Are you curious about the world of structured notes and how they can boost your investment portfolio? “Structured notes are a type of debt security that banks, corporations, or financial institutions sell which have gained solid traction since their inception in the U.K.

in 1990s. This blog dives into what structured notes are, and how they function and explores potential benefits and downsides for investors may to consider before diving in.

Get ready to become an informed investor as we unveil this hybrid investment product vehicle!

Key takeaways

●Structured notes are sold by banks or financial firms. They can give more money back than bonds or stocks.

●You get to pick how these notes work. This puts you in control of the type of asset, term length, and risk-reward profile.

●It's hard to sell structured notes before they mature. If a company that gives out these notes fails, all investment might be lost!

●High fees may come with buying structured notes. These costs make it tough to understand if the note is good for your money or not!

Understanding Structured Notes

Structured notes are a type of debt security sold by banks or other financial institutions. They were first seen in the U.K. in the early 1990s, and now they are getting more popular in the U.S. too.

The money you make from a structured note depends on what happens to one or more underlying assets. All structured notes have two parts: a bond component and a derivative component. These could be stocks, bonds, commodities, or currencies.

Unlike bonds and CDs, structured notes do not pay at a fixed rate of interest. The bank decides how much it pays based on how the underlying asset does over time.

If things don’t go well with the base asset, your specific investment in structured notes is still safe to some extent as these offer protection against losses that may happen to it.

The Role of Structured Notes in the Global Market

Structured notes play a big part in the global market. Banks and financial companies sell these notes all over the world. They were first sold in the U.K. but now, they are also popular in the U.S.

This kind of note gives a shield against loss when an asset drops in value. Let’s say, a company or bank loses money, investors who have structured notes don’t lose as much else would have with regular shares.

So, how do they earn from structured notes? The answer is based on how well assets work out. If an asset makes a good profit, then that means higher returns for investors of structured notes too! This proves that it does not give fixed interest like bonds or certificates of deposit do.

The Innovation of Structured Notes in the Investment Landscape

Structured products are changing how we invest money. They started in the U.K. and now they’re popular here too. You use an online broker platform to buy them, like Ameriprise Financial or Fidelity.

These aren’t like bonds and CDs though, they don’t have a fixed interest rate.

Money is safe with structured notes even if assets lose value. They shield you from loss better than other types of investments. So it’s not just about growing your savings, but also about keeping them safe in hard times! This makes structured products a very smart pick for your portfolio.

Types of Structured Notes

There are a variety of structured notes depending on investment in a structured note. For example, different notes can have different maturities, different call features, payoff structures, tax implications, and creditworthiness of the issuers.

Here are some examples of different types of structured products:

- Principal Protected Notes: PPNs are designed to offer principal protection to investors. This means that the investor’s full principal investment is typically returned at the end term of the note, regardless of the performance of the underlying asset.

- Reverse Convertible Notes: RCNs offer the investor fixed coupon payments, while the value of the note is linked to its reference asset.

- Enhanced Participation or Leveraged Notes: EPNs offer investors the potential for higher returns through the use of leverage. Leverage is the use of borrowed money to increase the potential return on investment. These notes typically are linked to 2x or 3x the return on the underlying asset.

- Hybrid Notes: These notes combine elements of both debt and equity. They may offer the investor a fixed coupon payment but also give the investor the potential for capital gains through the ownership of equity in the issuer.

- Credit-Linked Notes: These products are linked to the credit risk of a specific issuer or a group of issuers, such as a bond index. Credit-linked structured notes can offer investors a way to gain exposure to credit risk without owning the underlying bonds.

- Equity-Linked Notes: These securities are linked to the based on the performance of an underlying specific equity or a group of equities, such as a stock index. Equity-linked structured notes can offer investors a way to gain exposure to the stock market without directly owning stocks.

- Currency-Linked Notes: These notes are linked to an underlying performance of a specific currency or a basket of currencies. Currency-linked structured notes can offer investors a way to gain exposure to currency exchange rates without directly owning a foreign currency.

How to Invest in Structured Notes?

Investing in structured note’s takes a few steps. Here is the process to guide you:

- First, reach out to a financial advisor or any professional from a financial institution for advice.

- They will explain about structured notes. They sell these as debt obligation securities.

- You can also buy or sell your structured notes online through platforms like Yieldstreet, Fidelity, or Ameriprise Financial.

- Money put in structured notes is based on the value of certain assets like stocks and bonds.

- The return money from this type of note links to how well those underlying assets perform.

- Make sure about the risk/reward equation before investing your money into it.

- Do not forget to ask about possible fees for investing in structured notes.

- Know that even though this investment has higher returns, it does risk missed payments, and other credit risks can happen.

- The selected note might be sold on the secondary market but now availability can be limited.

Advantages of Structured Notes

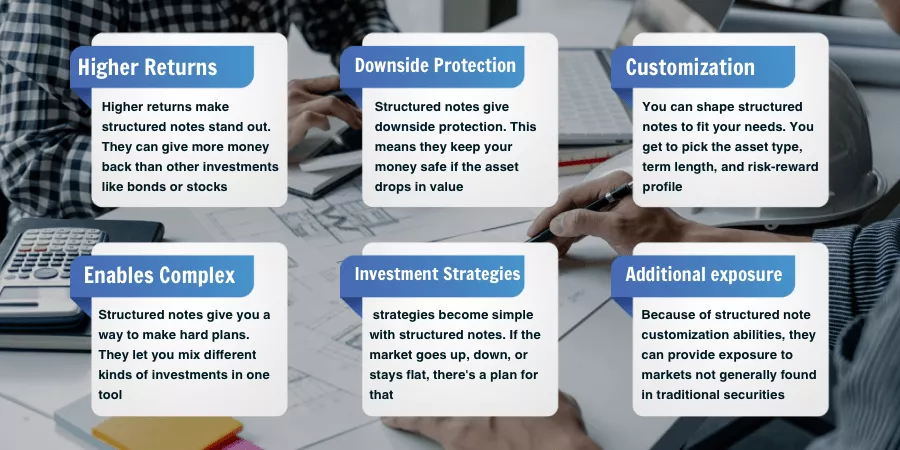

Structured notes offer a range of benefits to investors, including the potential for higher returns and downside risk protection. These financial instruments are often customizable and can enable complex investment strategies.

They tap into underlying assets such as stocks, bonds, commodities, or currencies which may enhance market exposure significantly.

Higher Returns

Higher returns make structured notes stand out. They can give more money back than other investments like bonds or stocks. Your cash grows when the things that your note is based on do well in the secondary market.

Yieldstreet’s notes have been known to do just this, helping earn more than what you might see with traditional investment options.

Downside Protection

Structured notes would give downside protection. This means they keep your money safe if the asset drops in value. You don’t lose all your money when things go bad. For example, a note could be set up so that even if the underlying asset stocks fall by 30%, you won’t lose any money.

Downside protection is good for people who worry about structured note market risk. It makes structured notes less scary than traditional bonds or stocks.

But remember, we aren’t making the promise of no loss at all times, sometimes it may not cover the full amount invested.

The level of safety can change based on the note type used and market conditions too.

Customization

You can shape structured notes allow to fit your needs. You get to pick the asset type, term length, and risk-reward profile. This puts you in control.

Also, if the asset class tied to the note loses value, a custom plan can protect you from loss.

The payout and tax rules for these notes are also flexible based on how they’re set up.

Enables Complex Investment Strategies

Structured notes give you a way to make hard plans. They let you mix different kinds of investments in one tool. You can use stocks, bonds, or other items as the base for your particular structured note.

This makes it easier to reach your goals in many kinds of markets.

Complex investment strategies become simple with structured notes. If the market goes up, down, or stays flat, there’s a plan for that! These plans shield you from big losses while still offering high returns.

Additional exposure

Because of structured note customization abilities, can notes provide exposure to markets not generally found in traditional securities. Example of a structured note can depend on stock market volatility, as measured by the VIX.

No matter what kind of goal you have, there is a structured note strategy waiting for you!

Disadvantages of Structured Notes

Structured notes may lack liquidity, making them difficult to sell prior to the note before maturity date. Another risk is credit risk since the return of principal and any payouts are dependent on the issuer’s ability to meet their financial obligations.

Investors must also consider the chance of missed payments if the note does not perform as expected. Additionally, structured notes come with high fees that could eat into potential returns.

Lack of Liquidity

Selling structured notes is hard. One big reason for this is the lack of liquidity. These notes are not like stocks that you can sell at any time. They stick with you till they mature.

Structured notes also stop quick reactions to market changes. As an investor, you cannot get fast cash from them when needed. This makes them a tough choice for people who may need money at short notice.

Credit Risks

Put your money in structured notes. But you should know about credit risks first. These are big risks with structured notes.

If a company that gives out these notes fails, you may lose the money you put into it.

This is because the notes are unsecured debt obligation promises from this company. No safety net backs these types of loans! So if things go wrong, your initial investment might be lost entirely! The risk gets higher when a note issuer is not financially strong or stable itself.

Chance of Missed Payments

Structured notes have a risk of missed payments. This happens when the assets tied to your note do poorly. If the assets lose too much value, you might not get any money back at all.

It’s important to think about this and pick what assets go into your note with care.

High Fees

Structured notes can come with high fees. These costs make it hard for you to see if the note is good, bad, or worth your money. Major investment banks and financial institutions are the ones that issue these notes.

They add in charges for creating, selling, and managing them. It’s like a hidden price tag on top of what you pay for the note itself. The extra cost can eat into any profit you might make from your investment.

You should always check all the fees before buying structured notes!

Structured Notes: Pros and Cons

Delve into the dual nature of structured notes, exploring how they can offer excellent customized payouts and time savings but also face limitations with liquidity and pricing rigidity.

Explore the call risk along with potential fees as we delve deep into a comprehensive view of this financial product. Prepare to get informed before making your next major investment decision.

Customized Payouts

Structured notes offer you payouts that are special. You can set up these payments based on what you want or need. The pay depends on things like market changes and the rules of the note.

But it’s not always easy to know how much you will get back. Some structured notes have a top limit for gains, stopping more earnings if this level is hit.

If the market drops past a certain point, some structured notes might stop paying out at all! So while custom payouts sound nice, they also come with risks.

Exposure

Structured notes is linked to many types of assets. With these, you get exposure to stocks, bonds, commodities, and foreign exchange rates. You take on market exposure when you buy a structured note.

This means the worth of your note moves with the changes in the value of linked assets. The more assets you are exposed to, the higher the chance for gains and losses as well. Always be wise about this market risk!

Returns

The amount of money you get from structured notes is not the same all the time. It changes based on how the note is set up. Sometimes, your earnings may be taxed as regular income or capital gains.

This also relies on how your structured note is put together. Some only give back money and main payment after a set time, while others pay four times a year.

The participation rate matters too! This tells us just how much of an asset’s price lift will reach investors’ pockets.

Time Savings

Investing in structured notes saves time. You don’t need to follow the market every day. The bank makes investment choices for you. So, you can do other things while your money grows.

This is good for those who like to invest but lack spare time.

Structured notes also reduce stress. They help avoid quick decisions that may lead to losses. You decide how much risk you are willing to take at the start and then let it go.

Your money grows over a set amount of years, giving you more free time without worry.

Limited liquidity

Selling structured notes can be hard. This is because of the limited liquidity, and the ability to trade them quickly for cash. In many cases, no quick buyers can be found for these notes.

So this makes it tough to turn your investment back into money fast if you need to. Limited liquidity is a key thing that could make investing in structured notes risky.

Pricing Rigidity

Structured Notes have set prices. This is called pricing rigidity. It’s hard to change the price after it’s set. Banks give out structured notes with fixed costs based on market conditions.

When those conditions change, the note price stays the same. This can be tough for buyers who want to sell their notes before they come due or note mature.

You may lose money if you sell your note early because its cost won’t match up with current market values.

Call Risk

“Call Risk” is a term you need to know when talking about structured notes. It means the bank or group that gave out the note can take it back before it ends. When this happens, you may not earn all the money you hoped for from your investment.

This could be because of changes in interest rates or other market situations. For instance, if rates fall, they might call back their old notes and give out new ones at lower rates.

Structured notes with high call risk are risky for retail investors who want to hold onto their investments till the end term.

Fees

Structured notes can have high fees. These costs may make it hard for you to see how much they are worth and how risky they are. Fees play a big part in the growth of your investment too.

Some notes also add extra charges on top of the basic fee. It’s important to know about all the fees before buying any note.

This helps you avoid getting caught off guard with fees that eat into your earnings from these notes.

How Structured Notes Can Diversify Your Portfolio

Structured notes can add more variety to your investment pile. This is because they use different parts like stocks, bonds, and other things.

Think of it as a mixed salad with many ingredients that all taste good together. Putting money in structured notes gives you safety if the things you put money in lose value.

Also, how much money you make depends on these things doing well. Some people say this helps spread out investment risk over many places instead of just one or two.

So, with structured notes, not all your eggs are in one basket!

Conclusion

Structured notes bring a new angle to investing. They let you make gains based on other things like stocks and bonds. Yet, they also keep your money safe if values drop.

It’s an exciting way to take care of your money and see growth notes at the same time!

FAQs

Structured notes are a type of investment with a risk-return based on market variables like S&P 500 and fixed-income securities.

They tie your returns to an index or asset, like an equity index. They use derivative portion packages such as call options or put options to create distinct outcomes.

It depends on your goals! Structured notes can help increase diversification in portfolios and provide protection options against stock market losses, but they also contain risks.

Yes, types include principal protection notes (PPN), principal guarantee; absolute return, digital, and income notes all have varied features and term lengths. Structured notes with principal protection are a common type of investment product designed to provide investors with a level of security for their principal investment.

Global issuers play an important role as it involves paybacks from unsecured loans given by these institutions leading to credit risks besides market-linked return uncertainties

Sophisticated investors often invest in these due to their complexity. While they might be ideal for conservative investors looking for low-risk investments; you would need guidance from an investment adviser (CFA/CFP) before making such tactical investments.

Commodity-Linked Structured Investment is a dual investment involving a selected basket of currencies of your choice and gold. The investment is non-principal protected, but it offers the investor the opportunity for higher returns on structured notes.

Why You Need a Personal Financial Manager?

Personal finance management (PFM) is not confined to budgeting and investment any longer. There are

Nearing Retirement Advice for a Secure Future

Nearing retirement advice? A plan for retirement is essential to enjoy a happy healthy life

What is Debt Ceiling? A Complete Guide for Beginners

What is Debt Ceiling? Debt Ceiling, also known as the debt limit, is the highest

Is It Possible to Have No Debt?

Debt is often considered the norm in the corporate world, but the debt free companies