Investing in the stock market can be intimidating, especially when you hear terms like “Bear Market” being thrown around. Did you know a bear market refers to a period where prices fall 20% or more from recent highs? This blog is here to demystify that term for you, explaining not only what it means but also its causes, impacts, and how one can navigate through such conditions effectively.

Ready to become investment savvy? Keep reading!

Key takeaways

● A bear market is when stock prices fall 20% or more from their top point. This can last for weeks, months or years.

● Bear markets occur due to weak economies, changes in money rules and big world issues like wars or sicknesses that spread.

● You can spot a bear market by watching for falling stock prices, shifting interest rates and bad feelings about the stock market.

● In a bear market, you should use smart ways of investing such as buying shares over time (dollar - cost averaging), spreading your investment across different areas (diversification) and keeping your eyes on long term goals.

Understanding Bear Markets

Bear markets, characterized by falling stock prices and pessimism among investors, play a vital role in the financial world. They are generally defined as a scenario where securities prices fall 20% or more from recent highs amid widespread negative investor sentiment.

Contrasted with bull markets, which exhibit rising investment prices and economic growth, bear markets represent prolonged periods of market downturns. It’s important to note that a bear market is more severe than a market correction, with the latter typically involving a temporary dip in stock prices of less than 20%.

Understanding these concepts can provide crucial insights for navigating challenging economic landscapes.

Definition of a Bear Market

A bear market is a time when prices of stocks, or other investments, fall 20% or more from their high point. This big drop can last for weeks, months or even years. It can happen in all types of markets, like bonds or commodities.

During this time, many people think that prices will keep falling. The name “bear market” comes from the way a bear swipes down with its claws to attack. It’s the opposite of a bull market where prices rise and people feel hopeful about buying more.

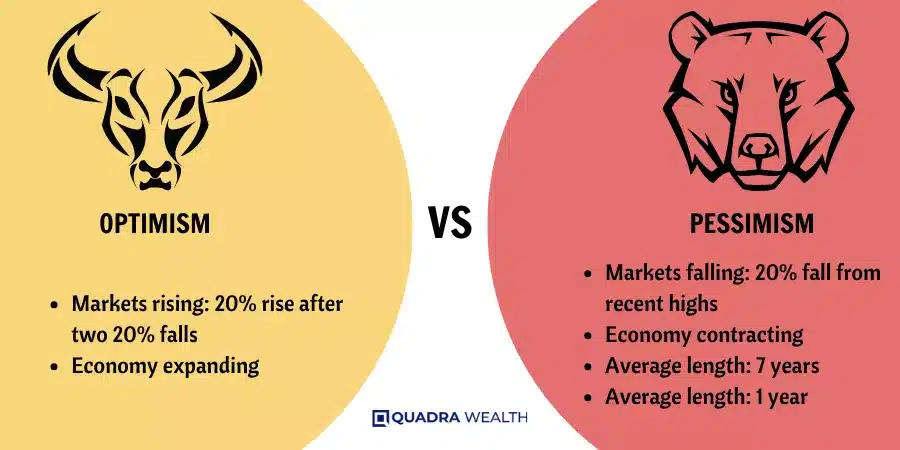

Difference between a Bear Market and a Bull Market

A bear market and a bull market are not the same. In a bear market, stock prices drop at least 20% from recent highs. This means investment prices are going down. People who buy stocks hope for high profits but may lose money instead.

On the other hand, a bull market is when stock prices rise by at least 20%. Here people feel happy because they earn more money from their investments. Investors often have high hopes during a bull market and think positive about the economy.

So, in simple words – Bear Market means bad times with lower prices while Bull Market means good times with higher prices!

Difference between a Bear Market and a Market Correction

A bear market and a market correction are not the same. A sharp fall in prices marks a bear market. Prices drop by 20% or more from their recent highs. It lasts for at least two months, sometimes longer.

On the other hand, we have a market correction. Here stock prices fall too but it is less severe. The decline is 10% or more but remains under 20%. This happens over a short time, often just few days or weeks.

Both events can cause difficulties for investors, but they are part of our investment markets’ normal cycle.

Causes and Frequency of Bear Markets

Bear markets are usually triggered by factors such as recessions, high inflation rates, and geopolitical crises that cause a prolonged drop in securities prices. Understand the frequency and duration of bear markets is crucial for investors striving to navigate market downturns successfully.

Common Causes of Bear Markets

Bear Markets can start for many reasons. Here are some common causes:

- Weak or slow economies: When jobs are lost and money is tight, people buy less. This can lower business profits and start a bear market.

- Bursting market bubbles: Sometimes prices go very high very fast. But then they fall very hard. This is called a market bubble burst.

- Pandemics: Illnesses that spread around the world can hurt the economy and cause bear markets.

- Wars and big problems between countries: These can scare investors and lead to a bear market.

- Big changes in how the economy works: If there’s a big change like new taxes or interest rates, it might cause a bear market.

- The government changes rules about money: For example, if taxes go up or interest rates change, it might scare people away from buying things. This could cause a bear market.

Frequency and Duration of Bear Markets

Bear markets vary greatly in both frequency and duration, depending on a host of factors including the strength of the economy, government policy, and market sentiment.

Frequency of Bear Markets | Duration of Bear Markets |

Bear markets are unpredictable and can occur at any time. Economic downturns, such as recessions, geopolitical crises, and paradigm shifts in the economy can all trigger bear markets. Government intervention, like changes in tax rates or the federal funds rate, can also prompt bear markets. They can occur in overall markets or indexes like the S&P 500, as well as in individual securities or commodities. | Bear markets can last for multiple years or just several weeks, depending on the severity of the economic conditions that triggered them. In some extreme cases, such as secular bear markets, they can last from 10 to 20 years. It’s also important to note that bear markets should not be confused with corrections, which are short-term trends lasting less than two months. |

Impact of Bear Markets

Bear markets can have significant effects on the economy, often leading to recessions. They erode investor confidence, decrease asset values and corporate profits while increasing unemployment rates.

These broad economic impacts can deeply affect individual investors, industries, and entire nations.

Effects on the Economy

Bear markets can change the way people live, shop and work. They often lead to less spending by consumers and businesses. This is because many fear losing money or jobs. The drop in spending hurts companies’ profits.

In a bear market, job loss goes up too. People have less money to spend when they are not working. Also, some businesses stop growing or close down due to low sales. These changes make economic growth slow down or even stop for a time.

Relationship between Bear Markets and Recessions

Bear markets and recessions often go hand in hand. A bear market can show a weak economy. It happens when stock prices drop by 20% or more from recent highs. This fall in investment prices may hint at a coming recession.

A recession is when economic activity slows down for six months or longer. During this time, jobs might be hard to get, business profits may fall and people might not have much money to spend.

So, both bear markets and recessions signal tough times in the economy. But they are different things that happen for different reasons – one deals with the stock market while the other deals with the whole economy.

How to Spot a Bear Market

Identifying a bear market involves understanding key indicators such as persistent drops in stock prices, increase in unemployment rates, and signs of slowing economic activity.

Key Indicators of a Bear Market

There are signs that can help you see a bear market. These hints include:

- The prices of stocks are falling. They go down for a long time.

- Interest rates are going down too.

- People who put their money in the stock market feel bad about it.

- The stock market shifts around a lot, up and down.

- Most people don’t want to buy stocks because they think the prices will keep going down.

Investing in a Bear Market

Navigating through a bear market requires strategic planning and careful decision making, exploring concepts such as the importance of diversification in your portfolio, taking advantage of dollar-cost averaging, investing in recession-proof sectors, and always keeping sight on your long-term financial goals.

The Concept of Dollar-Cost Averaging

Dollar-cost averaging is a smart move in bear markets. It means putting the same amount of money into an investment over time. This way, you buy more shares when prices are low and fewer when they’re high.

Over time, this evens out the cost of shares. Even if the market is down, you get to buy at lower rates which can be good later on. But remember, this method doesn’t always save you from losing money in tough markets.

Importance of Diversification

Spreading money across different types of investments is known as diversification. This step helps you to lower risk. Look at it like this, if you put all your eggs in one basket and that basket drops, what happens? All the eggs break! But spread them out in more baskets and if one falls, you still have others intact.

Diversification can keep you safe during a bear market. Owning a mix of stocks, bonds, and other assets lessens damage when prices drop. If one investment does bad, another might do well to balance it out.

A robo-advisor or financial advisor can help set up a diverse portfolio for you.

Investing in Recession-Proof Sectors

Sectors that can do well even in a bad market are known as recession-proof sectors. These can be good places to put your money during bear markets. Sectors like utilities and consumer staples often stay strong because people still need these things, no matter the economy’s state.

Even in tough times, folks buy food and pay their power bills. So, companies in these areas keep doing okay when others struggle.

Some funds track these sectors’ stocks. You could buy shares of those funds to spread out your risk more than buying just one stock might allow. But be sure you know what risks come with any investment before you make it!

Focusing on Long-Term Goals

Keeping your eyes on long-term goals is key in a bear market. It’s easy to feel panic when you see prices drop. But, smart investors know this is part of the journey. They stick to their plan and don’t let short-term changes shake them.

Your investment can still grow over time if you stay put. That’s why money for things soon-to-come should not be in stocks. If your goals are far off, it might be good to buy more shares while prices are low.

During a bear market, talk with your advisor often about your targets and next steps.

Advanced Investment Strategies

Learn how savvy investors leverage bear markets with advanced tools like short selling, put options, and inverse ETFs. Delve into these strategies to acquire a proactive approach in mitigating risks and maximizing potential returns, irrespective of market trends.

Stay tuned to uncover the secrets behind successful investments during a Bear Market!

Short Selling in Bear Markets

Short selling is a smart move in bear markets. It means you borrow shares and sell them. You wait for the price to drop, then buy back the shares and return them. The profit comes from the difference between selling at a high price and buying at a low one.

Timing is important in short selling. It needs good study of market trends to know the best time to sell and buy back shares. Short selling can help cut losses when stock prices fall fast.

Using Puts and Inverse ETFs

In a bear market, Puts and Inverse ETFs come in handy. A put is a deal to sell an item for a set price before a date. It’s like selling your toys before you must move house. You sell it even if toy prices drop the next day.

An inverse ETF follows an index but in reverse. If the index goes down 2%, the inverse ETF goes up 2%. Both can help guard your money or make more when markets dip. But be careful! These tools are not simple.

Learn all about them first, so you don’t lose money by mistake.

Real-World Examples of Bear Markets

The Great Depression was a bad bear market in the 1930s. It saw stock prices fall by more than 80%. Many people lost jobs and money. In 2000, the dot-com bubble burst. That made another bear market.

Tech stocks fell hard.

Jump to 2007-2009, we saw the global financial crisis. This was due to bad home loans in America. Many banks failed and it sent shock waves around the world’s economy. Next is the COVID-19 pandemic in early 2020 that caused stocks to lose value fast across sectors worldwide.

Conclusion

A bear market is when stock prices fall a lot. This can last for many weeks, months or even years. Bear markets can happen because of things like low jobs or money being spent in the economy.

Thus, getting good at spotting signs of a bear market helps you make better money choices.

FAQs

A bear market happens when the prices in the Market Index, like Dow Jones Industrial Average, drop by 20% or more from its recent high.

In a bear market, most stocks including dividend-paying ones and Exchange-traded funds (ETFs) see price declines. It may hit your investment account balance as well but can also open up new investment opportunities.

Two popular cases of Bear Markets are the Housing Mortgage Default Crisis and Dot Com Bubble where US Stocks saw big sell-offs due to economic recession and high trading activity by speculators.

Yes! A Bear Market can slow down hiring, lower wage growth, shift consumer spending patterns making it hard for businesses to predict their growth prospects.

You should meet with Investment Advisors for comprehensive financial planning which includes Wealth Management and adjusting asset allocation based on your risk tolerance and long-term goals.

Investing in recession-proof sectors or recession-resistant stocks could be one approach; Regularly updating your financial plan based on current Market performance while keeping an emergency savings fund is another sound strategy.