wealth, lifestyle goals, and personal values to ensure a secure future.

It’s best to start holistic retirement planning as early as possible to maximize your savings and investments over time. The earlier you start, the more time you can focus and have to build a solid financial foundation for your retirement.

The benefits of holistic retirement planning include having a clear roadmap for achieving your retirement goals, minimizing financial stress in old age, ensuring a comfortable and desired lifestyle post-retirement, and leaving a legacy for loved ones.

While it’s not mandatory to seek professional help, consulting with a certified financial planner, CPA or Holistic advisors try not to leave any stone unturned so that you can provide valuable expertise and guidance in developing an effective and comprehensive retirement plan tailored specifically to your needs and circumstances.

Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

Master Robert Kiyosaki 10 Keys to Financial Freedom

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way