Are you feeling left out because your employer doesn’t offer a 401(k) plan, or do you just want to diversify your retirement savings? You’re not alone; about one-third of U.S. private workers find themselves in the same predicament.

This article will guide you through several alternative savings options that can help secure your golden years without relying on a 401(k). Let’s dive into these creative ways to save for retirement!

Key takeaways

● Saving for retirement is not just about 401(k) plans. You can save in other ways like IRAs, HSAs, or taxable investment accounts.

● Traditional and Roth Individual Retirement Accounts (IRAs), Health Savings Accounts (HSAs), small businesses, and real estate investments are good choices for saving without a 401(k).

● IRA options have different rules but both grow your savings. The IRS sets the limit on how much you can put in each year.

● Health Savings Accounts also help with both current health costs and saving for future medical needs in retirement.

● Buying property to rent out or investing in businesses can add to your savings too. But they come with more risk. Always do plenty of research first.

Exploring Retirement Without a 401(K)

Retirement saving is not just about 401(k) plans. Some people don’t have this option at work. Many jobs do not offer a match for their retirement plan. But you can still save for retirement without one.

There are many other ways to reach your retirement savings goal.

Each choice has its own benefits and rules. You might choose an Individual Retirement Account (IRA). Or a Health Savings Account (HSA). Maybe a Taxable Investment account works best for you.

Investing in real estate and small businesses is another way to build wealth over time as well.

Alternatives to 401(K) Savings

If a 401(k) plan is not accessible, there are several worthwhile alternatives to consider for retirement savings such as Individual Retirement Accounts (IRAs), Health Savings Accounts (HSAs), taxable investment accounts, real estate investments, and small business investments.

Individual Retirement Accounts (IRAs)

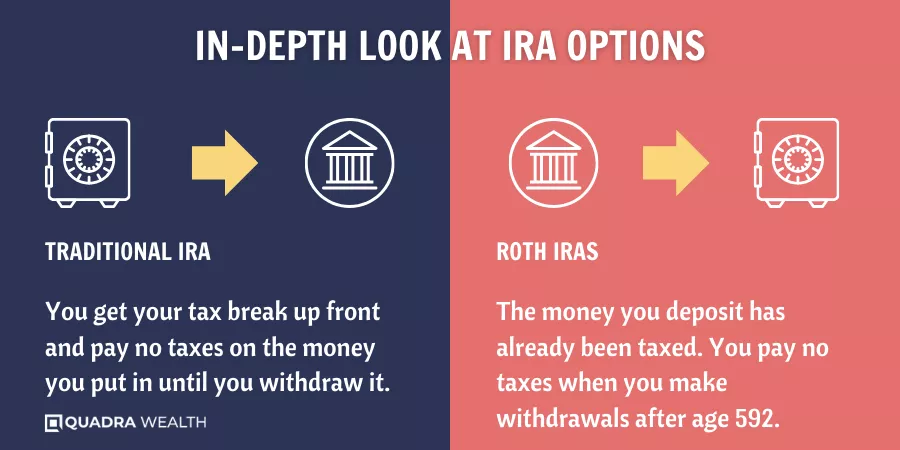

There are two main types of Individual Retirement Accounts: Traditional and Roth. Both help you save for retirement but they work in different ways. In a traditional IRA, your money grows while saving you on taxes.

You put money in before tax and pay the tax when you take it out later.

Roth IRAs flip this around. You put after-tax money in so there is no upfront tax break. But, the good part is when you retire, the money comes out tax-free! For both accounts, there’s a cap on how much we can put in each year: $6,000 for 2022 and $6,500 for 2023 if you’re over age 50.

All these make IRAs one smart way to grow your savings for life after work!

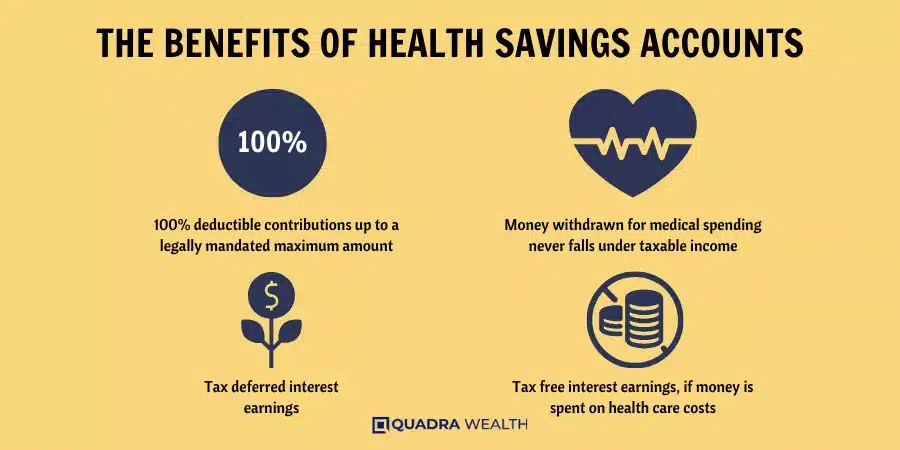

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are a great way to save. You can use these accounts to cover health costs now or in the future. The money you put into an HSA is tax-deductible. That means it helps lower your taxes this year! Money taken out for qualified medical expenses is also tax-free.

Plus, HSAs let you invest your savings. This offers a chance to grow your money over time! To open an HSA, you need a special type of health plan called high-deductible insurance.

Taxable Investment Accounts

You can use taxable investment accounts to save for retirement. These accounts let you put in as much money as you want. They don’t have limits like some other options. But, be ready for the taxes! You will need to pay them when you make money from your investments.

This can happen if your stocks go up in value or if you get interest and dividends. Even though there are taxes, these accounts can still help a lot with saving for retirement.

Real Estate Investments

Buying a house can be more than just a home. It’s also an important way to save for retirement. Real estate investments can boost your wealth when property values go up. You might even get money each month if you rent out the property.

These funds are great for your golden years. Don’t forget, Individual Retirement Accounts (IRAs) can hold real estate investments too! This gives you tax benefits that help grow your retirement savings faster.

Small Business Investments

Having your money in a small business can help you grow it. It’s not like putting cash in a 401(k) or an IRA. This way, you get to play a part in the success of a company. But be careful, this choice can come with big risks.

Still, buying into a small business has its perks. It offers more chances for big wins and adds variety to your investment portfolio. Be sure to do plenty of research and understand how this fits into your retirement savings goal before starting out.

In-Depth Look at IRA Options

We’ll delve into the details of different IRA options, namely Traditional or Roth IRAs while comprehending their unique features, contribution limits, and tax benefits.

Traditional IRAs

Traditional IRAs are a great way to save for retirement. You can put your money into this type of account and watch it grow over time. The best part is that you get a tax break when you put the money in.

This means less of your money goes to taxes now, which leaves more for you to invest! In 2023, you can put up to $6,500 in an IRA if you’re old enough. When it’s time for retirement, you will have to pay tax on what you take out.

But don’t worry – by then, chances are good that your nest egg has grown big because of all those years of saving!

Roth IRAs

Contribute to a Roth IRA is a smart choice for your retirement savings. They let you put in money after tax now and pull out the money tax-free when you retire. But, there’s an income limit to contribute.

You can put in up to $6,500 per year, or $7,500 if you’re 50 or older by the end of 2023. This type of IRA doesn’t give a tax break on input but it does let your investments grow without any taxes.

And at retirement age? You get all that growth free from taxes too!

IRA Contribution Limits

The Internal Revenue Service (IRS) institutes annual contribution limits for both traditional and Roth Individual Retirement Accounts (IRAs). These limits are subject to changes each year. Below is an HTML table depicting the contribution limits for traditional and Roth IRAs for the years 2022 and 2023.

Type of IRA | 2022 Contribution Limit | 2023 Contribution Limit |

Traditional IRA | $6,000 | $6,500 |

Roth IRA | $6,000 | $6,500 |

The Benefits of Health Savings Accounts

Delve into the world of Health Savings Accounts (HSAs) and explore their contribution limits, potential tax benefits, and how they can supplement your retirement savings. Want to know more? Dive in!

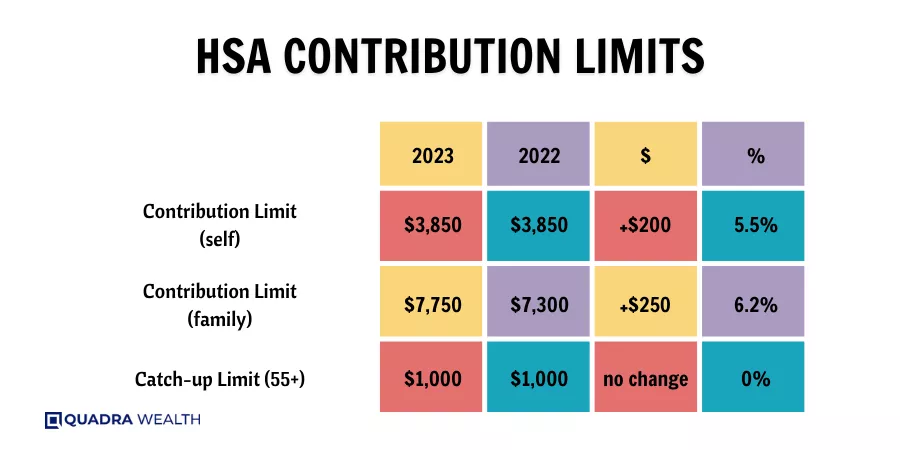

HSA Contribution Limits

The contribution limits to Health Savings Accounts (HSAs) are set by the Internal Revenue Service (IRS) and vary based on whether the coverage is for an individual or family. The limits are adjusted for inflation each year. For 2023, the limit is $3,650 for individuals and $7,300 for families. Individuals aged 55 and older are allowed to contribute an additional $1,000 as a catch-up contribution.

Here’s a look at the specific HSA contribution limits:

Year | Individual Coverage | Family Coverage | Catch-up Contributions (Age 55 and older) |

2022 | $3,600 | $7,200 | $1,000 |

2023 | $3,650 | $7,300 | $1,000 |

The HSA contributions can be made by both individuals and their employers. It’s important to note that some employers even offer matching contributions to encourage their employees to save more for future healthcare expenses. It’s a win-win for both the employee and the employer as HSA contributions are tax-deductible, providing a great way to save for retirement healthcare expenses.

HSA Withdrawals in Retirement

You can use your HSA funds in retirement. They offer great benefits. Here are some key points:

- No tax on money taken out for health bills.

- You don’t pay a fee if you use the money for medical costs.

- HSA funds can cover many kinds of healthcare needs.

- In retirement, you can take out HSA money for any reason after age 65.

- If not used for health costs, normal taxes apply after 65.

- HSAs help with healthcare costs in retirement.

- You do not lose unspent money in your HSA each year.

Investing in Real Estate and Small Businesses

You can use your money to buy houses or buildings. This is known as real estate investment. Later, you may sell the property for a profit. Or, you could rent it out and make money over time.

Putting your money into small businesses is another option. You might become a part owner of a store, for example. If the business does well, so do you! Choose these investments wisely though; they can be risky too.

To keep safe, divide your savings among many types of investments.

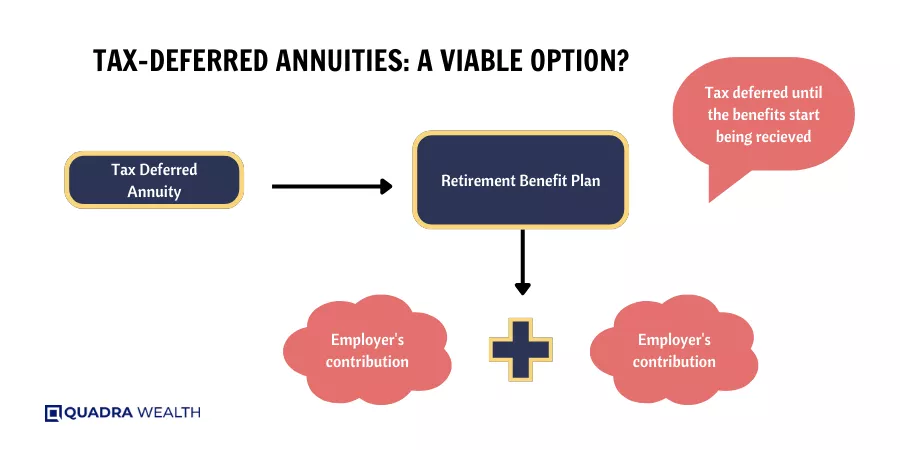

Tax-Deferred Annuities: A Viable Option?

Tax-deferral annuities are another choice for saving. They let you put off paying taxes. When you place money in these, it grows tax-free until you take it out. This means more of your cash stays invested.

You will pay taxes when you start taking money out though. Also, every state might not treat this money the same way for taxes. It’s best to talk with an attorney or a professional who knows about tax laws before choosing this option because such rules can change and affect your savings differently.

Fidelity Advantage 401(k) and its Benefits

Fidelity Advantage 401(k) is a great plan for retirement. It helps those who can’t get work-based plans. You can grow your savings with it. Plus, you don’t have to worry about having an employer match for the plan! You are in control of your own money.

This gives you peace of mind and security for your future years. Life after work becomes fun and stress-free with Fidelity Advantage 401(k). It’s not just a smart move, but also the right one!

Retirement for the Self-Employed: SEP IRA and Self-employed 401(k)

Self-employed folks have great choices for retirement. They can pick a SEP IRA or self-employed 401(k). A SEP IRA, or Simplified Employee Pension plan, is easy to use. Small business owners and solo workers like it a lot.

It lets them put aside more money than regular IRAs.

A Self-employed 401(k) is another good option. This plan works well for freelancers and tiny businesses with no staff. In the year 2023, you can save $22,500 in this type of account as an employee part and up to a quarter of your pay as the boss part!

Conclusion

Start early to plan for retirement, even if you don’t have a 401(k). Look at the options like IRAs and HSAs. Don’t forget about investing in real estate or small businesses. There is more than one way to save for your golden years!

FAQs

Tax-advantaged accounts offer tax-free growth, upfront tax breaks, and other benefits that help grow your retirement income.

Through good financial planning and wealth management, you can fit your risk profile to the right choices and handle any future risks.

Yes! Options like self-directed IRAs, SIMPLE IRAs, or solo 401(k)s offer eligible compensation methods for those with side jobs, furloughs, or those facing unemployment due to COVID-19.

These licenses allow someone to give advice on financial planning including advising on which type of non-traditional 401k-like plan will suit best based on their time horizon towards the goal.

Roth options follow different rules about employer contributions which lead to differences in when you pay taxes – it could be a smart move depending upon your current tax bracket & future expected earnings post-retirement!

Yes, make sure you understand all the tax implications associated with things like required minimum distributions and early withdrawal penalties before making decisions that may impact your long-term goals!

Why You Need a Personal Financial Manager?

Personal finance management (PFM) is not confined to budgeting and investment any longer. There are

Nearing Retirement Advice for a Secure Future

Nearing retirement advice? A plan for retirement is essential to enjoy a happy healthy life

What is Debt Ceiling? A Complete Guide for Beginners

What is Debt Ceiling? Debt Ceiling, also known as the debt limit, is the highest

Is It Possible to Have No Debt?

Debt is often considered the norm in the corporate world, but the debt free companies