Introduction

As a newbie investor, you must have thousands of questions that are spinning in your head. This is with respect to choosing a financial advisor or an investment banker who can sit with you one-on-one and discuss various investment options with you.

And, you do not want to make wrong moves while you plan to build a diversified investment portfolio. Therefore, you must perform ample research and ask the right type of questions to your person.

This way, you identify the right financial advisor who can use his experience, guidance, and intellect to help you steer your investment needs in a seamless manner indeed.

On this parlance, here are the top 7 Questions To Ask Before Hiring A Fiduciary Financial Advisor while also providing you with a touch-down covering the revolving specifics. Helping you get started here:

Who is a Fiduciary Financial Advisor- Meaning and Conceptualization Explained

A Fiduciary Financial Advisor is an advisor that is governed by regulatory authorities and banking corporations indeed. Therefore, a fiduciary financial advisor is expected to act in the interests of financial investors alone. The personnel is not supposed to take added commissions from the sale proceeds of financial products. Or, should he act to promote his sole or vested interests alone.

A fiduciary financial advisor is expected to provide an unbiased form of advice that would suit any type of investor. Even, if the investor is a novice or an amateur one.

A fiduciary financial advisor helps novice investors pick diversified investment cum income portfolios that comprise bonds, equities, real-estate mortgage deeds, and currencies.

And, the personnel rebalances the not-so-going investment options with better investments so that your overall investment portfolio does not suffer on account of volatile market conditions and continues growing at an even pace.

You can listen to financial podcasts to learn more about how fiduciary financial advisors work with investors, clients, and other stakeholders.

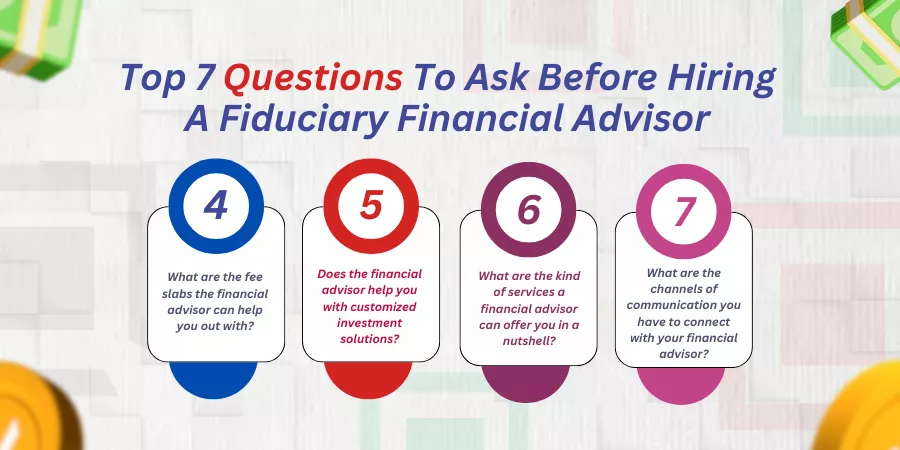

Top 7 Questions To Ask Before Hiring A Fiduciary Financial Advisor

These are the top 7 Questions To Ask Before Hiring A Fiduciary Financial Advisor. Helping you through with a run-down into the same:

What kind of Experience does a Fiduciary Financial Advisor have?

As a newbie investor, you definitely would want to place your hard-earned funds or money into safer hands. Therefore, you look for a financial advisor who comes to you with the right kind of competence to start with.

A financial advisor who has completed his fiduciary qualifications and has decades of experience in handling clients inside a wealth managing firm or has been a private practitioner helping clients one-on-one should be the one you must be looking for.

Can the Financial advisor show positive testimonials or samples of work that was done for clients before?

As a newbie investor, you do not want to risk your funds by working with a financial advisor who has never worked with clients before. You might be an enterprise owner or a salaried employee, to begin with.

However, you would want to place your financial portfolios with the person who comes to you with the right talent and expertise to help you seek tailor-made or customized investment solutions.

Therefore, you can ask for samples or client testimonials the financial advisor would like to share.

Would you want to look for online recommendations on websites?

For most of you, operating in a digital space is easier than walking down to an investment office and speaking to the personnel in a Face-to-face interview. Therefore, to make things easier, you can open websites of wealth management firms to look for online recommendations or comments about the financial team or advisor you might plan to partner with. This way, you might find the right fit via an online medium too.

What are the fee slabs the financial advisor can help you out with?

Of course, all of us are on shoe-string budgets to pay for rentals and other family-oriented expenses. Therefore, if the financial advisor is going to charge you above the roof, things are not going to work out in your favor.

Whether you are hiring a financial advisor or an investment planner in a Wealth Management firm, or you are looking for independent practitioners who help clients on a fee-only basis, there is nothing wrong in discussing the pricing slabs beforehand.

Does the financial advisor help you with customized investment solutions?

There is a proverbial saying that goes like this: “Not the same size fits all”. Similarly, you might come to the table with a set of financial expectations. You can bifurcate them into short-term, mid-term, or long-term financial goals.

The financial advisor must help you curate customized or tailor-made solutions that perfectly align with the financial goals or objectives you have in mind.

Therefore, you must look for a Financial advisor or a Wealth Manager that offers customized or tailor-made investment solutions for you as such.

What are the kind of services a financial advisor can offer you in a nutshell?

While you are on the lookout for a fiduciary financial advisor or an investment planner, you must enquire about the kind of services the personnel can offer you in a nutshell.

It can be retirement planning or curation of diversified income-generating wealth baskets. Or, it can be in lieu of general advice you might want to seek with respect to how investments or finances work.

You must zero in favor of an advisor who offers versatile financial plans and can provide you with bundle add-ons other than what you want to initially sign in for.

What are the channels of communication you have to connect with your financial advisor?

You might be an investor who is constantly out on the move. Therefore, a static line of communication will not solve the purpose here.

You can enquire with your fiduciary financial advisor as to the modes of communication he would like to connect with you.

What’s App, Facebook, Insta Messages, Zoom meets, Gmeet suites, and other online portfolios are available for you to connect with your fin advisor as and when the need arises. Therefore, discussing the channels of communication is a very important consideration before you may want to zero in on a financial advisor.

In a nutshell, these are the key questions to ask before hiring a financial or investment advisor indeed.

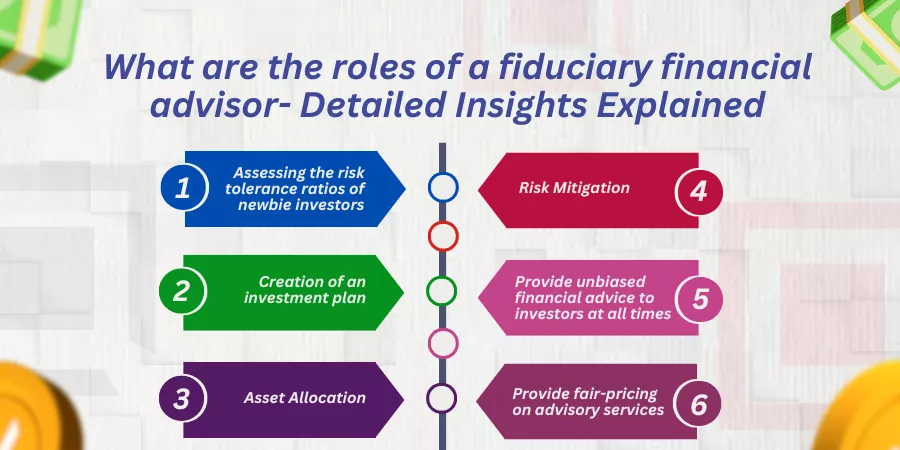

What are the roles of a fiduciary financial advisor- Detailed Insights Explained

These are the following roles of a fiduciary financial advisor. Here is a run-down on pointers pertaining to the same:

Assessing the risk tolerance ratios of newbie investors

A financial advisor usually provides customized or tailor-made solutions to investors who aim to seek robust growth in their investment portfolios. A risk assessment profiling is done wherein the risk tolerance ratios are derived for every independent customer.

This way, it gets easier for the financial advisor to know the level of risk the investor can take under his belt. And then investment options are suggested for you to choose from.

Creation of an investment plan

An investment plan is then curated in a customized manner. This is because the level of risk tolerance can differ from one individual to another.

Based on a risk profiling session that gets done at the initial stages of your interaction with your financial advisor, here comes the step of curating an investment plan that aligns with the financial goals you have in mind.

It can be budgeting, saving, retirement planning, estate planning, or tax planning objectives you might want comprehensive solutions. Therefore, the creation of the right investment plan becomes the need of the hour during your next interaction with your financial advisor.

Asset Allocation

Here is the third main area in which a financial advisor or wealth manager is involved. The personnel allocates assets. These are equities, real-estate bonds, government-backed fixed-income securities, and high-paying currencies to name a few.

A healthy and diversified investment portfolio is mandatory for any investor mainly because the loss arising from one investment option can offset the gains made by the other investment component. This way, the wealth basket or the income-generating portfolio does not suffer capital erosion.

Therefore, a fiduciary financial advisor does the asset allocation in a crafty and wise way for newbies as well as amateur investors out there.

Risk Mitigation

A financial advisor also helps his clients in managing risk factors against volatile market conditions. The bullish trends indicate a rising market for stocks, commodities, and high-paying securities in stock exchanges. While the bearish trends indicate a falling trend for stocks and equity shares.

Therefore, the shares or stocks you may have curated inside your wealth or investment basket might tend to lose their value prices on account of rising or falling markets or other volatile socio-economic scenarios that play their part here.

It is therefore the responsibility of a financial advisor to help his clients rebalance investment portfolios. Here, the not-so-good investments are replaced with highly tradeable stocks and securities so that the portfolio remains liquid and highly agile for investors.

Rebalancing investment portfolios is an important requirement that needs to be exercised across investment portfolios so that the wealth baskets or portfolios keep growing and do not remain stagnant.

Provide unbiased financial advice to investors at all times

As a financial advisor, it is important that he is supposed to act in the best interest of investors and not try to mimic profits or push sale proceeds of investment products to improve his level of commissions or incentives with the sale proceeds of stashing unnecessary financial products onto his investor’s clients.

Here, the financial planner must solely act to protect the overall interests and financial obligations of investors on the whole. He must provide unbiased advice to investors to protect their financial as well as their legal interests.

In a nutshell, the fiduciary advisor must act in the fiduciary interest to wholeheartedly support the financial decisions of his investor clients.

Provide fair-pricing on advisory services

A right advisor must offer a fair pricing overview for different investment plans he showcases to his investor clients. There are three types of pricing slabs a financial advisor can incorporate under his belt. Let us have an overview of what these are:

Flab fee slabbing

A Financial advisor can get paid flat fee or take a fee-only basis transaction on the overall advisory or investment-related solutions he offers to his investor clients on the whole. Brokers or retainers also participate in the campaign.

Fees under the AuM Nomenclature

A Financial advisor can assess the overall value of the investor client’s assets under management or what is popularly abbreviated as AuM.

Under the AuM, the financial advisor usually charges 5 to 10% of the asset value.

For instance, if an investor has an investment portfolio of $100,000 and the financial advisor wants to charge 5% under AuM, it would be 5% on 100,000 which is $5000.

The financial advisor therefore charges $5000 to his client for maintaining his investment portfolio or for providing advisory services for the client from time to time.

Fee-only transaction

The financial advisor who usually charges a flat slabbed fee or AuM method belongs to a Wealth Management firm per se.

Whearas, the fee-only fiduciary financial advisors are usually independent practitioners who curate investment plans or provide advisory services to clients from their own office outlets or residential premises.

Here, the financial advisor charges an hourly transaction or a fee-only amount for every independent client he deals with.

The Bottom Line

Approaching a fiduciary financial advisor is always beneficial for a newbie investor who would need a little more hand-holding support on how to choose financial instruments or investment products without getting influenced or biased over market reviews.

What are your thoughts on this? Do mention it in the comments below!