The UAE offers an environment that is conducive to retirement, making it an appealing place to retire. Planning ahead is the best way to ensure that you have the right amount of money to retire with and that you are staying on top of everything.

The retirement age limit in UAE is a topic that has gained a lot of traction over the recent years and it’s important to be aware of it if you are living or working in the UAE. The cost of living in the UAE is not easily affordable for all. This is making it difficult for new expatriates to adjust.

Planning for retirement is difficult enough without having to plan for a new cost of living.

Quick Summary

In short, you will gain a clear understanding of the retirement age regulations in the UAE and the available retirement options in the UAE for expatriates. Plus you will also learn about crucial factors to consider before retiring, such as the financial well-being of dependents and maximizing return on investment.

Furthermore, the post offers valuable insights, into the pros and cons related to various retirement planning strategies. These include starting investments

What is the official retirement age in UAE for expats?

The Federal Decree-Law No. 33 of 2021 does not explicitly state the retirement age for foreigners in the UAE.

The expatriates above the age of 60 have previously been allowed to work in the UAE and continue to be able to do so by obtaining approval from MOHRE- Ministry of Human Resources and Emiratisation. There has never been an age restriction for residency for those who run their own businesses.

Also, there are certain industries or companies that may have their own internal policies regarding retirement, which are not mandated by law.

But the retirement age for ex-pats was set at 60 in the former Labour Law by Ministerial Resolution 52 of 1989. However, Article 3 of UAE Labour law by Ministerial Resolution No.

52 for 1989 states cases where you can hire employees over 60 years. The article states, “According to labor law, the laborer recruited shall not be less than 18 and not more than 60 years old.

The maximum age limitation, however, may be waived if the employee to the recruited shall have extensive and rare experience in the field of his specialization provided for the job he has been recruited for employment in the U.A.E, shall be of economic importance such wavier shall be sanctioned by the Minister.”

The age of retirement is not specified in the recently passed UAE Labour Law from the perspective of employment.

UAE work permits for ex-pats after retirement age

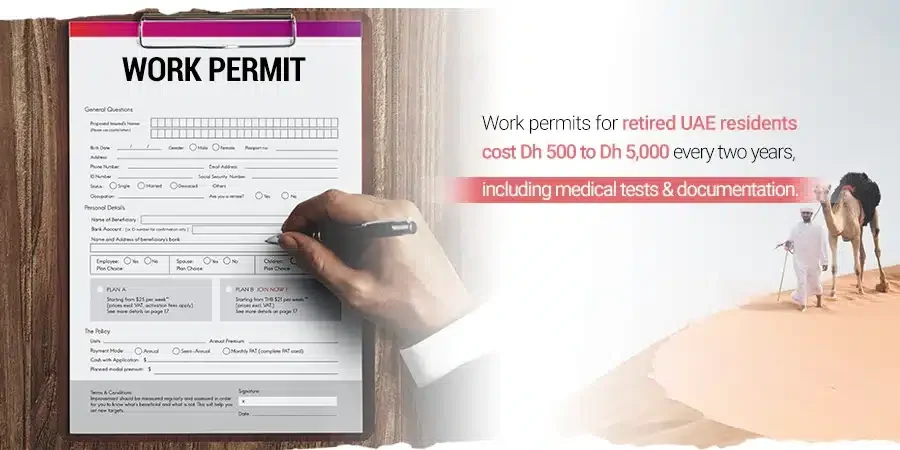

According to MOHRE, the process to apply for work permits for residents above the retirement age of 60 is like the regular process. According to the UAE’s Ministry of Human Resources and Emiratisation, applying for work permits for anyone above their official retirement age of 60 or even 65 will cost you upwards of Dh 500.

To obtain a work permit, the MOHRE requires companies to disclose how much an employee is paid, their skill level, and whether their contract is limited or unlimited.

This is necessary to determine the cost of the work permits. They generally range from Dh 500 to Dh 3,200. Another point to note is that for employees over 65 years, the cost of obtaining the initial work permit approval is Dh 5,000 every 2 years.

Getting work permits requires following through with some formalities after the employment contract has been finalized. Sponsoring companies must assist in the completion of certain tasks.

These include- arranging for medical tests, getting the Emirates ID Card, obtaining the Labour Card, and stamping the residency permit on the employee’s passport within 60 days.

Things to consider before retirement

Like water, go with the flow, and be flexible. Retirement planning is important but there will always be things that get in the way of your best-laid plans.

It’s important to keep these unexpected obstacles in mind when you are preparing your financial portfolio as well. You need to ensure that there is enough diversity and that your resources aren’t too heavily invested in any particular investment to avoid the possibility of major losses.

It’s also a good idea to make sure you stay up-to-date with how all of your investments are performing even if, at first glance, they may appear to all be doing fine. Remember to adjust and update your portfolio plans as you progress to get the most out of them.

This can also greatly improve your wealth during your retirement years.

Consider your dependents

When making your retirement plans, don’t forget about the people who rely on you. This could be your spouse, family members, or even other dependents.

When planning for retirement it’s important to consider their needs— both now and when you reach old age. This is necessary to protect them if something were to happen to you unexpectedly.

Try speaking with an independent financial advisor or insurance agent as they may be able to help you find a plan that suits what you need.

Pros of considering your dependents:

- Financial security

- Care and support

- Reduced burden

Cons of not considering your dependents:

- Financial vulnerability

- Uncertain future

- Lack of protection

Return on investment (ROI)

When it comes to determining the most profitable opportunities to invest your money, you have quite a few options at your disposal. While stocks might have a volatile ROI, mutual funds or gold and real estate might provide better ROIs over time.

All of these also come with a certain level of risk depending on which one of them you choose. For example, a real estate investment might be less risky than investing in, let’s say, cryptocurrency or stocks.

Depending on what sort of financial outlook you’re after, choosing which type of asset you should invest in is wise.

Pros of considering return on investment:

- Wealth accumulation

- Increased income

- Long-term financial stability

Cons of not considering return on investment:

- Inadequate retirement funds

- Missed growth opportunities.

- Risk of financial loss

How to plan for retirement in UAE?

The key step to beginning saving for retirement is to set aside a portion of your income each month. Financial institutions always looking for new customers who will invest their money with them. They often award substantial interest rates on investments and may even pay commissions.

This means you can potentially grow your wealth a lot quicker than if you were just saving the cash. Remember the following points when doing your retirement planning-

Start investing early

It’s better to get started on your financial savings journey as early as possible because something we often take for granted is the power of compound interest. Your priorities depend on your current age, and whether you have children or a home to pay off.

For example, if you’re younger, you can more easily afford a larger home whereas once you become older and closer to retirement, your expenditure priorities will change.

As a result, what may seem like an impossible goal with little money in the bank could be much easier than you think.

Pros of starting investing early for retirement in the UAE:

- Compound growth

- Time to recover from market fluctuations

- Building a larger retirement nest egg

Cons of not starting investing early:

- Missed opportunity for growth

- Higher savings requirement

- Limited options for risk tolerance

Have a budget for your life

Budgeting is an essential component of a well-balanced life. Allowing for savings to retire, alongside taking care of regular expenses helps protect your investment.

With a little bit of organization, even on-the-go smartphone users can budget in minutes. Many ex-pats forget to factor their retirement savings into other costs.

But, having a part of your earnings only set aside and apart from the rest of your finances helps make it clear that saving for the future is possible if you’re willing to meet your goals.

Pros of having a budget for your life in retirement in the UAE:

- Financial discipline

- Awareness of the financial situation

- Peace of mind

Cons of not having a budget for your life:

- Overspending and financial strain

- Lack of financial planning

- Difficulty in identifying savings opportunities

Adjust your retirement allocation

There are no two ways about it: retirement planning is about more than just investments. It’s about your lifestyle, projections for the future, and ensuring that you have enough income to support that.

Therefore, as retirement planners, we always suggest reviewing your investment portfolios every so often.

This helps make sure you keep up with your evolving financial situation earlier rather than later. In this way, you can adapt your strategies when needed so that you can stick to your chosen risk level for the asset classes representing your overall portfolio.

It’s also important to bear any potential retirement benefits in mind when choosing your asset allocation strategy as these vary between each financial instrument.

Pros of adjusting your retirement allocation in the UAE:

- Risk management

- Aligning with retirement goals

Cons of not adjusting your retirement allocation:

- Increased exposure to market volatility

- Insufficient income generation

- Limited flexibility

Broaden your assets

Financial advisors advise clients on not putting all their retirement investments in a single place, for several reasons. First, it can be risky to concentrate your investments in too few sectors or products.

This is because if one goes wrong, you could lose more than you expected. Second, when you diversify your retirement portfolio by spreading your investments across different instruments in the hope of balancing risk with reward, you will invariably find that even though a few may fail, the others are working in harmony to benefit your long-term plan.

Pros of broadening your assets for retirement in the UAE:

- Stabilizing returns and mitigating losses.

- Returns increase with diverse investment opportunities.

- Manageable Risk

Cons of not broadening your assets:

- Concentration risk

- Missed growth opportunities

- Lack of resilience

Get professional help

If you are the indecisive type when it comes to managing your finances, be sure to seek out expert advice. A financial advisor can offer guidance on different financial trends, the best kinds of investments, and which ones match your goals.

Remember to many questions about what fees and commissions they charge. This way you will feel comfortable deciding with them when the time comes!

(Also read: A Guide To The Best Investments In UAE)

Pros of getting professional help for retirement planning in the UAE:

- Expertise and knowledge

- Customized retirement plan

- Having a professional advisor can give you peace of mind, knowing that you have a trusted expert guiding your retirement planning journey. They can provide reassurance, answer your questions, and offer ongoing support as your financial needs evolve.

Cons of not getting professional help:

- informed decisions about retirement planning

- Time-consuming and overwhelming

- Potential for mistakes

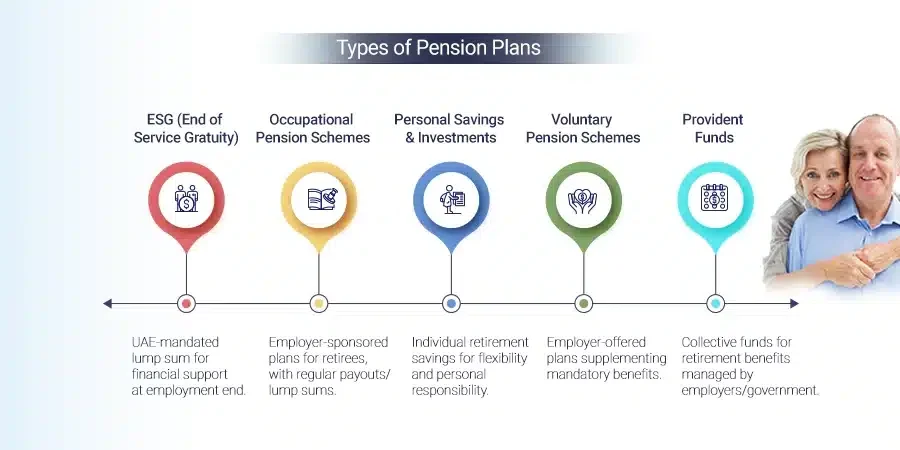

Types of pension plans

Think of pension plans as insurance plans for the future. It’s an investment that can protect you from poverty when your working career ends and there’s no safety net to catch you.

There are numerous kinds of pension plans that give you options to invest in different assets such as property or bonds, but sometimes it can be daunting to decide which one will be most beneficial for you.

Do your homework, talk to experts, and try not to let emotion into your decision-making process because it can lead you astray. Instead, prioritizing logic is a sound alternative on the other end of the spectrum.

Abu Dhabi Pension Fund

The Abu Dhabi Retirement Pensions and Benefits Fund (ADRPBF) is an organization that manages contributions on behalf of private-sector employees as well as public-sector employees located in the Emirate of Abu Dhabi.

All UAE nationals who work in Abu Dhabi, including those working for the Emirate’s local government, must contribute to ADRPBF.

Additionally, any employer based in Abu Dhabi is required to make contributions to social insurance for its Emirati employees via ADRPBF.

For expatriates

According to UAE, pension plans do not exist for expatriate workers, but they are entitled to a gratuity upon ending their contract.

If the employee has served a full year of continuous service, he is entitled to gratuity for each completed year of service. The gratuity amount is calculated by taking the last basic salary paid to him into consideration.

In the government sector, to be eligible for end-of-service benefits, an expatriate employee must have completed a year of continuous service with their respective federal entity.

Dubai retirement visa

The Dubai retirement visa also referred to as (the retirement residency permit) plan is an undertaking by the Dubai Tourism and General Directorate for Residency and Foreigner Affairs (GDRFA).

The program is an incredible method for retirees from other countries and ex-pats to not only enjoy their retirement in the view of both modernized infrastructure and history but also encourage them to travel around the country and experience more than just the city they initially settled in.

Over the last few decades, Dubai has become a haven for ex-pats to retire in. However, most ex-pats do not stay till the end due to visa requirements.

The announcement of the 5-year retirement option is changing that. It is providing ex-pats with the chance to make Dubai their forever home.

Some retirees may not be eligible and there are plenty of other factors to consider before you apply for a retirement visa, so it’s important you take all this into account when deciding whether this retirement visa is right for you.

Thus UAE’s Immigration Laws then come into effect and these laws do specify a minimum age after which an individual can be qualified for a retirement visa.

Eligibility requirements to apply for the retirement residence permit

- The applicant should be over the age of 55 years or The foreign national’s service period prior to their retirement shall not be less than 15 years (whether inside or outside of the UAE) or the foreign national is at least 55 years old;

- They must have 1 million AED in savings.

- They must have 2 million AED invested in the property.

- Or they could have savings and property with a value of 2 million AED.

- They should have an active monthly income of 20,000 AED or its equivalent foreign currencies.

When you go through the application process, you must undergo a series of medical tests with a doctor. Once your application has been accepted, however, you should consider buying health care coverage.

Summing up

Retirement planning takes time, and a lot of thinking, but it’s essential for your future.

If you are starting out in your professional journey or heading towards your retirement in UAE, it is vital to plan ahead and diversify your investment portfolio. Our financial advisors, at Quadra Wealth Management, help ex-pats in the UAE with their retirement planning, financial planning, and more.

We offer tailor-made advice to our clients to help them grow their wealth by 20% and more so that their future is financially secure. Our experts will individually work with you to maximize your wealth based on your goals and risk appetite.

Frequently Asked Questions

What is the retirement age for expatriates in the UAE?

The retirement age for expatriates in the UAE is not explicitly stated in the Federal Decree-Law No. 33 of 2021. However, expatriates above the age of 60 have been allowed to work in the UAE by obtaining approval from the Ministry of Human Resources and Emiratisation (MOHRE).

Can expatriates apply for work permits after reaching retirement age?

Yes, expatriates above the retirement age of 60 can apply for work permits in the UAE. The process involves disclosing their salary, skill level, and contract details to determine the cost of the work permit, which can range from Dh 500 to Dh 3,200. For employees over 65 years, the cost of obtaining the initial work permit approval is Dh 5,000 every 2 years.

What should I consider before retiring in the UAE?

Before retiring in the UAE, it is important to consider factors such as your financial portfolio, diversification of investments, and the needs of your dependents. Additionally, assessing the return on investment (ROI) of different assets and planning for a budgeted lifestyle can contribute to a secure retirement.

Is it advisable to start investing for retirement early?

Yes, starting to invest for retirement early is highly advisable. By doing so, you can benefit from the power of compound interest and potentially grow your wealth more quickly. Starting early allows you to take advantage of long-term investment opportunities and provides more time to recover from any potential market downturns.

Should I seek professional help for retirement planning?

Seeking professional help for retirement planning can be highly beneficial. A financial advisor can guide you on investment options, trends, and risk management strategies. They can provide personalized advice based on your financial goals, and risk appetite, and help you make informed decisions to maximize your wealth and secure your future.