Choosing the right gold coins for investment can seem challenging, given the myriad options available in the market.

Did you know that certain types of gold coins are tax-free for investors? This article offers crucial insights about the best gold coins to invest in and what makes each one unique.

Read on to find out how your investment in these glittering treasures can multiply!

Key takeaways

●Gold coins offer numerous benefits for investors, including potential capital gains and tax advantages like exemptions from Capital Gains Tax.

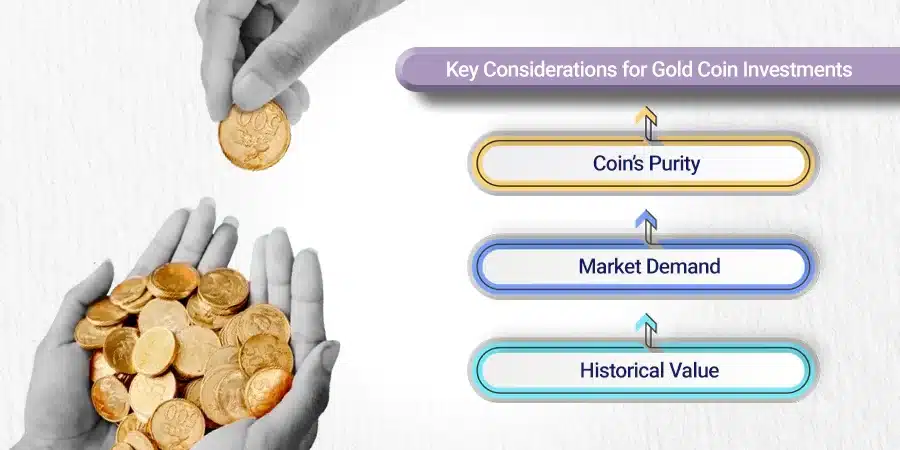

●When investing in gold coins, it's important to consider factors such as purity, market demand, and historical value.

●The best gold coins for investment include the Gold American Eagle, British Sovereigns, Canadian gold Maple Leaf coins, and South African gold Krugerrand. Each coin has its own unique features and advantages that make it suitable for different types of investors.

●The American Gold Eagle coin is known for its high purity, recognizable design, and potential for capital gains. It is available in different sizes but the one-ounce coin offers the best value.

●British Sovereigns are a historic investment option with rich historical appeal and exemption from Capital Gains Tax in the UK. They have a recognized value and are highly divisible.

●This is an internationally acclaimed coin with high gold purity. It has innovative security measures to prevent fraud and holds great liquidity in the market.

Why Invest in Gold Coins?

Investing in gold coins offers numerous benefits, including the potential for capital gains, tax advantages, and a tangible asset that retains value over time.

However, it is important to consider factors such as purity, market demand, and historical value before making an investment decision.

Benefits of gold coin investment

Investing in gold coins has many benefits. Here is a list:

- Gold coins are good for small investors.

- They have tax perks like being free from Capital Gains Tax.

- Keeping gold coins is not hard.

- The live spot gold price shows the strong gold market.

- You can think about things like coin size and upside potential when buying gold coins.

- Gold Britannia 1oz coins are one of the top options for UK investors.

Pros and cons of gold coin investment

Investing in gold coins has its unique advantages and disadvantages that are crucial for potential investors to consider.

- Gold coins are a suitable option for small investors looking to diversify their portfolio with gold.

- Gold coins are easy to store and maintain.

- Some gold coins, like the gold Britannia, are exempt from Capital Gains Tax for UK investors.

- Gold coins often have a historical and aesthetic value that can increase over time.

- Most gold coins are globally recognized, increasing their liquidity.

- Gold coins generally carry higher premiums than gold bullion coins in the world.

- The value of gold coins depends on the volatility of the gold market.

- For those not well-versed in coin collecting, it may be challenging to identify the value of rare or historic coins.

- It requires a safe storage solution to prevent theft.

- Finding a buyer for your specific gold bullion coin type may sometimes be tricky.

Remember, the decision to invest in gold coins should be based on your financial goals, risk tolerance, and investment timeline.

Factors to Consider When Investing in Gold Coins

When investing in gold coins, it is important to consider factors such as the coin’s purity, market demand, and historical value.

Coin's purity

Gold bullion coin purity is key. Buyers look at this when picking coins. Purity means how much gold is in the coin.

Some coins like the Canadian gold Maple Leaf have a high purity of 99.9%. The Krugerrand gold coins also stand out for their high purity levels.

Coins with high pureness or “fineness” are more valuable and good to invest in.

Market demand

A lot of people want gold coins. This high demand makes it easy to sell fast. High market demand means you can trade your gold coins for money anytime you need it. This is called liquidity.

Gold Britannia 1oz coins and Gold Sovereign coins are well-liked in the UK, so they’re sold a lot there! Other popular ones are Krugerrand gold coins from South Africa because they don’t cost much.

Always look for the coin that most people want when you choose one to buy.

Historical value

Gold coins hold historical value due to their recognition worldwide. For example, the British Sovereign coins have been a part of British coinage for over 200 years.

These coins are sought after not only for their gold content but also for their historical appeal.

The older the Sovereign coin, the more valuable it is considered, especially those from the Victorian era.

Similarly, the Saint-Gaudens Double Eagle Gold bullion Coin is renowned for its beauty and is often regarded as one of the most visually stunning gold coins ever produced.

In addition to their intrinsic value, these coins carry a sense of history and heritage that makes them highly desirable among collectors and investors alike.

What Are The Best Gold Coins for investment: Gold American Eagle

The Gold American Eagle is considered one of the best gold coins for investment due to its high purity, recognizable design, and potential for capital gains.

Features & Description (Gold American Eagle)

The Gold American Eagle is a popular gold bullion coin for investment. The first gold bullion coin was issued in 1986 and is part of the American Gold Eagle series.

The coin has a high purity of gold content and is available in four different sizes: half-ounce, quarter-ounce, tenth-ounce, and one-ounce gold coins.

The one-ounce Gold American Eagle offers the best value for investors because it contains one troy ounce of .9167-fine gold. It also has a face value of $50.

Investors are attracted to this coin because it combines the beauty of the design with its potential for long-term growth and preservation of wealth.

Pros & Cons (Gold American Eagle)

The Gold American Eagle coin, popular with investors since its inception in 1986, holds several advantages and disadvantages that potential investors should be aware of.

- The Gold American Eagle provides high purity with .9167-fine gold content, making it a valuable addition to any portfolio.

- The one-ounce Gold American Eagle coin provides the best value for investors, ensuring a significant return on investment.

- It is highly liquid, allowing for easy buying and selling in the market as needed.

- The Gold American Eagle has a strong performance track record, making it a reliable investment.

- Compared to the gold bar or other bullion coins, the Gold American Eagle carries a higher premium which could potentially reduce overall returns.

While the Gold American Eagle has its pros and cons, its high purity, liquidity, and reliable track record make it a favored choice for many investors.

Best Historic Investment Coin: British Sovereigns

British Sovereigns are considered one of the best historic investment coins due to their rich historical appeal and their reputation as a reliable store of value.

Features & Description (British Sovereigns)

The British Sovereigns are a popular choice for investors due to their historical appeal and recognized value. These gold coins have been in circulation for 200 years and are minted by the Royal Mint, ensuring their authenticity and quality.

The British Sovereigns contain 7.322 grams of 22-karat gold, giving them a total weight of 7.9881 grams.

They are also known for their distinctive design featuring the effigy of Queen Elizabeth II on the front and the iconic Saint George slaying the dragon on the reverse.

Their smaller size makes them highly divisible, providing flexibility when it comes to buying or selling.

Additionally, these coins are exempt from Capital Gains Tax in the UK due to their face value of £1, making them even more attractive to investors looking for tax advantages.

Pros & Cons (British Sovereigns)

Investing in British Sovereigns has its unique advantages and potential pitfalls.

- British Sovereigns are a solid investment option for smaller investors.

- These coins are free from Capital Gains Tax (CGT), which can be beneficial for UK investors.

- The gold market remains buoyant, indicated by the live spot gold price, which can result in high profits for investors.

- British Sovereigns, particularly the gold Britannia 1oz coins, are considered one of the best and most beautiful gold bullion coins for UK investors.

- Gold Britannia coins have low premiums due to their lower production cost per gram.

- Their value is dependent on the current gold price, which can fluctuate.

- Investors may need to consider additional costs for storage and maintenance of the coins.

- If the gold market declines, the value of British Sovereigns can decrease, resulting in potential losses.

- Selling these coins may require dealing with a dealer, which might not necessarily offer the best price.

- Gold Britannia coins are more suitable for long-term investments and may not be the best option for those seeking short-term profits.

Features & Description (Canadian Maple Leaf)

The Canadian Maple Leaf gold coin is known for its high purity and quality. It has a 24-carat gold content, making it one of the purest gold coins available.

The coin features radial lines on both sides, which serve as a security feature to prevent counterfeits.

Struck by the Royal Canadian Mint, the Canadian Gold Maple Leaf is considered one of the purest gold bullion coins.

These lines create a unique pattern that makes it difficult to reproduce accurately.

The Canadian gold Maple Leaf also has a face value assigned by the Canadian government, adding to its authenticity and credibility.

This means that the coin can be used as legal tender in Canada, although its actual value is based on its gold content rather than its face value.

With its high purity and recognition in the international market, the Canadian Maple Leaf gold bullion coin is considered one of the best options for investment.

It holds great liquidity and can be easily sold on the secondary market when needed.

Pros & Cons (Canadian Maple Leaf)

The Canadian Maple Leaf is internationally acclaimed and is known for its high gold purity. However, like any investment, it has its advantages and drawbacks.

Here’s a closer look at the pros and cons of investing in Canadian gold Maple Leaf gold coins.

- Canadian Maple Leaf gold coins have a high purity level of 99.9%.

- The authenticity and quality of these coins are guaranteed by the Canadian Mint.

- The radial lines on the face of the coin are an innovative security measure to prevent fraud.

- Gold coins, like the Canadian gold Maple Leaf, offer diversification for your investment portfolio.

- These coins have strong liquidity in the secondary market.

- They can be prone to scratches and marks due to their high purity and softness.

- They are slightly more expensive than other gold coins due to their high gold content.

- Not all investors are familiar with these coins, which could limit the market when you want to sell.

- The value of gold coins can fluctuate with the market price of gold, which can be volatile.

- Storing physical gold coins securely can be a challenge.

Best Gold Coin for Long-term Investment: South African Krugerrand

The South African Krugerrand is considered the best gold bullion coins for long-term investment due to its historical value and recognition, as well as its high gold purity content.

Here is a list of the best gold coins to buy for investment :

Features & Description (South African Krugerrand)

The South African Krugerrand is a popular gold coin for long-term investment. Produced by the South African Mint since 1967, it is known for its affordability and high-quality purity.

The South African Krugerrand was the world’s first bullion coin, so it’s no surprise that it’s one of the most prestigious and widely traded gold bullion coins.

The United States widely accepts these bullion coins, even outside the U.S. The name of the coin originates from the first South African Republic president, Paul Kruger.

If you take a look at the obverse, the coin represents his image. The Krugerrand does not have a face value but is valued based on its gold content.

It has strong liquidity, meaning it can be easily bought or sold in the market. With its unique design featuring a springbok antelope on one side and former President Paul Kruger on the other, the Krugerrand is easily recognizable and highly sought after by investors worldwide.

As a resilient investment in the gold market, it provides stability and potential growth for those looking to diversify their portfolios with tangible assets like precious metals.

Pros & Cons (South African Krugerrand)

The gold South African Krugerrand is a remarkable gold coin that has been a steady choice for investors since its debut in 1967.

However, like all investments, it consists of pros and cons.

- Krugerrand gold coins have outstanding purity and strong liquidity, making them reliable for investment.

- These coins are popular due to their affordability, providing more opportunities for investors with varying budgets.

- Being easily identifiable, Krugerrand coins represent a resilient investment and offer good upside potential.

- As tangible assets, Krugerrand coins serve as a store of value and can act as a hedge against inflation.

- These gold coins are easily sold on the secondary market, offering investors a high degree of liquidity.

- The design of the Krugerrand isn't as appealing or intricate as other gold coins, which some collectors might find less attractive.

- While Krugerrands have a high gold content, they do not have any additional valuable metals, which other coins might offer.

- They have been linked to the apartheid-era South Africa, which negatively affects their reputation for some investors.

- While they have strong liquidity, their value can still be impacted by fluctuating gold prices, posing a risk to investors.

- The South African government can change the regulations related to Krugerrands, which might affect their value or legality in certain circumstances.

Most Aesthetically Pleasing Coin: Austrian Gold Philharmonic

The Austrian Gold Philharmonic is widely considered one of the most aesthetically pleasing gold coins on the market.

Features & Description (Austrian Gold Philharmonic)

The Austrian Gold Philharmonic is a gold coin made from 99.99% pure gold. It features a beautiful design with images of orchestral instruments and the grand pipe organ.

The obverse side of the coin showcases an elegant design of the Great Organ of the Golden Hall, located in Vienna’s Musikverein concert hall.

The coin comes in various sizes, ranging from 1/25 oz to 1 oz, making it suitable for different investment needs.

It has a face value of 100 euros, but its actual value is determined by the market price of gold.

This coin holds legal tender status in Austria, which provides additional security and recognition for investors.

Pros & Cons (Austrian Gold Philharmonic)

The Austrian Gold Philharmonic coin has several pros and cons that investors should consider. Here is a detailed breakdown:

- Recognized worldwide and popular among collectors and investors.

- Made of 99.99% pure gold, ensuring high quality and value.

- Features a stunning design of the Musikverein's pipe organ on its reverse side.

- Highly liquid and offers strong upside potential for investors.

- Only gold bullion coins are offered in euros and insured by the Austrian Mint.

- Face value of 100 euros, making it free from Capital Gains Tax for Austrian investors.

- Available in various sizes, including 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz.

- Value is tied to the global gold price, which can be volatile.

- Less well-known compared to some other international gold coins.

- The design may not appeal to all investors and collectors.

- High liquidity can sometimes mean higher transaction costs for buyers and sellers.

- Face value in euros may be less convenient for investors outside the Eurozone.

- Tax benefits may not apply to non-Austrian investors.

- Smaller sizes may not offer the same cost-efficiency as larger coins.

As with any investment, it’s important to do your research and understand the pros and cons before you buy.

Few More Things to Know About Gold Coin Investments

How should gold coins be stored? Is it better to buy gold coins or gold bars? What is the process for selling gold coins for cash?

How to store gold coins?

Gold coins need to be stored in a safe and secure manner to protect their value. Here are some tips for storing gold coins:.

- Choose a secure location: Store your gold coins in a place that is secure, such as a home safe or a safety deposit box at a bank.

- Protect against theft: Keep your gold coins hidden from view and avoid discussing them openly. Consider installing security systems or using burglar-proof containers for added protection.

- Maintain proper conditions: Gold coins should be kept in an environment with stable temperature and humidity levels to prevent damage. Avoid exposure to extreme heat or cold, as well as moisture and direct sunlight.

- Handle with care: When handling gold coins, use clean cotton gloves or soft cloth to avoid leaving fingerprints or scratches on the surface.

Should I buy gold coins or gold bars?

When deciding whether to buy gold coins or gold bars, there are a few factors to consider.

Gold coins are often preferred by smaller investors because they are easier to buy and sell in smaller quantities.

They also have the advantage of being free from Capital Gains Tax in some countries.

On the other hand, the gold bar may be more suitable for larger investors due to its lower premiums over the spot price of gold.

Ultimately, the choice between coins and bars depends on your investment goals and preferences.

How to sell gold coins for cash?

Selling only gold bullion coins for cash can be a straightforward process. You have a few options to consider.

Firstly, you can sell your gold coins directly to a local coin dealer or jewelry store.

They will evaluate the coins and offer you a price based on factors like their condition and current market value.

Another option is to use online platforms that specialize in buying and selling precious metals, such as reputable websites or auction sites.

These platforms provide an easy way to connect with potential buyers from around the world. Before selling your gold coins, it’s important to research their current market value so that you have an idea of what they’re worth.

Conclusion

In conclusion, gold coins are a beneficial investment option for smaller investors. Factors to consider when choosing the best gold coin for investment purposes include liquidity, tax advantages, and coin size.

The top choices for investment are the Gold American Eagle, British Sovereigns, Canadian Maple Leaf coin, and South African Krugerrand, gold Chinese Panda.

Each of these coins has its own unique features and advantages that make them suitable for different investors.

Whether you’re looking for historical appeal or long-term growth potential, there is a gold coin out there that can meet your goals and make the right investment choices.

FAQs

The top gold coins for portfolio balancing include 1oz Krugerrand Gold Coins, American Eagle Gold Coins, Austrian Gold Philharmonics Coins, and other world Gold Coins like Chinese Gold Panda Coin, and Australian Kangaroo Gold Coin.

Gold bullion coins have slightly higher premiums compared to gold bars due to additional minting costs. investments can serve as a legacy asset to balance your gold investment portfolio against losses in fixed-income securities or market loss. They often gain appreciation over time.

Sure! Other favorites are the Canadian gold Maple Leaf, French Rooster Gold Coin, American gold Buffalo coin, and South African Krugerrands from the Royal Canadian Mint.

Live rates for metals like Platinum and palladium Bars or even precious metals could be found with services giving Live Gold Spot Prices along with Silver spot price charts.

Buying gold coins such as a few highly sought-after items such as The Tudor Beast Series might be limited-issue coins but others like British Royal Mint Gold Coins have no known limitations!

Renowned companies like Valcambi Suisse, PAMP Suisse Refinery, or Heraeus Precious Metals Refinery offer high-quality precious metals including platinum casting grain besides different forms of sovereign minted Metalor products.