Introduction

In today’s digital world, we are marching forward, AI bots and online tools are making headlines doing most of the tasks that humans were performing once upon a time. And the field of finances and investments is no different from following suit in the newly emerging digital trends of the millennial.

It is often felt that when organizations automate their key operations via chatbots or online software, human intervention is less. Therefore levels of productivity supersede their excellence giving less scope for errors or omissions that can be caused by human intervention or biased opinions.

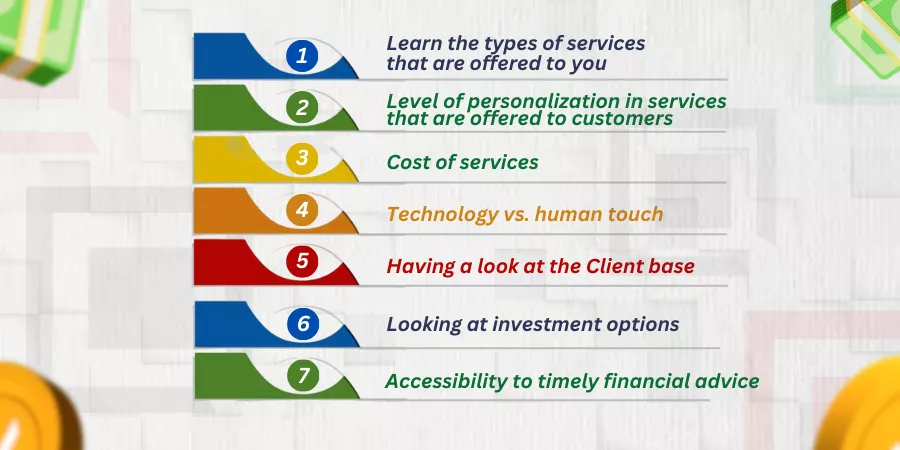

On this parlance, let us understand the key points of differences covering Robo Advisor vs Wealth Manager. Helping you get a run-down of pointers that are connected with the same:

Learn the types of services that are offered to you

For a Robo Advisor, the robots or online-based chatbots offer wealth management services in terms of investment advice, portfolio management, or risk handling via clients’ responses to the questionnaire an online platform throws to customers via the internet. The chatbots or online advisors get their fleet of responses that are already fed via algorithms or programs that are already inputted into the online platform based on a predefined set of rules or norms. Therefore, there is little scope for innovation or customization of member services to further improve the overall aspects of your financial life.

Whereas, with respect to a Wealth Management firm, it is a team that comprises human professionals who steer customers and clients in the right direction for their financial needs or goals. The human professionals are designated as wealth advisors, investment planners, and financial analysts who offer varied services in a wealth management team.

These services include portfolio-based asset allocation, retirement planning, tax planning, risk management, and estate planning to name a few. In a human wealth management firm, clients can discuss their concerns with financial advisors who can provide tailor-made solutions or offer customized services that can align with the financial goals or objectives of their clients, customers, and stakeholders.

Level of personalization in services that are offered to customers

A Robo advisor is an online assistant that works based on a predefined set of rules and norms that are pre-programmed on data systems based on fixed consumer responses via online survey pamphlets or questionnaire forms. The responses are algorithms or data programs that are fed into customer management systems of investment-related software. Therefore, advice is offered to clients and customers with no scope for customization or alteration on the type of services you receive from robots or chatbots that belong to investment advisory firms.

Whereas a wealth manager is an individual personnel who has gathered years of experience in the field of wealth management, financial planning, or banking services. Therefore, a wealth advisor may sit with a client or a customer one-on-one to discuss customized or tailor-made solutions that align with the short-term, medium-term, or long-term goals and objectives of investors, clients, and stakeholders on the whole. Therefore, the level of personalization or customization one could expect from a wealth advisor or wealth manager can be at its superlative best.

Cost of services

As the robo advisor typically provides services through online or highly digitized mediums, the fees for the operations a robo advisor provides can be far lesser as compared to the cost of services provided to you by a usual wealth management firm as such. The fees are usually the bare minimum of 0.25 to 0.5 percent of the assets under management (AuM). You can also avail a whole range of financial planning or wealth management services free of charge from service providers who provide you with digital platforms or software with robo advisors.

Whereas, in the case of a Wealth Management firm, the fee usually ranges from 2- 5% of AuM depending on the type of services that you would want to avail from a Wealth Management firm or from independent wealth managers who are individual practitioners. Some of the wealth managers may levy a pricier sum to plan a host of activities pertaining to investment banking or financial services and the cost can be flat-slab fees for a whole range of services that depend on every client’s complexities.

Technology vs. human touch

A robo advisor typically relies on predefined algorithms or programs that are already fed inside online or digital software a financial or wealth management service provider gives to you. Therefore, the clients or customers usually fill in surveys or questionnaires that are curated by chatbots, and then conclusions are arrived at with respect to the range of financial or wealth management services every client would want to take under their belt.

Whereas, under a wealth management spectacle, a wealth manager speaks to clients using a personalized degree of humane touch that gets added to the entire thing as such. Therefore, a wealth advisor can understand what the client exactly needs.

The wealth advisor can therefore curate highly customized investment management or wealth management services like tax planning, estate management, or retirement planning. Therefore, when you approach a wealth manager, you can get tailor-made financial cum wealth management services that perfectly align with the short-term, mid-term, or long-term financial goals you have in mind.

Having a look at the Client base

Robo-advisors can usually handle a huge target audience without laying emphasis on the geographical domains the investors belong to. The robo advisor can also offer low-cost services to independent retail investors who are newbies or amateurs in the line of finance or investments. Retailers who handle smaller portfolios can also get their stuff handled via robo-advisors. The younger and more tech-savvy individuals prefer to invest with online-based robo advisors to start with.

Whearas, a wealth manager deals with High Net Worth Individuals popularly abbreviated as HNWIs. Here, these investors have decades of experience dealing with investment and finances. The high-net-worth retail and institutional investors usually need wealth managers who can deal with their complex and highly capital-intensive investment portfolios to arrive at amicable solutions for retirement planning or tax planning.

And, as HNWIs have more complex investment needs, you look for wealth managers who can curate customized or tailor-made financial solutions that align with the goals you have on in mind.

Looking at investment options

Robo advisors usually deal with low-cost investment options such as exchange-traded funds or ETFs. Or, they can deal with the S&P 500 which has a mix of high-performing bonds, shares, and securities. The robo advisors deal with consolidated investment options that utilize passive monitoring strategies on the whole.

Whereas, in the case of a Wealth Manager, he deals with complex investment portfolios of high net investors who are high-scale retail or institutional individuals that have complex investment needs which is why they require a human touch that can carefully evaluate the pros and cons of every investment option and then provide them with highly scalable and customized investment solutions.

Accessibility to timely financial advice

A Robo advisor provides cue cards or financial recommendations based on predictive analysis methods. The chatbots process customer info and evaluate the type of financial or wealth management services one might need. No specialized or customized services can be provided by robo-based advisors. Therefore, investors can only get a limited scope of advice or financial recommendations from a robo-advisor.

Whereas, in the case of a Wealth Manager, the personnel clearly understands what every client’s financial concerns are. The personnel therefore provides financial advice based on the complex investment needs of every client he deals with. Moreover, high net-worth investors can connect to wealth advisors or wealth managers via phone calls, emails, or instant chatting mediums. The strategic advice a client receives is therefore in an active investment mode.

How do you choose a good wealth management firm- Insights Explained

These are the following prerequisites investors keep in mind while choosing a good wealth management firm. Let us get a run-down into pointers connected with the same:

Look at the credibility and experience of the Wealth Management firm

You must look at the overall credibility and the experience a Wealth Management firm has across industry verticals. When you have a look at the level of experience a Wealth Management firm has, then you would have a fair idea of how good or competent services are you going to receive from the console.

Read through website testimonials

You can take time out to visit the websites of Wealth Management firms. By doing so, you can go through genuine customer testimonials. These testimonials belong to previous clients who have worked with a Wealth Managing company before. And by reading those testimonials, you being a newbie investor get a more clarified view on the type of company or brand you are signing up for.

The Bottom Line

Investors must read through disclosure documents before signing up with a Wealth Management firm. At the same time, you can also visit office outlets and have face-to-face conversations with experienced wealth managers to know what type of investment portfolios are there for you to choose from and what services you can avail from a firm. This way, you would have a clear picture of what you are signing up for.

Frequently Asked Questions or FAQs

Do Robo advisors deal with stock exchange services?

Answer: Yes, Robo advisors deal with stock exchange transactions. Members must deposit the account minimums into their accounts and pay up a fee structure the service provider levies on customers. And, you can get started right away. You can provide investment options via your inbox or using a predefined box that shows a dropdown of minimum investment. Here, you do not have hourly or premium charges as levied to you by an affiliated CPA planner or financial advisor.

Why do veteran investors prefer traditional advisors?

Answer: You can deal with regular investment options or time horizon based portfolios too. This way, you are able to rebalance your portfolio or high net worth investments from time to time. You can choose more specialized services like estate planning or retirement planning.