Introduction

While you have traditional bonds and fixed-income securities that were dealt with by people belonging to generations two decades back, things are way different now. The technological innovation has brought an all-new high to how finances and investments work. There are modern websites that help investors self-drive sans the need for intermediaries or brokers. You have sophisticated trade bots that monitor market trends of stocks or commodities.

Similarly, you have structured notes that combine debt bonds with equities. These notes offer you customized payout plans and help you choose the term of investments. Therefore, investors can have customized portfolios that take care of their wealth or income-generation objectives seamlessly.

On this note, let us move on to discover how the process know-how behind structured notes maturity actually works. We would touch upon the basics and then move on to explain how the process know-how works.

What Are Structured Notes: Meaning and Conceptualization Explained

Structured notes are hybrid notes that combine debt and equity. The bond or the promissory note is issued in the name of the investor by investment-grade bankers, wealth managers, or other biggie financial conglomerates. These notes are posh investment products wherein the bond takes up most of the investment portfolio. This is done so that the investors’ capital or initial principal money can be safeguarded against losses or investment-based erosion. While the debt or bond component is also linked to the performance of underlying assets or derivatives.

The underlying assets comprise equity stocks, bonds, market indices, credit notes, commodities, and currencies to name a few. Therefore a structured note has a combination of debt and underlying assets added to it. This asset allocation makes potential gains during the term of the asset.

In a nutshell, a structured note is a component that comprises a bond to safeguard an investor’s capital amount while the potential gains of the portfolio are linked to the performance of the underlying assets the note is linked with.

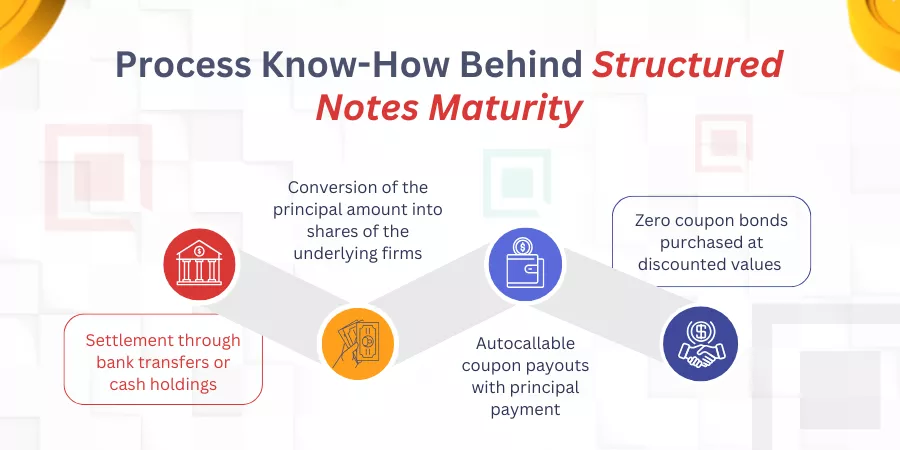

Process Know-How Behind Structured Notes Maturity

Typically, the redemption of the term asset is the mainstream event that happens with the maturity of the portfolio. There are three to four scenarios structured notes take up with respect to their maturity process. Let us discuss the options further:

- Settlement through bank transfers or cash holdings

- Conversion of the principal amount into shares of the underlying firms

- Autocallable coupon payouts with principal payment

- Zero coupon bonds purchased at discounted values that stand redeemed at the full values by maturity

Let us look at each redemption option at the time the asset matures in a detailed insight:

Settlements Through Cash Holdings Or Direct Bank Transfers

The performance of the underlying assets is gauged when the asset reaches a specific barrier limit value or the assets can be auto-called to verify if they have reached above-spot prices at the time they are observed. Usually, the term assets has specific observation dates wherein the performance of all underlying assets of structured products are looked into.

Using matrix methods or compound interest accrual methods, the investment portfolios are looked for performance-related parameters.

Therefore, when the performance of the asset satisfies predesigned or pre-set conditions during maturity, then investors are provided with a complete value of their initial investment amount. The interest earnings on the asset happen through dividends, coupons, and fixed payment options too. The investors can therefore enhance their cash holdings as the amount directly gets credited into their respective bank accounts.

Conversion Of Capital Investment Into Underlying shares Of The Company

This is the 2nd method of redemption of notes at the time of maturity. Sometimes, the final sale points of underlying assets in notes may not perform as per expected stipulations. This can also be a probability owing to the volatile trading conditions of the market. While the bond component in a note remains fixed or static, the prices of underlying assets can keep changing dynamically. The stock markets are subject to bullish, bearish, or stable scenarios that allow prices of stocks to rise or plummet.

That explained you must understand the fact that not all assets can reach their desired points at the time of maturity of the investment portfolio. Therefore, you have reverse convertible notes that convert the capital investment of the investor into underlying shares of the said company. The value may differ as there is a specific formula that applies when the product issuer converts the principal money into requisite shares of underlying firms. The interest amount is usually paid out as a cash settlement.

Autocallable Coupon Payouts With Principal Repayment

Autocallable notes have an in-built callable facility that is added by the product issuing firms. These notes are term assets that have a maturity period ranging from 6 months to 5 years. Therefore, autocallable notes are notes that can meet the short-term or medium-term financial objectives for investors. As with any other type of structured note, an autocallable note also has underlying derivatives linked to it. The underlying derivative components can comprise stocks, commodities, or currencies to name a few.

The performance of the underlying assets is keenly observed during observation dates. Once, the asset values reach their values at par or go above their initial purchase points, then the product issuer autocalls the notes leading to their immediate maturity. The interest earnings are accrued in the form of coupons. As a structured investor, you can choose between fixed or floating coupons.

In a nutshell, once the notes are auto called, they receive their principal amount and interest-backed coupons irrespective of when the asset will mature. Therefore, if underlying stocks perform really well in the market, investors get their principal amount and coupon payouts even before the maturity of the investment portfolio.

On the other hand, if assets do not reach their values, then the product issuer fixes the next observation period. And the process continues. During the actual maturity period, if the performance of underlying assets does not reach their desirable sale points, the investors may get lesser value over their initial investment with interest earnings that have accrued through the entire tenor of the asset. e over their initial investment with interest earnings that have accrued through the entire tenor of the asset.

Zero-Coupon Bonds

Zero coupon bonds are yet another form of capital-friendly investing option for most investors out there. The investors purchase them at discounted values that are pre-determined. The discounted purchase prices mark the level of capital or principal investment for investors as such. While, at the time of redemption they get the pay-parity values or actual purchase values for the bonds. The difference amount between the at-discount values and the selling price of these bonds is the yield the investment portfolio earns. This is yet another redemption event you expect at maturity.

What Are The Features Of Structured Products?

These are the primary features that investors have an edge over while investing with structured products also known as notes. Let us have a run-down into what these features are:

Highly Customized

A Structured note is a hybrid security that is highly customized and as an investor, you get the leverage to choose what you want. You can choose what kind of underlying assets you want with the note. You can choose equities, stocks, commodities, options, or currencies. The customization just doesn’t stop here. You can also choose your payout options with these notes.

Whether you want attractive interest rates or payoff options in the form of fixed-income coupons, floating coupons or interest earnings, dividend payouts, or growth notes, the choice is all yours. In a crux, you can opt for structured notes with principal protection and those notes that work dynamically.

Investors can also choose the term of the asset to fulfill their short-term, medium-term, or long-term financial goals or objectives. Therefore, this is an investment option that can highly be tailor-made to suit the independent requirements or preferences you have in mind. Of course, the structured notes may have maturity dates that differ from product to product.

Getting A Know-How On The Component Structure

As a structured investor, you must clearly understand how the product works. The note has two components added to it. The first component is the bond or the fixed component that takes up most parts of the investment. This portion of your capital investment may go for annuities or fixed bonds and you get downside protection against your capital investment.

On the other hand, the note also comprises a derivative component. Here, you have underlying assets like equity stocks, commodities, and currencies, to name a few. While the bond is linked to investment protection, the potential gains of the portfolio are linked to the performance of the underlying assets that the note is linked to. Therefore, you must get a thorough understanding of how the structural overlay works to further analyze how the product may work for you as such.

Combination Of Underlying Assets

Structured notes are considered as wholesome investment portfolios owing to reasons more than one. You do not have one underlying asset but a combination of assets like independent stocks, a basket of securities, and dual variations of currencies. The performance of the assets gets gauged on a collective scale to determine the value of investment at the time of redemption.

Technical Strategies Adopted To The Workflow Of Your Investment Drive

The structured notes are structured products as they combine a streamlined set of technical strategies to make the investment portfolio a win-win for you and the product issuer. You have a series of simulations added to make the portfolio work better.

These are offer spreads, futures, put or call options, buffers, and barrier limits which are pre-determined values that are added as the notes get designed. For instance, a highly derivative component like a reputable etf, works through call or put options. You must use your discretion here to make their portfolio work in favor of your goal objectives.

This way, you get the best out of what the investment portfolio can offer you both in terms of its principal protection and the returns you get from the investment. These elements added to your product mitigate losses or gains and help you achieve a fair-value investment portfolio on the whole. you both in terms of its principal protection and the returns you get from the investment. These elements added to your product mitigate losses or gains and help you achieve a fair-value investment portfolio on the whole.

The Bottom Line

Investment options come to you with default risk, market risk, liquidity, and currency fluctuation risks to name a few and structured notes also have most of the risks attached to them.

Therefore understanding structured notes is the first check point in your investing career. Then comes the next priority as to how a structure note is linked

You must further identify how structured notes allow stimulating components to grow. This is in terms of the values of the underlying asset the notes are linked with.

Hence, you must look for notes that lend attractive returns on investment and provides principal protection too. You must also analyze the note to more speculative investment options.