When contemplating retirement planning, an essential consideration is the rate of inflation to use in your calculations.

This seemingly simple query holds significant weight as it directly impacts your retirement savings and spending. Inflation risk can greatly affect the purchasing power of your hard-earned nest egg over time.

In this post, we will delve into various aspects of retirement planning in the face of rising inflation. We’ll explore how changing spending habits and adjusting withdrawal rates from savings can help mitigate the impact of inflation rises on your retirement income strategy.

We’ll also discuss investment strategies during high inflation periods, including diversifying asset allocation and investing in Treasury-Inflated Protected Securities (TIPS). Furthermore, we will examine the role employers and Federal Reserve play amidst surging costs rise.

The challenges faced by social security due to increased life expectancy will be addressed along with potential solutions such as growing assets beyond the retirement date or considering other insurance options. Lastly, we’ll highlight the importance of using effective tools like Retirement Planning Calculators and working with Certified Financial Planners for personalized financial plans.

So if you’re still wondering “For retirement planning, what inflation rate should I use”? stay tuned as this comprehensive guide aims to provide valuable insights for residents in UAE at the CXO level who are navigating their way through these complex issues.

What Inflation Rate Should I Use For Retirement Planning

Understanding the impact of inflation on retirement planning is crucial to maintain your purchasing power during your golden years.

With recent surges in inflation, retirees and those approaching retirement need to reconsider their spending habits and withdrawal rates from their retirement savings.

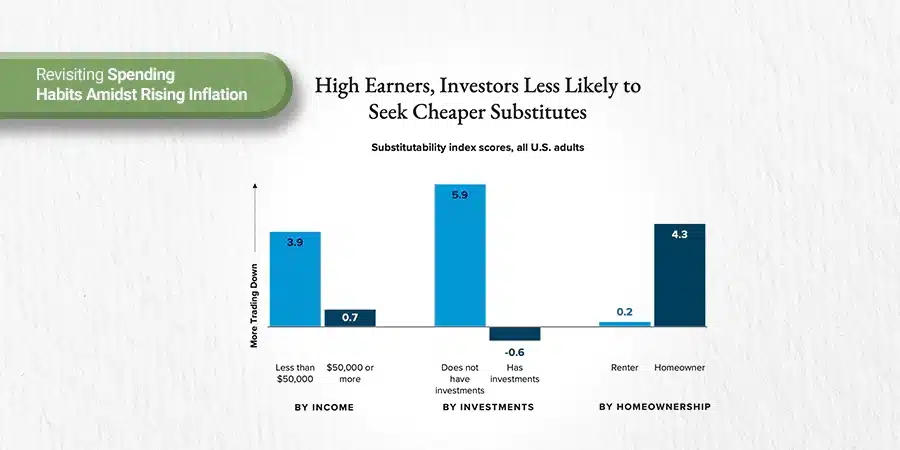

Revisiting Spending Habits Amidst Rising Inflation

In a world where inflation rises, it’s essential to reassess our spending habits regularly. It’s essential to modify our expenditure as the cost of living increases, making it necessary for us to adjust accordingly.

For instance, if you need $50k income today, due to the effects of inflation, you would need about $80k in 20 years.

- Increased financial awareness

- Better financial management

- Maintaining purchasing power

- Diminished purchasing power

- Financial strain

- Increased debt

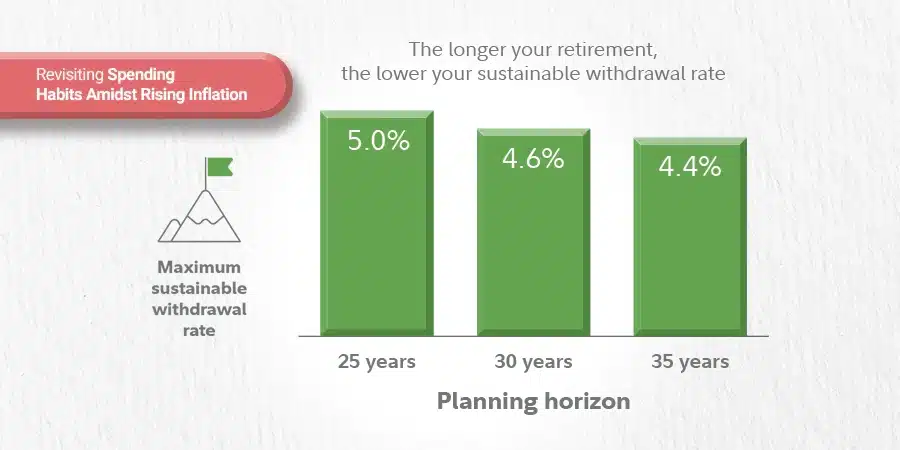

Adjusting Withdrawal Rates From Retirement Savings

Besides reevaluating spending habits, adjusting the withdrawal rates from your retirement savings is another effective strategy against the rising price.

This involves calculating how much money you’ll need each year during retirement considering expected inflation risk and then determining what percentage that represents of your total savings.

A common rule followed by many financial advisors is the “4% Rule,” which suggests withdrawing 4% from one’s portfolio in the first year of retirement and then increasing this amount annually based on cost-of-living adjustments (COLAs).

However, with higher levels of sustained price rise or if market returns fall short than anticipated, this might prove inadequate, requiring further modifications.

An alternative approach could be ‘dynamic withdrawals,’ where instead of sticking to a fixed percentage irrespective of market conditions, one adjusts annual withdrawals depending on changes in both investment performance and current living costs, thereby offering more flexibility to cope with unexpected circumstances such as sudden health issues or unplanned travel needs without jeopardizing long-term financial stability.

- Preserving retirement savings

- Mitigating longevity risk

- Adapting to changing expenses

- Depletion of retirement savings

- Inadequate income

- Increased reliance on other income sources

Investment Strategies During High Inflation Periods

Diversifying your investment portfolio can help mitigate concerns regarding rising prices during periods of high inflation.

A diversified asset allocation reduces exposure to any single type of asset, thus spreading risks across different types of investments, including stocks, bonds, real estate, commodities, etc.

This provides better protection against potential losses due to economic downturns or other adverse events while still offering opportunities to gain when markets perform well.

Key takeaways

The article discusses the impact of inflation on retirement planning and suggests strategies to maintain purchasing power during one's golden years. It emphasizes the need for revisiting spending habits, adjusting withdrawal rates from your retirement savings account, and diversifying investment portfolios to mitigate concerns regarding rising prices during periods of high inflation. The "4% Rule" is a common approach followed by many financial advisors but may prove inadequate in certain circumstances, requiring further modifications such as dynamic withdrawals.

Investment Strategies During High Inflation Periods

Don’t let inflation risk ruin your retirement plans. With strategic asset allocation and careful planning, you can protect your retirement income from being eroded by increasing prices.

Diversifying Your Portfolio To Beat Inflation

A diversified portfolio is one of the best defenses against inflation risk. Spread your investments across different asset classes, regions, and sectors to balance out potential losses with gains in another area.

This approach helps ensure consistent growth for your investment portfolio even during periods of high inflation.

Diversification doesn’t just mean investing in different types of assets; it also involves varying the regions and sectors where these assets are located or operate.

For instance, international equities could offer higher returns than domestic ones during certain economic cycles while technology stocks might perform better than energy shares amidst specific market conditions.

- Higher returns potential

- Risk mitigation

- Capital preservation

- Inflation risk exposure

- Limited growth potential

- Increased volatility

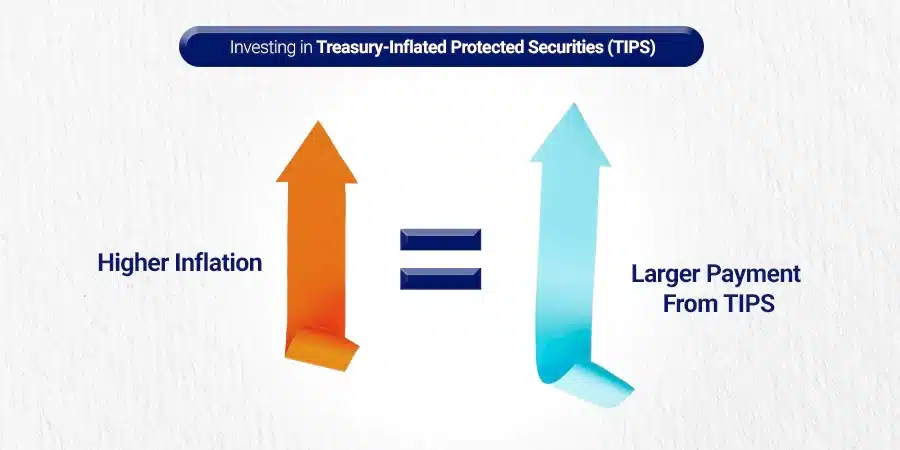

Investing in Treasury-Inflated Protected Securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) are government-issued bonds designed to provide protection against inflation.

Their principal value adjusts with changes in the Consumer Price Index (CPI), ensuring that if inflation rises so does the value of TIPS, thereby preserving purchasing power.

The interest paid on TIPS, which is fixed when purchased but calculated off an ever-increasing principal amount due to Consumer Price Index (CPI) adjustments, offers investors a reliable stream of income unaffected by price increases making them an attractive option for those seeking stability amidst volatile markets caused by surging costs-of-living adjustments.

Note:

- TIPS aren’t without risks – their yield tends to be lower compared to other types of treasury securities since they include a built-in hedge against price rise, meaning they may not always keep pace with stock market returns, especially during low-inflation environments or times of rapid equity appreciation.

- If sold before maturity, TIP’s value could decrease because its rate of return would likely appear less attractive relative to newer issues offering higher rates given increased expectations of future cost increases.

Remember: While diversification and investing strategies like TIPS can help mitigate some effects of a high-price rise period, there’s no guarantee these methods will completely eliminate the impact of elevated levels of a price increase.

Hence, it’s important to regularly review and adjust one’s retirement plans based on ongoing financial circumstances and market conditions.

In this complex landscape, managing finances through fluctuating economic climates, having professional guidance becomes invaluable – working with a certified financial planner who understands the nuances of global finance, including how to navigate turbulent waters in a high-cost increase environment, provides reassurance and peace of mind knowing expert hands are guiding towards achieving long-term goals irrespective of external challenges thrown along the way.

- Inflation protection

- Preserving purchasing power

- Lower default risk

- Diminished real returns

- Missed inflation protection

- Limited diversification

Key takeaways

Protect your retirement income from inflation risk by diversifying your portfolio across various asset classes and regions. Treasury Inflation-Protected Securities (TIPS) can also provide protection against inflation, but they come with risks such as lower yields compared to other types of treasury securities. It's important to regularly review and adjust one's retirement plans based on ongoing financial circumstances and market conditions while seeking guidance from a certified financial planner who understands the nuances of global finance.

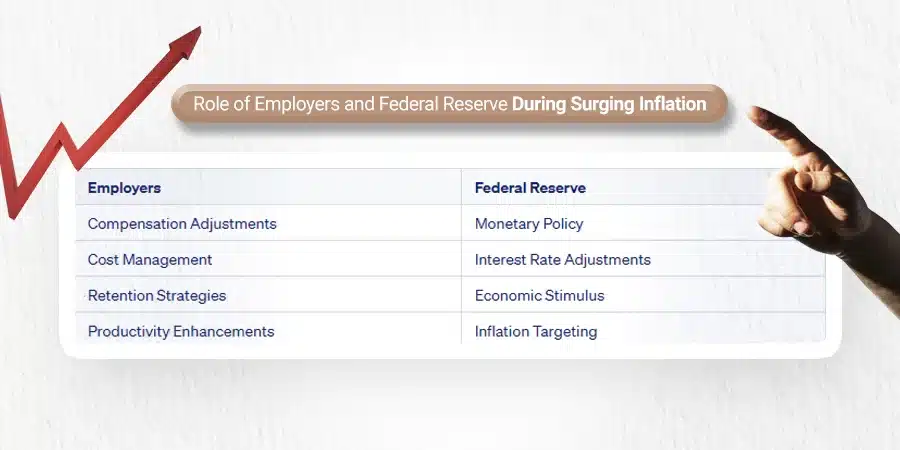

Role of Employers and Federal Reserve During Surging Inflation

In an environment of escalating inflation, the roles played by employers and federal institutions are critical.

As prices rise, businesses must adapt their strategies to maintain a stable workforce and keep operations running smoothly.

At the same time, federal institutions like the US Federal Reserve have a significant part in managing economic stability.

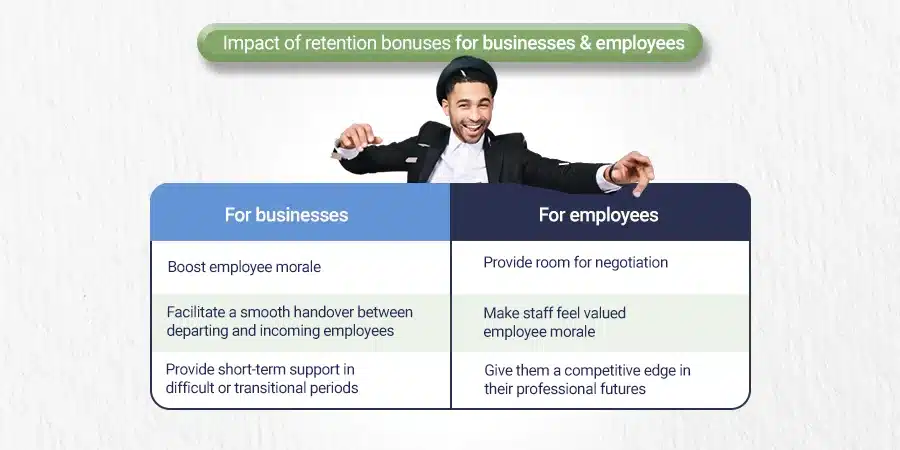

Employer Retention Bonuses Amidst Surging Costs

To combat rising costs and retain valuable employees, many companies resort to implementing retention bonuses.

These additional incentives aim at offsetting increased living expenses for workers while ensuring continuity in business operations.

A study by SHRM (Society for Human Resource Management) suggests that these bonuses can be particularly effective during periods of high inflation when employee turnover tends to increase due to financial pressures.

The challenge lies in determining an appropriate bonus amount that adequately compensates for higher costs without putting undue strain on company finances.

This delicate balance requires careful planning and consideration from HR departments and top-level management alike.

- Retaining skilled employees

- Increasing employee loyalty

- Motivating high performance

- Financial strain on employers

- Inequitable distribution of bonuses

- Temporary solution to underlying issues

Future Projections by the US Federal Reserve

The role of the US Federal Reserve is also crucial amidst surging the inflation rate. They project future economic trends based on current data, which helps shape fiscal policies aimed at stabilizing markets.

A recent speech by Jerome Powell, Chairman of the US Federal Reserve Board, highlighted how despite current spikes in the inflation rate, they expect it will lower over time as supply chain disruptions resolve themselves, allowing stock growth even through such periods.

- Fed’s Tools: The Fed has several tools at its disposal, including adjusting interest rates or altering reserve requirements for banks, which can influence the overall money supply, thereby controlling price levels.

- Predicting Future Trends: Predictions made by this institution play a vital role in shaping investor sentiment towards market conditions, helping them make informed decisions about where best to allocate resources.

- Economic Stabilization: Despite short-term volatility caused by factors such as geopolitical events or natural disasters, long-term projections suggest that with prudent policy measures, the economy should stabilize, leading to sustained growth investments.

In conclusion, understanding the dynamics between employer initiatives like retention bonuses, coupled with actions taken by federal bodies, helps navigate turbulent waters during high-inflation periods effectively.

This is key to achieving financial independence during retirement years, especially for those residing in the Middle East looking for consistent portfolio growth via structured notes offered by Quadra Wealth.

Future Projections by the US Federal Reserve:

- Insight into economic trends

- Informed decision-making

- Adjusting financial strategies

- Uncertainty and speculation

- Potential for inaccurate forecasts

- Over-reliance on projections

Key takeaways

During periods of high inflation, employers can implement retention bonuses to retain valuable employees and offset increased living expenses. The US Federal Reserve plays a crucial role in managing economic stability by projecting future trends and using tools such as adjusting interest rates or altering reserve requirements for banks. Understanding the dynamics between employer initiatives and federal actions is key to achieving financial independence during retirement years.

Challenges Social Security Faces Due To Increased Life Expectancy

Retirement planning has changed with people living longer than ever before. This poses a unique challenge to social security systems worldwide. Expatriates residing in UAE are no exception.

Growing Assets Beyond Retirement Date

Retirement planning is used to focus on accumulating enough assets to last through one’s golden years. However, with individuals living well into their 80s and beyond, it’s become necessary to grow assets beyond that. Asset allocation plays a crucial role in this.

A diversified portfolio can provide consistent growth even during your post-retirement phase. The balance between riskier investments like equities for long-term growth and safer options like bonds or fixed deposits for immediate income needs.

- Additional income sources

- Increased financial security

- Pursuing personal goals

- Market volatility risks

- Extended working years

- Balancing work-life priorities

Considering Other Insurance Options

Considering other insurance options is equally important when planning for an extended lifespan after retirement.

Long-term care insurance can be beneficial in helping to cover the expenses of assisted living or nursing home services that could become necessary as one grows older.

Disability coverage provides financial support if you’re unable to work due to illness or injury before reaching your planned retirement age.

Inflation risk is yet another factor that cannot be ignored while planning for an extended period of post-retirement spending.

Inflation erodes purchasing power over time; hence it is vital that your investment strategy factors in expected inflation rise during both the accumulation and withdrawal phases of your retirement spending plan.

- Expanded coverage options

- Tailored protection for specific needs

- Potentially lower premiums

- Increased complexity in policy management

- Potential coverage gaps

- Additional financial burden

The Role Of Certified Financial Planners In Mitigating These Challenges

If all these considerations seem overwhelming, working with certified financial planners can simplify this process immensely by providing personalized advice based on individual circumstances rather than generic targets often suggested by online calculators or rule-of-thumb guidelines.

Key takeaways

Secure your financial future in the Middle East by growing assets beyond retirement with a diversified portfolio and considering insurance options.

- Professional expertise and guidance

- Tailored financial strategies

- Mitigating risks and optimizing opportunities

- Cost of financial planning services

- Limited availability or accessibility

- Additional financial burden

- Potential for conflicting advice

Retirement Planning Calculators: A Good Starting Point?

Retirement planning can be intimidating, but online calculators offer a beginning point.

These tools estimate the amount you’ll need to save for retirement, taking into account factors like current savings, desired retirement income, and market returns.

However, it’s important to remember that these calculators are just a starting point.

Choosing a Return Rate for Your Calculations

The return rate is a crucial input in retirement planning calculators.

It represents the expected average annual returns from your investments over time. But what about inflation?

Recent inflation rises have made this question even more important.

Financial advisors often recommend using a return rate between 6% and 8%, which includes expected investment gains and assumed levels of future cost increases driven by inflation.

However, there’s no consensus on what precise figure to use. Some experts suggest using a conservative estimate of around 5%, while others propose an optimistic estimate of around 12%.

It’s important to consider your individual circumstances and seek advice from certified professionals.

Why You Should Work with a Certified Financial Planner

A CFP can help you develop a tailored retirement plan that takes into account your individual needs and potential inflation risks, as studies suggest Americans may need close to $2 million for their golden years.

A CFP can help you address specific concerns related to rising costs during high-inflation periods and guide you toward suitable asset allocation strategies that factor in potential inflation risks.

According to recent studies, Americans may need close to $2 million to fund their golden years, so generic targets won’t suffice for everyone’s situation.

A CFP can help you create a personalized plan that considers factors like your lifestyle expectations, health considerations, and risk tolerance level.

Don’t rely solely on retirement planning calculators. Consult with accredited specialists to guarantee you’re progressing in the right direction.

Working With Certified Financial Planners

With retirement spending on the rise and inflation impacting retirement income, it’s crucial to work with certified financial planners.

These experts provide personalized advice tailored to your unique situation, helping you navigate the complex world of retirement planning.

Importance of Personalized Financial Plans

A certified financial planner (CFP) takes into account various factors when crafting a personalized plan for their clients.

They consider current income levels, future earnings potential, lifestyle preferences during retirement, risk tolerance towards investments, and much more.

This holistic approach ensures that every aspect of your finances is considered while creating an effective strategy for your golden years.

Recent studies suggest that Americans may require close to $2M to fund their retirement years comfortably.

This figure implies that generic targets won’t suffice for everyone’s unique situation.

It might not be the same for everyone, as expenses, life span and other aspects of an individual’s situation can differ.

This is where working with a CFP comes into play. They are trained to take all these variables into consideration when developing a comprehensive retirement plan.

A good planner will help you understand how different market returns could affect your overall portfolio balance over time and how adjustments need to be made based on changing market conditions or inflation rises.

Potential Prolonged Periods Above-Average Cost Increase

Certified financial planners also factor in potentially prolonged periods of above-average cost increase while devising strategies.

Inflation risk can significantly erode the purchasing power of your savings accounts over time if not properly accounted for in asset allocation decisions.

Your planner should have strategies ready at hand that would protect against such scenarios, ensuring consistent growth even amidst volatile economic environments like today’s high-inflation period.

Finding the Right Planner for You

Finding the right CFP who understands both local UAE market dynamics as well as international trends impacting expatriates’ wealth accumulation goals requires a careful research and vetting process.

Rest assured, efforts put here to pay off in the long run by providing peace of mind knowing someone skilled is steering the ship towards achieving the desired level of financial independence post-retirement age.

Note: The links provided within the text lead readers to credible sources for further information related to the topic discussed in the paragraph, thereby adding value to the overall reading experience and enhancing the credibility of the content presented to them.

Key takeaways

The article discusses the importance of working with certified financial planners for retirement planning, as they take into account various factors and provide personalized advice. Inflation risk is also a crucial factor that needs to be considered in asset allocation decisions, and finding the right planner who understands both local market dynamics and international trends can help achieve financial independence post-retirement age.

Conclusion

When planning for retirement, it’s important to consider the impact of inflation on your savings.

Don’t let rising prices eat away at your hard-earned money – adjust your spending habits and withdrawal rates accordingly.

Diversifying your portfolio and investing in Treasury-Inflated Protected Securities can also help combat inflation.

Keep an eye on future projections by the US Federal Reserve and consider growing your assets beyond your retirement date.

Don’t rely solely on Social Security – increased life expectancy means you may need additional insurance options.

Retirement planning calculators can be helpful, but working with certified financial planners who provide personalized financial plans is highly recommended.

FAQ

The historical average of 2% to 3% is a common assumption, but it’s important to adjust based on personal circumstances and economic forecasts.

Consider a conservative estimate of a real return (after inflation) of around 4% per year in your retirement calculations.

Inflation can significantly erode purchasing power over time, making it a crucial factor to consider when crafting a long-term financial plan.

Adjust future income needs and investment returns with expected annual increases in cost of living during your wealth management strategy development.

It’s important to avoid discussing specific financial products or services not related to the topic, political views and biases, and personal experiences or anecdotes.