Are you wondering how to manage your investments more effectively and mitigate the impact of market fluctuations? Asset allocation could be the key, being an integral part of smart investing that can help distribute risk while maximizing returns.

This article will make asset allocations easy to understand, highlighting their importance, factors influencing them, and different strategies you can use based on your unique financial goals.

Get ready to dive into a concept that institutions such as Vanguard swear by for long-term success in investment management.

Key takeaways

● Asset allocation is how you split your money between different asset classes like stocks, bonds, and cash. Different mixes give varying levels of risk and return.

● The way you pick your mix depends on things like age, comfort with risk, and goals for investing.

● There are many ways to do asset allocation. Some examples include a strategic asset allocation strategy that holds a fixed mix, dynamic allocation that changes based on money market trends, or insured allocation that has a safety net value.

● It's key to check in on investments often as market changes can mean needing to adjust the mix. For those who find it hard to make this asset allocation decision alone, getting help from financial experts may be a good idea.

Understanding Asset Allocation

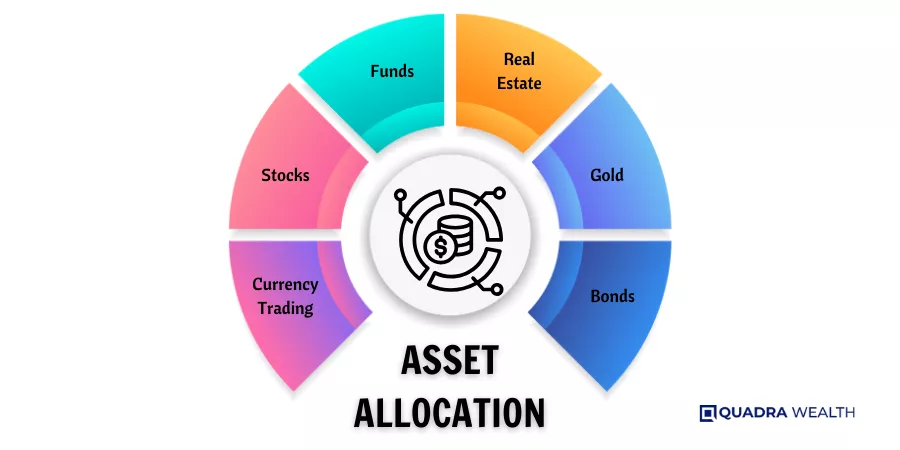

Asset allocation is a key step in the investment process. It’s how you spread your money across different types of investments, or “asset classes”. The three main ones are equities (stocks), fixed income (bonds), and cash.

Each one has its own level of risk and possible reward. Stocks may offer high rewards but also come with high risks. Bonds are less risky but may not earn much.

Asset allocation helps balance risk and reward in your portfolio according to your goals and comfort with risk. This balance matters more than picking particular stocks or bonds for good results.

Investors use various allocations to reach different targets, like saving for a car or planning retirement.

Knowing how to allocate assets can help manage risks better while still aiming for good returns on your investments. The asset mix should match the investor’s attitude towards risk and time left before needing the funds back boosting chances of reaching financial targets without losing sleep over market ups and downs.

Importance of Asset Allocation

Asset allocation plays a crucial role in risk management, allowing investors to distribute their investments across different asset classes. Its importance also lies in investment diversification, helping to spread the potential for reward while reducing risk concentration.

Furthermore, it optimizes returns by aligning your portfolio with your financial goals and investor’s risk tolerance.

Risk management

Risk management is a key part of asset allocation. It helps to protect your money from major drops in value. The aim of risk management is to balance out the bad times with good ones.

For this, you need to know how much risk you can stand.

This is called your ‘risk tolerance’. Some people don’t mind taking big risks for big rewards. Others play it safe and avoid higher risk. Your own personal level of risk tolerance should guide your choices in asset allocation.

Picking the right mix keeps you from making rash changes when markets go up or down. This avoids loss and gives peace over time.

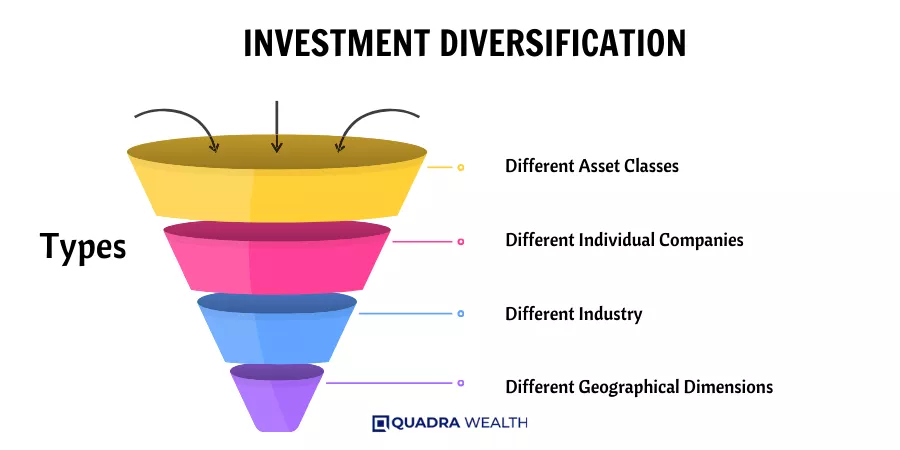

Investment diversification

Spreading your money into different types of assets is called investment diversification. It’s a way to manage risk in your portfolio. For example, if you put all your money in stocks and the stock market drops, you could lose a lot.

But if you spread your money around — some in stocks, some in bonds, maybe even some in real estate or gold — then if one type of asset goes down, the others may not. This can protect you from big losses.

Also, different types of assets often do well at different times. So having a mix might help make more money over time.

Optimizing returns

Asset allocation helps get more returns. It works by spreading your money in different places like stocks, bonds, and cash. Some places may give high returns but carry higher risks.

Others may offer lower returns but are safer. By mixing these in a smart way, you can max out your returns based on the level of risk you’re comfortable with. This kind of asset allocation mix is what asset allocation does best! With it, you can aim to get the most bang for your buck!

Key Factors that Influence Asset Allocation

There are several essential factors to consider in asset allocation, including an investor’s age, risk tolerance, and individual investment goals. Discover more about how these elements can influence your investment strategy by delving deeper into the topic of asset allocation.

Age

Your age plays a big part in asset allocation. As you get older, your investment goals may change. You might want to keep more of your money safe. This is because you have less time to make up for any money that might be lost in risky investments.

Financial professionals often use an easy rule for this. They say to subtract your age from 100. The result is the amount of cash you should put in stocks. The rest should go into safer choices like bonds or cash and equivalents.

So, if you are 30 years old, you could put 70% of your money in stocks and the rest elsewhere.

This type of plan changes over time as you grow older and it’s known as life-cycle funds or target-date funds strategy also called Age-Based Asset Allocation. It keeps things simple and heads off risk as you near retirement.

Risk tolerance

Risk tolerance is about how much risk you can handle. It shapes your choice of assets. If you don’t like taking risks, you might choose more safe assets such as bonds or cash. If you are okay with risks, you may go for stocks or real estate.

People who can wait a long time before they need their money back can take more risk than people who need their money soon.

Investment goals

Investment goals are key to smart asset allocation. They guide how, when, and where you put your money. A retiree may need stable income sources like bonds. A younger person might want growth from stocks for a long time.

It is not a one-size-fits-all strategy. Your goals shape your investment plan and help pick the right mix of assets in it.

Different Types of Asset Allocation Strategies

Asset allocation strategies vary, and each investor can adopt a strategy that suits their unique needs. Strategic Asset Allocation focuses on maintaining specific ratios of various asset classes over the long term for balanced risk-reward trade-offs.

Constant-Weighting Asset Allocation involves regular portfolio rebalancing to maintain original asset proportions irrespective of market fluctuations. Tactical Asset Allocation allows flexibility in adjusting the asset mix based on short-term market predictions, seizing temporary investment opportunities.

Dynamic Asset Allocation strategy adjusts assets based on market trends and economic conditions aiming at capitalizing on good markets and minimizing losses during downturns. Insured Asset Allocation provides a twist by setting a base portfolio value below which the portfolio should not fall; if it does, assets are moved into risk-free areas like treasuries or bonds until markets stabilize again.

Finally, Integrated Asset Allocation considers both changing market conditions and an investor’s financial circumstances when making allocation decisions; this flexible approach adapts to meet evolving objectives and expectations.

Strategic Asset Allocation

Strategic asset allocation is a way to split money among different areas. These areas are called “asset classes”. The big ones are stocks, bonds, and cash. Each of them has a different level of risk and reward.

People use this plan to try and keep their money safe while making more of it. They do this by spreading out the risks. So if one area loses money, maybe another one will make money instead.

This balance helps them reach their investment objectives.

Constant-Weighting Asset Allocation

Constant-Weighting Asset Allocation is a way to manage risk. This method keeps the same mix in the investment portfolio all the time. It makes sure that no asset grows too big or too small.

For example, if you start with half bonds and half stocks, you want to keep it that way. If stocks go up more than bonds, you sell some stocks to buy bonds. This brings it back to half and half again.

You do this when things change in your portfolio because of market moves.

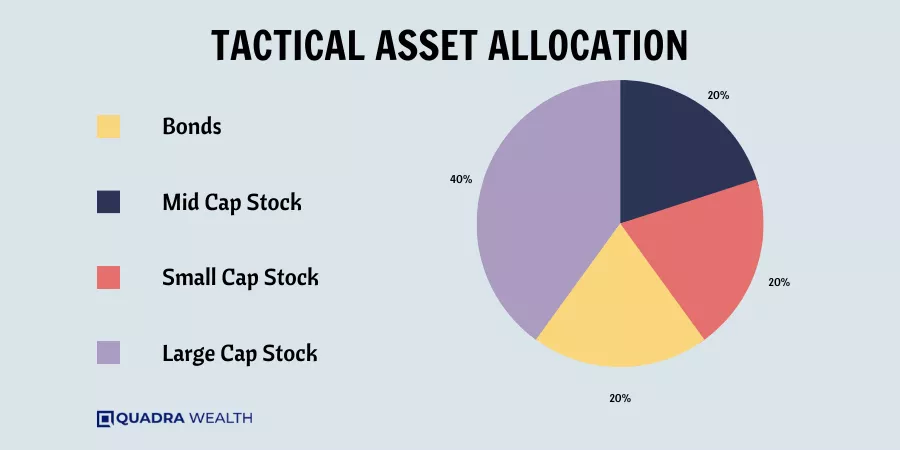

Tactical Asset Allocation

Tactical asset allocation is a useful tool for investors. It helps make more money from short-term market changes. This way of planning needs constant watch over market trends. The main goal is to get higher returns by making use of quick market shifts.

It sets itself apart from other types of asset allocation plans because it asks for active changes based on current market conditions.

Dynamic Asset Allocation

Dynamic asset allocation changes based on how the market acts. This is a type of asset plan where the assets change because of what happens in the market. In this method, you may stray away from your fixed plan for a short time to grab good chances to invest.

To increase your money value, dynamic asset allocation needs active work and care. It keeps track of your goals for investing, your ability to take risks, and your money facts.

Insured Asset Allocation

Insured asset allocation is a smart way to handle your money. It keeps the base value of assets safe. This means that the worth of these assets will not go down. You decide on this base value.

If the market makes your assets drop in price, you take action.

You might buy or sell certain things to keep your money safe in insured asset allocation. The goal is to let you make more money without taking on too much risk. It helps to stop big swings in the price of what you own.

Your personal goals, how much risk you can stand, and how long you plan to invest are all parts of this.

Integrated Asset Allocation

Integrated asset allocation is a mix of many asset allocation plans. This plan aims to get the most money back and keep risks low at the same time. It works by spreading money into different assets like stocks and bonds.

Some things that affect how much goes into each type of these are personal goals, risk level, and how long you want to invest. For example, changes in stock investment could happen based on age or if someone is nearing their life span end.

The Connection Between Asset Allocation and Diversification

Asset allocation and diversification work together in investing. They both aim to manage risk and maximize returns. The money you invest is spread out in asset allocation. This means it goes into different things like stocks, bonds, or cash.

Diversification takes this idea a step further. It spreads the money within these categories too. So, instead of buying shares from one company, you buy from many companies. These two concepts make sure not all your eggs are in one basket! This way if one part does not do well, others may still bring profit.

How to Get Started with Asset Allocation

Getting started with asset allocation is all about good planning. Here are some steps to guide you:

- First, figure out your risk tolerance. This is how much change in value you can stand before it causes stress.

- Identify your time horizon. This shows how long you plan to invest.

- Decide the type of assets to include in your portfolio from stocks, bonds, and cash or equivalents.

- Take your age into account. Younger people might want more stocks while older folks might go for more bonds.

- Add other asset types like real estate and gold if they fit into your risk tolerance and time frame.

- Keep checking in on your investments. Market changes could mean you need to shift things around.

- If this feels too complicated, seek guidance from a finance pro who understands asset allocation.

I apologize for any confusion. Here are all the points as requested:

- Risk Management

- Optimized Returns

- Goal Alignment

- Diversification

- Adaptability

- Long-Term Focus

- Higher Risk

- Reduced Diversification

- Lack of Goal Alignment

- Emotional Decisions

- Inefficient Returns

- Limited Risk Management

Conclusion

In conclusion, right asset allocation is the cornerstone of a prudent investment strategy, providing a roadmap to balance risk and returns. This vital financial planning tool considers factors such as age, risk tolerance, and goals to create a diversified portfolio management tailored to individual needs. Regular monitoring and adjustment are essential as market conditions evolve. For those seeking guidance in this complex arena, consulting with a knowledgeable financial advisor is a wise step. Financial advisors can offer expertise in crafting and fine-tuning asset allocation strategies, helping investors navigate the intricate world of investments and financial goals.

So, asset allocation is like a meal plan for your money. It can help you reach your dreams and keep investment risks low. To make it work best, think about things like age, risk limits, and goals.

And remember, there are different ways to do it. So pick the one that fits you best!

FAQs

Asset allocation is a way to plan your investments. It helps you pick the best mixture of assets based on your goals, risk appetite, and how long you want to invest.

In retirement planning, you can use life-stage funds like Vanguard Target Retirement 2030. They change the mix of assets as you get older so that they match your changing needs.

No! You can also put money into other things like mutual funds, exchange-traded funds or ETFs, U.S. Treasury securities, corporate bonds, or even precious metals.

Yes! With the help of an online broker or Robo-Advisor Account, you can create a diversified portfolio yourself by buying individual securities.

All investments come with some risk such as market movements and inflation risk but having a good mix of assets helps lower these risks.

This strategy means to purchase an investing product when its price drops (buy low) and sell it when its prices goes up(sell high). This is used for getting better investment returns.