You may have heard about debt funds but do you know how they generate money? Debt funds hold the power to provide stable returns by investing in fixed-income instruments such as government securities and corporate bonds.

This blog is designed to clarify your understanding of how these investment vehicles operate and reveal the mechanisms behind profit generation in debt funds. Keep reading for an enlightening journey into the world of debt funds!

Key takeaways

● Debt funds put money in bonds and other debt tools to earn interest. They make more when the debts are paid back.

● There are many types of debt funds, like high-risk ones that offer better returns. Some invest only in safe bets with good credit scores.

● Debt funds add value through interest payments and capital gains. Interest comes from loans being paid off, while capital gains come from selling assets at a higher price than they were bought.

● To invest, you can either put all your money into a fund at once or add small amounts over time. Both ways have their own benefits.

● Before investing in debt funds, it's important to know about the risks involved such as loss if companies cannot pay back loans or swings in prices due to changes in interest rates.

Understanding Debt Funds

Debt funds, a type of mutual fund or exchange-traded fund (ETF), are investment vehicles that pool money from individuals to purchase fixed-income assets like bonds and securitized products.

They come in many types such as short-term bonds, long-term bonds, floating-rate debt, credit funds, and more. Debt funds can focus on various sub-categories within the broader fixed-income asset category including investment-grade debt, high-yield debt, developed market debt, and emerging market debt among others.

These diverse options provide investors with both passive and active products based on indexes like the Bloomberg U.S. Aggregate Bond Index or the ICE U.S. Treasury Core Bond Index for example.

Some popular ETFs include iShares Core U.S. Aggregate Bond ETF and iShares U.S.Foreign Exchange Traded Fund. Each type of these funds has its unique attributes suitable for different investor needs – this entails understanding your financial goals before investing in these lucrative yet complex financial instruments.

Definition of Debt Funds

Debt funds are a type of mutual fund. They put money into bonds and other debt tools to earn interest. These funds also buy debt from people or companies who need cash now. They make their money back, with extra, as the debts are paid off over time.

Debt funds can invest in many types of debt, like U.S. government and company debt. Because they stick mostly to bonds and similar assets, these funds carry less risk than those that invest in stocks, for example.

Types of Debt Funds

Debt funds come in many forms. They are picked based on the issuer’s credit score or market index.

- Investment-Grade Debt: These are debt funds with high scores from rating firms. They are seen as safe bets for your money.

- High-Yield Debt: These funds offer a higher return, but also carry a higher risk.

- Developed Market Debt: This type of fund invests in bonds from developed markets like the U.S. and Europe.

- Emerging Market Debt: These funds invest in bonds from growing, new markets around the world.

- Passive Funds: They copy what fixed-income benchmark indexes do.

- Active Funds: Professionals manage these funds to do better than benchmark indexes.

- Commercial Real Estate Projects: Short-term loans are given for office buildings and shopping centers.

- Residential Construction Loans: These loans help build homes and apartments.

- Retail and Shopping Developments: Loan money aids in making new retail spots.

- Property Rehab/Redevelopment Loans: Money is loaned to fix up old properties.

How Debt Funds Operate

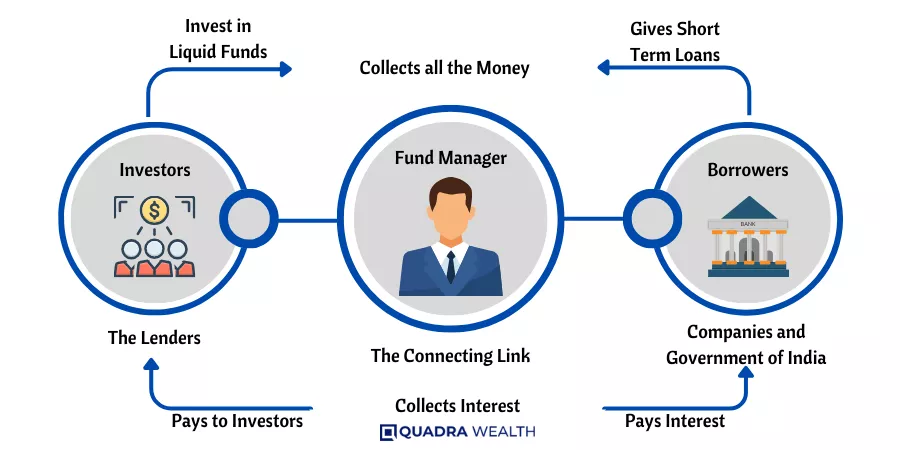

Debt funds operate by investing the pooled funds of numerous investors into fixed-income assets. These assets can include bonds, government securities, and other debt instruments. Through these investments, debt funds generate returns for their investors in the form of interest payments and capital appreciation.

High-grade corporate bonds or government securities often make up a significant portion of a debt fund’s portfolio due to their lower risk profile compared to equity mutual funds. Debt fund managers strategically select investment opportunities with varying degrees of risk and return potential to optimize total returns while managing associated risks effectively.

Investment Process

To make money, the investment process of debt funds follows a few steps:

- The fund manager collects money from investors. This money is their capital.

- They use this capital to buy fixed-income securities like bonds and money market instruments tools.

- These securities pay interest over time. The fund manager collects this interest.

- When the price of these securities rises, the fund can sell them and make a profit. This is known as capital gain.

- Sometimes the manager will swap lower-yield bonds for ones that offer higher yields, this helps increase profits.

- This process repeats until the investor decides to take out their money.

- If all goes well, the investor gets more than they invested.

Income Generation

Debt funds make money from bonds. They earn interest on these bonds. The amount of money they get depends on three things: market conditions, how interest rates move, and the credit scores of the bonds that the fund holds.

These can change how much income is made by debt funds. This type of investing is good for people who want to keep their capital safe while still making some profit. Also, debt fund fees are often less than those for equity funds.

This means you could end up making more money with a debt fund.

How Debt Funds Make Money

Debt funds generate income in two primary ways: through interest payments and short-term capital gains. Interest comes from the fund’s holdings in bonds, corporate debts, government securities, and other fixed-income instruments that pay periodic interest to their holders.

Capital appreciation or gain arises when a bond is sold at a price higher than its purchase cost due to growth in its market value. However, it’s important to note that this also bears the risk of potential loss if the market value decreases.

The rate of return on debt funds can be affected by changes in market conditions and interest rates but they tend to provide stable returns for investors with low-to-moderate-risk appetite.

Interest Payments

Debt funds make money from interest payments. These are the payments they get from the bonds and other debt instruments they own. The money comes from borrowers who pay back loans.

If a fund owns a bond, it gets paid interest by the issuer of that bond. This is steady income for the debt fund. It happens no matter what goes on in the market. So, even when things are up and down, this money keeps coming in!

Capital Gains

Debt funds can make more money through capital gains. This happens when the worth of what they own goes up. For example, a debt fund buys a bond. Later, the price of that bond rises.

The debt fund sells it and makes a profit. That profit is called “capital gain.” It adds to the value of the debt fund or its Net Asset Value (NAV). But if interest rates fall, this can also lead to capital gains for the fund.

Capital gains in debt funds might change because of risk too. Debt funds could have credit risk which means they might lose cash if someone doesn’t pay back their loan or goes broke.

Corporate bonds often have higher credit risk but may also bring higher capital gains.

Risks Associated with Debt Funds

Just like any investment, investing in debt funds also comes with its own set of risks. The primary risks associated with debt funds are credit risk and interest rate risk. Credit risk arises when the issuer of the bonds or other fixed-income instruments in which the fund has invested faces financial difficulty, potentially leading to a default on payments.

On the other hand, interest rate risk refers to the inverse relationship between bond prices and interest rates; as interest rates rise, bond prices tend to fall, impacting your returns negatively.

In addition to these principal risks, investors should be mindful of liquidity issues that can occur if markets become volatile and there are not enough buyers for bonds being sold by the fund.

Lastly but important is reinvestment risk where a bond within a portfolio matures or is called prior to maturity and needs to be reinvested at lower prevailing rates.

Therefore it’s key for potential investors in debt funds to understand these inherent risks completely before deciding their asset allocation towards this category of mutual fund schemes.

Credit Risk

Credit risk is a big part of debt funds. This kind of risk means a firm may not pay back its debts. The more likely it is that the firm won’t repay, the higher the credit risk. Credit ratings can show how high or low this risk is for each company.

The better a company’s credit rating, the less risky it is.

Debt fund managers study these risks very closely. They pick bonds from firms with good credit ratings to keep risks low and profits high. These choices help decide how well the debt fund will do over time and how much money investors make.

Interest Rate Risk

Interest rate risk can change the value of debt funds. This happens when interest rates go up or down. If rates climb, bond prices drop and this hurts debt fund investors. This is because bonds pay a fixed amount.

When rates rise, these fixed payments are less attractive compared to other investments. This leads to a fall in bond prices and hits debt fund returns. So, changes in market conditions and interest rates sway how much money you make from your debt fund investment.

It’s key for you as an investor to understand and keep an eye on this risk.

How to Invest in Debt Funds

Investing in a debt mutual fund can be done by making a lump sum investment or by subscribing to a systematic investment plan, each of which suits different financial goals and investing styles.

With a lump sum investment, you invest the entire amount at once, ideal for those who have significant capital on hand. A Systematic Investment Plan (SIP) allows investors to contribute smaller amounts periodically, offering affordability and flexibility.

Before investing in any debt fund, examine its scheme information document carefully considering all associated risks and potential returns as well as your personal risk appetite and financial objectives; this will ensure that your asset allocation aligns with your portfolio’s requirements.

Lump Sum Investment

Putting a lot of money in debt funds at one time is called a “Lump Sum Investment”. Here are the ways a lump sum investment can be good:

- You can earn steady money from interest every month or year.

- The value of bonds or loans in the fund can go up. This will give you extra money. This is called “capital gains”.

- Real estate owners who need a lot of money quickly can get help from debt funds.

- Your money gets to work right away when you invest it all at once.

- Also, if you put your money into many different debt funds, you could lower the risk of losing money.

- Find out about different debt funds.

- Choose one that fits your needs.

- Decide how much money you want to invest.

- Pay that amount into the fund.

- If interest rates go up, bond prices may go down and you could lose some of your money.

- Also, if the company or government that borrowed the money can’t pay it back, you could also lose some or all of your investment.

Systematic Investment Plan (SIP)

A Systematic Investment Plan, or SIP, is a popular way to put money into debt funds. Here are some facts about it:

- A SIP lets you invest a fixed amount regularly. You can do this every week, month, or quarter.

- It works well for people who don’t have a lot of money to invest all at once.

- With an SIP, you buy more units when prices are low and fewer units when prices are high.

- This helps lessen the risk of changes in the market.

- In the long term, an SIP can give good returns because of this “buy low, sell high” approach.

- A big plus of an SIP is that it’s flexible. You can start or stop one whenever you want.

- Professional fund managers manage these debt mutual funds. They keep track of market situations and make wise choices for you.

- Lastly, many people like SIPs because they’re easy and automatic once set up.

I apologize for the oversight. Here are all the points, as requested:

- Stable Returns

- Diversification

- Lower Risk

- Professional Management

- Liquidity

- Convenience

- Tax Benefits

- Lower Potential Returns

- Interest Rate Risk

- Credit Risk

- Inflation Risk

- Management Fees

- Market Risk

- Lack of Control

- Regulatory Changes

Conclusion

Investing in debt funds can be smart. They give you good money from interest and rising bond prices. Yet, they have risks too. So, always check all details before investing your hard-earned money.

FAQs

Debt funds are a type of investment that puts money in fixed-income funds, like U.S. corporate debt funds or global debt funds.

Debt Funds make money through interest income from loans and bonds such as U.S. Government debt or other types of market instruments.

You can invest in bonds, government fiscal policies, multifamily buildings, real estate lending and more using Debt Funds.

Yes! A lot of cash flow comes from non-interest-based fees like due diligence fees, origination fees, extension fees, and even exit fees when invested strategically.

The loan-to-cost ratio helps show how much risk is involved with your investment. If the ratio is high then it could mean there’s more risk involved.

In a commercial debt fund, your money gets used to lend for office assets, retail assets, and industrial assets among others which generates good returns compared to traditional bank fixed deposits.