Salim's Slow and Steady DRIP (dividend re-investment plan)

Salim never thought of flashy Lamborghinis or overnight riches. He was a man of chai and long walks, content with the day-to-day pleasures.

But even Salim dreamt of a future secure and comfortable, with his simple ways and approach. And as the saying goes, you attract your vibe, he stumbled upon DRIP investing, a concept as unhurried and dependable as his morning cuppa.

He started small, with a few rupees each month saved, and directed towards a steadily growing textile company known for its consistent dividends.

Like tiny drops of water nourishing a seed, each reinvested dividend bought him a slice of more ownership. Salim wasn’t glued to his investments throughout, in fact, he invested and forgot about it almost until the next investment installment was triggered.

Years merged into decades, and Salim’s little DRIP had blossomed into a substantial holding. The textile company, fuelled by smart management, had grown into a giant conglomerate.

With each dividend that Salim re-invested, his ownership in the company grew. The company’s valuation increased so did Salim’s investment chunk multiplied manifold.

Steady investment growth by DRIP

Do you believe in the thought of being slow steady and consistent? Then drip investing might be the suitable way for you! But what exactly is drip investing, and how can you get started?

Let’s explore this simple, humble yet powerful investment technique. Drip investing, called dividend reinvestment plans (DRIPs), might sound complicated, but it’s a simple and effective way to grow your wealth over time.

Let’s break down the concept and answer most of the queries you might have.

What is DRIP Investing?

Think of a faucet dripping steadily into a bucket. With drip investing, the “drips” are the dividends paid by companies you invest in, and the bucket is your portfolio.

These dividends are automatically reinvested to purchase additional numbers of shares of the same company, making your investment grow bit by bit.

Simply speaking, drip investing involves automatically reinvesting the dividends you earn from stocks back into the same stock, and purchasing additional shares.

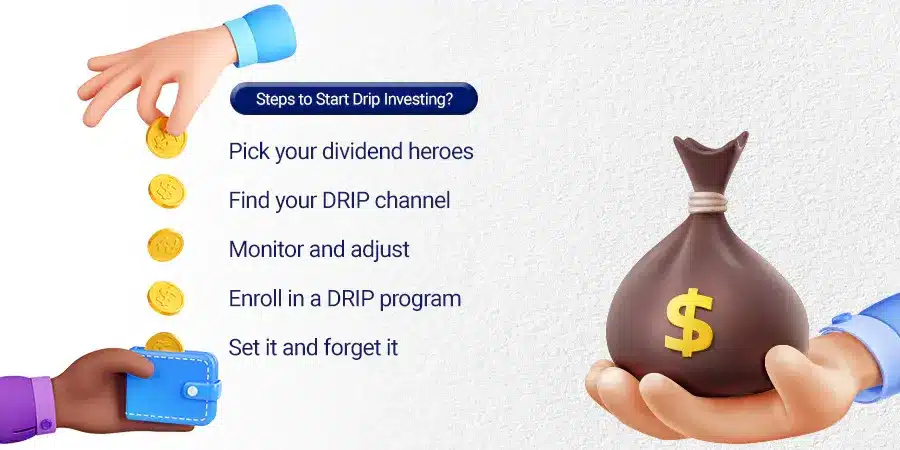

How to Start Drip Investing?

Ready to watch your investments drip their way to growth? Here’s your roadmap to starting DRIP investing.

• Pick your dividend heroes:

Find companies with a history of paying consistent dividends. Consider factors like their dividend yield, payout ratio, and long-term growth potential.

Research companies with a history of reliable payouts that align with your financial goals and risk tolerance. Consider sectors like utilities or consumer staples known for steady dividends.

• Find your DRIP channel:

Many companies offer their own DRIP programs, accessible through their investor relations department. Alternatively, check your brokerage account.

It usually offers automatic reinvestment options for various stocks and funds. Consult your financial advisor.

• Monitor and adjust:

While DRIPs are designed for hands-off investing, keep an eye on your chosen companies’ performance and adjust your portfolio strategy as needed. In this dynamic world, even the mightiest fall, a simple technology disrupts the market.

Be watchful of the market trends and economic indicators. Shuffle your portfolio if need be.

• Enroll in a DRIP program:

Many companies offer DRIPs directly, often with fractional share purchases and commission-free transactions. Check the company’s investor relations website for details.

Alternatively, your brokerage might have an automatic reinvestment option.

• Set it and forget it:

The beauty of drip investing is its automation. Once set up, you don’t need to manually reinvest your dividends.

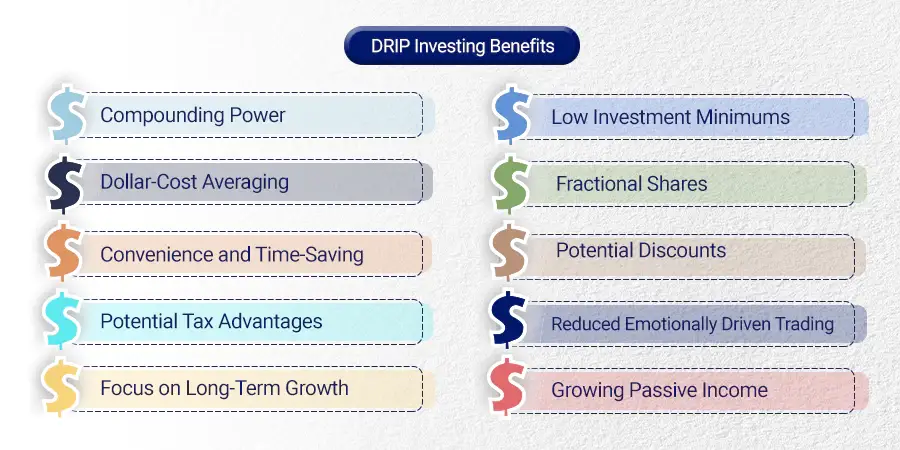

Benefits of Drip Investing

• Compounding Power:

Compounding is the mightiest force. By automatically reinvesting your dividends, you benefit from the magic of compounding.

This means your earnings generate additional earnings over time, accelerating your investment growth significantly.

• Dollar-Cost Averaging:

DRIPs automatically buy stock directly at regular intervals, regardless of the market price. This helps average out your cost per share, reducing the impact of market volatility and potentially lowering your overall investment cost.

• Convenience and Time-Saving:

DRIPs eliminate the need for manually reinvesting your dividends, saving you time and effort. You can set it up once and let it work its magic in the background.

• Potential Tax Advantages:

Depending on your location and investment choices, reinvested dividends may have tax advantages compared to receiving cash payouts. Consult a tax professional for specific details.

• Focus on Long-Term Growth:

DRIPs encourage a long-term investment mindset by automatically reinvesting your dividends. This can help you avoid emotional decisions based on short-term market fluctuations and stay focused on your long-term goals.

• Low Investment Minimums:

Some DRIP programs allow you to start with small investments, making them accessible to even beginner investors.

• Fractional Shares:

Many DRIPs allow you to make fractional stock purchases, ensuring that every penny of your dividends gets invested.

• Potential Discounts:

Some companies offer discounts on shares purchased through DRIPs, further reducing your investment cost.

• Reduced Emotionally Driven Trading:

By automating reinvestments, you avoid the temptation to make impulsive trades based on market emotions, which can often lead to poor investment decisions.

• Growing Passive Income:

As your investment portfolio grows through DRIPs, your cash dividend payouts also increase, potentially generating a reliable stream of passive income in the future.

Some recommended DRIP stocks

Here are a few stocks that have a consistent dividend history and you might consider DRIP investing.

Stock | Annual Dividend Yield |

Verizon Communications Inc. (ticker: VZ) | 6.8% |

Diageo PLC (DEO) | 2.8% |

JD.com Inc. (JD) | 2.8% |

CK Hutchinson Holdings Ltd. (OTC: CKHUY) | 7.3% |

Wells Fargo & Co. (WFC) | 3% |

One Main Holdings Inc. (OMF) | 9% |

Duke Energy Corp. (DUK) | 4.3% |

Southern Co. (SO) | 4% |

United Microelectronics Corp. (UMC) | 7.4% |

Washington Trust Bancorp Inc. (WASH) | 7.7% |

Exxon Mobil Corp. (XOM) | 3.9% |

National Storage Affiliates Trust (NSA) | 6% |

Realty Income Corp. (O) | 9% |

Unum Group (UNM) | 3.2% |

British American Tobacco PLC (BTI) | 9.6% |

Best Drip Investing Strategy:

The best strategy depends on your individual goals and risk tolerance. Consider factors like investment horizon, risk tolerance, dividend yield

• Focus on dividend growth:

Prioritise companies having a history of consistently increasing or steady dividends. This allows you to benefit from both compounding and rising income of the company over time.

• Fractional Shares:

Many DRIPs allow you to make fractional stock purchases, ensuring that every penny of your dividends gets invested.

• Diversify across sectors and asset classes:

Don’t put all your eggs in one basket. Spread your DRIP investments across different sectors and asset classes (e.g., utilities, consumer staples, REITs) to manage risk and get exposure to diverse sectors.

• Consider tax efficiency:

Some DRIP options offer tax advantages. Explore tax-advantaged accounts like IRAs or 401(k)s for eligible DRIP investments.

• Start small and scale gradually:

Don’t hurry on DRIPs right away. Begin with smaller investments and gradually increase as you gain confidence and experience.

• Consider fractional shares:

Many DRIPs allow purchasing fractional shares of the company, ensuring all your dividends get invested. This can be particularly beneficial for smaller investments.

• Combine with other investments:

DRIPs are good but they shouldn’t be your only tools. Combine them with other approaches like value or growth for a diversified and comprehensive portfolio.

• Seek professional advice:

If you’re unsure about which DRIP strategy is right for you, consider consulting a financial advisor for personalized guidance based on your specific needs and circumstances.

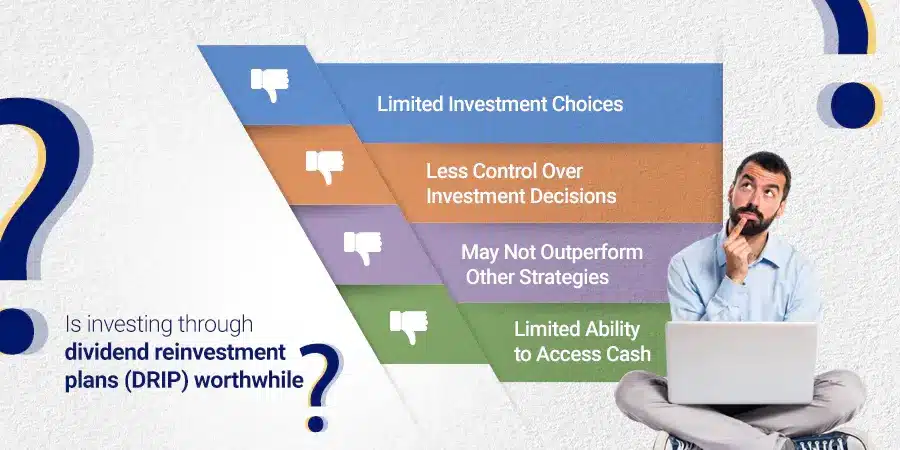

Is Drip Investing Worth It?

Drip investing can be a valuable tool for long-term investors seeking to grow their wealth through compounding and regular investment. However, it’s not a guaranteed path to riches.

Consider your investment goals and risk tolerance before diving in. While DRIP investing offers numerous benefits, one should also consider its potential drawbacks before making a decision:

• Limited Investment Choices:

With DRIPs, one gets restricted to the company offering the plan. This limits portfolio diversification options and can expose you to greater risk if the company’s performance suffers.

• Less Control Over Investment Decisions:

Once you set up a DRIP, the automatic reinvestment removes some control over your investment decisions. You can’t react to market fluctuations or company news by changing your investment strategy.

• Potential Tax Implications:

Depending on your location and the type of DRIP, reinvested dividends might be subject to taxation, impacting your overall return. Consult a tax professional for specific advice.

• Risk of Overweighting Specific Sectors:

If you heavily invest in DRIPs within a particular sector, your portfolio becomes vulnerable to industry fluctuations. Hence, diversification is important

• May Not Outperform Other Strategies:

DRIPs are a long-term approach, and their returns might not always outperform other investments, particularly in the short term.

• Limited Ability to Access Cash:

With dividends automatically reinvested, accessing cash readily might be challenging. Consider your liquidity needs before committing to DRIPs.

Parting Thoughts

DRIPs are best suited for long-term investors who are risk-averse and have a hands-off approach. If you need regular income or require more active portfolio management, other approaches, and portfolio mixes would be more suitable.

By understanding both the benefits and limitations of DRIP investing, you can make an informed decision about whether it aligns with your goals and risk tolerance.

Consider consulting a financial advisor for personalized guidance according to your specific circumstances. Ready for a bespoke financial planning conversation? Schedule your personalized investment advisory meeting today