Investing can be a complex, time-consuming process that many find intimidating. With the advent of AI technology, however, this is rapidly changing as automated advisors are simplifying the investment journey by providing data-driven and personalized financial advice.

This blog post aims to demystify AI Investment Advisors – explaining how they work and detailing their myriad benefits including cost-effectiveness, high availability, and personalized attention,

Ready to revolutionize your finances? Keep reading! among others.

Key takeaways

●AI Financial Advisors use smart tech to help with money. They can work all day, every day, and give fast advice.

●Using an AI advisor may save you money. They cost less than human advisors.

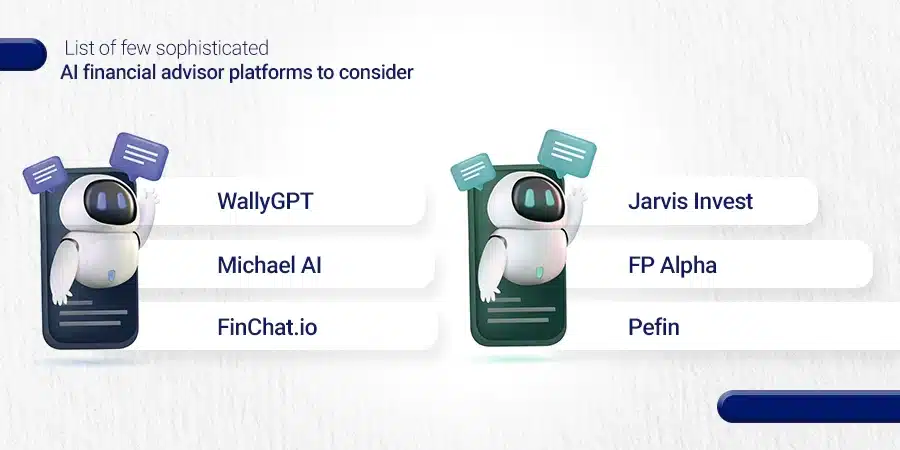

●Well-known AI financial helpers include WallyGPT, Michael AI, FinChat.io, Jarvis Invest, FP Alpha, and Pefin.

●These same helpers can also help with big jobs like tax planning. This helps keep more cash in your pocket!

Understanding AI Investment Financial Advisors

AI Financial Advisors use advanced algorithms and machine learning techniques to provide personalized investment advice and optimized portfolio management services. These AI-driven platforms like WallyGPT, Michael AI, FinChat.io, and Jarvis Invest among others operate 24/7 with improved efficiency and accuracy in their decision-making.

Armed with vast amounts of financial data they continuously learn from, these digital advisors have the ability to manage your investments based on calculated predictions for higher returns at lower costs than the traditional human intelligence advisory landscape.

Definition

Generative artificial intelligence financial advisors are tools that use technology to give money advice. These digital helpers use advanced machines called algorithms. This transparency helps investors make informed decisions and understand the reasoning behind them.

They offer help in many ways, like investing coaching, and planning services. Some well-known AI financial advisors are WallyGPT, Michael AI, FinChat.io, Jarvis Invest, FP Alpha, and Pefin.

How they work

AI Financial Advisors use special tech called machine learning. They study a lot of data and learn from it. Using what they learned, they give you financial guidance that fits you best.

These digital advisors also make trade orders happen for investors. They consult surveys done by the users to do this task in an automated way with help from advanced algorithms.

You get their help anytime since these AIs are always ready and don’t need rest! This is how AI works in giving out financial advice around the clock, making sure goals are met!

The Benefits of Using AI Financial Advisors

AI Financial Advisors bring improved efficiency by handling multiple operations simultaneously. They utilize high-tech algorithms for data-driven investment decisions, providing more accurate and timely advice.

These digital consultants offer cost-effectiveness as they charge lower fees than traditional advisors. The artificial Intelligent systems are available 24/7, offering financial advice at any time of day or night that suits the investor’s needs; this instant availability makes them a valuable tool in managing personal finances effectively and quickly.

By leveraging advanced machine learning techniques, these automated systems deliver personalized strategies tailored to each client’s unique requirements and risk tolerance levels.

Improved efficiency

AI financial advisors work fast. They use computer brains called algorithms. These can look at lots of data in little time.

They give you money tips based on this data. AI does not need breaks, so it can help users all the time. This allows for quick changes to your money plans when needed.

Data-driven decision making

AI financial advisors use data to make choices. They work fast, looking at lots of information in real-time. This helps them make smart moves with your money.

The technology is also good at seeing patterns in the data it uses. These could be market trends or changes in the economy. Every bit of new info leads to a tweak here and there on your investments!

Cost-effectiveness

Using AI financial advisors can save you money. They do the work at a much lower cost than human advisors. These machines use data-driven insights and automated portfolio management to help with your financial goals.

Their services are also available 24/7.

A machine’s ability to work non-stop helps it go through large amounts of data quickly. It makes more informed decisions about where to put cash in or take it out from, without asking for high pay like some humans might do.

The technology behind these AI advisors does not cost a lot after setting up, meaning even small-scale investors can afford their service.

24/7 availability

AI financial advisors are always there for you. They work all day, every day. You can use them at any time.

You don’t have to wait until normal hours to get help with your money. They are on mobile apps and online sites for easy reach.

This means you can check on your money whenever you need to.

The Role of AI in Transforming Financial Advice

Harnessing the power of advanced AI technology, financial advice takes on a new dimension through personalized investment strategies, asset allocations, heightened risk assessment capabilities, and sophisticated tax planning and optimization – transforming the landscape of professional financial advisory services.

Dive in to uncover more about this game-changing integration!

Personalized Financial Advice

AI financial advisors make personal advice easy for you. A tool like Michael AI looks at your money goals and risk level. It then makes a plan that fits you best.

This support is there all day, every day for any questions or changes you might have. Tools like WallyGPT and FP Alpha give smart tips to help you make good choices with your money.

With these tools, it’s like having a wise friend in your pocket who knows about stocks, bonds, ETF portfolios, and more!

Risk assessment

AI financial advisors look at risk in a new way. They use things like algorithms and machine learning to assess risk. This is different from human advisors who have their own views about what’s risky or not.

The AI platforms study lots of data to find out how much risk there might be.

This helps you make better choices with your money. For example, the AI could warn you if an investment is too risky for your goals.

Or it might tip you off about a chance that has little risk but could give good returns. But these platforms can’t see everything – they do not know when something unexpected will happen in the financial markets.

Tax planning and optimization

AI financial advisors use advanced tools for tax planning and optimization. They sift through complex data to find the best ways to cut your tax bill. These smart programs think about all the taxes you need to pay.

Then, they craft a plan that takes less of your money for taxes and puts more into your pocket. Even better, they keep an eye on new tax laws.

Every change is a chance to save you money! AI makes sure no stone is left unturned when it comes down to saving on taxes.

Popular AI Financial Advisor Platforms

The revolution in financial advisory services has seen the rise of sophisticated AI platforms such as WallyGPT, an AI-powered personal Finance Assistant; Michael AI, a GPT-Powered Investment Analyst; FinChat.io, providing valuable insight as an AI Stock Investing Analyst; Jarvis Invest working towards maximizing Your Stock Market Returns with artificial intelligence solutions; FP Alpha that transforms Financial Planning using advanced AI Technology and Pefin serving as your own personal financial planning partner utilizing distinctive machine learning techniques.

The AI-powered advisor platform generates detailed reports and insights, providing investors with a comprehensive view of their portfolio’s performance and the rationale behind the recommendations.

WallyGPT: AI-Powered Personal Finance Assistant

WallyGPT is a top AI financial helper. Using advanced AI, it looks at 12 million money facts to give you smart tips. It helps you make better money choices by giving advice and rewards for good acts.

You can get WallyGPT free from the Apple App Store or Google Play Store. This is how it supports your finances all day, every day!

Michael AI: GPT-Powered Investment Analyst

Michael AI is an investment analyst run by smart tech. It helps people make good money choices based on deep facts and figures. This AI tool can look at a lot of company data very fast.

With this wide view, it gives useful tips to users about where to put their money.

You ask questions to Michael AI, it answers you back with clear points, no guessing games involved! As part of the new wave of smart finance tools, folks see Michael AI as one of the top choices in 2023.

So whether you’re doing savings for school or planning your retirement fund, Michael knows how to help.

FinChat.io: AI Stock Investing Analyst

FinChat.io is your AI buddy when it comes to stock investing. This tool uses smart tech like machine learning to help you make better choices.

Its brain holds knowledge about over 750 companies.

It also knows a lot about super-investors and key money data.

You can use a basic version of this service for free each day if you only need up to 10 tips or ideas. In the future, FinChat.io plans on adding more features and becoming even smarter!

Jarvis Invest: Let AI Maximize Your Stock Market Returns

Jarvis Invest uses AI to help you earn more from stocks. It looks at 12 million different points in the market, helping to keep risks low.

This way, your money can grow more and faster than before. People say it is one of the top seven AI financial advisors for 2023 because of how well it works.

FP Alpha: Transforming Financial Planning with AI Technology

FP Alpha is a top platform that uses AI to help with money planning. This site digs deep into tax, insurance, and legal papers.

It offers tips you can use right away based on clear facts about your money. FP Alpha makes plans that fit each person’s needs using smart AI rules. With its skill, it aims to change how we plan for our future with money.

Pefin: AI-Powered Financial Planning Partner

Pefin is a special tool. It uses AI to help you make money choices. AI can learn and get better over time. Pefin uses this to give good advice when needed.

This handy helper does lots of work fast! It looks at tons of data to know what’s going on with your money. Pefin makes it easy for all users, even if they’re new.

You don’t need to know big words or hard math ideas, but you still get great tips on how and where to put your power.”.

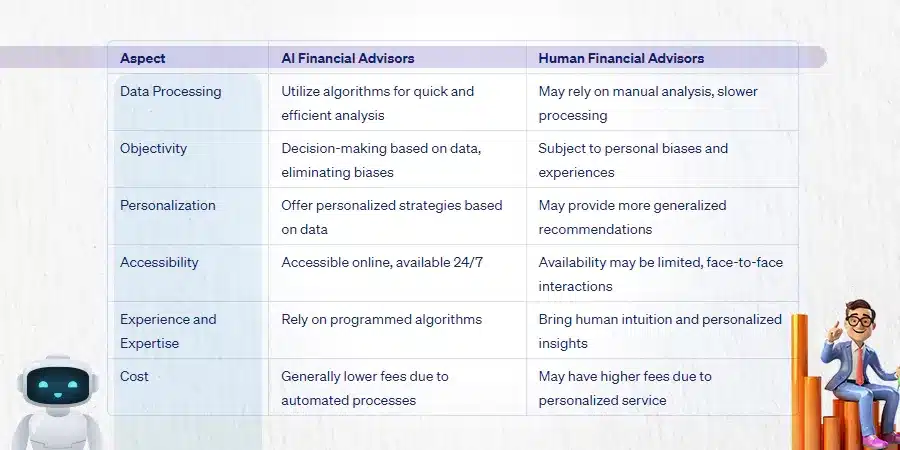

Comparing AI Financial Advisors and Human Financial Advisors

In this section, we will delve into the intrinsic differences between AI and human financial advisors, exploring areas such as their efficiency levels, cost factors, personalization capabilities, and accessibility options.

We aim to present unbiased facts – crucial in helping you decide which option best suits your unique investment needs and preferences.

Efficiency

AI financial advisors are quick and always ready. They help any time of the day, all year round. This helps in managing your money with less fuss and no downtime.

Since they use machines to work, they don’t get tired or need breaks like people do. AI advisors use facts from data to give smart advice which saves time too.

There is no high pay for their help, as compared to human advisors. So more of your cash can go into growing your funds instead of paying fees.

Robo-advisors offer a similar service but are much cheaper than usual managers of funds; this makes things better for you as an investor by adding value while cutting down on costs! These robo-types diversify – spread out – where they put your money so that there’s less risk tied up in one place; also making the best return possible at the same time!

Personal touch

People often want to feel a human bond when they deal with money. AI advisors can do many things, but they cannot give the warm feeling that a real person gives.

They don’t know you or your unique life story. The lack of a personal touch can be hard for people who need help in complex money issues. This is one limit of AI financial advisors.

Cost

AI financial advisors cost less. They do not have the high fees that human advisors do. Robots can work all the time without pay.

This makes things faster and cheaper. You need to pay upfront for a human advisor’s help. But, it is different with AI technology on your side. Some types of this tool even let you use them for free or at a low price!

Accessibility

AI financial advisors are open all the time. This means you can get help at any hour of the day, no matter where you are.

Using these services is also less costly than hiring a human advisor. So, more people can afford them. Lastly, some robo-advisors ask for less money to start investing when compared to their human counterparts.

Hence, even if your budget is small, you can still make use of these platforms to grow your wealth.

The Suitability of AI Financial Advisors for Different Types of Investors

This section will evaluate the viability of AI Financial Advisors for different investor profiles – from novice investors requiring assistance and learning, sophisticated investors keen on data-driven insights, to socially conscious investors seeking ethical investment options.

Beginners

Starting to invest can feel hard for beginners. But with AI financial advisors, they don’t have to fear. Using the best tools like Betterment, new investors can find help easily and fast.

This robo-advisor makes things simple because it knows each beginner’s goals, money facts, and how much risk they are okay with. These smart helpers offer an easy way to manage your investment plans on your own time.

With them, anyone can start investing in stocks and bonds without a lot of learning first.

Sophisticated investors

Sophisticated investors have a lot of money. They know the rules of investing very well. They can handle big risks for high returns.

AI Financial Advisors are a great help for them. These advisors work all the time without breaks. This means they can watch the market every second.

They use facts and data to make smart choices about how to invest money, even in fast-paced markets where things change quickly.

Socially responsible investors

Socially responsible investors value more than just money. They care about the earth, people, and fair play. They like to put their dollars in places that do good things for the world.

AI financial advisors can help them a lot. These smart tools use data to find companies that fit these values. This way, making both the right and profitable choices becomes easier for socially responsible investors.

The Security of Personal and Financial Data with AI Financial Advisors

AI financial advisors put your safety first. They use top-notch encryption methods to guard your personal and money data. This heavy security is part of their design.

It blocks bad people from getting to your details. So, you can trust AI financial advisors with your information.

These strong safety steps make users feel safe and happy using AI services for advice about money. While it won’t take the place of human help, an AI advisor adds more ways for people to make good decisions about their cash.

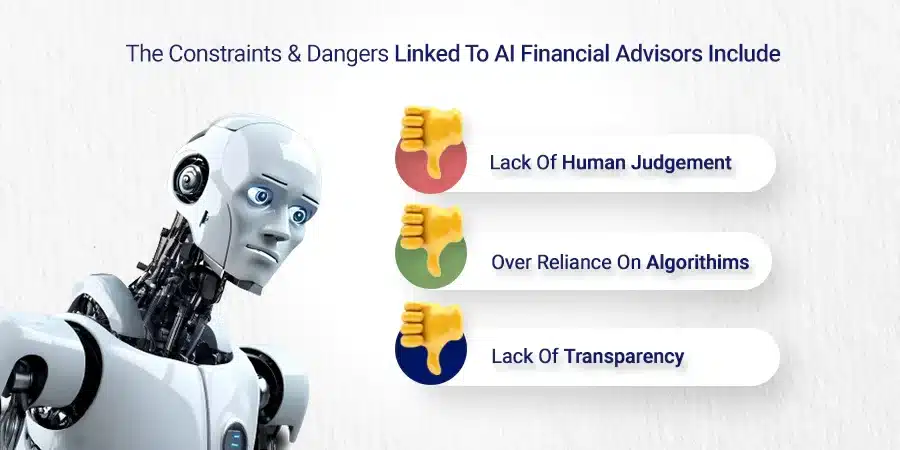

The Limitations and Risks Associated with AI Financial Advisors

AI financial advisors are smart. But they have some limits and risks too. One limit is their bias in picking stocks to buy or sell. This comes from the way they learn about the stock market conditions using certain rules.

Another risk is that AI’s can’t tell what will happen next on the stock market. They don’t know when something sudden might change everything, like a war or virus.

Finally, there’s one more big thing AI lacks: human touch. Some money troubles need more than just data and charts to fix them, like a home loan running out of time, for example.

AI financial advisors take good care of your personal details though – they use special codes so no one can steal your identity or information easily (data security). Just keep in mind it’s always important to stay safe online whatever platform you’re using!

The Cost Comparison Between AI Financial Advisors and Traditional Financial Advisors

The costs associated with AI Financial Advisors and Traditional Financial Advisors vary widely. It’s important to note that AI financial advisors, or robo-advisors, generally charge much lower fees compared to their human counterparts.

In fact, they usually charge less than 0.50% of the assets they manage. Moreover, the minimum investment amounts for robo-advisors can range from as little as $10 to $100,000, allowing for a wider range of investor engagement. Here’s a more detailed comparison:

Cost Element | AI Financial Advisors | Traditional Financial Advisors |

Fees | Typically less than 0.50% of assets under management | Typically between 1% and 2% of assets under management |

Minimum Investment | Can vary from $10 to $100,000 | Usually $250,000 or more |

Additional Costs | Usually none | May have additional costs for services outside of asset management |

With the advent of robo-advisors, the cost of financial advice has become much more accessible to a wider audience, breaking down the barriers previously associated with traditional financial advisors.

The Future of AI in the Financial Advisory Field

AI is set to play a big role in the world of finance. We can expect to see AI advisors on an even bigger scale. They will offer help with money plans and robo-investment services. The goal is for everyone, no matter how much money they have, to get good advice.

New ways are coming that will let AI learn more about you and your needs. For example, these AI-based systems may look at what you buy or where you travel to make better strategies for you.

Also, there will be better tools for keeping data safe as these systems grow.

In all, the future looks bright for AI in financial advice. We should all keep our eyes open for new advances and ideas.

Conclusion

AI investment advisors are here to stay. They use smart tech to give good advice fast. This helps you save money and grow your wealth in a way that works best for you.

No matter where we look, AI is truly changing the world of financial advice!

FAQs

An AI investment advisor is a digital investment manager who uses artificial intelligence, like GPT-powered personal finance assistants, for things such as analytics and trade order execution.

The natural language processing of AI Investment Advisors helps in maximizing stock market returns by analyzing earnings call & conference transcripts, and annual and quarterly reports for you.

Yes! The personalized approach of fintech firms like Merrill Guided Investing or M1 Finance involves using user-friendly interfaces for risk management systems; taking care to maintain user privacy through encryption protocols.

Many platforms like E*TRADE Core Portfolios provide automated investing services alongside human advice known as digital-advisor hybrid models.

Digital financial planners assist with cash management; socially responsible investing,, college planning, retirement planning, etc., using methods like direct indexing and tax-loss harvesting

With modern portfolio theory (MPT), asset classes include inflation assets and high-yield cash accounts.

investing growth crypto funds can become part of your planned portfolio. Some fintechs offer debit cards too.Instructions/info put out may include webinars morningstar investor videos, Retirement calculators, etc.