Understanding the reasons why retirement planning is important can be a comfortable, stress-free golden age and one filled with financial worries.

As residents in UAE or expatriates at the CXO level, it’s crucial to ensure you have an effective retirement plan that will provide for your needs when you decide to stop working.

In this blog post, we’ll delve into the various aspects of retirement planning – from determining income goals and sizing up expenses to implementing a savings program and managing assets.

We’ll discuss diversifying income sources through retirement and pension plans, as well as saving strategies for future medical costs.

We’ll also explore how you can optimize charitable giving through your retirement plan, work with tax advisors for maximum benefits, start early on your current savings for better returns, determine how much you should aim to save based on pre-retirement salary considerations and investment strategies ensuring adequate funds post-retirement.

Remember that knowing why retirement planning is important is just the first step; taking action ensures a secure financial future.

The Importance of Retirement Planning

Early retirement planning is crucial for achieving security, especially for expatriates and residents in the Middle East.

It involves determining retirement income goals, sizing up expenses, implementing a savings program, and managing assets and risks.

The ultimate goal is to maintain your current lifestyle even after you stop earning a regular paycheck.

Determining Retirement Income Goals

Your retirement income goals depend on factors like your desired lifestyle, expected life span, and potential medical costs.

Use a retirement income calculator to help determine these goals.

- Clarity

- Planning

- Realistic Expectations

- Motivation

- Uncertainty

- Lack of Focus

- Risk of Falling Short

- Missed Opportunities for optimizing savings and investments, such as taking advantage of tax benefits or employer-sponsored retirement plans.

Sizing Up Expenses

Estimate future living expenses, including housing, food, healthcare, etc., keeping inflation in mind.

Use online budget calculators or consult with a financial advisor at Quadra Wealth for this purpose.

- Accuracy

- Budgeting

- Lifestyle Planning

- Adjustments

- Underestimating Needs

- Inefficient Budgeting

- Overspending

- Lack of Preparedness

Implementing a Savings Program

- Create an emergency fund: Cover 6-12 months’ worth of living expenses.

- Prioritize debt repayment: Pay off high-interest debts like credit card balances first.

- Increase contributions towards retirement accounts: Maximize contributions towards employer-sponsored plans like 401(k) or individual retirement accounts (IRAs).

- Avoid unnecessary expenditures: Cut back on dining out or luxury purchases.

- Financial Security

- Goal-Oriented Saving

- Capital Growth

- Flexibility

- Lack of Emergency Fund

- Inconsistent Saving Habits

- Missed Investment Opportunities

- Financial Vulnerability

Managing Assets and Risks

Risk management is crucial to ensure that your nest egg isn’t wiped out due to unforeseen circumstances like market downturns or personal emergencies. Diversify investments across different asset classes, geographical regions, and sectors to reduce risk exposure.

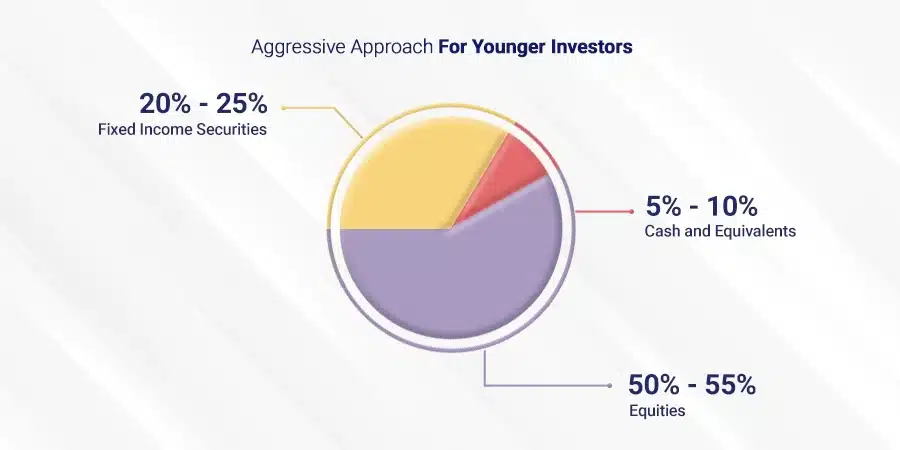

Investment strategies should align with one’s early age – generally, an aggressive investment approach is recommended for younger individuals who have a longer time horizon to tolerate market fluctuations, whereas a more conservative mix of investments is advised for those nearing retirement age to avoid potential losses close to their retirement date.

Working with experienced professionals at Quadra Wealth, we ensure consistent growth of your portfolio through structured notes, helping you become financially independent post-retirement.

- Diversification

- Risk Mitigation

- Maximizing Returns

- Financial Stability

- Exposure to Volatility

- Limited Growth Potential

- Lack of Protection

- Inadequate Asset Allocation

Key takeaways

Planning for retirement is crucial for achieving financial safety in the Middle East. To achieve this, one must determine retirement income goals, size up expenses, implement a savings program, and manage assets and risks. Working with experienced professionals at Quadra Wealth can help ensure consistent growth of your portfolio through structured notes to become financially independent post-retirement.

Saving for Medical Costs in Retirement

As we age, the likelihood of needing medical care increases. This is why a significant part of retirement planning involves saving for potential healthcare costs and long-term care expenses.

It’s crucial to understand that these expenses can significantly impact your retirement savings if not planned properly.

Money-Saving Tips for Future Medical Costs

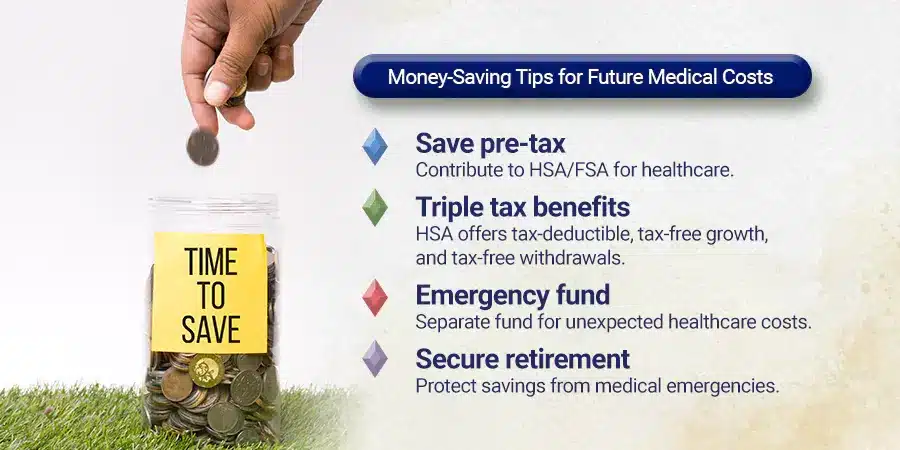

One strategy is to contribute regularly to a Health Savings Account (HSA) or Flexible Spending Account (FSA). These accounts allow you to set aside pre-tax dollars specifically for health-related expenses.

An HSA, in particular, offers triple tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals used for qualified medical expenses are also tax-free.

Another tip is to have a separate emergency fund dedicated solely towards unexpected healthcare costs. By having this safety net in place, you’re less likely to dip into your main retirement funds when faced with sudden medical emergencies.

Long-Term Care Planning

Long-term care insurance is another important aspect of preparing for healthcare costs during retirement.

According to the U.S. Department of Health & Human Services, about 70% of people over 65 will require some form of long-term care services during their lifetime.

Purchasing a policy earlier rather than later can help reduce premiums while ensuring coverage should you need it down the line.

However, remember that policies vary greatly so it’s essential that you carefully review what each one covers before making a decision. Explore AARP for further details on long-term care insurance.

By incorporating these strategies into your financial plans early on with Quadra Wealth’s assistance, residents and expatriates living in UAE can ensure they have adequate funds set aside specifically designed towards meeting any future healthcare needs. Remember – proper planning today leads to peace of mind tomorrow.

Key takeaways

Retirement planning involves saving for potential healthcare costs and long-term care expenses. One strategy is to contribute regularly to a Health Savings Account (HSA) or Flexible Spending Account (FSA) while having a separate emergency fund dedicated solely towards unexpected healthcare costs. Long-term care insurance is also important, with purchasing a policy earlier rather than later helping reduce premiums while ensuring coverage should you need it down the line.

Optimizing Charitable Giving Through Your Retirement Plan

Retirement planning isn’t just about securing your financial future. effective retirement planning offers a unique opportunity to leave an enduring legacy for the causes you are passionate about.

By adding charitable giving to your retirement plan, you can optimize tax benefits while supporting organizations that align with your values.

Direct gifts during a lifetime or at death

Making direct gifts to charities during your lifetime is one way to optimize charitable giving through your retirement plan.

This strategy allows you to see the impact of your contributions firsthand and may provide immediate tax benefits depending on the nature of the gift and applicable IRS regulations.

In addition, naming a charity as a beneficiary in your will ensures that part of what you leave behind supports causes close to your heart even after you pass away.

Benefits from using charitable remainder trusts/gift annuities

A more complex but potentially rewarding option involves establishing a Charitable Remainder Trust (CRT). A CRT provides income for life or a specified term, after which remaining assets go directly towards designated charities.

Gift annuities offer fixed payments for life based on age at the time of donation made along with potential tax deductions upfront.

Naming charities as beneficiaries

Another effective method includes naming charities as beneficiaries in various investment accounts such as IRAs or 401(k)s. This approach not only leaves a legacy but could also reduce estate taxes upon death by removing these assets from the taxable estate.

Through strategic planning and understanding different ways to contribute, it’s possible to achieve personal financial goals and support meaningful causes at the same time – a truly win-win scenario.

Remember though – always consult with a professional advisor before making any major decisions regarding finances, especially when dealing with matters like taxation and legal implications associated with the various strategies discussed above.

Key takeaways

Retirement planning is not just about securing your financial future, but also an opportunity to make a lasting impact on the causes you care about through charitable giving. Direct gifts during a lifetime or at death, using charitable remainder trusts/gift annuities, and naming charities as beneficiaries in various investment accounts are some of the ways to optimize tax benefits while supporting meaningful causes. It's important to consult with a professional advisor before making any major decisions regarding finances and tax implications associated with the different strategies discussed above.

Working With A Tax Advisor On Your Retirement Plan

The journey to financial independence and a comfortable retirement is often complex. That’s where a tax advisor comes in handy.

Working with one on your retirement plan offers several advantages, from finding deductions and tax credits to providing peace of mind about finances during your golden years.

Finding Deductions & Tax Credits

A skilled tax advisor has an in-depth understanding of taxation laws and regulations.

They can identify potential deductions and credits you may not be aware of, such as those related to healthcare expenses or charitable contributions made through structured notes like Quadra Wealth provides for expatriates in UAE.

These deductions could significantly reduce your taxable income, leading to immediate savings.

Contributing to retirement plans such as 401(k)s and IRAs can potentially lead to deductions on your taxable income, depending on various factors.

Peace Of Mind About Finances During Golden Years

Beyond tangible financial benefits, working with a tax advisor also brings emotional relief by ensuring that there will be no unexpected surprises when it comes time for withdrawals during retirement years.

They help ensure that all aspects of retirement planning, from calculating required minimum distributions (RMDs) from IRAs after age 72 to optimizing Social Security claiming strategies, are taken care of efficiently.

This level of detailed attention helps avoid penalties associated with early withdrawals or missed RMDs while maximizing available benefits – allowing retirees more freedom to enjoy their hard-earned nest egg without constant worry over money matters.

Key takeaways

Working with a tax advisor on your retirement plan can offer advantages such as finding deductions and tax credits, providing peace of mind about finances during retirement years, and avoiding penalties associated with early withdrawals or missed RMDs. It's important to start your financial planning for retirement sooner rather than later to allow compound interest to work its magic and grow your portfolio value exponentially over the long-term horizon. This is especially crucial for ex-pats in the Middle East who might not be familiar with local taxation rules due to being in a unique regulatory environment.

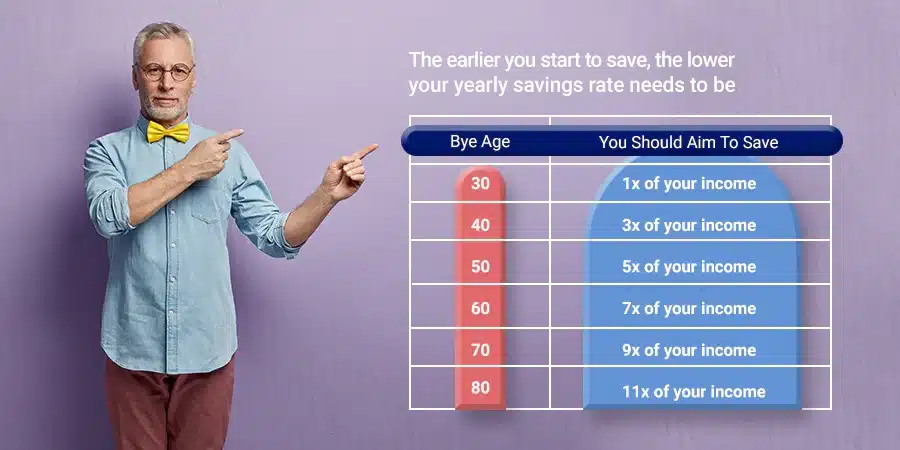

Starting Early On Your Savings For Better Returns

The importance of starting early on your savings cannot be overstated. As an ex-pat or resident of the UAE, recognizing that time is a valuable asset is essential when you plan for your retirement.

The earlier you start saving and investing, the more time your money has to grow

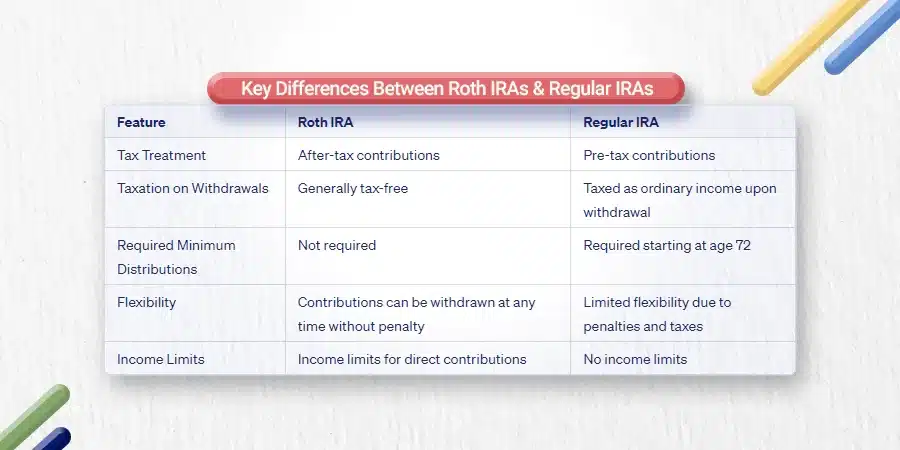

The Benefit Of Roth IRAs Over Regular IRAs

Beyond employer-sponsored plans, another excellent option for young adults is contributing post-tax dollars to Roth IRAs.

Unlike traditional IRAs, which tax withdrawals during retirement, Roth IRA distributions are generally tax-free.

This means any growth and earnings within the account can be withdrawn without additional taxation upon reaching the eligible age.

In comparison with regular IRAs where pre-tax dollars are invested but taxed at the withdrawal stage often leading to potentially lower returns due to higher income brackets during working years – Roth IRAs offer greater benefits if one expects their income level and hence tax rate would increase over time.

To summarize: Starting early gives you the power of compound interest – earning interest not just on initial investment but also on accumulated interests over years; utilizing an employer’s 401(k) plan provides immediate return through company matching funds; while choosing Roth IRA could lead potentially higher net gains after considering taxation rules associated with different accounts.

If there’s anything that we’ve learned from our experience at Quadra Wealth helping ex-pats in the Middle East become financially independent through structured notes, it’s this: Every little bit counts when it comes to ensuring security in post-retirement life. So don’t wait – get started today.

Key takeaways

The importance of starting early retirement savings cannot be overstated. Employer-sponsored plans like 401(k) and Roth IRAs are excellent options for young adults to jumpstart their retirement savings, with immediate returns through company matching funds and potentially higher net gains after considering taxation rules associated with different accounts. Every little bit counts when it comes to ensuring financial security in post-retirement life, so don't wait - get started today.

Retirement Savings: How Much Should You Aim For?

Planning for retirement is crucial for your financial future. But how much should you aim to save? Guidelines for retirement savings can be determined by taking into account factors such as pre-retirement salary and social security payments.

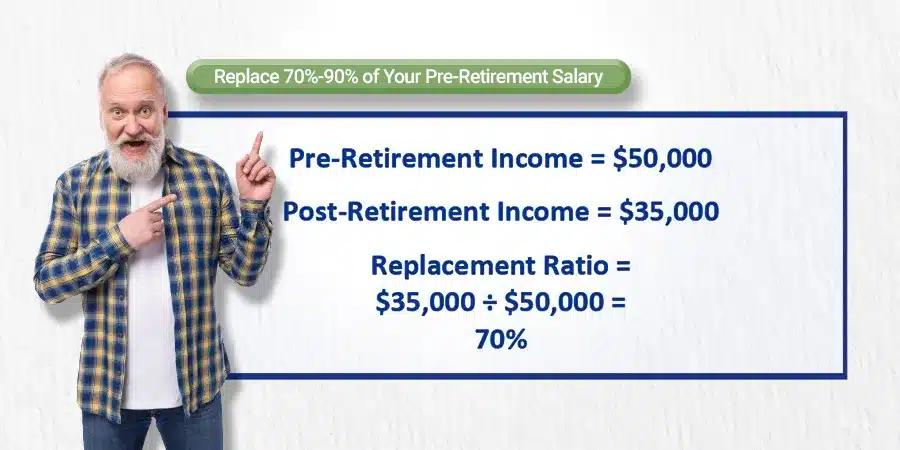

Replace 70%-90% of Your Pre-Retirement Salary

Experts suggest replacing between 70% -90% of your annual pre-retirement salary through personal savings and social security payments.

This percentage allows most people to maintain their current lifestyle after retiring without worrying about running out of funds.

Use an online calculator to estimate how much you should be saving each year based on your age, income level, desired retirement age, and expected expenses.

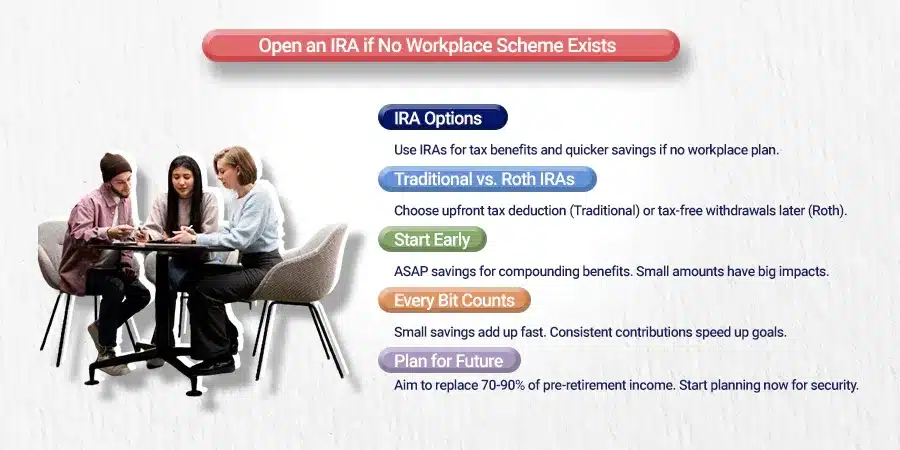

Open an IRA if No Workplace Scheme Exists

If no workplace retirement scheme is available or if it doesn’t meet your needs, consider opening an IRA to take advantage of its tax benefits and maximize savings. IRAs offer tax advantages that can help grow your savings more quickly than regular savings accounts.

Choose between traditional and Roth IRAs. Traditional IRAs allow for tax-deductible contributions now with taxes paid upon withdrawal in retirement while Roth IRAs involve post-tax contributions with tax-free withdrawals later on. Learn more about the differences here.

Remember – starting early always gives the best results due to compounding interest over time. So start today even if small amounts initially – every bit helps towards reaching the goal sooner rather than later.

The key takeaway? Start planning as soon as possible. It’s never too late or too early to begin preparing for a financially secure future.

“Secure your financial future by aiming to replace 70-90% of pre-retirement salary through personal savings & social security. Start planning today.

Investment Strategies for a Comfortable Retirement

Strategic investment planning is crucial for ensuring a comfortable retirement. For those nearing retirement, it is important to weigh the risks and potential rewards of one’s portfolio.

Conservative Investments for Those Nearing Retirement

If you’re closer to retirement age, a conservative mix of investments is advised. This approach helps protect against potential losses that could occur close to the date when regular paychecks stop.

Consider bonds, money market accounts, and high-yield savings accounts as part of this retirement strategy. Diversification is still important, even within this more cautious framework.

Aggressive Approach for Younger Investors

Younger individuals can afford an aggressive investment approach since they have more time before retirement. This allows them greater flexibility in weathering market fluctuations while potentially achieving higher returns.

For younger investors, beginning with low-cost index funds that track wide-market indices is a good strategy.

Find a Balance with a Balanced Portfolio

A balanced portfolio contains both equity and debt instruments tailored to each investor’s specific needs. Target-date funds automatically adjust allocation between various asset types depending on expected year withdrawal, providing a hassle-free way to maintain optimal balance throughout your investing journey.

Remember, no matter your age, it’s never too early or too late to start planning for retirement. Start investing today to secure your financial future.

“Secure your financial future with strategic investment planning for retirement. Whether young or nearing retirement, find the right balance in your portfolio.

Conclusion

In summary, it’s no secret that financial stress can significantly affect your expected life expectancy.

When you don’t have to worry over your financial circumstances in your old age, stress is considerably reduced, which in turn can increase your average life expectancy.

So, retirement planning is crucial for everyone, especially for expatriates at the CXO level.

It involves determining income goals and expenses, implementing a savings program, managing assets and risks, diversifying income sources with pension plans and Social Security benefits, saving for medical expenses in retirement, and optimizing charitable giving through your plan by using direct gifts or charitable trusts/gift annuities/naming charities as beneficiaries.

You should also work with a tax advisor to find deductions & tax credits while starting early on your savings for better returns by taking advantage of employer-sponsored plans like 401(K) or opening an IRA if no workplace scheme exists.

Lastly, investment strategies in ensuring adequate funds post-retirement require more conservative mix investments advised for those nearing their golden years.

And it’s no secret that financial stress can significantly affect your expected life expectancy.

When you don’t have to worry over your financial circumstances in your old age, stress is considerably reduced, which in turn can increase your general life expectancy.

FAQs in Relation to Why is Retirement Planning Important

A retirement plan ensures financial security when your income from employment stops, so you can enjoy your golden years without financial burden. Learn more about Retirement Planning here.

The most important part of retirement planning is to determine your income goals and start saving early, including asset management and risk mitigation strategies. Read more on Forbes Advisor.

Starting early allows compounding interest to work in your favor, increasing potential returns over time while reducing financial burden later in life. Check out this article on the power of compound interest.

A pension plan provides steady income during retirement years, supplementing personal savings and social security benefits – an essential element in comprehensive retirement plans. The Motley Fool explains further.