Navigating the rising costs of higher education can prove daunting for many parents. In today’s world, it’s a fact that investment in children’s education reaps significant benefits that go beyond merely financial returns.

This article simplifies and demystifies investing in Child Investment Plans, showcasing how it represents an effective method to secure and prepare for your child’s future academic pursuits.

Ready to light up your path to smart educational planning? Let’s break it down.

Key takeaways

●School costs are rising fast. A child investment plan can help pay them.

●These plans give more money back than regular savings plans.

●If anything bad happens to you, these plans may still grow your kid's Education Fund.

●Starting early with a child investment plan is smart. It gives the fund more time to grow big!

The Importance of Investing in Children's Higher Education

Rising education costs necessitate strategic investments in children’s higher education to provide them with a stepping stone for better career opportunities.

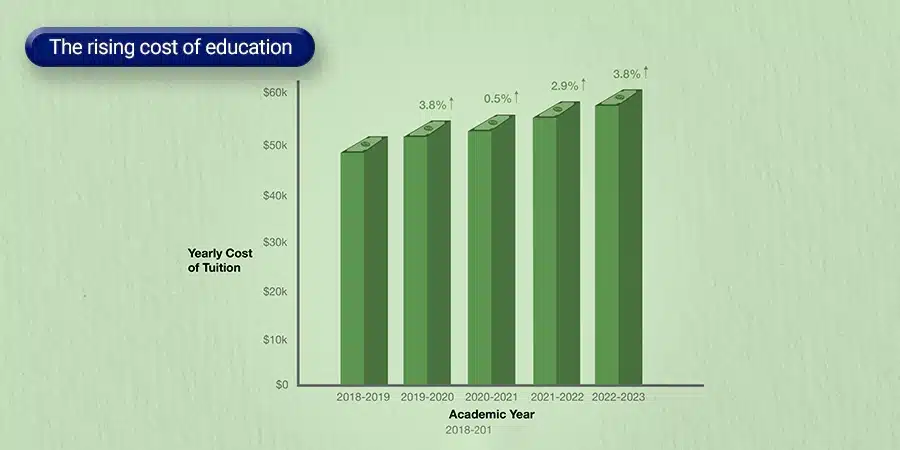

The rising cost of education

School costs are going up fast. This rise in cost can make it hard for families to pay for school. Parents may have to use a lot of their money for their kids’ education.

Some parents might not be able to afford school at all because of how much it costs. Kids need a good education so they can get good jobs when they grow up.

When school is too costly, kids might miss out on better career chances later on in life.

The potential for better career opportunities

Going to college opens up many job doors. A good degree can lead to high pay and work that you like. Jobs are changing fast these days. Many jobs need a college education.

If you need to invest in your children’s college education now, they might have better career choices later on.

- Secure Future

- Career Advancement

- Higher Earnings

- Personal Growth

- Networking

- Resources Access

- Global Opportunities

- Health Benefits

- Limited Careers

- Financial Struggles

- Income Disparity

- Job Insecurity

- Missed Growth

- Networking Loss

- Global Limits

- Health Risks

What is a Child Investment Plan?

A child investment plan is a tool for saving money for your kid’s future. This type of plan works like a pot where you put in money over time. The special thing about these plans is they grow the money you put in.

They do this by investing it into different things that can make more money, such as shares or property.

Child investment plans are usually made to pay for big costs like college fees.

You start by paying a fixed amount of cash every month or year. This is called the premium payment.

As time goes on, this pile of cash gets bigger and earns interest too! So when your child needs to go to school, there will be enough funds to cover it.

These plans can also give something extra if anything bad happens to you right away; this is known as life covers. For example, if you get really sick and cannot work anymore, the insurance company might still continue making payments into the fund even if you stop paying them.

Why You Need a Child Investment Plan

A Child Investment Plan offers vital financial protection, helps counteract the impact of education inflation, provides better returns on investments than standard saving plans, and ensures continuous premium waiver under adverse situations.

Immediate Financial Protection

A child investment plan gives quick money help. This is key for your child’s future and school costs. These plans prevent any sudden money problems from harming your kid’s dreams.

They can lessen stress if something bad happens to you, the parent. You feel safe knowing your child has money set aside right away.

It makes sure their education does not suffer in such times. That way, life moves smoothly even when the ride gets rough.

Counter Education Inflation

School costs go up each year. This is called education inflation.

A child investment plan helps fight this rise in cost. It boosts your savings and gives you more money for schooling later on.

Even as school fees increase, you will not worry. You have enough cash from the investment plan to pay.

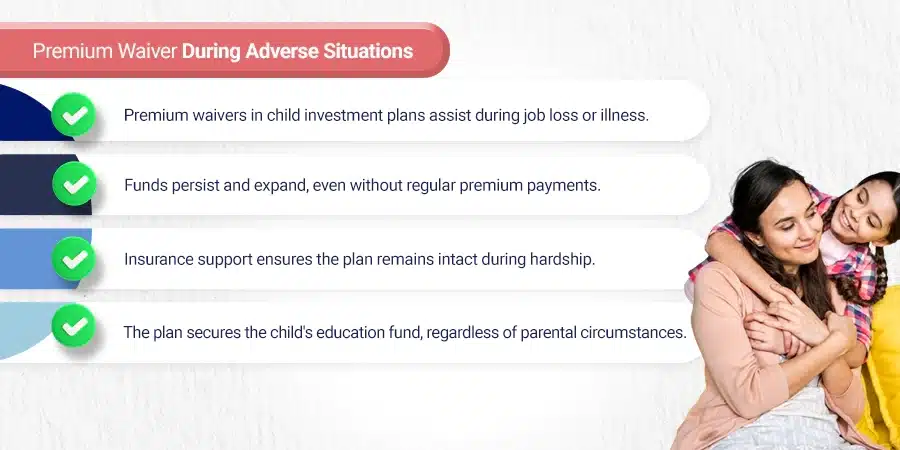

Premium Waiver During Adverse Situations

Bad things can happen. You might lose a job or get very sick. These bad times are called “adverse situations”.

If you have a child investment plan, you will not have to pay your premium during these hard times. This is known as “premium waiver”.

It helps keep your child’s education fund safe and growing. Even if you can’t pay the cost, the plan keeps going. The insurance company steps in and pays for it.

Better Returns on Investments than Normal Saving Plans

Child investment plans get you more money than regular saving plans. In the UAE, these plans bring higher returns.

For example, just by setting aside AED 2,000 each month, one can grow a big amount of nearly AED 1 million! Such high growth is not possible in normal savings.

Thus, child investment plans in the UAE rise above as a strategic investment option for smart parents wanting to secure their child’s future education needs. The choice lies between regular payments or a lump sum to keep the plan going and interest earned over time.

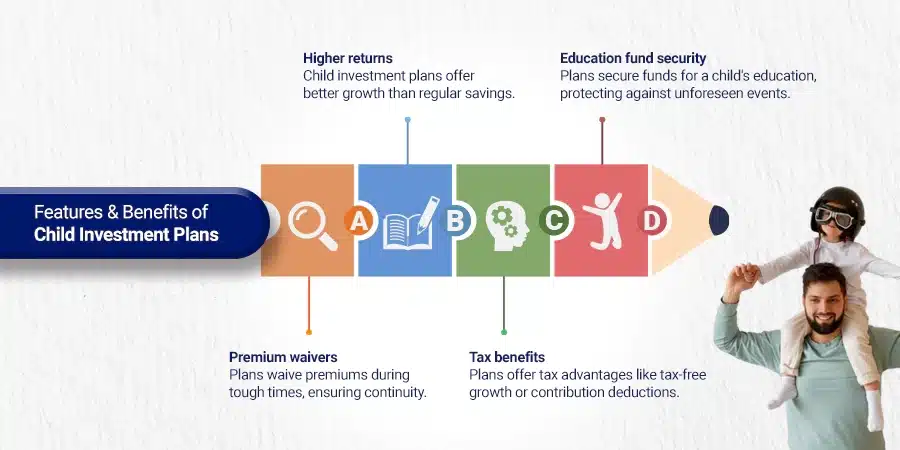

Features and Benefits of Child Investment Plans

Child Investment Plans offer an extensive range of benefits including a secure corpus for your child’s education. These plans are designed to combat inflation with competitive returns.

Comprehensive life coverage is another major benefit, providing peace of mind for the family. In addition, premium waiver options ensure uninterrupted education for your child in case of any adversities.

Lastly, these plans cater to household income protection necessities by allowing partial withdrawals, offering diverse flexibility and long-term financial security for your child’s future.

Corpus for Child’s Education

Corpus for a child’s education is a big pile of money. It’s made by saving little bits at a time. Usually, moms and dads start when their kids are still small.

They keep putting in money until the kid grows up to go to college or university. Making this corpus is very important! While college costs have risen nationally, student parents have been hit particularly hard by tuition increases.

This large sum can pay for school fees so your child can study well without worrying about costs. Starting early will make it easier for you because there’ll be more time to save up enough funds.

Inflation Beating Returns

Investing in a child’s education can be costly. But there is help. Child Investment Plans offer the edge you need with inflation-beating returns.

These plans give more money back than what inflation takes away over time. This way, your hard-earned savings remain safe and grow for your child’s future learning needs.

It beats normal saving plans too! So, through strategic investing, families in the UAE enjoy higher results with their trusted insurance partners.

Comprehensive Life Coverage

Child investment plans in the UAE have a key part called Comprehensive Life Coverage. This is about safety for the child if bad things happen that are not planned. For example, if a parent dies, this part of the plan will take care of costs.

To keep this coverage active, one must make regular premium payments. At times, when a child finishes school, some funds can turn into term life insurance plans.

These provide lasting help beyond education.

Premium Waiver

A Premium Waiver is an important part of child investment plans. The UAE offers this feature in these plans. It protects your money if bad times come. If you can’t pay because of illness or job loss, the plan still stays active with the premium waiver.

It helps to grow cash for your child’s higher education costs. You need to pay a lump sum or regular amounts of money into the plan so it can earn more over time.

For example, investing AED 2,000 per month could get you AED 1 million back! This key benefit lets you focus on securing a better future for your kid without worry.

Income Protection for the Child

Child investment plans give kids money safety. This means they will have enough funds when needed for their schooling. It helps to make sure a child’s dream does not stop due to lack of cash.

A shaky event cannot hurt the plan, as it stays strong regardless of what happens. The kid gets yearly income even if something sad occurs like the death of a parent.

In this way, these plans help kids finish school without any worry.

Types of Child Investment Plans

There are several types of Child Investment Plans such as Single-Premium, Regular Premium, Child ULIP, and Endowment Plans that families can opt for based on their unique needs.

Single-Premium Child Investment Plan

A Single-Premium Child Investment Plan is good for your child’s future. You pay one big amount at the start.

The plan then grows over time. This money helps to pay the qualified educational expenses later for your child.

It gives high returns and is a smart way to invest. It must remain active, meaning you can’t stop making payments or take out any money during its term.

Regular Premium Child Investment Plan

A Regular Premium Child Investment Plan is a smart choice in the UAE. You put money into this plan on a normal basis. It could be once a month or every three months, but it’s not all at once.

The goal of this plan is to give your child plenty of money for their schooling when they grow up. With just AED 2,000 a month, you can get as much as AED 1 million back! This plan makes sure that even if costs go up later, your child will still have the money they need for school.

Child ULIP Plans

Child ULIP Plans have two sides. One side is for saving money and the other is a life cover. These are good plans as they help parents save up for their child’s quality education. They also offer safety if something bad happens to either of the parents.

With Child ULIP Plans, what you can invest in depends on how safe or risky you want to be with your money. There are options like equity, debt, or balanced funds.

Over time, this investment may grow large enough to pay for higher education institutions fees.

Child Endowment Plans

Child endowment plans help save for your child’s higher education. You put in a lump sum or regular payments. The plan grows as it earns interest.

If bad things happen, the plan gives safety to your child. It is ready to pay for school fees when it’s time for college expenses.

Things to Consider When Investing in a Child Investment Plan

Dive into a thorough evaluation before investing in an early childhood education, keeping an eye on factors such as the significance of early investment, economic variables’ influence, terms and conditions’ implications, and the benefit of premium waiver options while also contemplating policies allowing partial withdrawals for flexibility and navigating fund choices wisely.

To better understand these essentials and navigate this vital investment decision effectively, read on!

Begin Investing Early

Start putting money into your child’s investment plan as soon as you can. This lets the money grow over time. When you start early, even small monthly amounts can add up to a lot of money.

In UAE, if you put in AED 2,000 every month, it can grow to AED 1 million. The sooner you begin investing in your child’s future education, the less pressure and worry about costs when college time comes around.

It is smart to use an investment plan built for kids’ higher education needs in the UAE because they cover college costs than other savings plans. Plus, these plans make sure that your kid’s school bills are paid no matter what happens down the road.

Factor in Economic Variables

Economic variables can impact your child’s investment plan. Things like job rates, price increases, and national debt can change the value of money.

Carpools are good at dealing with these changes. They take wise steps that benefit from good times and soften bad hits during tough times.

As an investor, you have to think about the economy too. If it looks like costs will go up a lot or jobs will be hard to get, you might want to save more now.

That way your child still has enough for school when it’s time.

Special Attention to Terms and Conditions

Reading the terms and conditions is important. These hints help you know what to expect from your plan. Here, you learn about fees and costs tied to the plan.

You will also see rules about when you can take money out of the plan.

Always read these terms before deciding on a child investment plan.

Choose the Premium Waiver Benefit

You need the premium waiver benefit in your child investment plan. This keeps your savings safe even when bad things happen. If you get sick or pass away, the premium waiver benefit kicks in.

The company then pays for your plan until it ends. You can have peace of mind knowing that your kid’s future is secure no matter what happens to you.

Opt for Policies Allowing Partial Withdrawals

Pick plans that let you take out some money if needed. This rule is often in UAE child investment plans. Parents can use this money for things like school fees. It allows the plan to keep working as well.

Policies with this option help parents control their child’s school costs better.

Choice of Fund

You should pick the right fund for your child’s education plan. Think about how long you can put money in.

Some plans need a lot of years to yield good returns. Be aware that high gains may come with high risks.

Picking a fund is not as hard as it seems! Our website offers funds from 50 different insurance partners. This means you have many options to choose from! We have earned trust by selling 250,000 policies successfully.

You too could make lots of money by putting just AED 2,000 per month in the chosen fund.

Conclusion

Investing in a child’s higher education is serious. It can shape their future for the better. Child investment plans are handy tools to meet this need. They provide safety, and good returns, and set your child on a path to success.

FAQs

A child education plan is an investment option, like mutual funds or insurance policies, to save for your child’s higher education expenses.

You pay regular money into the best children’s investment plans. This can act as collateral for getting a loan and offer tax benefits under section 80C and other rules. In the U.S., the government designs tax-advantaged plans, such as 529 plans and Coverdell Education Savings Accounts, to encourage saving for the future higher education expenses of designated beneficiaries.

Yes, situations such as alcohol and drug abuse, self-hurt, risky sports, criminal acts, or war-related events may not be covered in the policy.

There are many tools such as SBI Smart Scholar and ICICI Prudential Smart Kid Solution plans that offer different benefit payouts depending on your financial goals and risk appetite.

They do! Charges might include fund management charges, premium allocation charges, or policy administration charges but they vary from plan to plan.

Well, putting trust will report certain gains! Such planning opens doors to choice-based quality learning avenues ensuring successful graduation rates and securing even finance during COVID-19 impact times.