Facing the daunting task of covering college expenses, many students turn to loans for help. In the US alone, student loan debt has skyrocketed to a staggering $1.75 trillion.

This blog post will illuminate why student loans are considered unsecured and risky investments and identify strategies to mitigate these risks.

Dive in; it’s time for a financial wisdom journey!

Key takeaways

●Student loans are considered risky investments by banks due to their unsecured nature, high default rates, and lack of flexibility in repayment options.

●Banks are concerned about the unsecured nature of student loans because there is no collateral if borrowers fail to repay the loan.

●High default rates on student loans make banks worried about losing money and recovering their investment.

●Limited options for repayment and the potential consequences of defaulting on student loans increase the risk for both borrowers and lenders.

Why do many Banks Consider Student Loans Risky Investments

Student loans are money that banks or the federal government lend to students. This money helps them pay for college costs like tuition and books. In the US, student loan debt is a big issue with a total of $1.75 trillion owed by students.

That’s because most people can’t afford to pay for college on their own.

Loans come in two types – federal and private. The federal government gives out a federal loan while the bank gives out a private student loan. Federal student aid has a lower interest rate than bank loans.

On average, outstanding student loans owe about $30,000 after they finish school. But some students owe even more – hundreds of thousands of dollars! It all depends on how much school costs and how many years you go to college.

Banks look at your credit score when deciding if they should give you a loan or not (this is called ‘loan approval’). Your credit score starts building up when you borrow money and pay it back on time (this is known as a ‘repayment schedule’).

Since most students don’t have a job while in school, this process starts only after they graduate and start working.

Why are Student Loans Considered Risky by Banks?

Student loans are considered a risky investment by banks due to their unsecured nature, high default rates, and lack of flexibility in loan repayment.

Unsecured nature of student loans

Student loans are unsecured loans. This means they do not need any collateral, like a house or car. Banks give student loans based on trust in the future earnings of students.

But this makes banks worried. The risk is high because there’s nothing to take if a student does not pay back the loan. It’s unlike a mortgage or car loan where banks can take the house or car.

So for banks, an unsecured nature of student loans means more risk and worry about loss.

High default rates

Many students do not pay back their federal loans on time. This is known as a default rate. Banks see this as a risk because they may lose money if the loan is not paid back in full.

In fact, student loans investing have higher rates of not being paid back than other types of debt, like car loans or mortgages.

For example, banks often find that big amounts like $30,000 to over $100,000 are hard for students to pay off after they graduate from college. This makes banks think twice before giving out student loans.

Lack of flexibility in loan repayment

Student loans are considered risky by banks because there is often a lack of flexibility in loan repayment. Unlike other types of loans, such as mortgages or car loans, student loans have limited options for repayment.

Borrowers are typically given a fixed interest rate repayment schedule and may not have the ability to adjust their payments based on their financial situation. This can be especially challenging for student loan borrowers who experience unexpected financial hardships or struggle to find high-paying jobs after graduation.

Additionally, defaulting on student loans can have serious consequences, including wage garnishment and withheld tax refunds. This inflexibility in repaying the loan increases the risk for both borrowers and lenders alike.

Impact of Student Loans on Borrowers'

Student loans have a significant impact on borrowers, causing financial burdens and potentially affecting their credit scores. Read more about the consequences of student loans for borrowers.

Financial burdens

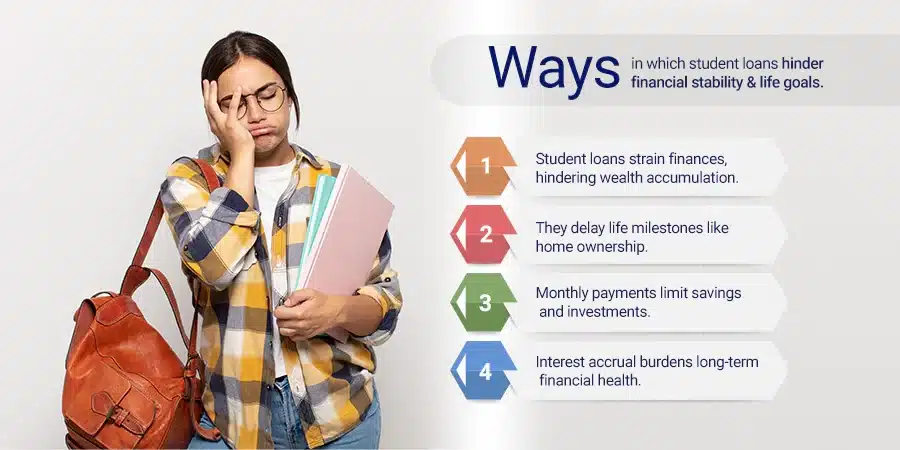

Many students find themselves burdened by the financial pressures of student loans. The average student loan debt is around $30,000, but it can be much higher for some individuals.

This debt can create significant financial stress, as borrowers are responsible for making monthly payments that can eat into their income and budget. It becomes even more challenging when starting a career with entry-level salaries and limited job opportunities.

In fact, studies have shown that high levels of student loan debt can delay important life milestones such as buying a home or starting a family.

For low-income students, these financial burdens can be particularly overwhelming and may limit their ability to pursue further education or secure loans for other purposes in the future.

Banks consider student loans risky investments because they have high balances and a higher interest rate compared to other types of debt like mortgages or car loans.

Additionally, there is no collateral backing up these loans, which means that if borrowers default on their payments, it’s difficult for lenders to recover their money.

Defaulting on student loans also has severe consequences for borrowers – it leads to damaged credit scores and potential wage garnishment or tax refund withholding by the government.

Effect on credit score

Defaulting on student loans can have a negative impact on credit scores. This means that if borrowers fail to make their loan payments, it will be recorded as a negative mark on their credit history.

Having a lower credit score can make it difficult for borrowers to qualify for future loans, such as mortgages or car loans. It may also result in a higher interest rate when they do borrow money.

Therefore, it’s important for students with student loan debt to make timely payments and manage their finances responsibly to avoid damaging their credit scores.

The Role of Government in Student Loans

The government plays a significant role in the student loan system. They guarantee these loans, which means they promise to repay the lender if the borrower defaults. This guarantee reduces the risk for banks and encourages them to provide student loans.

Additionally, government-backed loans often have lower borrowing costs compared to private student loans because of this guarantee. The government also regulates and oversees the student loan industry, ensuring that borrowers are protected from unfair practices.

Moreover, the government has implemented repayment plans and assistance programs to help students manage their debt. These programs offer flexible options such as income-driven repayment plans and loan forgiveness for those who work in certain public service fields.

By providing these options, the government aims to lessen financial burdens on borrowers and promote successful loan repayment.

Overall, the involvement of the government in student loans helps reduce overall risk for banks and lenders while also providing support for borrowers facing financial challenges.

The Pros and Cons of Investing in Student Loans for Banks

Investing in student loans can be a double-edged sword for banks due to the potential rewards and risks involved. Below is a summary of the pros and cons banks face when investing in student loans.

- Banks can earn high returns due to the higher interest rates of student loans.

- As American student loan debt is at $1.75 trillion, it represents a substantial market for banks.

- Banks can diversify their loan portfolio with student loans.

- Multiple repayment options for student loans can attract a broader customer base.

- Most student loans are unsecured, making them risky investments as there is no collateral if the borrower defaults.

- High balances of student loans can lead to high default rates, causing losses for banks.

- During economic downturns, like the 2008 financial crisis, student loan defaults can rise, increasing the risk for banks.

- Private student loans financed by banks are especially risky due to the potential for loan defaults.

Strategies for Mitigating Risks Associated with Student Loans

To mitigate the risks associated with student loans, banks can employ several strategies:

- Conduct thorough creditworthiness checks before approving loans.

- Offer loan consolidation or refinancing options to lower interest rates and monthly payments.

- Implement flexible repayment plans based on borrowers’ income levels.

- Collaborate with guarantee agencies to ensure repayment in case of default.

- Provide financial education and resources to help borrowers make informed decisions.

- Monitor borrowers’ progress and offer support programs for struggling individuals.

- Diversify investments by including other low-risk options in their portfolio.

What do you want to know more about investing in student loans

What is the average interest rate on student loans? How long do I have to pay back my student debt? Find answers to these common questions and more as we delve into the risks associated with student loans in our blog.

What is the average interest rate on student loans?

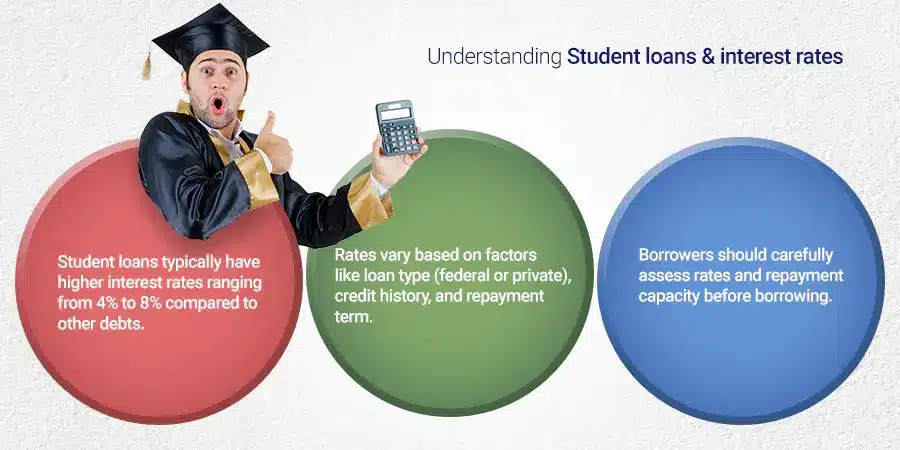

Student loans often come with higher interest rates compared to other types of debt. On average, the interest rate for student loans can range from around 4% to 8%.

However, it’s important to note that interest rates can vary depending on various factors such as whether the loan is federal or private, credit history, and repayment term.

It’s essential for borrowers to carefully consider these rates and their ability to repay before taking out a student loan.

How long do I have to pay back my student debt?

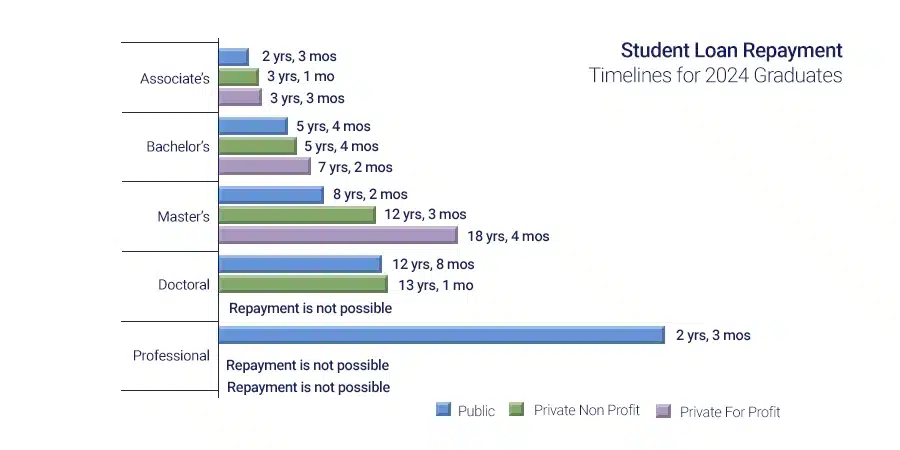

You have a specific time period to pay back your student debt, which is known as the loan repayment period. The length of this period varies depending on the type of loan you have.

For federal student loans, the standard repayment term is generally 10 years, although there can be options for longer or shorter terms based on your circumstances.

Private student loans may offer different repayment periods, so it’s essential to check with your lender.

It’s important to remember that extending the repayment period can result in paying more interest over time. Therefore, it’s advisable to explore repayment plans and strategies that align with your financial situation and goals.

Conclusion

In conclusion, banks consider student loans risky investments for several reasons. First, the unsecured nature of these loans means that banks have no collateral in case of default.

From the complexities of the student loan market to potential repayment uncertainties, there are several student loan programs available, so it’s important to research the options before making a decision.

Additionally, high default rates and inflexible repayment options make it difficult for banks to recover their investment. Despite government guarantees, the lack of credit history and net worth in students also adds to the risk.

Overall, while student loans play a vital role in higher education, they present challenges for banks seeking low-risk investments with stable returns.

FAQs

Banks consider student loans risky investments because there is a higher chance of default or non-payment compared to other types of loans. Thankfully, the government guarantees student loans. This government guarantee means students can get the loans they need to fund their education.

Factors that contribute to the riskiness of student loans for banks include limited credit history, uncertain future income prospects, and the possibility of students not completing their education.

The high cost of education increases the riskiness of student loans as it can lead to larger loan amounts and potentially higher monthly payments which may be difficult for borrowers to handle.

Yes, some measures are in place such as requiring co-signers or collateral, conducting credit checks, and setting limits on loan amounts to minimize potential losses for banks if borrowers are unable to repay their loans.