Understanding how to buy stock in the UAE can be a rewarding journey toward financial growth and independence. In this guide, we provide a comprehensive overview of the Dubai Financial Market (DFM), NASDAQ Dubai, and Abu Dhabi Securities Exchange (ADX) to demystify these stock market works for both residents and expatriates.

We provide insights that help demystify these stock exchange markets for both residents and expatriates. We then transition into practical steps on how to start investing in the UAE stock. From acquiring your National Investor Number (NIN) to opening the account you’re going to trade with licensed brokers, we cover all you need to know.

In addition, we discuss strategies for successful investment such as thorough company research and building diversified portfolios. For our expatriate readers at the CXO level interested in buying stock in UAE, we explore potential limitations and opportunities available through ETFs.

Finally, make sure not to miss our section on online trading platforms like the Sarwa Trading app or eToro’s multi-asset offerings. Plus, get tips on using financial comparison services like MyMoneySouq for an informed investment decision.

Understanding the Stock Exchange Markets in UAE

In the UAE, stock exchange markets abound and offer myriad possibilities for investors. These include the Dubai Financial Market (DFM), NASDAQ Dubai, and the ADX.

Each platform provides its unique offerings, making it possible when an investor buys stocks in the UAE, according to their preferences.

Overview of the Dubai Financial Market (DFM)

The DFM operates as a secondary market for trading securities and bonds, commodities, derivatives, and other financial instruments.

It’s known for its adherence to sharia principles and hosts over 170 listed companies including some prominent ones like Emirates NBD. This makes it an attractive option if you’re looking at how to buy stock in the UAE.

Exploring NASDAQ Dubai’s Offerings

NASDAQ Dubai offers international companies access to exchange locally within the Middle East region while also providing local firms with global exposure. The exchange provides listings from a range of areas, such as REITs, mutual funds, and ETFs.

It’s a great option for those looking to put money into UAE companies.

Insight into the Abu Dhabi Securities Exchange (ADX)

A key player in facilitating economic growth within the Abu Dhabi Chamber is ADX which serves as a venue where public joint-stock companies can list their company’s share price publicly after meeting certain requirements set by Ras Al Khaimah Investment Authority amongst others.

With more than 70 UAE stocks listed on this platform, there are plenty of investment options available here too. In order to start trading on these platforms or any other UAE stock exchanges, one must first obtain an investor number.

This will be covered further under the ‘Steps To Start Investing In Stock in UAE’ section later on in our guide provided by Quadra Wealth – your online financial advisor specializing in helping expatriates and residents build assets through structured notes.

Besides purchasing individual companies’ stocks directly via these exchanges, foreign investors can also consider investing indirectly through ETFs or mutual funds managed by asset management firms based out of places like Dubai International Financial Center which have expertise across different asset classes and geographies, thereby offering additional diversification benefits towards achieving your long-term investment goals.

Key takeaways

The article provides an overview of the stock exchange markets in UAE, including the Dubai Financial Market (DFM), NASDAQ Dubai, and the Abu Dhabi Securities Exchange (ADX). Each platform offers unique investment opportunities for investors looking to buy stock in the UAE. Foreign investors can also consider investing indirectly through ETFs or mutual funds managed by asset management firms based out of places like Dubai International Financial Center.

Steps to Start Investing in Stocks in UAE

If you’re aiming to expand your riches, investing in stock could be a lucrative approach. Before you get into stock trading, it’s essential to understand the process.

In this section, we’ll walk you through the steps needed to start investing in stock within the United Arab Emirates (UAE).

How to Get a National Investor Number (NIN)

The first step towards becoming an investor is obtaining a National Investor Number (NIN). This unique identifier is issued by Dubai Financial Market and allows individuals or corporations to trading on any UAE exchange.

To get your NIN, simply fill out an application form at DFM’s Customer Services Desk or through their online portal.

Opening Your Trading Account

Once you have your NIN, the next step involves opening a trading account with one of many licensed brokers operating within the UAE such as Interactive Broker.

A trading account enables investors like yourself to place buying/selling orders for equities listed on local exchanges using local currency.

Selecting Licensed Brokers

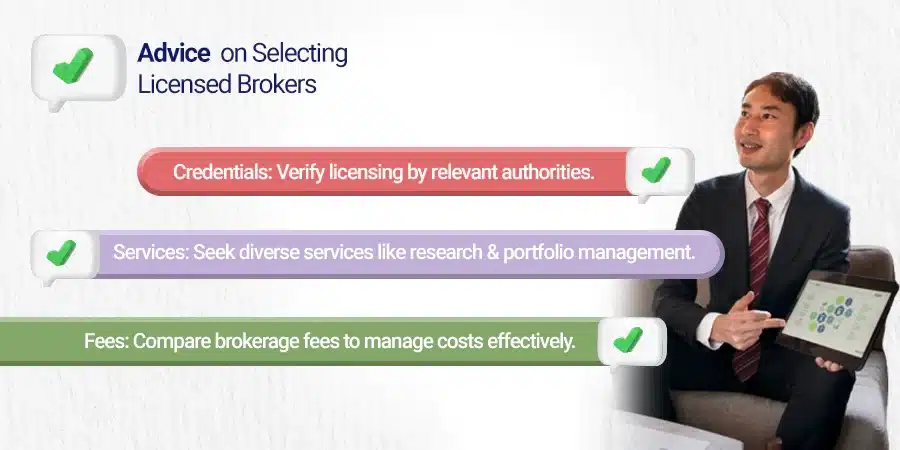

A crucial part of successful stock investment lies in choosing a reliable and experienced broker who can guide and support your journey.

Make sure that they are registered with either ADX or DFM and offer comprehensive services including market analysis reports which could prove beneficial when making informed decisions about investments.

Tips for Choosing Licensed Brokers:

- Credentials: Ensure that they are licensed by relevant authorities.

- Servicing capabilities: Look for those offering a diverse range of services beyond just transactional assistance – research reports; portfolio management, etc.

- Fees & Charges: Compare brokerage fees across different providers before settling down with one since these costs can eat into potential returns over time if not managed properly.

In summary, starting off as an investor may seem daunting, but once armed with the right knowledge, tools, and resources, anyone can embark on this journey toward financial independence.

Key takeaways

This section provides a guide on how to start investing in stock in the UAE, including obtaining a National Investor Number (NIN), opening a trading account with a licensed broker, and selecting reliable and experienced brokers. It also offers tips for choosing the right broker based on credentials, servicing capabilities, fees & charges. With the right knowledge and resources, anyone can embark on this journey toward financial independence.

Strategies for Successful Investment

To achieve success in the UAE markets, a sound strategy is essential. The UAE stock exchange offers plenty of opportunities, but it’s important to approach them with caution and a good understanding of investment principles.

Thorough Company Research is a Must

The first step to successful investing is conducting a fundamental analysis. This means researching a company’s financial health, industry position, and overall economic conditions before buying its equities.

Examine aspects like rate of earnings augmentation, liability-to-capital proportion, and ROE. Also, consider the macroeconomic environment in which the company operates.

Remember, stock represent ownership in real businesses – their value rises and falls based on business performance over time.

So, making informed decisions about where you put your money can significantly impact your returns.

pros

- Informed decisions

- Risk mitigation

- Value identification

- Long-term performance

cons

- Uninformed decisions

- Increased risk exposure

- Missed opportunities

- Lack of portfolio alignment

Diversify Your Portfolio

Diversification is another key strategy when investing in stock. By spreading investments across various sectors or types of companies (large-cap vs small-cap), you can reduce risk while potentially increasing returns.

A diversified portfolio consists of uncorrelated or negatively correlated stocks. This means that if one sector underperforms due to certain reasons (like regulatory changes), other parts may still perform well, thus balancing out losses.

- Sector Diversification: Don’t put all your eggs into one basket – spread them across different sectors like healthcare, technology, consumer goods, etc.

- Currency Diversification: Investing in international markets allows exposure to different currencies, adding an extra layer of diversification.

- Type-of-Company Diversification: Spread investments between large established firms (“blue chips”) & smaller high-growth companies (“growth stock”).

A diversified portfolio could potentially yield higher returns compared to bonds or real estate investments, given appropriate management & monitoring practices are followed alongside considering individual risk appetite tolerance levels.

It’s also worth noting that building such a portfolio requires patience – it doesn’t happen overnight but rather evolves over time as you continue learning about new industries/companies & adjusting holdings accordingly depending upon market dynamics.

For those who prefer professional guidance, Quadra Wealth offers structured notes services aiding consistent growth of investor portfolios, thereby contributing towards financial independence aspirations of residents and expatriates within the Middle East region alike.

pros

- Risk reduction

- Increased returns

- Exposure to opportunities

- Protection against fluctuations

cons

- Concentrated risk

- Vulnerability to downturns

- Limited growth potential

- Lack of flexibility

Key takeaways

The article provides strategies for successful investment in the UAE markets, including conducting thorough company research and diversifying your portfolio across different sectors, types of companies, and currencies. It emphasizes that a diversified portfolio requires patience but can potentially yield higher returns compared to other investments. Professional guidance is also available through Quadra Wealth’s structured notes services for consistent growth in investor portfolios.

Opportunities for Expatriates at CXO Level

The UAE’s stock market is a vibrant ecosystem offering numerous investment opportunities. However, expatriates at the CXO level may face certain limitations due to their access to only up to 122 available trading stocks on local markets.

This limitation does not mean that they cannot participate in the growth story of this region.

Limitations faced by ex-pats at the CXO level

Expats often find themselves restricted when it comes to investing in some local and international companies due to foreign ownership limits imposed by the Dubai government.

Additionally, there might be restrictions related to minimum capital requirements and complex regulatory procedures which can make direct investments challenging.

However, these challenges do not imply that high-level executives should refrain from exploring investment opportunities in this region.

With proper guidance and strategic planning, they can leverage various financial instruments and platforms for diversifying their portfolio while complying with all legal requirements.

pros

- Global perspective

- Network expansion

- Cross-cultural competence

- Skill development

cons

- Relocation challenges

- Language and cultural barriers

- Legal and regulatory complexities

- Loss of local market knowledge

Gaining exposure through ETFs

A viable alternative for those facing such constraints could be exchange-traded funds (ETFs). These are essentially baskets of securities that track an index like NASDAQ Dubai or DFM General Index and offer a way around individual stock purchase restrictions.

In addition to providing broad market exposure, ETFs also come with several other benefits including lower costs compared to mutual funds; liquidity as they’re trading like ordinary shares; transparency since their holdings are disclosed daily, etc.

It’s important to keep in mind that buying international ETFs from UAE-based chosen brokers might involve paying foreign exchange fees, hence many investors need to factor these into overall cost calculations before making any decision to invest in such instruments.

Several brokerage firms operating within the UAE allow the purchasing of global ETFs, thereby enabling ex-pats to gain access to a wider range of asset classes beyond just locally listed stocks without having to navigate cumbersome regulatory hurdles associated with direct equity investments.

pros

- Diversification

- Accessibility

- Lower costs

- Transparency

- Tax efficiency

cons

- Lack of individual control

- Tracking error

- Market volatility risks

- Limited customization

- Overlapping holdings

Key takeaways

Expatriates at the CXO level in UAE face limitations when it comes to investing in some sectors or companies due to foreign ownership limits and complex regulatory procedures. However, they can still explore investment opportunities by leveraging financial instruments like ETFs that offer broad market exposure, lower costs compared to mutual funds, liquidity, and transparency. Several brokerage firms operating within UAE allow purchasing of global ETFs enabling ex-pats to gain access to a wider range of asset classes beyond just locally listed stocks without having to navigate cumbersome regulatory hurdles associated with direct equity investments.

Online Trading Platforms: A Game Changer for Investors in UAE

The world of investing has been transformed by online trading platforms, making it easier for residents and expats in UAE to invest in particular stock both locally and internationally.

Sarwa Trade: Real-time Market Data at Your Fingertips

Sarwa, a well-known trading platform in UAE, provides users with an intuitive user interface that permits them to transact on international exchanges such as the NYSE.

With real-time market data, you can make informed decisions about when to buy or sell shares. The app also provides educational resources for novice investors looking to understand more about the UAE stock market investment strategies.

eToro: Diversify Your Portfolio with Multi-Asset Investment Opportunities

If you’re looking to broaden your portfolio beyond traditional stock, eToro could be the perfect solution for diversifying your investment journey.

This global trading platform provides multi-asset investment opportunities, including commodities, indices, currencies, and even crypto assets like Bitcoin and Ethereum.

You can follow other successful traders’ portfolios or create your own unique strategy based on personal risk tolerance levels.

Baraka: Full Control Over Your Investments

Baraka, another prominent player in this space, caters specifically to self-directed investors who prefer having full control over their investments.

Offering access to over 6k US-listed securities without any minimum requirements makes it highly accessible even for those with smaller budgets.

An added advantage is its auto-invest feature, which facilitates bi-weekly/monthly/quarterly investments depending on user preference, promoting disciplined regular savings habits among its users.

Online trading platforms offer a range of advantages, such as convenience, adaptability, and assortment – perfect for navigating the intricate financial markets with ease and efficiency to help accomplish long-term objectives.

Key takeaways

Online trading platforms have made it easier for residents and ex-pats in UAE to put money in stock both locally and internationally. Sarwa Trade offers real-time market data, eToro provides multi-asset investment opportunities, while Baraka caters specifically to self-directed investors who prefer having full control over their investments. These online trading platforms offer numerous benefits including convenience, flexibility, and variety that can help achieve long-term financial goals successfully.

Making Use Of Financial Comparison Services

Investing in the stock market can be daunting, especially for expats and residents new to the UAE’s financial landscape.

One way to navigate this complex environment is by using financial comparison services like MyMoneySouq.

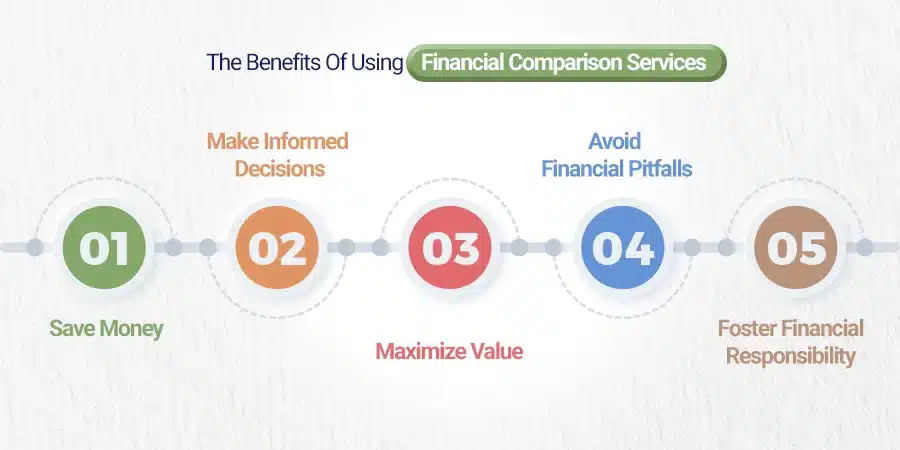

Benefits of Comparison Services Provided By MyMoneySouq

MyMoneySouq offers an array of benefits that help investors make informed decisions about their investments. This platform allows users to compare different financial products such as loans, insurance accounts, credit cards, and more.

- Ease of Navigation: The user-friendly interface makes it easy for visitors to find what they’re looking for without any hassle.

- Variety of Products: With a wide range of financial products available on one platform, users have the opportunity to explore various options before making a decision.

- Informed Decisions: By comparing different products side-by-side, users can make educated choices based on their individual needs and circumstances.

Besides these general benefits related to all kinds of financial products offered by MyMoneySouq, there are specific advantages when it comes to stock-market investments too. Let’s delve into them below:

Specific Advantages for Stock-Market Investments

- Detailed Stock Information: Users get access to detailed information about stock listed on UAE exchanges, including historical data, which aids in understanding how certain stock performed over time, thereby helping predict future trends with better accuracy.

- Risk Assessment Tools: The platform provides tools that allow you to assess the risk associated with particular stocks, hence aiding you in managing your portfolio effectively while minimizing potential losses.

- User Reviews & Ratings: Before investing in any company’s shares, reading reviews and ratings provided by other investors who have already invested in the same could prove very beneficial in terms of getting real-time insights into the actual performance of said companies, thus enabling you to make well-informed investment decisions.

- Tips and Advice from Experts: The platform also features blogs and articles written by finance experts providing tips and advice regarding best practices related to stock trading, useful for both beginners and seasoned traders alike.

In conclusion, whether you’re an experienced investor or just starting out on your journey towards achieving financial independence, using platforms like MyMoneySouq not only simplifies the process but also ensures that every step taken is in the right direction, backed up by thorough research and expert advice, ultimately leading to a successful and profitable investment experience.

Key takeaways

The article discusses the benefits of using financial comparison services like MyMoneySouq for investing in the stock market in the UAE. The platform offers detailed information on trading stock, risk assessment tools, user reviews, and ratings, as well as tips and advice from finance experts to help investors make informed decisions about their investments. Using such platforms can simplify the investment process and lead to a successful and profitable

Conclusion

When writing, stick to the outline and avoid introducing new topics.

- Use SEO keywords if they fit naturally in the sentence.

- Short, witty, and funny sentences are preferred.

- Active voice is key for engaging content.

- HTML tags allowed include p, a, li, ul, strong, and b.

Remember to keep the content concise and to the point, and always back up claims with credible sources.

Learn How To Increase Your Passive Income By 20%, 30%, or more….and Secure A Reliable, Predictable Income Stream In Less Than 5 Years!

Frequently Asked Questions

How to Start Buying Stocks in UAE?

To start buying stock in the UAE, you need a National Investor Number (NIN) from the Securities and Commodities Authority, and then open a trading account with a licensed broker like MyMoneySouq.

Is Stock Trading Legal in UAE?

Yes, stock trading is legal in the UAE, and it is regulated by the Securities and Commodities Authority.

You can buy US stock from the UAE using online platforms like eToro, which offers multi-asset investment opportunities, including access to international markets that make a profit.

What Are the Risks Associated with Stock Trading?

Stock trading involves risks such as market volatility, company-specific risks, and economic risks that can lead to losses.

Yes, ex-pats can buy stock in the UAE, and they need to follow the same process as UAE nationals to obtain a National Investor Number (NIN) and open a trading account with a licensed broker.

What Are Other Forms of Investment Not Related to Stock?

Other forms of investment not related to stocks include real estate, bonds, mutual funds, exchange-traded funds (ETFs), and commodities like gold and silver.