Introduction

As a newbie investor, you may want to discover different investment portfolios. When you learn about different portfolios, you get a better understanding of how each investment portfolio works. This way, you know what kind of investment portfolio you can customize to meet your short-term, medium-term, and long-term financial objectives.

Tony Robbins was an investment philosopher who introduced modern ways of bifurcating investments and turning them into profitable portfolios. He emphasized the need for investors not to just rely upon one or more investment options, such as:

- Equities

- Bonds or

- Fixed-income securities

He rolled out a unique philosophy that investors must diversify more of portfolios to help them grow or thrive in the financial world. He further urged retail and institutional investors to include diverse investment strategies such as investing in private markets, venture capital funding, and more customized investment options.

On this parlance, let us discover the entire know-how of Tony Robbins Investment Portfolio. Helping you get started here:

Deeper Insights into Tony Robbins’ Investment Philosophy

Tony Robbins collaborated with Christopher Zuck to bring out his best-selling book known as ‘The Holy Grail of Investing’. He then teaches retail and institutional investors on how investment portfolios can be redefined using posh and sophisticated investment strategies. These are investment hooks that were used by top industry leaders.

The investment prodigies, namely Tony Robbins and Christopher Zuck, teach us various strategies that today’s posh investors use very strategically. They urged the need for investors to get into modern-day investment techniques like:

- Private Equity

- Private Credit

- Venture Capital and

- Alternative Investments

These were more in sync with how the current markets evolve. He wanted investors to use more dynamic investment strategies that were capable of outperforming traditional markets.

He further re-emphasized how investors can delve into the latest investment strategies that are capable of thriving in different market conditions and yet remain resilient, therefore, providing you with robust investment portfolios.

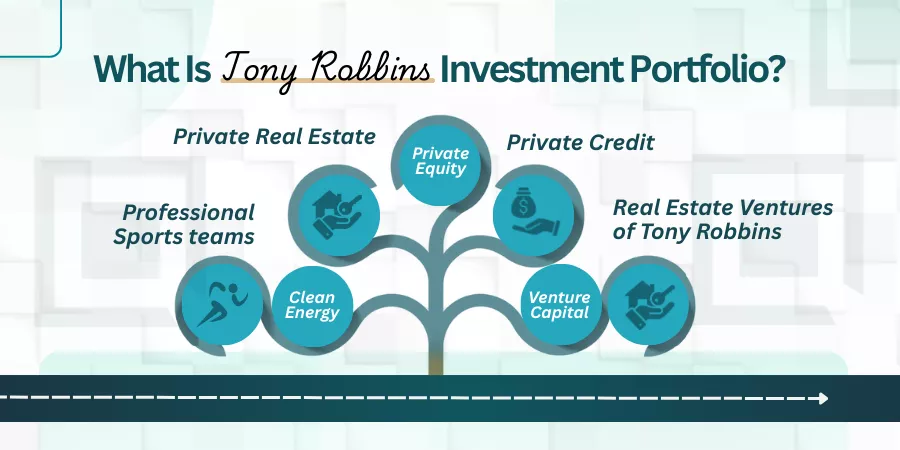

What Is Tony Robbins Investment Portfolio?

Here is a personalized pick of investments from the exclusive likes of Tony Robbins. Let us have a sneak peek into Tony Robbins’ Investment Portfolio comprehensively:

Private Equity

Tony Robbins holds ownership stakes in more than 65 privately owned and privately managed enterprises. His private equity portfolio, therefore, generates substantial cash flow and growth.

Private Credit

Investments via private credit offer higher rates of return as compared to traditional investment opportunities. It is a known fact that private credit offers immense growth for your portfolios in a rising interest rate environment.

Private Real Estate

Tony Robbins is a fan of investing in properties and commercial spaces. This way, he can leverage his passive earning potential of receiving rental income from residents and business clients. Plus, investing in real estate keeps Tony ahead of tax implications. He gets annual waivers and tax benefits when he shows depreciation accounts for properties to the local tax authorities.

Venture Capital

Venture Capital does come to you with higher risks. But as a matter of fact, Tony Robbins is an investment expert who loves taking highly risky investment opportunities under his belt. Venture Capital Investments allow Robbins to engage with disruption as well as innovation.

Professional Sports teams

Tony Robbins engages with sports teams regularly and invests in their fundraising initiatives too. He is the owner of several private equity firms that invest heavily in Sports league tournaments. The Sports leagues are banners of:

- Boston Red Sox

- Los Angeles Dodgers and

- Golden State Warriors

Clean Energy

Robbins has investments totalling US$ 200 million for a clean energy project, namely the Omnis. This company plans to convert coal into clean-burning hydrogen without greenhouse gas emissions. This is the project that is yet to take off. It would start as a publicly funded initiative shortly.

Real Estate Ventures of Tony Robbins

Robbins has decided to purchase a 7000 square foot property atop the Waldorf Astoria Hotel and Commercial Residences in Miami. This is a real estate project that is slated to be the tallest residential building situated at the southern end of New York City. This is a project that is expected to be completed by the year 2028. Additionally, Robbins is also making inroads to adding additional spaces to develop his office cubicles.

What are the advantages of owning a diversified investment portfolio?

Here are a few strategic advantages of owning diversified investment portfolios. Let us have a rundown of the same:

Your risk factors reduce considerably

When you invest via diversified investment portfolios, your market risks reduce considerably. This is especially true when you have placed mixed financial derivatives comprising stocks, bonds, real estate shares, and commodities. Here, the loss of one derivative offsets the other. Therefore, your investment portfolio remains intact.

Stable rates of return

When you own diversified investments or wealth baskets, you get stable rates of return from varied forms of financial instruments that you own. You get coupon earnings, interest payouts, and dividend payments, to name a few. This way, your rate of return solidifies when you have diversified investment baskets.

Getting hands-on with capital preservation

When you have mixed financial instruments inside your investment portfolios, your capital vault remains intact. This is because you have not put your money inside a stand-alone vault, say, like stocks or bonds alone. You have diversified your capital investment into different financial derivatives like stocks, commodities, futures, shares, and currencies. Therefore, your investment basket grows exponentially over a given period of time.

Better exposure to growth opportunities

When you invest your capital corpus towards enterprise-owned shares, private equity, and strategize the latest investment methodologies to grow big, you attain a diversified exposure to different geographical domains, trade instruments, and you grow on to become a world-renowned investor.

Hedge against inflation

When you own the right configuration of assets, your investment portfolio is bound to grow exponentially. You can contemplate inflation better as you hedge derivatives and financial instruments inside your wealth baskets. Therefore, having a diversified portfolio can prove to be a hedging tool against growing inflation.

What are your learnings from Tony Robbins Investment Portfolio?

Here are the learnings from Tony Robbins Investment Portfolio. Helping you with pointers related to the same:

Insights from his book- The Holy Grail of Investing: Never fear taking those risks

The primary insight you get from Tony Robbins ‘ winning book, ‘The Holy Grail Of Investing,’ is that you should never shy away from taking those additional risks. You can understand your true potential by taking a mile above what is expected of you.

Having a diversified investment portfolio is always better than putting your capital into a stand-alone investment

This is the next primary insight you get from the investment expert Tony Robbins. Robbins says that putting all your eggs in the same basket can be futile for you as an investor. If you have diversified investments like stocks, bonds, and commodities, you can reinvent better investment strategies and grow your portfolio. This way, you gear towards achieving your short-term, medium-term, and long-term financial goals seamlessly.

The Bottom Line

Tony Robbins’ Investment Book ‘The Holy Grail To Investing’ is a must-read book for every investor out there. You get a better perspective on what investments are all about. What are your thoughts on this? Do mention it in the comments below!

Frequently Asked Questions or FAQs

What is the asset allocation for investment diversification?

Answer: The assets must include diverse investment tools like stocks, indices, credit notes, mortgage deeds, commodities, and currencies to get you a wholesome or diversified investment portfolio.

Who is Ray Dalio, and what is Dalio famous for?

Answer: Ray Dalio is an investment biggie who is the founder of Bridgewater Associates. This is a very big investment hedge fund house that helps investors diversify into hedge funds.

What is the approximate amount of money that you can retire with?

Answer: When you have investment savings ranging from 4,50,000 to 5,00,000 USD, you can comfortably allocate this money for your retirement planning. The economic percentage is to allocate 10-15% of your earnings on a monthly scale for a wholesome period of 30 plus years. This way, you do not lose your lifestyle and lead the life of an ultra-wealthy billion dollars man as your interest compounds when you leave your corpus funds untouched.

Whether your corpus funds go into etfs, bonds, or mutual funds, your advisor would suggest the formula or the proportion of how your funds must be invested. He would allow stability of your portfolios against economic downturns and deliver the knowledge necessarily for you to survive better. If you want to know more about how to invest better, get in touch with a financial advisor right away.