Introduction

Insurance subscribers must learn and understand the general guidelines for how things work in a dynamic insurance sector. Only when you learn about the basic principles or common guidelines that apply to insurance, would you be able to make decisions in a well-informed manner with respect to your insurance needs.

This blog entitled ‘The Thumb Rule of Insurance’ is aimed to familiarize insurance consumers on what is the rule of thumb that can apply to varied segments of the complex insurance sector.

The rule of thumb with respect to insurance is not a stringent ‘do-it-mode’ but rather a more simplified approach that tells insurance subscribers on how things have to be done to get started off on their initial footing.

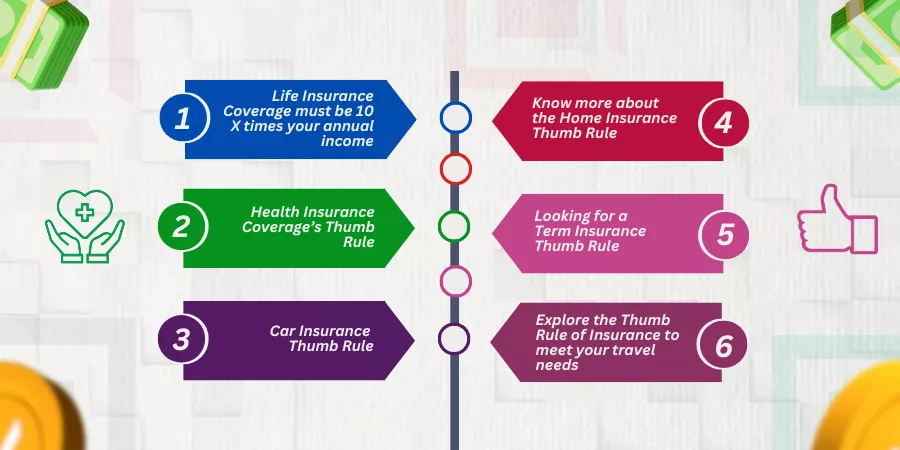

On this parlance, let us learn more detailed insights covering the Thumb Rule of Insurance. Helping you get started further:

Life Insurance Coverage must be 10 X times your annual income

You must make sure that your life insurance coverage must at least be 10X to 15 X times the value of your annual income. This is primarily because it is your income that can predominantly cover your family’s future expenses like your child’s future education, or cover for living expenses or debts you may have taken, to run the household in the event, of your untimely demise, in this scenario.

Say for instance, if your average household income measures USD 60,000 per annum, your life insurance coverage must at least be equal to $60,000 *10 = 6 Million USD.

And, the life insurance amount must be able to safeguard each of the family obligations that you were taking care of, and that must happen for many many years from the time of your demise. Therefore, you must predominantly make sure you aim for a life insurance policy that provides coverage equivalent to 10 X times or 15 X times your annual income to make ends meet for your family members.

This way, you can ideally make sure you help your family sail through life expenses or events in a seamless manner indeed.

Health Insurance Coverage’s Thumb Rule

You must make sure that your health insurance coverage must at least be 5 times your annual income. Here, you might need heavier coverage for health insurance as you may have to include the hospitalization expenses of not yourself alone but you might have to cover the medical bills of your family members too.

The 5 X coverage towards health insurance yields good enough for you to cover medical emergencies, hospital stays, surgeries, and other forms of critical illnesses for you as well as for your family members.

For instance, if your annual income is 80,000 US Dollars, then your health insurance coverage must be 80,000 * 5= $ 400,000

To make the paperwork easier for you as such, you can evoke family floater policies that cover medical expenses for each of your family members under the same plan.

Car Insurance Thumb Rule

Here, you must have car insurance coverage that matches the entire market value of your car. In industry parlance, would would call it ‘Insured Declared Value’ or IDV.

The Insured Declared Value or the IDV amount would be the total value of the amount you would receive from your insurance company in case your car incurs complete damage due to an accident or you experience theft of your car under bizarre circumstances.

Here, you must also understand that the IDV is the market value of your car with depreciation charges done separately and the amount gets adjusted from the IDV amount from time to time.

While choosing a viable form of car or automobile insurance, you can choose a comprehensive package that covers third-party liabilities as well as cover damages that are done to your vehicle.

Here, you can also include add-ons like zero depreciation and roadside assistance and the insurance firm takes the age of the vehicle vis-a-vis its condition on the whole.

Know more about the Home Insurance Thumb Rule

You must ideally make sure that you choose a comprehensive home insurance policy that takes care of A to Zee expenses with respect to building an all-new home altogether. This is because you might lose your property owing to natural calamities like floods, earthquakes, or even acute forms of landslides.

Looking for a policy that takes care of the market value of the house alone might not suffice. This is primarily because the market value of the property is all-inclusive of the land on which the property is built and land is not insurable as such.

For you to circumvent an acute form of property loss, you must look for a coverage policy that takes care of inflationary costs relating to the cost of labor, materials involved, and other types of building costs. This way, you can secure a brand new home in case you lose your present home or property to a natural calamity event.

To cover the inflationary costs of home building you must keep your home insurance policy upgraded from time to time. You must also look for policies that cover the insides of your home. These include fire insurance policies, theft insurance policies, home renovation policies, and so on.

Looking for a Term Insurance Thumb Rule

A term insurance policy is a type of policy that awards you with insurance-related benefits over a specific term. Here, you can get the policy amount as a lump sum in the event of your untimely demise or over the expiry of your term period whichever is earlier.

If you meet your untimely death during the policy term, you can avail of the term assurance policy amount that covers a cheque or demand draft in the name of a nominated family member.

What do you think is the thumb rule here? You must have a term insurance cover that is at least 10-12 times your annual income.

Say, for instance, if your annual income is US$ 80,000, then your policy coverage must at least be to the tune of US$ 800,000 or 840, 000 to be exactly precise here.

Here if you have an active work life of 30-40 years ahead of you, then your policy must cover for each of your future family expenses that run impending during a more futuristic point of time.

You must also understand that your income levels might improve over a point of time. The policy coverage value must also be upgraded accordingly.

Explore the Thumb Rule of Insurance to meet your travel needs

Are you an avid travel enthusiast? Do you plan international destinations with your family members frequently? Then opting for comprehensive travel insurance must be the top of your bucket list indeed.

You must choose travel insurance that covers the following contingencies. These are as follows:

- Medical Emergencies

- Sudden flight or trip cancellations

- Baggage losses if you experience any

- Unforeseen travel delays and

- Other unexpected exigencies you may contemplate during the course of your travel.

On a general note, it is always advisable that you cover your travel insurance that equalizes the entire cost of the trip you plan to embark on with friends, family, or business colleagues on the whole.

You can include add-on health coverage plans in case you are traveling to high-altitude regions or to locations where your medical risks in terms of health hazards may be higher up on the cards.

The Bottom Line

Here, we have seen the overall implications of commonly held insurance policies vis-a-vis the coverage amounts you can take up in lieu of the same.

You can have this ‘Thumb Rule of Insurance’ as an online guide to help you plan insurance policies more seamlessly than ever before.

What are your thoughts on this? Do mention it in the comments below!

Frequently Asked Questions or FAQs

- Explain the financial obligation behind a term life insurance account in 2024. Answer: You might have personal finance obligations like debt expenses or shell out money for your child’s education expenses. Opting for a term life insurance policy is an ideal choice as you get the policy amount once the term ends.

However, if you meet your untimely demise as a primary policyholder during term insurance, then your family members can claim a death-related reimbursement in lieu of the amount the policy coverage holds up for.

What are the best types of insurance policies you can go for in 2025?

You can choose insurance policies that double up as investment options too. Here, you get periodic interest payouts or coupons periodically.

Choosing affordable plans to cover life, health, vehicle, and home are the top-notch comprehensive policies you can ideally go in for. You must select the right type of policy that can tailor your customized requirements and getting guidance from an insurance expert makes the job a tad easier for you as such.

How do you report or update claim requests to your insurance service provider?

You must learn how to manage your claim request bills and replace trash bills with the more relevant ones your policy coverage demands of you. You can refer to policy documents that provide you with the entire set of steps on how a claim request can be actioned by you on a comprehensive scale.

You can also refer to insurance websites or read blogs to get valid tips in lieu of the same.