Introduction

Market-linked investments are investment products wherein you link the returns on investment to the performance of the assets inside the market.

You can include stocks, indices and commodities as market linked assets whose prices constantly keep fluctuating due to the volatility of rising or falling markets.

The rising markets are referred to as the bullish markets while the falling price markets are referred to as bearish markets.

On a similar parlance, lets understand the core know-how behind ‘What Are Market Linked Investments?’. Helping you get started here:

What are the primary features of Market Linked Investments?

Here are the primary features that are predominantly associated with Market Linked Investments. Let us have a touchdown into the same:

Meaning and Conceptualization

Market Linked Investments are financial products that have index values attributed to them. The assets can be stocks, shares, commodities or a basket of high-paying securities. The market indices are determined for asset values you have inside your investment portfolio.

The investors can get a fair level of capital protection as long as market prices do not crash very badly on account of sudden or unprecedented economic downturns like say a declaration of a recession or a global crash.

However, the RoI factor or the returns of investment primarily depend on how the indices perform in the market. Product issuers can cap ceiling limits on the earnings the assets make and issue coupons or interest earnings as agreed upon while you curated your portfolio in the first place.

Else, you may get downside protection if few of all the assets perform well even in case of adverse market conditions. This is with respect to your capital wallet.

Market linked investments can be calibrated as short-term or long term investments based on the financial obligations you may have to clear in the near future.

Returns primarily linked with market performance

The returns on market linked investments depend primarily on how the markets behave. If the initial purchase points of asset values spike up during the term of the investments, then investors get lucrative returns in the form of capital earnings like dividends, coupons or interest payouts on a grander scale.

On the other hand, if the purchase points of assets do not pick their desired indices, your returns on investment might be modest or even be nil.

You must be ready to face uneven market scenarios based on which your returns keep varying. Fixed or stable returns are usually not offered with Market Linked Investments.

Higher the risk, higher the rewards

When the market performs really well, investors can avail bounty returns on the investment portfolios that are based out of Market Linked Investments.

The returns here usually surpass the modest rates of returns you could possibly earn via traditional bonds or fixed-income securities.

Therefore, investors aim to utilize the rising markets to earn returns almost equal to their principal wallet and it is the adrenaline high that pushes retail investors to purchase market linked investments from banks and privately owned financial corporations.

Diversification of portfolios

You can have a basket of stocks, shares and equity products that can diversify your portfolios exponentially. This way, even if few assets fall down, the overall stability of well-performing assets can keep your capital vault well-protected. A diversified investment portfolio can help you gear yourself to achieving short-term, mid-term and long-term financial goals in a seamless manner indeed.

Having a look at the liquidity factor

Market Linked Investments are highly liquid in nature. You can easily sell shares or stocks at going rates in the market place and quickly gain profits over your investment. However, when the stocks or shares are not pulling up, then you may have to wait for a market revival before you sell your shares or securities.

Long-term investment horizon

For you to improve your growth index on Market linked investments, you may have to hold your portfolios over a longer period of time. This way, you can allow interest earnings or dividends cumulate on your financial portfolios wherein the interest compounds. The lumpsum can help you carry out long-term financial goals or objectives of yours seamlessly.

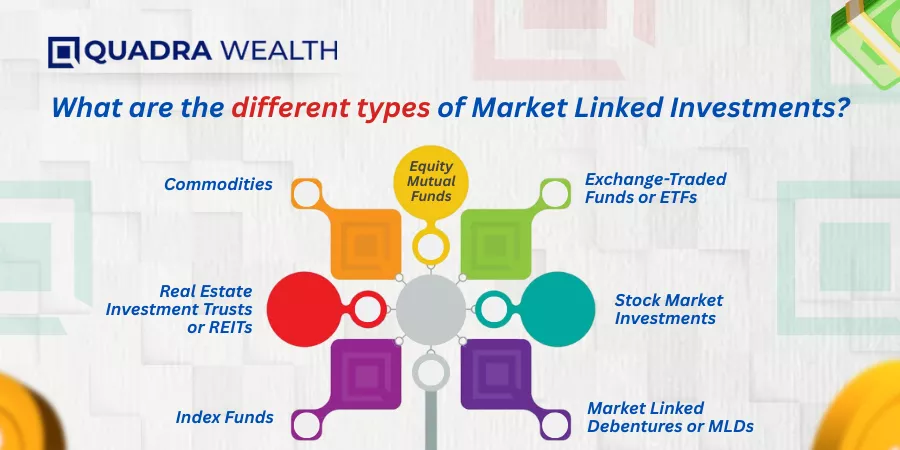

What are the different types of Market Linked Investments?

Here are the different types of Market Linked Investments you can choose from. Helping you through with a rundown into the same:

Equity Mutual Funds

Equity Mutual Funds belong to a type of Market linked investment options wherein a pool of funds are collated from multiple investors.

These pooled funds are utilized by mutual fund houses or financial corporations to procure stocks and shares of different companies.

The index values of these shares or equities are monitored by product issuing firms from time to time. The returns you want from these investments are directly proportion to the performance of these assets inside the stock or equity markets.

Large-cap funds, index funds, sectoral funds and mid cap funds are examples of Equity Mutual Funds.

Exchange-Traded Funds or ETFs

Exchange Trade Funds or ETFs refer to funds that are held inside a basket comprising stocks, commodities or bonds. The basket is then consolidated as a single fund and operates inside the stock market.

Say for instance, you can call Nifty 50 or S&P 500 whose overall index values are coagulated from time to time.

If the index performs well, investors get lucrative returns on their ETF portfolios. Else, the returns are restricted to the modest minimum.

Stock Market Investments

Stock Market Investments refer to direct investments in stocks of different entities. Your returns primarily depend on how these stocks perform inside the market.

For instance, when you buy stocks or shares of Apple or Tesla, then you own the stocks of these firms.

You get returns in the form of capital earning emoluments like dividends that get credited into your account from time to time.

However, the returns are not fixed but variable as the investments are performance linked to a greater extent.

Market Linked Debentures or MLDs

These are debt instruments that are usually linked to market assets like stocks, equity or indexes.

The principal investment is guaranteed. However, the returns on investment primarily depend on how the linked-in assets of the investment portfolios perform in the market.

Structured notes of different categories can be an example for Market Linked Debentures or MLDs.

Index Funds

Index Funds refer to mutual funds or ETFs with specific market indexes that are linked to them as such. The market indexes can be Nifty 50 or S&P 500.

The Funds are tracked according to how the index values rise or drop corresponding to the portfolio.

Nifty 50, S&P 500 and other Index Value funds that soar high in the market are chosen by investors as these are investment options that help the capital money stay intact and help garner steady rates of return on the investment portfolios as such.

Real Estate Investment Trusts or REITs

These are companies that own, operate, and produce real estate assets. REITs can be realtor developers or real estate companies that build commercial and residential properties for the entire city line.

Embessey Business Parks or DLF Properties Pvt Ltd can be Real Estate Investment Trusts that issue shares and stocks to investors.

As the real estate market booms, the investors are all set to gain.

Investment holders can also get plots or properties at discounted rates also and this is done as per the discretion of the real estate firms that offer the same to investors.

Commodities

Commodities can be physical or tangible products such as wheat, barley, gold, silver, and agricultural produce. The investors can invest via commodity-based portfolios. The returns on these investment portfolios are based on how the commodity markets operate.

What are the overall benefits you get when you pick market-linked investments?

These are the overall benefits you enjoy when you pick market-linked investments. Helping you through with a rundown into the same:

Customization

You can choose a basket of market-linked investments that suit your level of budget as far as the capital investment is concerned. You can also choose the tenor periods you might be able to hold up these funds for. This way, you can gear your investment portfolios based on the financial requirements you have in mind.

Having access to diversified portfolios

You can choose equities, commodities, or structured products inside your wealth-generation portfolios. By choosing a wide variety of assets inside your basket, you can enjoy a reasonable level of downside protection against market volatilities.

Potential for upside participation as offered by investment houses

Most of the market-linked investments offer customers lucrative income generation sources such as profits, dividends, coupons, interest earnings, etc.

The performance of equities or stocks in your portfolio is linked with determining how much you earn over a quarter or half-yearly. You get regular or periodic payouts, helping you garner additional sources of passive income.

Plus when the equities or shares you have invested in fare well, you can participate in the potential upside participation as the portfolios grow over time. This way, you get compounded interest payments and this is way better than what you earn via traditional bonds or fixed-income securities.

The Bottom Line

Market Linked Investments help protect your hard-earned money against inflation. Do read the offer documents carefully before investing. What are your thoughts on this? Do mention it on the comments below!

Frequently Asked Questions or FAQs

How do Market Linked Investments calculate taxes upon maturity?

Answer: The MLIs charge income received under ‘Capital gains slabs’ or as regular income. If the income you receive from your investment portfolios is treated as capital gains, then your tax slabs are lowered. Government bonds or capital backed securities help you earn interest payouts regularly and offer tax waivers for investors.

Can hybrid investment portfolios outperform stand-alone investment deposits?

Answer: Yes, Diversified investment portfolios can be hedged against market volatilities as hybrid investments provide a better degree of downside protection against the capital losses for investors on the whole.