Meet Jonathan, a prudent investor with a keen eye for stable returns. He recognizes the potential of mortgage bonds as a judicious way to diversify his portfolio.

With the prospect of regular interest payments and the security of underlying mortgages, he decides to allocate a portion of his portfolio to mortgage bonds.

Jonathan carefully evaluates the types of bonds available, weighing the merits of government-sponsored agency bonds against private-label mortgage-backed securities. He understood the risks, including prepayment concerns and interest rate fluctuations.

Jonathan keeps a watchful eye on mortgage market conditions, interest rate trends, and economic indicators, ensuring that his investment in mortgage bonds will be able to contribute to his financial plan as he had thought.

What are Mortgage Bonds?

Mortgage bonds might sound like some fancy financial instrument reserved for Wall Street sharks or seasoned investors, but they are a great way for regular investors to tap into the stability of the real estate market. Imagine owning a piece of a portfolio of mortgages without ever stepping foot in a home! So, let’s explore and understand the world of mortgage bonds and why they deserve to be a part of your portfolio.

How Do Mortgage Bonds Work?

You, me and so many of us avail of home loans/mortgages. Think of a mortgage bond as a pool of individual mortgages bundled together and sold to investors as a single security.

Like all home loans tied together becomes a single standalone loan where investors are pumping money. So instead of investors lending directly to homeowners, banks package these loans into bonds, allowing investors to buy a “share”.

This share is of the collective income stream generated by the borrowers’ mortgage payments. The bond issuer receives the money upfront, freeing up capital for further lending, while investors receive periodic interest payments and eventually their principal back when the loans mature.

Types of Mortgage Bonds:

Secondary mortgage bonds come in different categories, the two primary categories being government-sponsored and private-label mortgage-backed securities (MBS).

Government Sponsored – Government-sponsored entities like Fannie Mae and Freddie Mac issue agency mortgage bonds. These government-sponsored enterprises (GSEs) purchase pools of mortgages from lenders, package them into bonds, and guarantee timely payments to investors.

Private-label MBS – They’re created by private investment banks and investors, bundling together non-conforming loans that don’t meet the stringent criteria of the GSE. This could include mortgages with higher loan-to-value ratios, lower credit scores, or unique property types.

The choice between the two depends on investor preferences, risk appetite, and market conditions.

Mortgage Bond Returns:

Returns on mortgage bonds are between those of government bonds and corporate bonds. It offers a blend of moderate risk and reward. Returns on mortgage bonds come from both interest payments and changes in the value of the underlying mortgages.

As homeowners make their monthly mortgage payments, investors receive a share of the interest. However, fluctuations in interest rates can impact the bond market value, influencing overall returns.

The interest rate on the bond, the creditworthiness of the underlying borrowers, and the overall health of the housing market all impact the returns of these bonds.

Mortgage bonds offer benefits such as diversification, better yields compared to Treasury bonds, and as a low-risk investment than debenture bonds.

Mortgage Bond Limits:

There are no specific limits on investing in mortgage bonds for individual investors. While mortgage bonds provide a steady income stream, it does have potential risks.

These include the prepayment risk, where homeowners pay off their mortgages early, impacting expected returns. Investors should carefully assess these risks and set realistic expectations for their investment portfolios.

Consider your risk tolerance, investment goals, and diversification strategy when allocating funds.

Mortgage Bond Formula:

Calculating the potential returns on a mortgage bond involves a mix of interest rate projections, prepayment assumptions, and secondary market conditions.

While the underlying calculations can be complex, understanding a few key terms can help:

Coupon Rate: The fixed interest rate the bond pays periodically.

Maturity Date: The date the bond’s principal is due to be repaid.

Yield to Maturity: The effective rate of return you’ll earn if you hold the bond until maturity.

Mortgage Bond Fees:

Investing in mortgage bonds isn’t without its costs.

Be aware of potential fees associated with buying and selling mortgage bonds, such as transaction fees, commissions, and management fees for actively managed funds.

Mortgage Bond Example:

Imagine you buy a $1,000 bond with a 5% coupon rate and a five-year maturity. You’ll receive $50 in interest payments annually until you get your $1,000 back at maturity.

How to Buy Mortgage Bonds:

Buying mortgage bonds can be done through various channels, like brokerage accounts, mutual funds, or exchange-traded funds (ETFs). Investors can choose their platforms based on their know-how and comfort.

Mortgage Bonds and Interest Rates:

Mortgage bond prices and interest rates have an inverse relationship. When interest rates rise, existing bond prices fall, and vice versa.

Are mortgage bonds safer investments than corporate bonds?

Well, it’s like choosing between a reliable sedan and a sleek SUV – both have their merits, but it depends on the terrain you will be driving.

Mortgage bonds offer the stability of being backed by real assets, namely mortgages on homes. They’re like the comfort of knowing you have a solid foundation beneath you.

On the flip side, corporate bonds are a bit more like placing your bet on the success of a company. It’s the thrill of the market, the potential for higher yields, but with a side of risk.

It’s the classic risk-and-reward choice that ultimately depends on your risk tolerance, financial goals, and whether you prefer the reliability of bricks and mortar or the dynamic world of corporates.

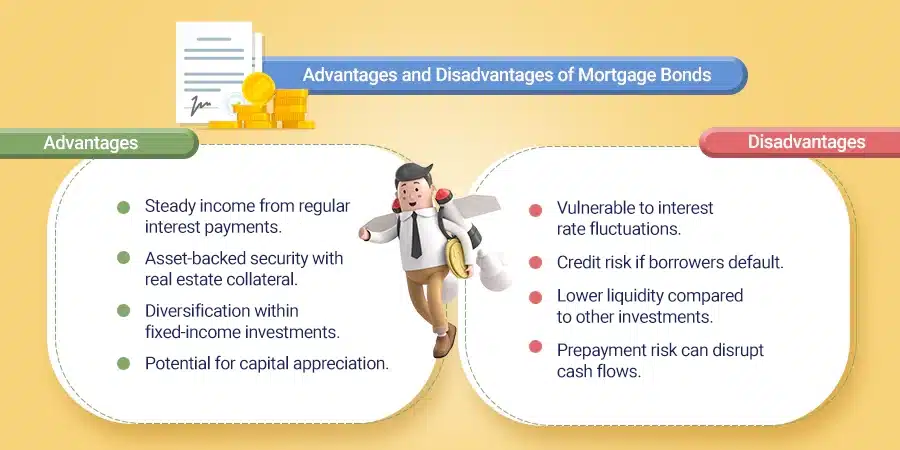

Advantages and Disadvantages of Mortgage Bonds

The main disadvantage of mortgage bonds is that their yields are lower than corporate bonds. The reason for this is simple, the more secured the loan the lower the interest rates, and vice versa.

Here the securitisation of mortgages makes such bonds as safe investments. In case the homeowner defaults on a mortgage, the bondholders have a claim on the value of the homeowner’s property.

The property can be liquidity with the proceeds used to compensate bondholders. In contrast, investors in corporate bonds have little to no recourse if the corporation defaults.

Corporate bonds are in a way unsecured loans backed by only the issuers’ reputation and history. As a result, when corporations issue bonds, they offer higher yields to entice investors to shoulder the risk of unsecured debt.

The Infamous Sub Prime Mortgage Crisis

Many of us common fellows first came to know about Mortgage Bonds after the 2008 economic devastation. The subprime mortgage crisis of 2007-2010 was not just a housing market meltdown; it made the economy collapse and centuries-old corporate behemoths went bankrupt.

Mortgage bonds suffered deep scars. At the heart of the crisis lay subprime mortgages, loans granted to borrowers with sufficient creditworthiness and questionable financial stability.

These loans were often bundled together and packaged into mortgage-backed securities (MBS), with an assumption that borrowers will always pay back their installments and thus a steady stream of income will always be there for mortgage bondholders.

But the illusion of stability was built on sand.

As interest rates went higher and housing prices went down, subprime borrowers began defaulting on their loans in large numbers. It was a scenario where the cost of a house went lower than the loan borrowed.

So who would care to repay, especially the subprime borrowers? The defaulted loans impacted the value of the MBS they were part of. As defaults rose, the value of MBS was lower and lower.

Financial institutions that held large amounts of MBS went bankrupt, triggering a global recession.

The subprime mortgage crisis and its impact on mortgage bonds are now constant reminders of the interconnectedness of the financial system and the importance of responsible lending practices.

Parting Thoughts

Mortgage bonds offer a unique blend of stability and complexity. Whether you’re a seasoned investor or a newcomer to the world of finance, understanding the nuances of mortgage bonds can open up exciting opportunities for building a diversified and resilient investment portfolio. Happy investing!