Understanding the ins and outs of retirement planning can often feel like a herculean task. However, it is essential to know that preparing for this critical phase in life is categorized into three stages: exploring, nesting, and reflecting.

This blog post will simplify these phases for you while illustrating strategies to manage your finances during each stage efficiently. Get ready to unravel the roadmap towards a financially secure retirement!

Key takeaways

● Successful retirement planning has three stages: Go-Go, Slow-Go, and No-Go.

● Start saving early for a safe retirement. Don't forget to plan for healthcare costs.

● Your money needs to change with each stage of retirement.

● Speak to legal, tax, and financial pros for better money decisions.

Understanding the Importance of Retirement Planning

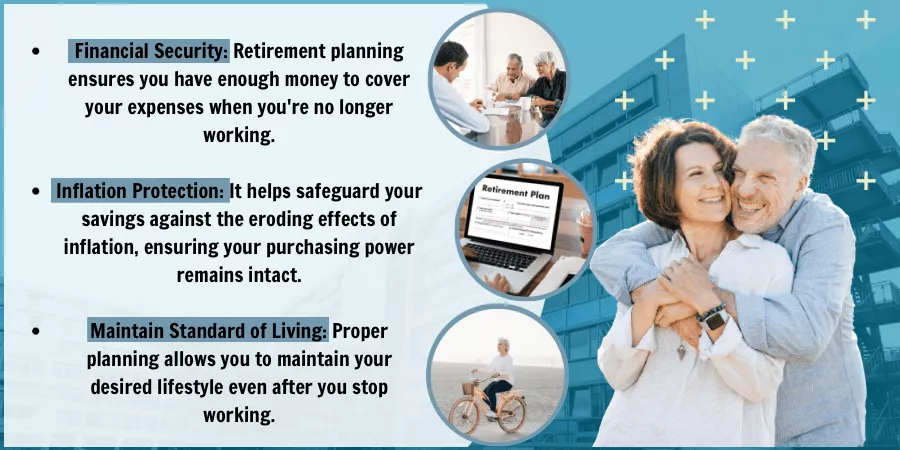

Planning for retirement is very important. You don’t want to run out of money when you get older and can no longer work. Starting to save early gives your money more time to grow. A good plan will also cover the cost of healthcare, trips, or hobbies in retirement.

Also, the different stages of our retirement life ask for different spending ways. At first, we might travel a lot or take on new hobbies (Go-Go phase). Later we might slow down (Slow-Go phase) and finally need help with daily chores (No-Go phase).

So planning how much and when to spend our retirement savings is key.

During this planning process, it’s wise to speak with an advisor about how you’ll pay for any help needed later on in life too.

- Financial Security

- Peace of Mind

- Compound Growth

- Tax Benefits

- Financial Independence

- Financial Instability

- Inadequate Savings

- Dependency

- Missed Growth Opportunities

- Uncertain Future

The Three Stages of Retirement

This section explores the three phases of retirement, often referred to as the Go-Go phase, the Slow-Go phase, and the No-Go phase. These stages represent varying levels of activity and lifestyle changes that occur as one transitions through their retirement years.

Each comes with unique financial considerations and requires a distinct planning strategy; including management of income needs, healthcare costs, and asset distribution among others.

The Go-Go phase

The Go-Go phase is the time to try new things. People often use this time for travel or fun hobbies. It’s part of the exploring stage in retirement investments.

Money decisions are big at this stage too. Some people choose part-time work to have more cash and let their savings grow longer. Others focus on making a steady income stream that they can trust every month.

This phase also includes plans for healthcare costs later on, so it’s smart to invest money now for growth in the financial future.

The Slow-Go phase

In the Slow-Go phase, life moves at a more laid-back pace. This is part of retirement when people have less energy but still keep an active lifestyle. Some choose to downsize or move to a new place at this stage.

Money matters get focus as well. They start to think about changes in healthcare costs and inflation. At this time, it can be smart to invest money in ways that may bring more growth later on.

Some retirees also look into long-term care services during this period. These services don’t come free, so they make a plan for how to pay for them.

The No-Go phase

The No-Go phase comes in the final stage of retirement. People slow down a lot during this time. Health issues are common and can cost a lot of money. Some may lose their spouse and need help from their family or others.

It is very important to plan for things like living wills, power of attorneys, healthcare choices, and who will get what when they pass on during this stage.

Planning for Income Needs in Each Stage

Making a plan for your money in each stage of retirement is key. Here’s how you can do it-

- Exploring Stage: Put money aside for fun. Plan trips or learn new skills.

- Nesting Stage: Think about downsizing. This may mean selling your house and moving to a smaller one to save money.

- Reflecting Stage: You will have more health costs in this stage. Make sure you have saved enough money for these needs.

- At every stage, check how much income comes in from the Canada Pension Plan, Old Age Security Clawback, or other sources like part-time work.

- Look at spending habits to make sure your money lasts throughout retirement. Think about what you really need and cut back on things that are not important.

- Track your fixed and discretionary expenses. Include a separate amount for savings. Adjust as you go, but remain disciplined.

Also consider other income sources, such as robo-advisors or real estate

Managing Health and Wellness in Retirement

In retirement, caring for your health is more than seeing the doctor. It also means staying active and eating well. Many people use the reflecting stage of their lives to fit in activities they didn’t have time for before.

This can range from walking, swimming or even trying a new sport.

Also important is being ready for high healthcare costs as we age. Retirees must plan ahead and ensure they have enough money saved up not just for fun but also to cover medical bills or care needs that might come up later on in life expectancy.

Effective Strategies for Retirement Spending

Planning for how to spend money in retirement is key. Setting these boundaries helps prevent withdrawing too much from retirement funds and depleting the source of income. Here are some tips:

- Know what you need: Have a clear idea of your basic needs, like food and shelter. Always meet these first.

- Plan for fun: Save some money for travel or hobbies. This is part of the exploring stage of retirement planning.

- Get ready for more costs: As you age, health expenses may rise. Keeping cash aside in the nesting stage can be a smart move.

- Be mindful of inflation: Both food and healthcare costs could go up over time. It helps if you plan ahead for this in your spending plans.

- Familiarize yourself with estate planning: In the reflecting stage, focus on things like updating wills and beneficiary names.

- Don’t do it alone: Talk to legal, tax, and financial pros before making big money moves. They can help you make sound choices based on facts, not gut feelings.

Conclusion

In conclusion, the journey of retirement planning is a multifaceted process, characterized by three distinct stages: the Go-Go phase, the Slow-Go phase, and the No-Go phase. Each phase presents unique financial challenges and opportunities, demanding a thoughtful approach to ensure financial security and peace of mind during retirement.

Starting early and saving diligently is the bedrock of a successful retirement strategy, providing your money with the time it needs to grow. However, as you transition through these stages, your financial priorities will evolve. From exploring new adventures and hobbies to considering downsizing and addressing potential healthcare expenses, prudent financial planning is essential.

Moreover, maintaining good health and preparing for rising healthcare costs is equally important, as health and wellness play a pivotal role in enjoying a fulfilling retirement. Lastly, navigating the complexities of estate planning and seeking investment advice from financial advisors when necessary can help protect your assets and ensure a smooth transition of wealth to future generations.

In this intricate personal finance journey of retirement planning, remember that you don’t have to go it alone. Consulting legal, tax implications, and financial professionals can provide invaluable guidance and support, helping you make sound financial decisions based on facts rather than intuition. By diligently following these strategies, you can unlock the path to a financially secure and fulfilling retirement, where your golden years are truly golden.

FAQs

The 3 stages are the accumulation phase, active retirement or income phase, and stable or limited retirement phase.

In the active stage, you may spend money on fun things like time with loved ones, volunteering, or even buying a second home.

The stable stage means your energy levels might be down but you still have predictable patterns. At this point, your spending may focus more on basic day-to-day living expenses than discretionary lifestyle spending.

Yes, Merrill Advisors often encourage adjusting financial decisions throughout each phase such as converting RRSP options and making efficient use of Senior Discounts.

Yes! Making plans for wills, and estates & setting up insurance beneficiaries can support families left behind and preserve wealth if one partner becomes a widow or widower.

Predicting income helps you budget during all three phases; whether from social security benefits, and self-employment in early retirement years to GIS funds in later years.