Introduction

Well, what is your understanding of the term ‘Due Diligence In Insurance?’

Due Diligence is the process of thoroughly analyzing, investigating, and assessing the various risk factors pertinent across the insurance industry or your insurance domain.

If you are an insurance service provider, you must have your very own due diligence insurance checklist in place so that you know how to spread awareness of the terms and conditions you roll out on policy documents or across contractual papers. And, you can also educate your customers on how they can file claims and get them sanctioned in a hassle-free manner.

It is quite imperative that having a thorough ‘insurance diligence checklist’ is of paramount importance for retail investors, individuals, and business enterprises.

On this parlance let us analyze detailed insights entailing the blog topic ‘What Is Due Diligence In Insurance? Helping you get started further:

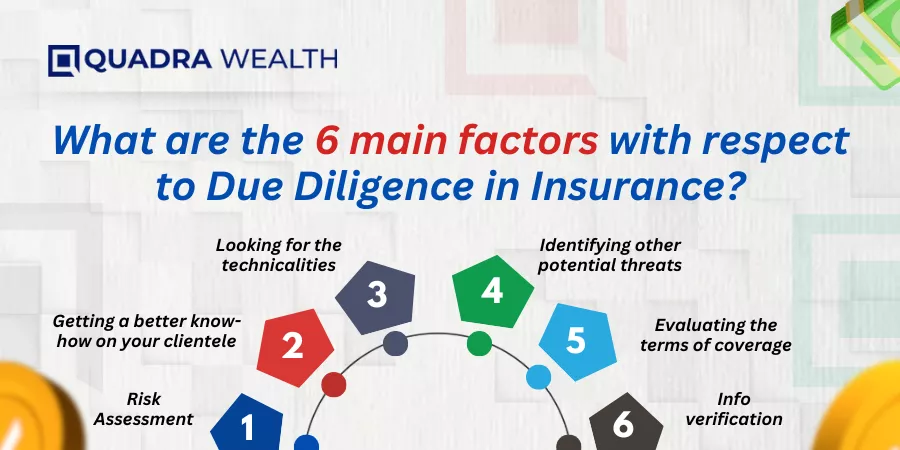

What are the 6 main factors with respect to Due Diligence in Insurance?

These are the 6 main factors that predominantly determine how Due Diligence In Insurance operates and how comprehensive checklists are prepared with respect to the same.

Let us a run-down into pointers pertaining to insurance due diligence:

Risk Assessment

An insurance service provider, also known as an insurer, the firm must evaluate the various types of risks that are pertinent in the insurance domain.

These risk factors must be made known to policyholders while you are disclosing your policy coverage documents or brochures for your customers to invest in.

Therefore, risk assessment is the first and foremost step when you draft a due diligence checklist in the insurance sector.

Getting a better know-how on your clientele

As an insurance service provider, you must get a better know-how of your clientele. You must know if your customers have had a previous association with any other service provider. You can probe more into what type of insurance service they take with a previous vendor.

This can help you understand your prospects better and relate to what their real-time expectations are. You can then roll out an appropriate insurance policy for them.

As you must be aware, not everyone prefers taking a life insurance policy alone. You may expect your members to look for different types of insurance policies over life insurance policies alone.

Looking for the technicalities

There are a couple of pointers you have while you deep delve into technicalities. Presenting them in the form of bullet points for an easier degree of understanding:

A. Checking into the client’s history

This refers to reviewing the client’s previous history with a previous insurance vendor. You can do so after obtaining the permission of your prospects or do them via your in-house teams. This way, you get better cue cards into how they were able to pay premium amounts and whether the premium amounts were paid out from time to time.

B. Checking into your client’s previous financial standing

You must check into your prospect’s previous financial standing. Did he skip paying premium amounts despite the insurance provider giving him several payment-related reminders? Did your client or prospect apply for delinquency with respect to his bank statements? You must also clear these questions while you have a face-to-face interview with your prospective client. By probing into the client’s previous financial standing, you get a better idea of whether the prospect will be the correct fit for your company or not. Makes sense, isn’t it?

C-Identifying other potential threats

You can identify other potential threats with respect to the prospective client you may want to liaise with. Was the client terminated from his current workplace or job? Was the client not responding to calls or messages from the previous vendor? These kinds of probe checks are necessary to make sure your client is seriously interested in business and complies with your protocols diligently.

Info verification

Here comes the 4th important factor while you create a due diligence checklist across the insurance industry. You must verify the core documents of your prospective clients on a comprehensive scale indeed.

You can look for KYC documents like ID Proof, Address Proofs, SSN ID, or Number docs in case of advanced economies like the US, Health verification cards, and so forth.

Passports and Driving Licenses are commonly accepted ID proofs. Gas bills, electricity bills, and Ration cards are commonly accepted KYC documents to prove the residence of an individual.

You must verify the legitimacy of these documents to know how loyal your client is and if is it safe to do business with him. Or take him as an insurance policyholder!

Evaluating the terms of coverage

You must evaluate the terms of coverage that is pertinent to every insurance policy you plan doling out on behalf of your firm. This way, you help your policyholders understand the terms and conditions that are pertinent to every insurance policy they plan to take up under their names or their nominee’s names.

This step is again a part of the due diligence insurance checklist mainly because it is your responsibility to ensure that the policy you offer to every single policyholder matches each policyholder’s financial obligations or expectations.

You can also read out the terms and conditions of every single policy you dole out to each member so that your policyholders are well aware of what they are signing up for.

Helping your policyholders understand the core insides of the policies they plan to take up

As an insurance provider, it is your primary responsibility to make your policyholders understand what the insides of the policy coverage documents stand for.

You must brief your members on the following:

- Policy coverage- Here, you provide the defining aim and purpose of why a policy of this stature needs to be taken up by the member

- Inclusions- Here, you brief on what are inclusions that the policy coverage takes care of

- Exclusions- Here, you brief the policyholder on what are the exclusions or stuff that the policy does not take care of

- Coverage limits- This is the maximum limit an insurance provider can give to a policyholder of that impending policy.

- Claim handling documents- Here, you give a clear-cut bifurcation on what kind of documents must be attached or scanned along with Claim forms. Does the policyholder attach or scan docs via digital means? Or do they send hard copies of their bills and receipts corresponding to the policy-related events to the insurance provider?

- Claim dates- Here, you brief your policyholders on the due dates that apply with respect to submitting the forms on time to claim the policy coverage amount

- Mode of payment- Here, you brief your policyholder on whether they get the money credited as a wireless settlement as a demand draft or a cheque that gets curated in the name of the primary policyholder or under the name of the nominee whatever applies here.

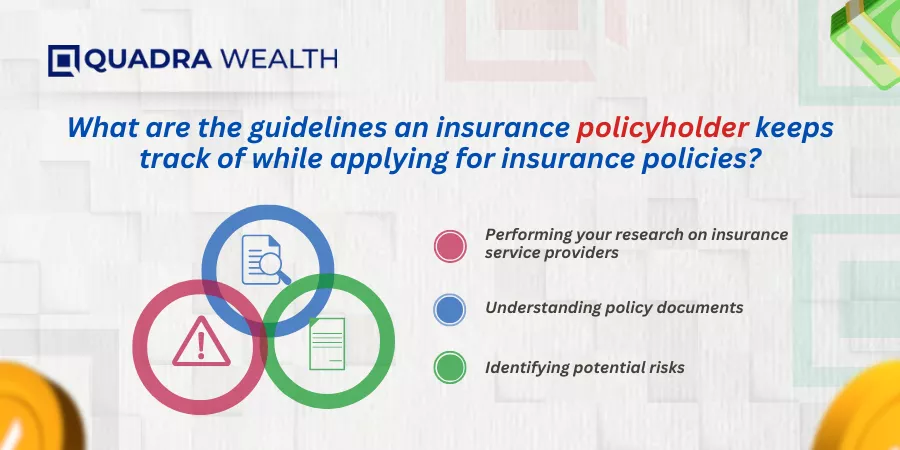

What are the guidelines an insurance policyholder keeps track of while applying for insurance policies?

These are the primary guidelines an insurance policyholder keeps track of while applying for insurance policies. Helping you through with a run-down of pointers with respect to the same:

Performing your research on insurance service providers

As an insured member or policyholder, you must perform thorough research on who your next insurance service provider is going to be.

These questions can help you through with your research gamut in a more consolidated manner:

- Does the insurance firm have credibility as a brand?

- Does the firm have decades of experience serving insurance members across all gamuts of society?

- Does the insurance company cater to members through claim-handling procedures in a smooth and hassle-free manner?

- Can your firm provide online modes of registering with you with far less paperwork?

Understanding policy documents

Before a school drama, you rehearse your lines, isn’t it? Similarly, you must understand policy documents better if you want the right fix for your insurance needs.

You can just visit random websites of insurance firms and go through their terms and conditions. This way, you get better guidelines on how to choose insurance policies for yourself or for your business enterprises.

Identifying potential risks

You must identify the gaps in the coverage policy so that you are not in tune for surprises over a later point in time. By identifying potential risks of the brand, you know if you can go forward with this brand or look for another.

The Bottom Line

By preparing a due diligence checklist in insurance, you mitigate or reduce potential risk factors to a greater extent indeed. You ensure fairness and loyalty to your esteemed policyholders who invest their hard-earned money into your insurance policies.

Above all, you extend a fairer overview of helping either party understand the terms and conditions of policy coverage documents to avoid stress or red flags later.

What are your thoughts on this? Do mention it in the comments below!

Frequently Asked Questions or FAQs

Is the cost of the premium a deciding factor for a policyholder going in favor of a target company for insurance?

Answer: Yes, the cost of the premium does play a major role in middle-class groups or lower strata of the society choosing insurance plans. Insurance costs play a major role in finding more buyers or even the acquisition of loss-earning firms.

Do fewer members add to the liability of insurance firms?

Answer: Yes, when you get fewer members to sign up for your firm, your operational costs increase and the cost of managing operations with respect to paying your staff members with salaries or renting out premises adds to expenses and therefore you incur a liability as against earning profits for the firm. Every transaction you make with a policyholder is a solution or an opportunity for you to build your brand as such.

Describe an insurance awareness programme you organize for insurance subscribers.

Answer: You can conduct online programs to nurture your prospect investment policyholders. You might have property and compliance specialists, investment brokers, retail investors or property realtors who may want to take insurance policies to improve or implement the same ebitda. This way, your policyholders deal with their personal or professional matter properly and enter records on their balance sheets or via social media business analytics accounts too.