Difference Between Financial Planning and Wealth Management? Understanding how to manage and grow your wealth can be a challenge. But, did you know This blog offers in-depth insights into these two essential financial services, helping you make informed investment decisions about which one is right for you.

Let’s dive in to explore more!

Key takeaways

● Financial planning helps individuals meet specific money goals like saving for a house or retirement, while wealth management is a more holistic approach that caters to high-net-worth individuals and involves investment management and addressing complex estate planning needs.

●The wealth manager offers a broader range of services including tax and estate planning, charitable giving, and business succession, while financial planners focus on budgeting, debt management, retirement, and building emergency funds.

●The private wealth manager typically caters to high-net-worth individuals with substantial financial resources, while financial planners work with clients at various income levels and financial life stages.

●Private wealth management usually involves higher costs compared to financial planning due to the comprehensive suite of services offered by the wealth manager.

What is Financial Planning?

Financial planning is a process that helps you meet specific money goals. It looks at your financial obligations and personal finance to create a plan. The main idea is to chart out steps for reaching short or medium-term aims.

These can be things like saving up for a family holiday, buying a house, or preparing funds for your child’s education.

The work of the financial planner includes many parts. They help set budgets so spending does not go overboard. Debt management is important too, as they guide on how best to pay off loans and credit card bills.

Retirement planning forms another critical part. Financial planners look into the financial future and lay out plans to save enough so you can live comfortably after retirement without work income flowing in regularly.

- Goals Clarity

- Savings Management

- Risk Mitigation

- Smart Investments

- Debt Control

- Tax Efficiency

- Retirement Prep

- Uncertain Future

- Missed Opportunities

- Financial Stress

- Inadequate Retirement

- Higher Tax Burden

- Debt Accumulation

- No Protection

- Family Disputes

What is Wealth Management?

Wealth management is a type of high-level financial aid. It helps rich people grow their money. A wealth manager offers many services, more than a regular financial planner. The Wealth manager works on tasks like helping with charity plans or dealing with large family estates.

They also team up with legal aides, tax helpers, and business experts to do the job well. Wealth managers talk often with other professionals about their clients’ needs.

They take care of portfolios, which are groups of stocks or bonds that belong to clients. This task means they manage assets in an active way.

- Optimized Growth

- Risk Diversification

- Financial Expertise

- Tax Optimization

- Legacy Planning

- Customized Strategy

- Goal Achievement

- Peace of Mind

- Unutilized Potential

- Increased Risk

- Missed Opportunities

- Tax Inefficiency

- No Long-Term Plan

- Unplanned Legacy

- Financial Stress

- Lack of Direction

Key Difference Between Financial Planning and Wealth Management

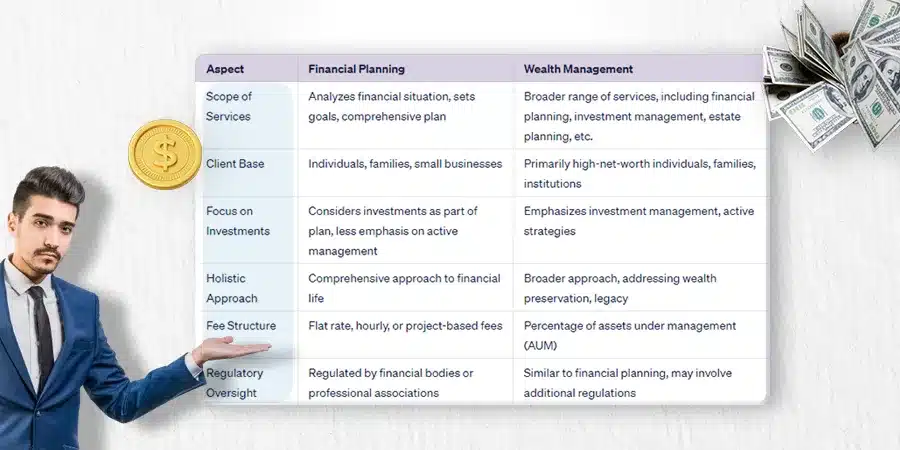

The components of financial planning focus on creating a comprehensive financial roadmap, while wealth management is a more holistic approach that involves not only financial planning but also investment management and other services.

Read on to understand the main differences between these two important aspects of managing your finances.

Services Offered

Wealth managers offer a full menu of services. They help with tax and estate planning. They aid in making charitable gifts and setting up for when the business changes hands.

The Financial Advisor has a more narrow focus.

They do budgeting, retirements, guide on debt, and set up an emergency fund.

The private wealth manager’s role is more broad and active than the financial planner’s job. Both can offer similar services but a wealth manager typically only works with high-net-worth individuals.

Client Type

Private wealth managers primarily cater to high-net-worth individuals who have substantial financial resources. These clients typically have a higher level of wealth compared to those seeking the services of a financial advisor.

Private wealth managers focus on providing personalized financial management and a comprehensive suite of services to meet the unique needs of their affluent clients. Conversely, the financial advisor works with a broader range of clients, including individuals at various income levels and life stages.

Costs Involved

Private wealth management typically involves higher costs compared to financial planning. This is because the private wealth manager provides a comprehensive suite of services, including investments and asset allocation strategies.

They often charge fees based on the assets they manage, which are assessed on a sliding scale. On the other hand, financial advisors typically charge a one-time flat fee or an hourly fee for their services.

The cost of financial planning can vary depending on the chosen fee structure and the level of service provided by the financial advisor. Overall, both private wealth management and financial planning have different cost structures based on their range of services and clientele served.

Required Education

To become a financial planner or wealth manager, there are certain educational requirements you need to meet.

While there is no specific educational pathway mentioned in the content, many professionals in this field hold a bachelor’s degree in finance, economics, or a related field.

Some even go on to earn advanced degrees like an MBA or specialized certifications such as Certified Financial Planner (CFP) designation and certification. These certifications often require completing specific coursework and passing exams to demonstrate knowledge and competency in areas like planning for retirement, investment planning, tax planning, and estate planning.

It’s important for financial planners and wealth managers to have a strong understanding of financial principles and regulations to effectively guide their clients to achieve their goals.

Reputation

To ensure that you select a professional with a clean record, you can check the Securities and Exchange Commission’s (SEC) Individual Adviser Public Disclosure website or the Financial Industry Regulatory Authority’s (FINRA) BrokerCheck feature on their website.

You can also speak with former clients, read online reviews, and check awards received.

These strategies will provide insight into a financial planner’s or wealth manager’s history or reputation and aid in your decision-making.

Necessary Skills

The Private wealth manager requires a range of necessary skills to effectively serve their clients. Strong communication and interpersonal skills are crucial, as they need to collaborate and coordinate with legal advisors, tax advisors, and business consultants.

They also need excellent problem-solving abilities to address complex assets and outside investments. Moreover, private wealth managers must have advanced knowledge in areas such as charitable planning, estate planning, business succession, and family governance.

These skills enable them to provide comprehensive services that align with their client’s financial goals.

Average Annual Income

Financial planning and wealth management are both lucrative fields that offer attractive average annual incomes. according to the latest data from the US Bureau of Labor Statistics (BLS), the average annual income of financial advising professionals is $94,170 per year.

Financial planners, on average, earn between $66,000 and $146,000 per year. However, the wealth manager has the potential to earn even higher incomes, with their annual earnings ranging from $100,000 to well over a million dollars.

It’s important to note that these income figures can vary depending on factors such as location, industry experience, and client base.

Financial advisors who hold the Certified Financial Planner (CFP) certification tend to earn higher incomes compared to those without the certification. Overall, both financial planning and wealth management offer promising financial opportunities for individuals in these professions.

Job Outlook

The job outlook for wealth managers and financial advisors is positive. The demand for these professionals is expected to grow due to the increasing accumulation of wealth and complex financial markets.

Financial advising professionals can expect around 30,500 new job openings annually until 2031. However, the job outlook for wealth management may be more volatile depending on the state of the economy.

Overall, both fields offer promising career opportunities with plenty of room for growth and advancement.

Factors to Consider When Hiring a Wealth Manager or Financial Planner

Consider their credentials, experience, fees, and reputation to make informed financial decisions.

Credentials

Private wealth managers typically hold advanced certifications like Certified Financial Planner (CFP) and Chartered Financial Analyst (CFA). They may also have additional credentials such as Certified Trust and Financial Advisor(CTFA) or Certified Private Wealth Advisor (CPWA).

These professionals often have a higher level of education, such as a master’s degree in finance or a related field.

Additionally, they may belong to professional organizations like the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA).

Private wealth managers also prioritize ongoing professional development and continuing education to maintain their credentials and stay updated on industry trends.

Experience

Private wealth managers typically have extensive experience in the financial industry, which helps them handle complex client situations. They have a deep understanding of various investment strategies and are skilled at managing diverse portfolios.

With their years of experience, they can provide valuable insights and guidance to clients to achieve their financial goals.

Moreover, private wealth managers often spend a significant amount of time interacting with other professionals, such as legal advisors and tax experts, to ensure comprehensive financial planning for their clients.

This collaborative approach allows them to provide personalized and well-rounded services tailored to each client’s unique needs and circumstances.

Fees

Private wealth managers and financial planners have different fee structures. Private wealth managers typically charge fees based on the assets they manage for their clients, also known as assets under management (AUM).

This means that the more funds a client has in their portfolio, the higher the fees they will pay to their wealth manager. On the other hand, financial planners may charge fees based on an hourly rate or a flat fee for creating a comprehensive financial plan.

The exact fees can vary depending on factors such as the complexity of the client’s financial situation and the services provided. It’s important for individuals to consider their needs and budget when choosing between these two types of financial professionals.

Reputation

When considering hiring a wealth manager or financial planner, reputation is an important factor to consider. A good reputation can indicate the trustworthiness and reliability of a professional in managing your finances.

It’s essential to research and read reviews about a potential financial advisor to get insights into their track record and how satisfied their clients are with their services. By choosing someone with a positive reputation, you can have more confidence in their ability to handle your financial affairs effectively.

The CFP certification mentioned earlier promotes the credibility and recognition of a financial planner in the industry. This certification indicates that they have met rigorous standards for competency, ethics, and professionalism.

Wealth Management vs Financial Planning: Which One Do You Need?

Wealth management and financial planning are two different approaches to managing your funds and achieving your financial goals. So, which one do you need? Well, it depends on your specific needs and circumstances.

If you have complex financial situations or a high net worth, someone who frequently invests, earns a salary in a higher tax bracket, has several streams of income, etc.

Then wealth management might be the better option for you. The private wealth manager offers a wide range of services beyond what traditional financial planners provide.

They can handle advanced charitable planning, multigenerational estate planning, business succession, and family governance.

They work closely with other professionals such as legal advisors, tax advisors, and business consultants to ensure all aspects of your finances are taken care of.

On the other hand, if you have more straightforward financial goals or don’t require advanced services, a financial planner might be sufficient for your needs.

Financial planners focus on creating comprehensive plans and investment advice tailored to each client’s situation and future goals. As well as financial planning costs lower fees than wealth management.

They help with budgeting, debt management, retirement planning, and investment guidance.

Ultimately, the choice between asset management and financial planning depends on the complexity of your current financial situation and the level of service you require.

It’s important to consider factors like credentials, experience, and fees.

Conclusion

In conclusion, financial planning and wealth management may sound similar, but they have distinct differences.

The financial advisor focuses on helping high-net-worth clients to invest and achieve their long-term goals and creating comprehensive plans.

On the other hand, the wealth manager caters to high-net-worth individuals and provides a broader range of services, including organizing investments and addressing complex estate planning needs.

Understanding these differences can help you in choosing a wealth manager or financial advisor who is best suited for your specific financial needs.

FAQs

Financial planning focuses on creating a roadmap for achieving your long-term financial goals, while wealth management focuses on preserving and growing your wealth once it is achieved, and involves the implementation and management of your financial plan with a focus on maximizing investment returns.

It depends on your individual needs and realistic goals. If you have specific financial objectives, like risk management or complex assets, both services may be beneficial to ensure comprehensive planning and effective asset management.

While it’s possible to handle some aspects of your own financial planning, it can be challenging without specialized knowledge and expertise. Wealth management typically requires the right professional assistance due to its complex nature.

The cost of these financial planning or wealth management services varies depending on factors such as the complexity of finances, the type of services required, and provider fee structure (e.g., flat fee or percentage-based). Some wealth managers charge an annual fee, while others charge a percentage of your portfolio under management. It’s recommended to discuss pricing details directly with potential service providers for accurate information.