Debt is often considered the norm in the corporate world, but the debt free companies excel and make outstanding progress. In reality, finding companies with no debt is rare.

Although living a debt free lifestyle is possible, it’s not that easy! You always need the right mindset, some capital to build an emergency fund, and a budget. Still, you can achieve these milestones in 2025.

By the end of this article, you will get the answer to the question: “Is it possible to have no debt?” It unlocks the secrets to no-debt concerns, living debt-free and how to get there, companies with small or no debt, and more.

What Does Debt-Free Lifestyle Mean?

As you strive to achieve a debt-free lifestyle, you come to know a couple of common meanings of the term “debt-free.” By the purist definition debt-free means having no debt at all (loans, credit cards, or other creditors). For this reason, you don’t depend on credit cards or any other forms of credit for everyday expenses.

On the other hand, you may adhere to a looser definition of “debt-free”. It means you are free of payday loans, debt you carry from month to month. It also means other forms of “bad debt”, but you make exclusions to meet your requirements.

This definition seems lucrative because it enables you to accomplish key objectives like residential ownership without paying highest interest debt.

Is It Possible to Become Debt Free?

To have no debt always takes time, but it is practically possible. Here’s how to be consistent in your effort to live within your limits and follow the debt elimination strategies:

· Note down all your debts, comprising current balances, interest rates, and monthly payments.

· Analyze your monthly spending to figure out how much capital you possess to repay your monthly debt payments.

· Review debt repayment methods, such as debt snowball method and debt avalanche method. You may select the one that suits your situation.

· Explore various ways to save money and get free of debt. For example, canceling unused subscriptions and reducing eating-out expenses. Save your hard-earned money to pay off your debts.

· Look for methods to earn more money than you can employ to get out of debt. For example, you may agree for overtime, take a side hustle to earn extra cash every month, or ask your employer for a raise.

· Make a call to your creditors to request an interest rate reduction.

· Think about consolidating your debts through a lower rate debt consolidation loan or with a balance transfer credit card with a 0% introductory period.

· If you cannot pay off debts, deliberate on connecting with a nonprofit credit counseling agency to find the right direction.

Start your journey by researching more about how to become debt-free and living without debt.

Companies With Little to No Debt

So, is a zero-debt strategy the right approach, or some debt is necessary to thrive?

The answer is not simple and relies on several factors. For instance, industry norms, the company’s growth stage, and risk tolerance level. What suits a tech startup may not work for a mature, dividend-paying company.

However, one thing is evident: Corporations executing with minimal or no debt present powerful case studies in financial management.

These companies reveal that success is possible without depending on debt financing, as long as your company’s business model supports it. Their business model allows them to invest in emerging ventures without seeking advice from shareholders or creditors.

Moreover, they are generally better-positioned to endure economic recessions. Because they don’t have to worry about a lot of debt repayments weighing on them.

But it’s also valuable to acknowledge that a debt-free strategy also carries with it a scope of limitations. Therefore, while the appeal of a no-debt balance sheet is strong, the company’s financial situation, wider fiscal strategies and long-term financial goals are also worth noting.

In fact, very few public companies are known today with little to no debt. It’s because of high-interest rates to fight against inflation. The circumstances are changing once again, leading corporates to double check their financing options, spending habits, and capital structures.

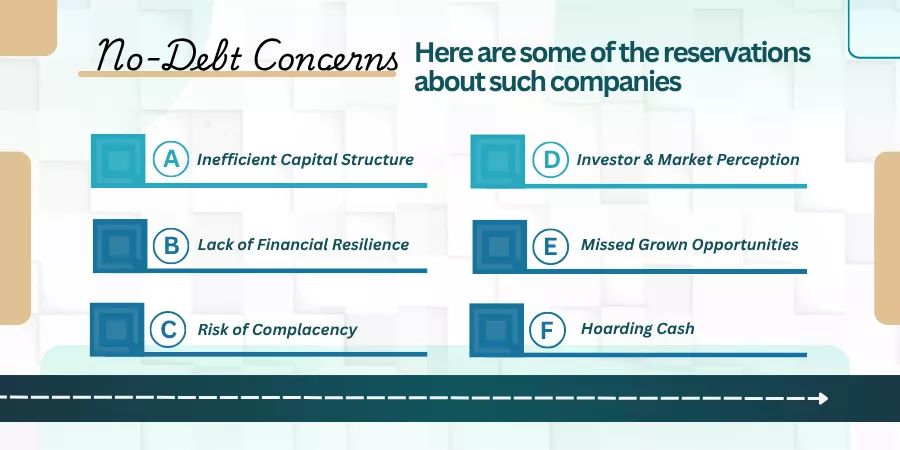

No-Debt Concerns

Organizations with no debt seem to be secure at a first glance. But this fiscal approach is not without drawbacks among analysts and investors.

Here are some of the reservations about such companies:

Inefficient Capital Structure

From a profit enhancement perspective, a certain amount of debt is thought to be beneficial for an organization. Debt interest payments are tax-deductible, which may improve your financial situation and lower effective tax rate. Analysts may raise a question whether a debt-free company is using its capital structure in the most efficient manner to attain long-term financial stability.

Lack of Financial Resilience

Oddly, being debt-free can sometimes hinder a company’s financial resilience. If a company has never taken a loan, it may impact the credit relationships required to urgently get a debt. In today’s rapidly evolving market, this lack of financial flexibility can be a setback.

Risk of Complacency

A no-debt strategy might sometimes be an indication of risk-averse management culture that withdraws from any form of financial or optimization challenge. While wisdom is typically a merit in business, an overly prudent strategy may cause missed opportunities. And your relentless competitors may grab a big market share taking loans from companies.

Investor and Market Perception

While having no debt can be a strategic advantage, it might also make your company less attractive to certain stakeholders. They may be browsing for higher-reward, higher-risk opportunities. It may restrict the diversity of the investor base and impact stock liability.

Missed Grown Opportunities

One of the most common objections is that the zero-debt companies might be missing out on growth opportunities to achieve their goals and dreams. Cheap debt can prove a powerful source to boost returns in a lower interest rate environment.

By not benefitting from such opportunities, a company can give up projects that could bring about notable future profits.

Hoarding Cash

Debt-free companies often boast considerable cash reserves. While a powerful cash position seems to be a safety net, it also sparks curiosity as to why those funds aren’t being utilized.

Investors may be anxious about the company that it isn’t trying to endorse innovation and stay competitive. In some cases, investors may even strive for dividends or stock buybacks as a means to get a return on this idle capital.

Conclusion

A limited number of companies make an impression with zero debt or close to it. The attraction of a debt-free approach provides financial freedom and stability to companies, it’s not without its downsides: capital efficiency and potential missed growth opportunities.

On the other hand, taking on debt, particularly, in a low interest rate environment can accelerate your financial growth. But it must be executed wisely to evade economic setbacks.

Understanding these complexities, as a student of corporate finance, or investor offers useful perspectives about the complex landscape of investment and business management.

We hope our thorough guide on debt-free living helped you acquire useful insights. If you are struggling with finance management, consider getting in touch with Quadrawealth today! Our team of seasoned experts can guide you with all finance-related woes and ensure your financial health remains top-notch!

FAQs

Q1. How Can Someone be Free from Debt?

A: The first step to live a debt-free life is understanding your financial limits. It means knowing your earning and more importantly, how much you can spend without having the burden of debt.

Q2. Is it Possible to Have No Debt?

A: Yes, it is possible to have no debt without much savings, but it can be quite a task. Pay attention to paying down your debt as aggressively as possible while managing any little savings.

Q3. What Are the Negatives of a Debt Management Plan?

A: Debt management plans (DMPs) usually omit secured loans, like mortgages and auto loans, and some types of unsecured loans, like student loans. It also requires a fee when starting and using a debt management plan.