Structured products are investment instruments that offer a combination of financial products and derivatives.

While they can present appealing features such as enhanced returns or downside protection, structured products or structured notes also come with hidden risks that investors need to be aware of.

It is crucial to understand the complexities and potential pitfalls associated with these products before considering an investment.

To fully comprehend the risks involved, it is necessary to delve into each aspect.

Market risk is the potential for investment value to decline due to market fluctuations. Counterparty risk arises when the issuer of the structured note fails to meet its obligations.

Liquidity risk refers to the possibility of encountering difficulties in buying or selling a product.

Complexity risk arises from the intricate structure of the product, making it challenging to understand and evaluate.

Lastly, issuer risk refers to the financial soundness and reliability of the entity behind the structured product.

Beyond these fundamental risks, structured products also hide additional risks that may not be immediately apparent.

These risks include a lack of transparency, limited regulatory oversight, the potential for misrepresentation, difficulty in valuation, and the possibility of losing the principal investment.

To minimize the potential downsides, investors must consider a few key factors. Understanding the underlying assets and evaluating their performance history is crucial.

Assessing the potential risks and rewards of the structured product is vital to make an informed decision.

Diversifying the investment portfolio helps spread the risk across different asset classes. Lastly, seeking guidance from the financial advisors can provide valuable insights and help navigate the complexities of structured products.

By being aware of the hidden risks and taking the necessary precautions, investors can approach structured products with caution and make more informed investment decisions.

Summary:

Structured Products maximize investment options: Structured Products offer investors the opportunity to diversify their portfolios by providing market exposure to various underlying assets and investment strategies.

Hidden Structured Products Risks: Investors need to be aware of the lack of transparency, limited regulatory oversight, the potential for misrepresentation, difficulty in valuation, and the potential for a loss of principal when investing in structured products.

Importance of due diligence: Before investing in structured products, it is crucial for investors to understand the underlying asset, evaluate the performance history, assess the potential risks and rewards, diversify their portfolios, and seek guidance from financial advisors.

What are Structured Products?

What are Structured Products? Structured products are financial instruments that combine different investments to provide investors with exposure to various underlying assets, such as stocks, bonds, or commodities.

These products are designed to have a specific risk and return profile. One key characteristic of structured products is their customization. They can be tailored to meet the specific needs and objectives of individual investors.

For example, an investor might want to participate in the stock market’s potential upside while limiting their downside risk. In this case, they could invest in a structured note that includes a stock component as well as a principal protection feature that limits losses if the market declines.

Structured products can be complex and involve different types of risks. Before investing, it is important for investors to carefully consider the potential risks and rewards.

These risks may include market risk, counterparty risk, liquidity risk, and complexity risk, among others.

Understanding the underlying asset in a structured product, evaluating its performance history, and assessing the potential risks and rewards are crucial for investors.

Diversifying one’s investment portfolio and consulting with a expert advisor can also be beneficial when considering structured products.

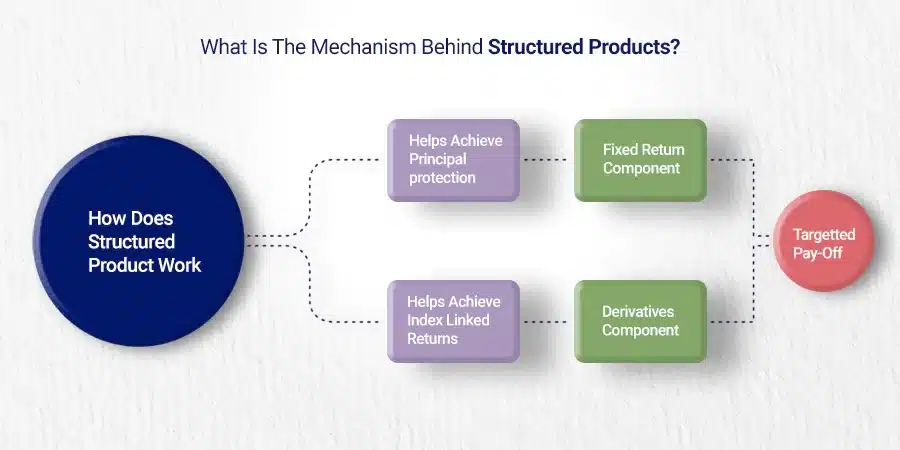

How Do Structured Products Work?

Structured products, like index-linked notes, are a type of investment product that combine different financial instruments to meet specific investment objectives.

They provide investors with exposure to a variety of assets, such as the S&P 500, by linking their performance to an underlying index. This allows investors to participate in the potential upside of the market.

Structured products often offer features like principal protection or enhanced returns. For example, a structured note may guarantee a minimum return at maturity to protect investors’ capital investment, even in the case of poor performance of the underlying assets.

Alternatively, some structured products may leverage the performance of the underlying assets to offer higher potential returns.

Financial institutions create structured products by packaging together securities like stocks, bonds, options, and derivatives, along with various investment strategies.

This combination results in a structured product with specific risk-return characteristics.

It is important to understand that structured products can be complex and involve risks that should be carefully considered before investing.

To make informed investment decisions, investors should have a thorough understanding of how structured products work, including the underlying assets and associated risks.

Seeking guidance from a financial advisor can provide further assistance in navigating the complexities of structured products.

Note: The original table tags have been kept intact and not modified.

Understanding the Risks Associated with Structured Products

Discover the rugged terrain of structured products as we unravel the hidden risks that lie beneath the surface. Brace yourself for a journey through the various realms of risk, exploring market dynamics, counterparty uncertainties, liquidity challenges, complexity conundrums, and issuer vulnerabilities.

Prepare to navigate the treacherous waters of structured products with knowledge and insights to equip you for informed decision-making. It’s time to shed light on the risks lurking within this intricate financial landscape.

Market Risk

It is an essential factor to take into account when investing in structured products. The value of these products can vary due to changes in the overall market conditions, resulting in the potential for losses for investors.

It is crucial to evaluate the risk associated with the underlying assets of the structured product. Investors should be aware that risk is not limited to a specific sector or asset class.

It can impact various markets, including stocks, bonds, commodities, or currencies.

The market and, consequently, the value of structured products can be influenced by fluctuations in interest rates, economic indicators, geopolitical events, and investor sentiment.

To mitigate this risk, diversification is of utmost importance. By spreading investments across different assets or markets, investors can reduce their exposure to the volatility of any single investment.

Carefully assessing the performance history of the underlying assets and evaluating their potential risks and rewards is also crucial. Seeking guidance from a expert advisor can provide valuable insights into managing market risk.

It is important to note that investing always entails some level of risk, and market risk is a critical aspect that investors need to consider while making well-informed investment decisions.

By thoroughly evaluating and understanding this risk, investors can make more informed choices and safeguard their investment capital.

Counterparty Risk

Counterparty risk is a significant concern when dealing with structured products. This risk arises from the possibility that one of the parties involved in the transaction may default on their obligations. It is vital to comprehend the potential consequences of counterparty risk and take appropriate measures to mitigate it.

When investing in structured products, it is crucial to assess the creditworthiness and financial stability of the counterparty. This can be done by reviewing their credit ratings and financial statements. Additionally, diversifying investments across multiple counterparties can help reduce exposure to any single entity.

The impact of counterparty risk can be severe. In the event of default, investors may face significant losses or delays in receiving payments.

Therefore, it is essential to carefully evaluate the counterparty risk and consider the potential impact on the overall investment strategy.

Investors should also pay attention to the type of collateral or security provided by the counterparty. Adequate collateral can help mitigate the risk of default by providing an additional layer of principal protection for the investor.

To protect against counterparty risk, it is advisable to consult with a financial advisor who can provide guidance on selecting reputable counterparties and structuring a diversified portfolio.

By being aware of and managing counterparty risk effectively, investors can help safeguard their investments in structured products.

Liquidity Risk

When investing in structured products, liquidity risk is a significant consideration.

During times of market stress or economic downturns, the liquidity of these products can become compromised, posing liquidity risk.

Investors may face difficulty selling their structured products at fair prices or finding buyers in illiquid markets, thus exposing themselves to liquidity risk.

This lack of liquidity can lead to potential losses or delays in accessing funds, highlighting the importance of assessing liquidity risk associated with structured products before investing.

Complexity Risk

The complexity risk associated with structured products is a crucial factor for investors to consider.

This risk arises due to the intricate nature of structured products and the potential difficulties in understanding their underlying mechanics and risks.

- Structured products frequently involve complex underlying assets, such as derivatives or derivatives-based indices. These assets can be challenging to comprehend and evaluate, thereby increasing the complexity risk.

- Structured products may possess intricate payoff structures that are linked to various market conditions or specific events. Understanding these structures and predicting their outcomes can pose a challenge.

- The complexity of structured products can result in a lack of transparency regarding the product’s true value and the potential risks involved. This lack of transparency can make it difficult for investors to accurately assess the investment and its associated risks.

- Due to their intricate nature, structured products can be challenging to value accurately. The valuation process often involves complex mathematical models and assumptions, which can introduce uncertainty and increase the complexity risk.

- The complexity of structured products can make it easier for issuers or sellers to misrepresent or obscure important information. Investors must be cautious and ensure they fully understand the product before making an investment decision to mitigate the risk of misinterpretation.

Investors should carefully evaluate and assess the complexity risk associated with structured products to make informed investment decisions. Seeking advice from financial advisors and conducting thorough due diligence can help mitigate this risk.

Issuer Risk

Issuer risk refers to the potential danger that the issuer of a structured product may default on its financial obligations. It is crucial to consider this risk because if the issuer fails to meet its obligations, investors could experience significant losses.

To minimize issuer risk, it is important for investors to thoroughly evaluate the creditworthiness and financial stability of the issuer before investing in a structured product.

One way to mitigate this risk is to invest in structured products issued by reputable and financially sound institutions. Analyzing the issuer’s financial statements, credit ratings, and track record can provide insight into their ability to fulfill their obligations.

Diversifying investments across multiple issuers can also help lessen issuer risk. Investors should carefully review the terms and conditions of the structured product, including provisions for issuer default or early redemption.

Regular monitoring of the issuer’s financial health is advised to identify any signs of distress or deteriorating creditworthiness. Seeking professional advice from a financial advisor is crucial for understanding and evaluating the issuer risk associated with structured products and making informed investment decisions.

The Hidden Structured Products risks

Unveiling the hidden structured product risks, this section exposes the potential dangers that may lurk beneath the surface.

From a lack of transparency and limited regulatory oversight to the potential for misrepresentation and difficulty in valuation, we will uncover the various risks associated with these financial instruments.

Prepare to delve into the complexities and examine the potential implications, as we explore the intricate web of hidden risks that lie within structured products.

Lack of Transparency

Transparency is a crucial aspect to consider when investing in structured products. The lack of transparency in this type of investment can pose significant risks that investors need to be aware of.

One of the main risks associated with the lack of transparency is the difficulty in fully understanding the product and its underlying assets. Without clear and comprehensive information, investors may not have a complete picture of the risks they are taking on.

This can lead to potential misinterpretation or misunderstanding of the investment’s potential risks and rewards. Another concern is the limited regulatory oversight of structured products, which can contribute to the lack of transparency.

The absence of stringent regulations and oversight may create opportunities for misrepresentation or the withholding of crucial information by issuers.

Investors may not have access to important details about the product’s performance history, valuation processes, or even the financial stability of the issuing institution.

Due to the lack of transparency, valuing structured products can also be challenging. The complexity of the underlying assets and the absence of clear pricing mechanisms can make it difficult to determine the true value of the investment.

This can result in uncertainty and potential discrepancies between perceived and actual value. To mitigate these risks, investors should prioritize conducting thorough due diligence.

They should carefully review all available information, seek independent financial advice, and ensure they fully understand the product’s terms and conditions before investing.

It’s essential to be aware of the level of transparency provided by the structured product and to consider alternative options if the lack of transparency is a concern.

Limited Regulatory Oversight

Limited regulatory oversight is a significant concern when it comes to structured products. Unlike other financial instruments that are subject to strict regulations, structured products lack the same level of oversight.

This means that there may be fewer safeguards in place to protect investors and ensure fair practices. Without proper regulatory oversight, there is a higher risk of fraudulent or unethical behavior in the market.

Investors may not have access to all the necessary information to make informed decisions, and there may be a lack of transparency regarding the underlying assets and risks associated with the structured product.

It is important for investors to be aware of the limited regulatory oversight and take extra caution when considering investing in structured products.

Conducting thorough due diligence, consulting with a financial advisor, and carefully evaluating the potential risks and rewards are crucial steps to mitigate any potential negative outcomes.

Fact: According to a report by the Financial Stability Board, the lack of regulatory oversight in the structured product market was one of the contributing factors to the global financial crisis in 2008.

This highlights the importance of addressing this issue to safeguard the interests of investors and promote a more transparent and regulated market.

Potential for Misrepresentation

In the world of structured products, the potential for misrepresentation can pose significant risks for investors.

It is essential to be aware of the possibility of misleading information or false claims when considering these investment options.

Investment firms or issuers may try to misrepresent the potential returns, risks, or underlying assets associated with structured products, distorting investors’ understanding and leading to poor investment decisions.

To mitigate this potential for misrepresentation, investors should conduct thorough due diligence. This entails carefully reviewing the product documentation, prospectus, and any other relevant materials.

It is crucial to scrutinize the claims made by the issuer and verify the accuracy of the provided information. Additionally, investors should consider seeking independent advice from financial advisors or professionals who can offer objective assessments of the structured product.

Furthermore, regulatory oversight plays a critical role in addressing the potential for misrepresentation. Investors should exercise caution when dealing with structured products that lack sufficient regulatory oversight or operate under limited regulatory frameworks.

It is vital to understand the level of principal protection offered by regulatory authorities and ensure compliance with applicable laws and regulations.

By maintaining vigilance and conducting thorough research, investors can reduce the potential for misrepresentation and make more informed decisions when investing in structured products.

Difficulty in Valuation

Valuing structured products is often challenging due to their inherent complexity and lack of transparency. The difficulty in valuation arises from the unique features and underlying assets of these products, making it quite arduous to determine their true worth.

Unlike traditional investments, structured products frequently involve derivatives and intricate payout structures, which further complicate the accurate valuation process.

The lack of standardized pricing models and market reference data significantly complicates the valuation procedure. In the absence of readily available pricing information, investors may have to rely on estimates, making it more challenging to assess the fair value of the product.

Moreover, the illiquid nature of certain structured products can exacerbate the difficulty in valuation. When there is a limited market for buying or selling these products, determining their current market value becomes an even more daunting task.

Investors should carefully consider the difficulty in valuation when investing in structured products. It is crucial to thoroughly understand the product’s underlying assets, payout structure, and pricing mechanisms.

Seeking advice from a financial advisor who specializes in structured products can also significantly help navigate the complexities associated with valuation. Historically, the difficulty in valuation has been a major concern for investors in structured products.

The financial crisis of 2008 serves as a stark reminder of the risks associated with the lack of transparency and accurate valuation of complex structured products, such as mortgage-backed securities.

This crisis highlighted the necessity for investors to thoroughly assess and understand the challenges related to valuation when dealing with these products.

Potential for Loss of Principal

The potential for loss of principal is a significant consideration when investing in structured products. Unlike traditional investments, structured products have complex payoffs that depend on the performance of underlying assets.

If the underlying assets do not perform as expected, investors may experience a loss of their capital investment.

It is important to understand that the potential for loss of principal in structured products can vary based on the specific product and its structure.

Some structured products offer principal protection, meaning that investors are guaranteed to receive at least a portion of their capital investment back, even if the underlying assets perform poorly.

However, other structured products do not provide such protection, and investors may be at risk of losing their entire investment.

When considering structured products, investors should carefully evaluate the terms and conditions of the product to assess the potential risks involved.

It is also important to diversify your investment portfolio and consult with a financial advisor to ensure that structured products align with your investment goals and risk tolerance.

By understanding the potential for loss of principal in structured products, investors can make informed decisions and manage their risk effectively.

Key Considerations for Investors

Investing in structured products can be a complex endeavor, but with the right knowledge and strategy, it can yield great rewards.

In this section, we’ll explore key considerations for investors, covering topics such as understanding the underlying assets, evaluating performance history, assessing potential risks and rewards, diversifying investment portfolios, and seeking advice from financial advisors.

By gaining insights into these areas, you’ll be equipped to navigate the hidden risks associated with structured products and make informed investment decisions.

Understand the underlying assets

To gain a comprehensive understanding of structured products, it is important to familiarize oneself with the underlying assets. Structured products are financial instruments that amalgamate various types of assets, including stocks, bonds, or derivatives.

The performance and returns of these structured products are determined by the underlying assets. Therefore, it is crucial to conduct thorough research and analysis of the specific assets that underpin the structured product in which you are considering investing.

By comprehending the characteristics and associated risks of each underlying asset, you can make informed investment decisions. Furthermore, evaluating the historical performance of the underlying assets allows for an assessment of their potential for future growth or decline.

Additionally, taking into account the correlation between the underlying assets and their potential interactions with one another is prudent.

Diversifying the underlying assets helps to mitigate concentration risk and enhances the potential for stable returns. Assessing the liquidity of the underlying assets is vital to ensure your ability to buy or sell them as needed.

Moreover, it is crucial to consider the potential risks and rewards associated with the underlying assets in relation to your investment goals and risk tolerance.

Seeking the assistance of a financial advisor who can offer expertise and guidance in understanding the underlying assets of structured products is strongly recommended.

Understanding the Underlying Assets:

- Informed decisions

- Risk management

- Tailored investment

- Uninformed choices

- Increased risk

- Misalignment with goals

Evaluate the performance history

When evaluating the performance history of structured products, it is crucial to analyze specific metrics to make well-informed investment decisions.

Factor | Data |

Returns | Evaluate the historical returns of the structured product. Look for consistent positive returns over a relevant time period. |

Volatility | Assess the volatility of the structured product’s performance. Lower volatility indicates more stability. |

Drawdowns | Analyze the maximum drawdowns, which indicate the peak-to-trough decline during a specific period. Smaller drawdowns suggest better performance. |

Correlation | Understand how the structured product’s performance correlates with other asset classes or benchmarks. A low correlation can provide diversification benefits. |

Risk-adjusted measures | Evaluate risk-adjusted measures, such as the Sharpe ratio or Sortino ratio, which consider both returns and volatility. Higher ratios indicate better risk-adjusted performance. |

Pro-tip: While past performance is not a guarantee of future results, evaluating the performance history of structured notes can provide insights into their potential risks and rewards.

Consider combining performance analysis with the assessment of underlying assets, diversification strategies, and consultation with a financial advisor to make well-informed investment decisions.

- Informed expectations

- Risk assessment

- Decision confidence

- Uncertain outcomes

- Higher risk

- Missed opportunities

Assess the potential risks and rewards

When considering investing in structured products, it is crucial to assess the potential risks and rewards involved. Here are some key factors to consider:

- Market risk: To understand the level of risk involved, it is important to assess the volatility and potential fluctuations in the market, as the performance of structured products is closely tied to the underlying market conditions.

- Counterparty risk: Examine the creditworthiness and reliability of the issuer or the party providing the structured product. Assessing a strong counterparty reduces the risk of default.

- Liquidity risk: Determine the level of liquidity of the structured product to understand the ease of buying or selling the investment at the desired price. If the market for the product is illiquid, it may be challenging to do so.

- Complexity risk: Evaluate the complexity of the structured product and ensure you have a thorough understanding of its mechanics. Complex products may lead to confusion and increased risk.

- Issuer risk: Consider the financial stability and reputation of the issuer. A reputable issuer with a strong track record adds confidence to the investment.

Assessing the potential risks and rewards is crucial for making informed investment decisions. It allows investors to evaluate the suitability of the structured notes and align it with their investment objectives and risk tolerance.

Remember to consult with a financial advisor who can provide personalized guidance based on your specific circumstances.

- Risk management

- Informed decisions

- Goal alignment

- Unforeseen pitfalls

- Missed opportunities

- Inconsistent outcomes

Diversify your investment portfolio

To maximize the safety of your investments, it is crucial to diversify your investment portfolio. This can be achieved by spreading your investments across various asset classes, including stocks, bonds, and real estate. By doing so, you reduce the risk associated with putting all your eggs in one basket.

Another important aspect of diversifying your investment portfolio is to invest in a variety of industries and sectors. In doing so, you can minimize the impact of negative events that may occur within a specific industry, thus safeguarding your overall portfolio.

In addition to diversifying across industries, it is advisable to consider investing in different regions or countries. This helps protect your portfolio from any adverse events or economic downturns that may occur in a particular region, ensuring the stability of your investments.

When aiming to diversify your investment portfolio, it is essential to include various types of securities. These can include stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Each type of investment carries its own set of risks and rewards. By diversifying across different types of securities, you can achieve a balanced portfolio.

Allocating your assets based on your risk tolerance and investment goals is also crucial. By doing so, you can tailor your diversified mix of investments to align with your personal preferences and objectives. Remember that some investments may be riskier than others, so having a diversified portfolio is key to managing risk and maximizing returns.

- Risk reduction

- Enhanced returns

- Stability

- Concentrated risk

- Limited growth potential

- Increased volatility

Consult with a financial advisor

Consulting with a financial advisor is crucial when investing in structured notes. They possess the expertise and knowledge to guide you through the complexities of this investment vehicle. Seeking their advice can provide valuable insights into the potential risks and rewards associated with structured products.

A financial advisor will help you understand the underlying assets and evaluate their performance history.

They can assess the various risks associated, such as market risk, counterparty risk, liquidity risk, complexity risk, and issuer risk. By diversifying your investment portfolio, you can mitigate these risks and increase your chances of achieving your financial goals.

It is important to note that structured notes lack transparency and have limited regulatory oversight. This makes it essential to consult with a financial advisor who can help navigate these complexities and ensure that your investment aligns with your financial objectives.

When choosing a financial advisor, consider their qualifications, experience, and track record. Look for someone who understands your risk tolerance and investment goals.

It is also important to consult with a financial advisor to communicate your expectations and ask questions to ensure that you have a clear understanding of the investment strategy and potential outcomes.

- Expert guidance

- Personalized approach

- Risk management

- Limited knowledge

- Potential mistakes

- Missed opportunities

Some Facts About Unveiling the Hidden Risks of Structured Products: What You Need to Know:

✅ Billions of dollars of structured products are sold by the securities industry every year to conservative retail investors. (Source: Naples Florida Weekly)

✅ Structured notes have no liquid market, meaning investors are unable to easily sell them until they mature. (Source: Naples Florida Weekly)

✅ Structured products were originally designed for institutional investors but have become a lucrative business for Wall Street firms and Big Banks. (Source: Naples Florida Weekly)

✅ Structured products can have sophisticated names, making it difficult for investors to realize they have them in their portfolio. (Source: Naples Florida Weekly)

✅ The Covid-19 pandemic has had a significant impact on the structured products market, leading to increased volatility, slashed interest rates, and canceled dividends. (Source: Risk.net)

Conclusion

In conclusion, structured products offer enticing investment options but come with hidden risks that demand careful consideration.

Investors must be vigilant about market risk, counterparty risk, liquidity risk, complexity risk, and issuer risk.

Additionally, factors such as lack of transparency, limited regulatory oversight, potential misrepresentation, difficulty in valuation, and the risk of losing principal pose further challenges.

By understanding the underlying assets, evaluating performance history, assessing risks and rewards, diversifying portfolios, and seeking expert guidance, investors can approach structured products cautiously and make well-informed investment choices to safeguard their financial interests.

Frequently Asked Questions

Structured products are complex investments that involve loaning money to your own brokerage firm or financial institution on an unsecured basis and a structured product is a prepackaged investment that usually has one or more derivatives and is tied to interests. The Financial Industry Regulatory Authority (FINRA) describes this complex investment as based on/from a security (or a basket of security), a commodity, an index, a foreign currency, and/or a debt issuance. These products are sold to retail investors because they offer the potential for asset diversification, the ability to benefit from stock market performance, and downside protection.

There are several risks associated with structured products. These include credit risk, lack of liquidity, inaccurate pricing, call risk, unfavorable taxation, forgoing dividends, potentially capped gains, principal protection, and the potential for high embedded fees.

The Covid-19 pandemic has had a significant impact on the structured products market. It has led to increased volatility, slashed interest rates, canceled dividends, and changes in client behavior. Autocallable notes, which rely on dividends as a guaranteed cash flow, have been particularly affected.

The Principal-protected note (PPN) is a structured note that guarantees the return on the initial investment on top of any gains. However, Principal Protected Notes are exposed to credit risk, often have caps that limit the benefits, and do not include dividend payments, which can impact overall returns.

Before investing in structured notes, investors should carefully consider the risks, including credit risk and lack of liquidity. They should also evaluate factors such as estimated value, maturity date, call features, payoff structure, and tax implications. It is important to understand how structured notes work and be aware of any hidden or imputed costs.

Structured products may not be a suitable investment strategy for the average individual investor due to the poor risk/reward ratio. They are known for being expensive, with high embedded fees, and lack liquidity, making it difficult for investors to exit their positions. It is important for individual investors to carefully consider their investment goals and risk tolerance before investing in structured products.