Salim and the Uncertainty of His Portfolio Returns

The Reality Strikes

Salim was gazing at his investment statements. His portfolio, a thoughtful mix of stocks and bonds, had performed well, dividends were flowing in, and over the last few years, the portfolio had grown substantially, thanks to the compounding returns on his investments.

Salim knew the significance of compounding returns, reinvesting dividends, and bond interest to sustain future growth.

But a question lurked, what if the market shifted? What if the market interest rate plummeted, and new bonds could yield lower returns than existing ones?

The thought of his portfolio’s income stream shrinking, potentially impacting his retirement plans, made him uneasy.

What does the Future Hold for Salim?

He envisioned two scenarios: a rosy one where the market continued its upward climb, and a gloomy one where interest rates declined, leaving him with a portfolio yielding less and less income.

The uncertainty was no way to fade. Salim knew he had to act. He could shorten the maturities of his bonds, reinvesting more frequently in the hope of catching higher rates.

Diversifying into dividend-paying stocks could offer another layer of protection. But each option carried its risks, and the more he analyzed the more confusing it got.

The Way Ahead

Salim took a deep breath. This wasn’t just about numbers; it was about his future.

He knew he needed help, someone to guide him through the uncertainties dangling in his mind. With a newfound resolve, Salim reached for his phone.

A call to a financial advisor, he realized, was the first step towards understanding the exact scope of reinvestment risk and securing his financial future.

What Investors Need to Know about Reinvestment Risk

What is Reinvestment Risk?

Reinvesting earnings is a simple and powerful way to grow wealth over time. But what if those reinvested funds fail to generate the same return as the original investment? That’s where reinvestment risk comes in – a possible pitfall that can erode your long-term gains.

Simply put, reinvestment risk is the chance that cash flows from an investment (like dividends or interest payments) are unable to reinvest at the same rate of return as the original investment. This risk arises because future market conditions may not be as favorable as the present.

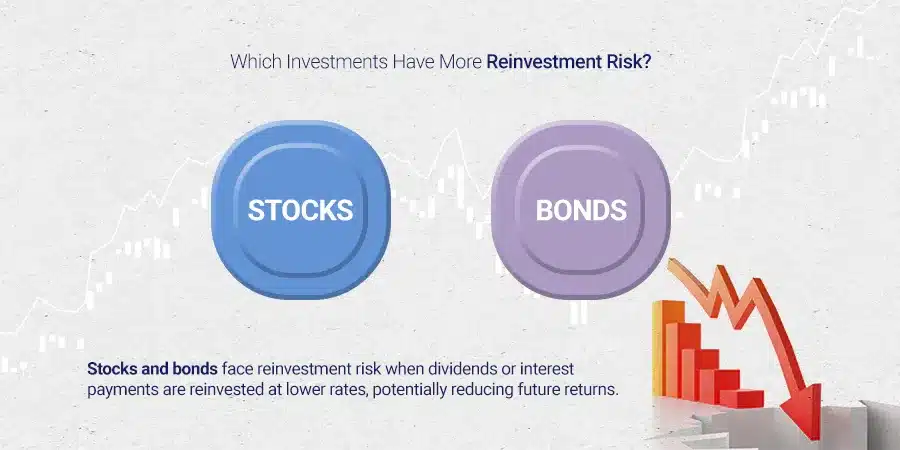

Which Investments Have More Reinvestment Risk?

While both stocks and bonds face reinvestment risk, fixed-income securities are particularly susceptible to reinvestment risk. Bonds, for example, have predictable interest payments.

But when those payments mature or the bond is called, you must reinvest the proceeds. If interest rates have fallen in the meantime, you may need help finding an investment with a comparable return and risk profile.

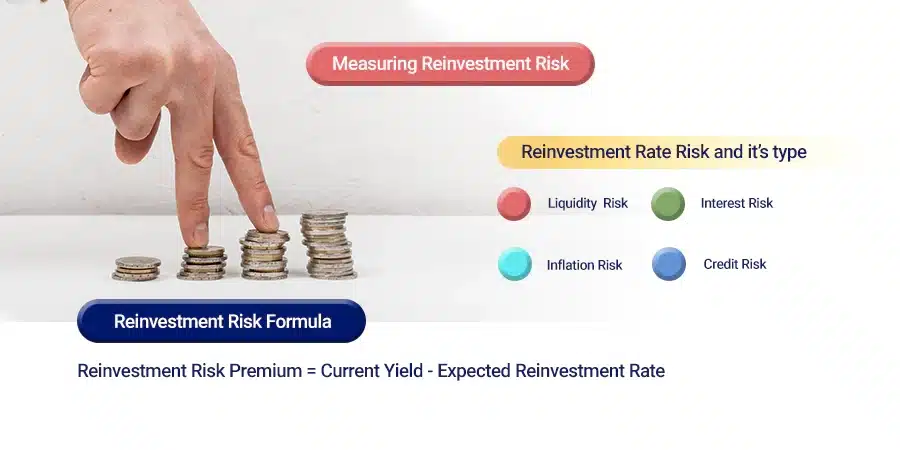

Measuring Reinvestment Risk:

Calculating the reinvestment risk premium helps you estimate the potential impact. This involves comparing the current yield of your investment to the expected future reinvestment rate. A wider gap signals higher risk.

Reinvestment Risk Formula:

Reinvestment Risk Premium = Current Yield – Expected Reinvestment Rate

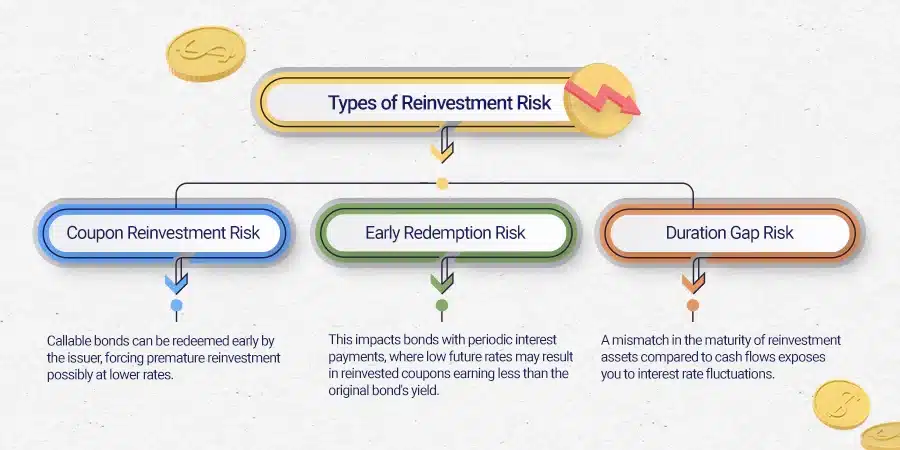

Types of Reinvestment Risk:

1) Coupon Reinvestment Risk: This affects bonds that pay periodic interest. Low future rates could mean reinvested coupons earn less than the original bond’s yield.

Let us say, Sarah invests $100,000 in a 10-year bond with a 5% annual coupon rate. This means she receives $5,000 in interest income each year from the bond.

However, due to changes in economic conditions, prevailing interest rates in the market decreased to 3%.

Now, when Sarah receives her $5,000 coupon payment, this will get re-invested at a lower rate of 3%. The rate of compounding will decrease and may not match her budgeted cash flows.

2) Early Redemption Risk: Callable bonds can be redeemed by the issuer before maturity, forcing you to reinvest before you expect, potentially at lower rates.

For example, Alex owns a 10-year bond issued by Company XYZ with a 6% coupon rate. The bond has a face value of $10,000.

Alex is enjoying the steady $600 annual interest payments from the bond. However, Company XYZ, seeking to take advantage of lower interest rates in the market, decides to call the bond after just five years.

Given the prevailing economic conditions, new bonds with a similar risk profile are offering only a 4% interest rate. As a result of the early redemption, Alex receives the face value of the bond, which is $10,000.

Now, the challenge for Alex lies in reinvesting this sum at a lower rate of 4%, reducing his total return.

3) Duration Gap Risk: This occurs when the average maturity of your reinvestment assets doesn’t match the maturity of your cash flows. A mismatch can leave you vulnerable to interest rate fluctuations.

Suppose Jane manages a bond portfolio with an average duration of 7 years. The duration represents the sensitivity of the bond prices to changes in interest rates.

Jane has liabilities, such as future obligations or expenses, with an average duration of 5 years. Now, let’s say interest rates in the market rise unexpectedly.

When interest rates go up, bond prices generally fall. As a result, the value of Jane’s bond portfolio declines because of the inverse relationship between bond prices and interest rates.

Here’s where duration gap risk comes into play. The duration gap is the difference between the duration of Jane’s assets (bond portfolio) and liabilities. In this case, the duration gap is 2 years (7 years – 5 years).

A positive duration gap means that Jane’s assets (bonds) have a longer duration than her liabilities. As interest rates rise, the bond prices in Jane’s portfolio drop more than the value of her liabilities.

The positive duration gap amplifies the impact of the interest rate increase, leading to potential losses for Jane. The risk arises from the fact that the assets and liabilities do not mature or reset at the same time.

How to Manage Reinvestment Risk:

• Ladder your maturities: Invest in bonds each with a different of maturities to avoid large lump sums coming due at once.

• Opt for non-callable bonds: Opt for bonds without early redemption features for greater control over reinvestment timing and mitigate reinvestment risk.

• Consider laddered ETFs or bond funds: These offer diversification and professional management that can mitigate risk.

• Use a reinvestment rate assumption: Make informed decisions by factoring in realistic future interest rate scenarios.

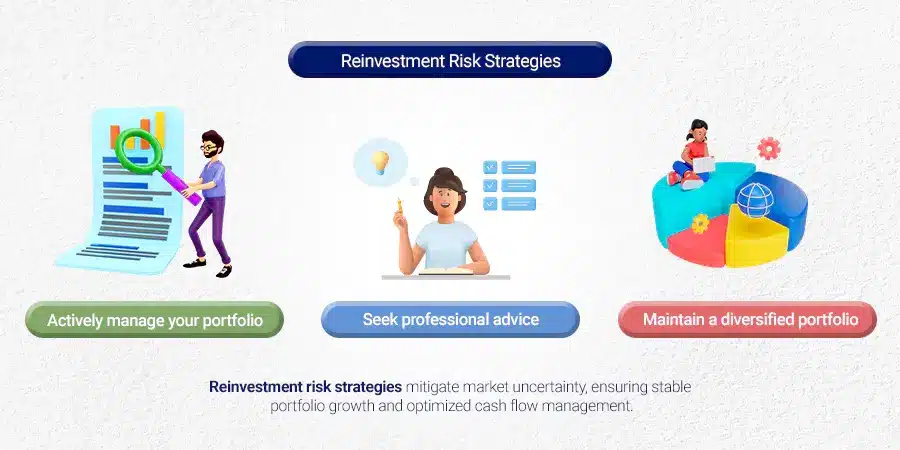

Reinvestment Risk Strategies:

• Actively manage your portfolio: Regularly assess reinvestment opportunities and adjust your holdings as needed.

• Seek professional advice: Consult a financial advisor for personalized strategies to manage reinvestment risk.

• Maintain a diversified portfolio: Diversification across asset classes minimizes the impact of fluctuations in any single category.

Parting Thoughts

Reinvestment risk is a significant factor to consider, especially for long-term investments. By understanding the types, strategies, and measurement tools, you can make informed decisions and reduce the chance of your gains going missing.