Taking a step toward financial literacy feels like the hardest part. And honestly, the internet may not always cooperate and make your task easier. One simple search for an investment term can leave you knee-deep in jargon that sounds like it came out of a finance textbook.

Fortunately, there’s another less daunting way to explore the realm of investment strategies. Grab a book. And not just any book, but one of the best books.

Whether you are a novice investor or a renowned entrepreneur looking to read about value, this blog will help you discover “What are the best investment books to read?”

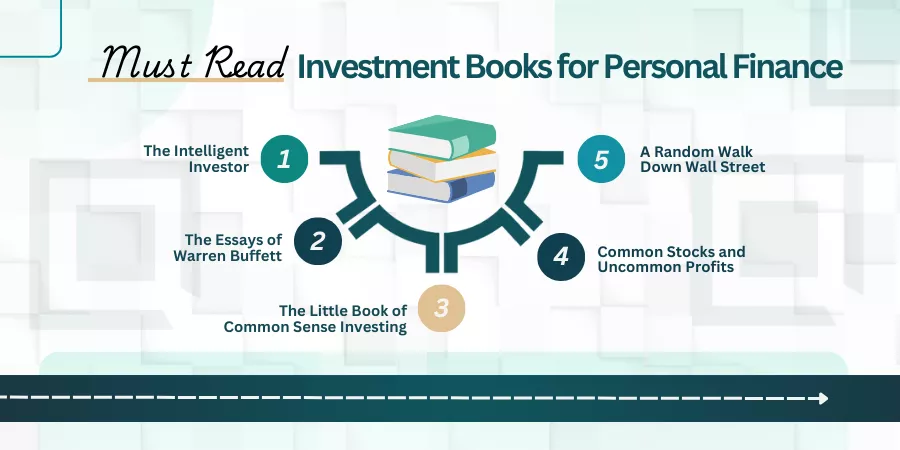

Must-Read Investment Books for Personal Finance

Here’s a list of the best books for beginners:

The Intelligent Investor (Benjamin Graham)

Benjamin Graham is recognized as the father of value investing. He tutored Warren Buffett, a modern investing icon. His book offers a framework for analyzing a business’s worth built on financial value, not short-term trading techniques.

In his book, Graham has described many important investing concepts, such as “margin of safety,” which is a key input in the Morningstar Rating for stocks.

The revised edition has commentary from The Wall Street Journal’s personal finance columnist Jason Zweig that illuminates and updates the text. With Zweig’s commentary on every chapter, the book exceeds 500 pages, making it a complete introduction to principles of investing.

“A marvelous articulation of this idea (Mr. Market) is contained in chapter two (The Investor and Stock Market Fluctuations) of Benjamin Graham’s “The Intelligent Investor”. In my opinion, this chapter has more investment advice than anything else that has been written.” (Warren Buffett).

The Essays of Warren Buffett

The Essays of Warren Buffett is a series of Warren Buffett’s letters to Berkshire Hathaway, a multinational enterprise led by Buffett and organized by Lawrence A. Cunningham.

This series demonstrates Buffett’s philosophy of investing, and has been one of the most successful investing guides. This book provides insights into corporate finance, business management, and aspects of investing.

As with the books by Benjamin Graham and Philip A. Fisher, Buffett’s teachers, this collection reveals clearly-stated and ever-relevant investing advice and valuing securities.

The Little Book of Common Sense Investing

Want to know what are the best investment books to read? The Little Book of Common Sense Investing by the founder of the Vanguard group, John C. Bogle presents a simple but efficient case for passive investing through low-cost index funds.

Bogle believes that this investment strategy offers the best potential for the average investor to build wealth. It helps them make the right investment decisions, rather than putting money through expertly-monitored funds or stock-picking.

Bogle focuses on how critical diversification is for investing success and how charges from actively-managed funds can undermine returns. This book, while short, is enriched with convincing arguments for a cost-effective and broadly available investing strategy.

Common Stocks and Uncommon Profits

Common Stocks and Uncommon Profits by Philip A. Fisher reveals an alternative method to valuing companies: qualitative analysis.

By collecting information, or scuttlebutt, about a company, involving competitor performance, customer evaluations, and supplier information, Fisher suggests that an investor can assess the success of an organization.

Fisher presents a 15-point checklist that illustrates practical criteria for evaluating the strengths and weaknesses of a stock. This book was inspirational for Warren Buffett, in addition to the teachings and writings of Benjamin Graham.

“I sought out Phil Fisher after reading his ‘Common Stocks and Uncommon Profits’. When I met him, I was impressed by the man and his ideas. A thorough understanding of a business, by using Phil’s techniques … enables one to make intelligent investment commitments.” (Warren Buffett)

A Random Walk Down Wall Street

A Random Walk Down Wall Street by Burton G. Malkiel, a professor and economist, supports the efficient market hypothesis, that stock prices represent all available information, making it challenging to beat the market.

As an alternative to stock-picking, Malkiel recommends people for long-term investing in low-cost index funds. Along with advice on investing principles in stocks, Malkiel provides insights into bonds, and how they can be vital to diversification.

This book was first published in 1973, but the updated editions carry modern topics, such as investment techniques and exchange-traded funds.

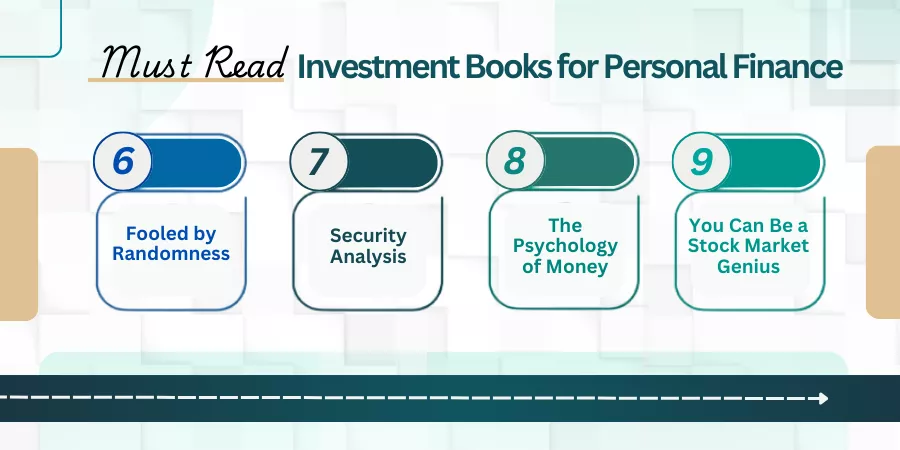

Still wondering what are the best investment books to read? The following titles continue to offer deep insight without overwhelming jargon.

Fooled by Randomness

Fooled by Randomness by Nassim Nicholas Taleb, a former trader and mathematical statistician, navigates the role of chance and randomness in both life and markets.

This book highlights how our emotions and past experiences impact our decisions, particularly financial ones.

Taleb explains how randomness is underrated as a cause of outcomes in markets while skills are exaggerated. Taleb details the nature of uncertainty, risk management practices, and limits of financial knowledge.

Taleb discovers how cognitive biases like hindsight bias can cause an investor to misunderstand success. This book defines the concept of “black swan” events, or events that are unpredictable and rare and which have major influences, an idea he explains further in his five-book series, the Incerto.

“Fooled by Randomness is a serious, intellectually sophisticated book, well worth reading carefully. At times, the book is condescending as though the author had discovered the holy grail of investing. There ain’t no holy grail, and the cosmopolitan tone can be somewhat off-putting. Nevertheless, there are some great insights” (Barton Biggs)

Security Analysis

The oldest book on this list – first published in 1934 is another classic book by Benjamin Graham and David Dodd. It’s still considered one of the sharpest books for stock market education nearly a century after it was originally written.

It has been updated many times over the years, of course, and zeroes in on the numerical analysis of companies and their investment characteristics.

Highly successful investors, including Warren Buffett and Michael Burry, of The Big Short fame, have employed the techniques explained in this book to analyze securities.

While this is an intricate read, it will be crucial to your investing journey if you choose to pursue value investing as a strategy.

The Psychology of Money

The Psychology of Money by Morgan Housel narrates the intricate relationships between people and money, recommending that financial success is more about behavior than intellect.

Through psychological insights and engaging stories, Housel observes how biases, emotions, and life experiences influence our financial decisions. The book argues in favor of a long-term perspective on wealth and emphasizes the significance of self-awareness, humility, and patience in achieving financial well-being.

Finally, it recommends readers rethink their behaviors toward money and investing.

You Can Be a Stock Market Genius

You Can Be a Stock Market Genius by Joel Greenblatt reveals an insightful and straightforward approach to investing, especially in situations, such as restructurings, mergers, and spin-offs.

Greenblatt focuses on the significance of extensive research and understanding the core principles of companies. With a mix of practical investment advice and humor, he simplifies complex investment strategies, making them approachable to individual investors.

The book inspires readers to embrace a disciplined approach to investing and chase unique investment opportunities in the stock market.

“Joel Greenblatt’s How to be a Stock Market Genius is required reading for all new Third Point employees. On the topic of spin-offs, Greenblatt writes: “When a business and its management are freed from a large corporate parent, pent-up entrepreneurial forces are unleashed. The combination of accountability, responsibility and more direct incentives take their natural course.” (Dan Loeb)

The Bottom Line

This comprehensive list of recommended books offers diverse investing perspectives and strategies. Some of these books demand more attention and time commitment than others. But with dedication, you can finish your research equipped with a strong understanding of markets and investing strategies at your disposal.

Whether you are looking for simple or advanced strategies, the investing advisors who authored these books provide wisdom about the financial markets. These books are also beneficial for investors seeking profitable opportunities in the stock market.

Was this article on “What are the best investment books to read?” helpful for your financial journey? Or do you want o master your own money destiny? Quadrawealth provides customized investment strategies, and expert help, whatever level of financial security, harmony or actual financial freedom you seek. Contact us today and enjoy the smarter, more assertive path for wealth growth.

FAQs

Q1. Who Should Read Investment Books?

A: These books on investing are perfect for all investors interested in learning about how public markets operate and those struggling for long-term passive income.

Q2. What is the Best Book for Skill Building?

A: One Up On Wall Street by Peter Lynch is one of the best investing books. This book provides an accessible analysis of the straightforward stock-picking style that won him so much success. Moreover, seeking help from financial advisors can also help you choose the best book.

Q3. Which Investment Book Does Warren Buffett Recommend?

A: Warren Buffett highly recommends “The Intelligent Investor” by Benjamin Graham. He calls it “by far the best book on investing ever written.” It refined his philosophy of value investing and long-term wealth building.