Are you feeling overwhelmed by the mountain of debt that seems to be getting bigger every month? Here’s an interesting fact: there’s a time-tested strategy known as the Debt Snowball Method that can help you systematically conquer your debts.

In this ultimate guide on how to pay off debt faster using this method, we’ll provide step-by-step instructions and useful tips to keep you motivated throughout your journey. Ready to turn your financial life around? Read on.

Key takeaways

● The Debt Snowball Method lists all debts from smallest to largest. You pay more on the smallest one while still making the least payment on others. Once a debt is paid, move its money into paying off the next in line.

● This plan works because it gives you small wins which keep your spirits high. It changes how you handle money and creates momentum towards being free of debt.

● Drawbacks of this method are not focusing on high interest rates first and so may cost extra over time. Large loans can grow bigger as we focus on smaller ones first.

● Alternatives to this plan include Debt Avalanche Method, Debt Consolidation loan or a structured Debt Management Plan each with their own upsides and pitfalls.

Understanding the Debt Snowball Method

This segment delves into the Debt Snowball Method, illuminating how this strategy works and explaining the reasons behind its effectiveness in managing and reducing debt.

How it Works

First, you list all your debts from the smallest to the largest. Ignore interest rates of these loans for now. Next, pay the minimum on each debt every month but put a bit more money towards the smallest one.

Keep doing this until you have paid off the smallest debt in full. Now that first loan is out of your way! This gives you more money to add to the next smallest debt’s payment. Just like a snowball rolling and growing, every cleared loan adds more power to clear bigger ones! That’s how Debt Snowball Method works.

Why it Works

The debt snowball method works well. It starts you off with your smallest debt. As soon as you pay it off, a feeling of success hits you. You then use that win to tackle the next smallest debt.

This cycle keeps going until every debt is paid off. This method changes behavior and builds momentum in money handling habits. Dave Ramsey backs this plan because it gives folks a sense of achievement and motivation early on their road to being debt-free.

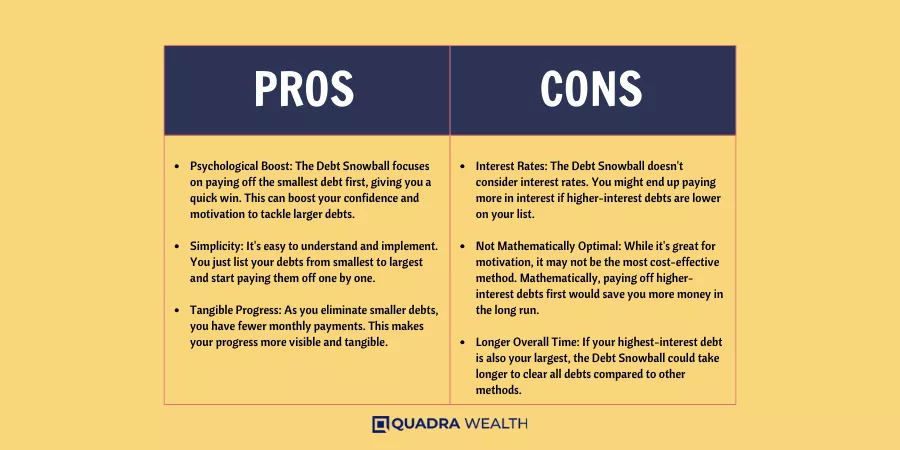

Pros and Cons of the Debt Snowball Method

In this section, we will delve into the advantages and disadvantages of the debt snowball method — analyzing its effectiveness in debt reduction, psychological boost it offers through small victories, but also noting potential pitfalls like possibly paying more interest over time compared to other methods.

- It gives you a clear plan to follow.

- You feel great when you pay off a debt.

- It helps you change your money habits for the better.

- Paying off debt can help make your credit score go up.

- The method is easy to use and understand.

- It works well for people who have lots of small debts.

- This plan can make it easier to stay positive while paying off debts.

- The Debt Snowball Method can help you become debt - free in less time than other plans might take.

- When used with the Debt Avalanche Method, it can speed up how fast your debt goes down even more.

- This plan was made by Dave Ramsey, a person many people trust for money advice.

- This strategy may not be the best for money - saving. You focus on small debts first, not the ones with high interest rates.

- You may pay more in interest over time when you use this method. The focus is on balances, not interest rates.

- Large and high - interest debts may keep growing as you focus on smaller ones.

- It may take longer to clear your total debt using this strategy.

- Using only the snowball method might mean you ignore other useful methods like debt avalanche or consolidation.

- Getting a lower rate through debt consolidation could help you pay off debt faster, but this is not part of the snowball method.

- This plan needs hard work and strong will power every month to keep going till all debts are paid off.

- If one month is missed, you are thrown back in your schedule and it affects motivation 1. levels too.

- People have to make sure they have enough money each month after other bills to put into their smallest debt.

Practical Application of Debt Snowball Strategy

This section delves into the actual implementation of the Debt Snowball Method, guiding you through gathering your bills, creating a debt snowball worksheet, and detailing how to effectively pay down debts.

Gathering your bills

Starting the debt snowball method needs you to gather all your bills.

- First, find every bill you have.

- The bills could be for credit cards, student loans or cars.

- Once found, list these bills from smallest to largest.

- Look at what you owe on each one.

- Write down how much you need to pay on each bill each month.

- This is called the minimum payment.

- You need to make these minimum payments on all debts, but focus more on the smallest one.

- Pay as much as you can towards it until it is all paid off.

Creating a debt snowball worksheet

Making a debt snowball worksheet is a key step. It gives a clear plan to manage your debts. These are the steps involved:

- List all your debts: Put down every debt you owe.

- Order the debts: Place them from smallest to largest amount. Ignore interest rates for now.

- Write down the minimum payment: Next to each debt, pen its least payment.

- Find extra cash: Look at your monthly household income and see where you can find more money.

- Pay off small debts first: Use the extra cash to pay the smallest debt on top of making the minimum payment.

- Roll over payments: Once you settle a debt, roll its payment into the next smallest one.

Paying down debt

Paying down debt is the main goal of the Debt Snowball Method. Here are the steps to follow:

- Make a list of all your debts. Start with the smallest debt at the top.

- Pay as much as you can on your smallest debt. But don’t forget to pay the minimum on your other debts.

- Once you’ve paid off your smallest debt, move on to the next one on your list.

- Use all the money you were putting towards your first debt to pay off this second debt.

- Keep doing this until all debts are paid in full.

Alternatives to the Debt Snowball Method

Investigate alternate debt reduction strategies such as the Debt Avalanche approach, taking a Debt Consolidation loan, or executing a structured Debt Management plan.

Debt avalanche method

The debt avalanche method is another strategy to pay off your debts. This method goes for the debt with the highest interest rate first. So, you pay all your minimum payments. Then, you put extra money toward the debt with the biggest rate of interest.

You keep doing this until that top-rate debt is gone. After that, follow the same process for your next highest-rate debt. This method can save you money on interest fees over time and may be a good choice if you want to lower overall costs.

Debt consolidation loan

A debt consolidation loan is one way to pay off debt. You get a big loan to repay smaller loans. This gives you only one repayment each month. It can make budgeting easier and reduce stress from multiple payments.

The new loan may have a lower interest rate than your old ones too. This helps you save money over time. But, be careful! This plan needs good credit scores to work best. So, it might not suit everyone’s needs.

Debt management plan

A debt management plan is another way to tackle your debts. You work with a credit counselor. They talk to your lenders for you. They try to lower the rates or change due dates. This makes paying off your debts easier.

It can also help you avoid late fees, making it a good choice for some people.

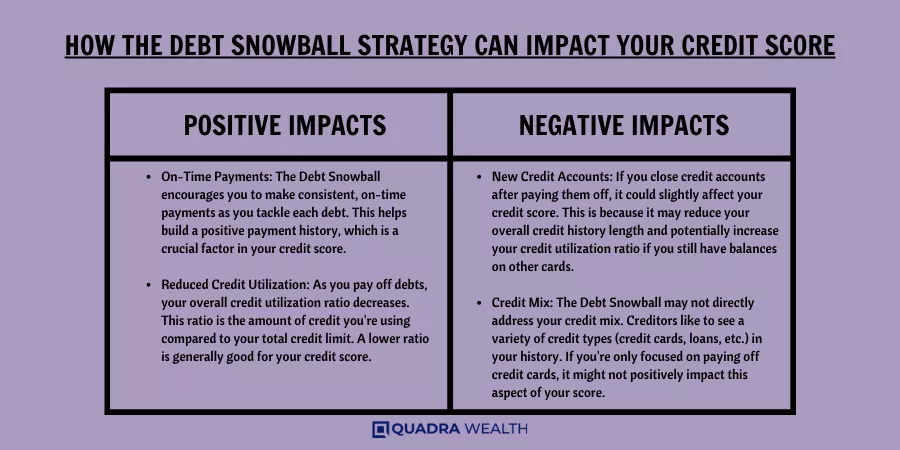

How the Debt Snowball Strategy Can Impact Your Credit Score

The Debt Snowball Strategy can change your credit score. It might even make it better. Here is how it works. As you pay off small debts, you lower the amount of money you owe. This is called credit utilization ratio.

A low ratio can help improve your credit score.

At first, paying off small debts may not lift your score much. But as time goes on, you will see a change for the better in your numbers! Just keep at it and do not give up! You will start to feel more at peace with money when you stick to this plan.

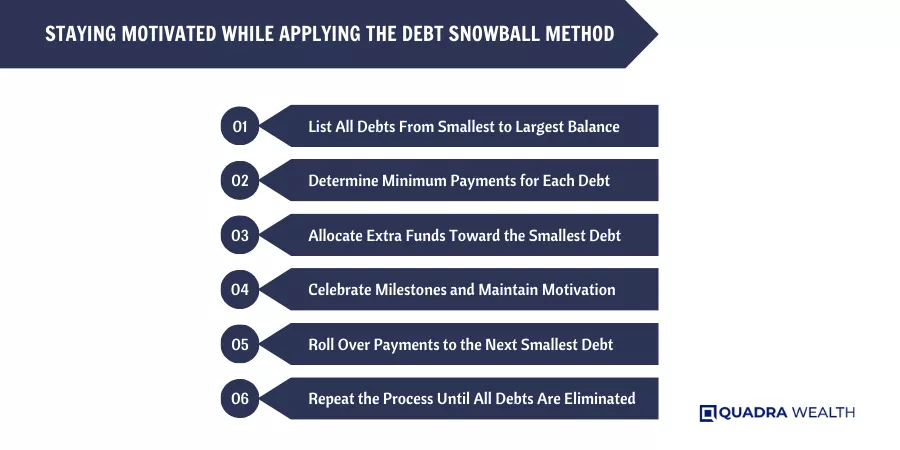

Staying Motivated While Applying the Debt Snowball Method

Paying off small debts first is the key to staying motivated. It’s a part of the Debt Snowball Method. You feel good each time you clear a debt. This feeling boosts your mood and gives you more energy to tackle bigger debts.

Making extra payments also helps with motivation. This can cut down your debt much quicker than if you only made minimum payments. Seeing that progress keeps your spirits high and urges you on in your journey to becoming debt-free faster.

Conclusion

So, the Debt Snowball Method is a big help. It helps you pay your debt fast and keeps you going. Start small, keep at it, and watch your debts melt away like snow. Now you have the power to free yourself from debt!

FAQs

The debt snowball strategy is a debt reduction plan to pay off your debts starting from the smallest. Once you clear one, you roll that payment into the next largest.

Dave Ramsey’s 7 Baby Steps in his Financial Peace University program includes the Debt Snowball Strategy to help people win with money by changing their behavior.

Yes! The Debt Snowball Strategy works for different kinds of debt like credit card bills, medical expenses, car loans and more.

You can use tools like EveryDollar Budgeting App and Debt Snowball Calculator to keep track of your debts and calculate your possible debt-free date.

Yes! Beyond the Debt Snowball Strategy; Dave Ramsey’s Financial University also addresses career clarity, retirement savings, net worth tracking using various calculators such as Retirement calculator or Net Worth Calculator respectively.

Ramsey Solutions offer numerous resources including real estate advice guides from their expert team members Rachel Cruze and Ken Coleman along with useful applications like Mortgage calculator or Investment calculator which could aid in implementing their financial strategies effectively.