Are you curious about equity-structured products but unsure of their benefits and risks?

One interesting fact is, that these unique investments package traditional assets with one or more derivatives to create a specialized risk-reward profile.

Our blog will dive into the intricacies of these complex financial tools, guiding you through their fundamental structure, pros and cons, and crucial considerations before investing.

Let’s unravel the world of equity products together!

Key takeaways

●Equity structured products mix basic and extra assets. They can earn you a lot when the market does well.

●These goods offer choices to change risk, size, and benefit goals. They also bring variety to your list of investments.

●But they do come with risks like liquidity problems and market changes. Even the firms who release these goods might not be able to pay back the money owed.

●So while investing in equity products may give a chance for gain, it demands careful planning as it is never fully safe from loss.

Understanding Equity Structured Products

Equity structured products stem from financial innovation, offering a blend of traditional fixed-income security, like bonds and derivative investments.

Their origins are traced back to the rise of the derivative component in the market and evolving investor class needs.

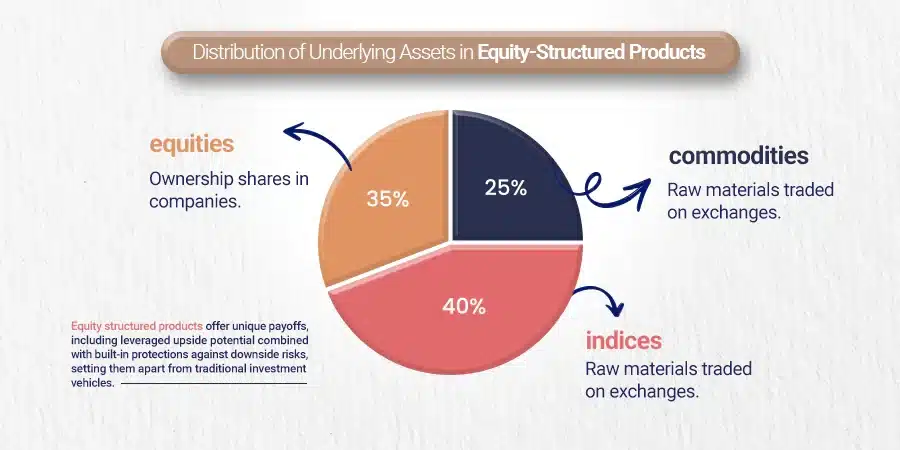

Underlying assets can be diverse such as equities, commodities, or indices (e.g., S&P 500 Index). They promise various non-traditional payoffs linked to performance features like leveraged upside participation with downside buffers.

What is Equity-Structured Products ?

Structured products first took root in Europe. They became a hit with people there before traveling to the United States. There, they also caught on quite fast.

Today, these financial tools are used across the globe. Structured products are usually created to meet specific needs that cannot be met by the standardized financial instruments available in the markets.

They can be used as an alternative to a direct investment, a part of the overall asset allocation, and also a risk-reduction strategy in a portfolio.

Structured products can be issued in various forms, including publicly offered and privately placed debt securities, publicly offered and privately placed pooled investments (such as closed-end funds and trusts), and certificates of deposit.

Some structured products are listed via the Securities and Exchange Commission, while others trade in over-the-counter secondary market.

Underlying Assets

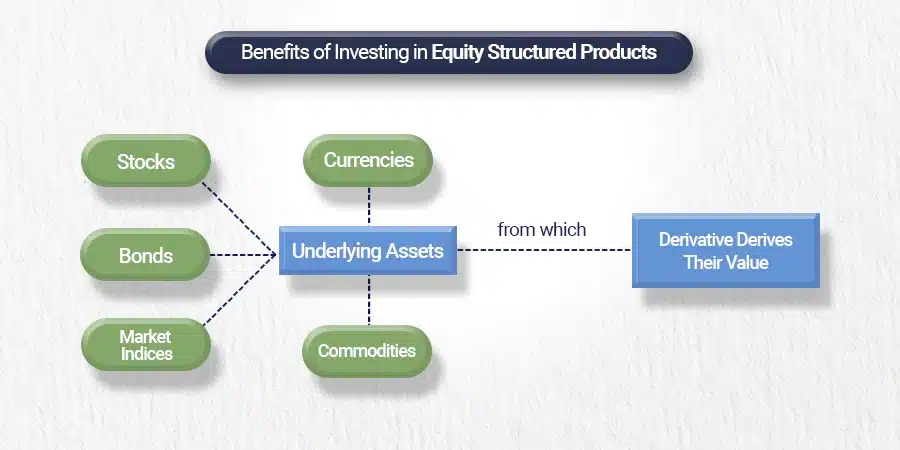

Underlying assets have a key role in Equity Structured Investments Products. They help decide the final payout of these products. Common types of underlying assets are stocks, index funds, and bonds.

Some may also rely on the interest rate or foreign exchange markets.

In many structured products, a zero-coupon bond pairs with an option call based on an asset. This mix creates interesting payoffs for investors when the market changes.

For example, the value of the S&P 500 Index can impact returns if it is part of your product’s underlying assets.

Returns

You get returns from equity products at the end. The issuer of these products sets this based on how the assets under them perform. They may pay you back your full face amount.

This is also known as being principal-protected. That means you will get your first investment back when it reaches maturity date.

Issuers aim to give investors both growth and capital protection for their money with these kinds of returns.

Benefits of Investing in Equity Structured Products

It offers investors many benefits, such as the ability to customize their investment size according to personal financial capacity. They foster a diversified investment portfolio by providing exposure to different asset classes like equities, bonds, and commodities.

This diversification not only helps in spreading risks but also opens opportunities for high returns. The guarantee of principal protection is another notable advantage, giving investors some assurance that they won’t lose all of their initial investment if market conditions unexpectedly turn disadvantageous.

Lastly, these products often come with an early-redemption mechanism allowing investors flexibility around getting their money back before the maturity date.

Custom Sizing

Custom sizing is a key plus of equity products. With it, investors can shape the product to fit their own needs and goals. They get to pick how much principal protection they want.

This means they control how safe or risky their investment is. They also set possible returns based on how well the asset performs. So, custom sizing helps manage risks and reach desired results in investing.

Diverse Investment Portfolio

Equity-structured products help to build a rich mix of assets. This means you can invest in many different things all at once. Stocks, bonds, and commodities are some examples.

This is key because it lowers the risk exposure of losing money on your investment. With rainbow notes, for instance, you profit from more than one type of asset. One could be linked to shares or stocks like LVMH or the S&P 500 Index.

Others might track bonds or currencies such as French OAT (a government bond) or Asian Option (Japanese currency). Having diverse assets helps you keep a steady income even when the market environment changes without warning.

Risks and Considerations of Equity Structured Products

Equity-structured products harbor liquidity concerns and are susceptible to market volatility. Liquidity is uncertain as the demand and supply for these complex financial products are weakly established, creating challenges in liquidation before the maturity date.

Furthermore, with their risk/return profile tied directly to the performance of the underlying asset classes like equities or commodities, these investment instruments become highly vulnerable to changes in market conditions.

As such, some investors may face significant losses if markets do not perform as expected. Investors also need vigilant assessment for counterparty risks by considering credit rating assessments and credit default spreads of issuer institutions; a dip in an issuer’s cash flow could impact its commitment towards pre-defined coupon payments or principal protection features offered via equity-structured product structures.

Ultimately, navigating through the dynamics of the market requires a deep understanding of financial planning strategies alongside careful scrutiny over the potential downside risk — even when lured by attractive leverage capabilities promised by this asset class.

Liquidity Concerns

Selling equity-structured products can be hard. This is also known as liquidity concerns. Exchange-traded notes (ETNs) help make selling easier for some types of these items

However, ETNs are different from ETFs because they consist of a debt instrument with cash flows derived based on the performance of an underlying asset.

A significant innovation to improve liquidity in certain types of structured products comes in the form of exchange-traded notes (ETNs), a product originally introduced by Barclays Bank in 2006.3

These are structured to resemble ETFs, which are fungible instruments traded like a common stock on a securities exchange.

ETNs also provide an alternative to harder-to-access exposures such as commodity futures or the Indian stock market. Yet the special nature of this product’s design can still make them less liquid.

You might have to wait or sell at a loss during tough times in the market due to low demand for such goods. It means you may not get your money out when you need it most, like in a financial dip or crash.

This risk has to do with how quickly and easily an asset can change into cash without losing its market value, which we refer to as “liquidity”.

Lack of liquidity is often seen as one key hazard linked to investing in equity products.

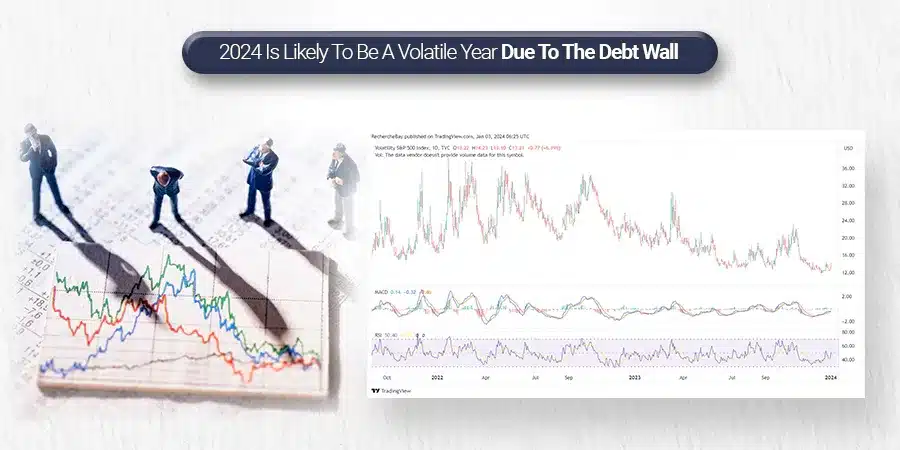

Market Volatility

Market volatility can play a big part in structured products. It is how much the price of an asset swings up and down. There are bigger changes in value for equity products when the market is more volatile.

High market volatility may raise risks with these types of investments. So before you invest, think about what level of risk you can take on and about the investment strategy.

Yet high levels of it can also make room for investors to gain from the performance of assets that underpin their structured products.

The Pros and Cons of Equity Structured Products

This section delves into the advantages and pitfalls of investing in equity-structured products, presenting a balanced view of their role in modern portfolio management.

Pros

Equity-structured products draw you in with choice. They let you match your wants. These assets can guard your first cash put in, getting it back when the time is up.

If there are secondary market prices jump, they help earn more. Also, tools like “rainbow notes” offer more chances to grow money by using many things of worth at once.

So even those who can’t reach such deals have a shot through these goods! This makes them work as doors to helpful trades for all sorts of people who want to make money grow.

Cons

Equity-structured products can bring risks. You may lose money if the market goes down. These items do not have FDIC insurance.

Not having enough buyers or sellers can make selling hard, this is called lack of liquidity. A big problem with these products is complexity.

They are very hard to understand for most people, which makes it tough to compare and choose between different options.

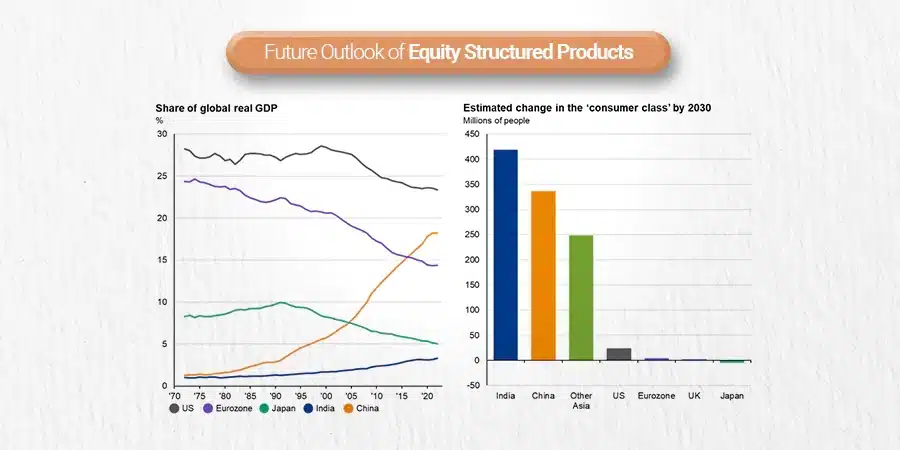

Future Outlook of Equity Structured Products

Equity-structured products may face ups and downs in the future. Market conditions play a big part in their performance. This means changes like higher or lower interest rates can greatly affect how these products do.

People who make equity-structured products aim to protect the main amount spent, but it’s not all safe. The safety of your money depends on who made these notes or bonds.

Usually, firms that are good at paying back debt are safer choices. These financial tools have longer terms and they might sell for less than what they’re worth later on! When you buy them today, you might be buying cheaper if sold years from now.

But remember, their complex nature makes it hard for us to say exactly what will happen in the future with these types of investments.

Conclusion

Equity-structured products can be a great tool for your money. They give you ways to earn more in the future. But, like any investment option, they come with risks too.

Do good research before investing and always handle your money with care!

FAQs

Equity structured products link to assets like the Russell 3000 Index or MSCI Pacific Ex-Japan Index. They might include swaps, futures, and call options.

Yes, there are risks such as market risk and liquidity risk when you invest in these types of products.

Some forms of structured notes offer principal protection or minimum return which can help shield your original money invested from losses.

Definitely! Equity instruments and derivatives like individual shares or a basket of shares on CAC 40 help build diversified retail portfolios.

Big banks like Barclays, Deutsche Bank, and JP Morgan Chase often issue this kind of asset-backed securities using bankruptcy-remote third-party vehicles for more safety.

The Federal Deposit Insurance Corporation(FDIC)and Financial Industry Regulatory Authority (FINRA) make sure everyone plays fair while handling exchange-traded funds(ETFs), mutual funds, futures, and other debt securities.