Introduction

Islamic principles of investing have different conventions that you must be aware of. The Islamic principles clearly state three defining rules for investment structures to be curated:

- There should be no interest rate or what is known as Riba in an Islamic context

- The prevalence of uncertainty, or what is known as Gharar, is prohibited in the Islamic context of investments.

- Investment should not indulge in excessive gambling. Say like, shares betting, or investment hedging. We call it Meyser in the Islamic context.

The investments are considered haram if they include interest rates, elements of risk, or indulge in excessive gambling. On the contrary, your investments can be called halal if your investments are fairly priced or proportioned, and you do not have elements of interest/ risk/ uncertainty covering the investing campaign.

On this parlance, let us address the blog topic- Is Investing Halal or Haram, on a more comprehensive note. Helping you get started further on the same:

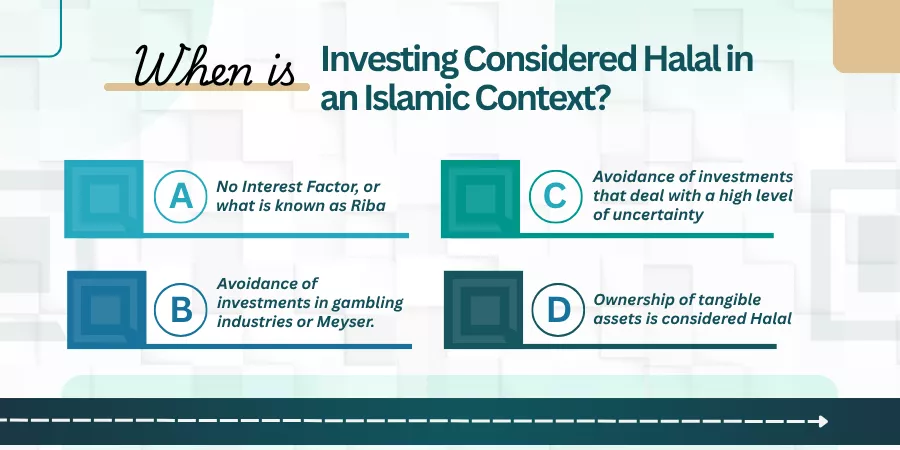

When is Investing Considered Halal in an Islamic Context?

Investing in an Islamic context is considered Halal when it is permissible to deal with investments. On the contrary, it is considered Haramic or forbidden when you deal with investments that do not comply with Islamic principles of finance or Investments.

Here are four simple factors by which Investments are considered Halal or permissible under an Islamic context. Let us have a rundown on the same:

A- No Interest Factor, or what is known as Riba

As an Islamic Investor, you must not consider investments that provide interest earnings on portfolios. This is considered exploiting an investor’s vested interests in financial affairs. Therefore, you should avoid investments that allow you to pay interest or receive interest payments.

Most of the traditional investments earn interest or levy interest rates on financial derivatives. For instance, you have Insurance wherein you levy premium amounts to save yourself from financial contingencies like hospitalization or fire outbreak inside your factory premises. Or, you have traditional bonds or fixed income securities that pay you fixed rates of return on their investment portfolios. Here, if you are purely in compliance with Islamic principles of investments, you must forbid traditional investments.

B- Avoidance of investments in gambling industries, or what is known as Meyser in the Islamic context

Meyser, in a pure Islamic context, refers to you investing money in industries that resort to extortion of money from public subscribers and playing with betting strokes using financial derivatives.

These are industries that procure funds or net turnover via excessive gambling and speculation. Here, when you invest money in such industries, you are deemed to follow Haramic or forbidden Investments that go against Islamic principles.

Here is the list of industries that fall under this particular category:

- Pornography

- Adultery

- Lottery betting

- Industries that manufacture cigarettes or liquor

As an Islamic investor, your investments are considered Haram if you indulge in investments in these industries. For your investments to be considered as Halal, you must avoid putting your funds into industries of this cadre.

C- Avoidance of investments that deal with a high level of uncertainty, or what is known as Gharar in the Islamic context

You must avoid dealing with investments that involve a high level of uncertainty or what is known as Gharar in the Islamic context.

For instance, take the case of the insurance industry. The probability of whether a death occurs or not in the family for a life insurance subscriber delves on the element of uncertainty. Whether an impending hospitalization would occur or not in a term insurance medical policy is a highly uncertain event.

Here, the investment firms capture the emotional loops of investors by assuring to them that their contingency events would be covered. Here, this type of an investment is considered Haramic or forbidden as you have a high level of uncertainty or what is known as the Gharar in Islamic context.

D- Ownership of tangible assets is considered Halal

In the Islamic parlance, when you own tangible assets that are visible to the naked eye and you perform economic activities in real time or with tangible assets, then the investments you continue with these firms that contribute to producing or manufacturing these assets are considered Halal investments.

For instance, owning properties and collecting rental income is owning a real time and tangible asset wherein you derive passive income and this is a type of investment that is considered Halal or permissible under the Islamic context.

Different assets that are considered Halal in the Islamic context

In the previous segment, we had learnt the factors that differentiate Islamic-friendly or Halal investments from those of Haramic or forbidden Islamic investments.

Now, let us move on to learn different types of assets that are Halal-friendly investments. Helping you take a look at the above:

A- Profit-sharing assets

In Islamic parlance, your investments must follow fair principles and ethos when it comes to dealing with investments. Therefore, when you deal with profit-sharing assets and liaison with friendly partnerships with your business colleagues, then you have fair and friendly profit-sharing ventures that are dealing with considered Halal in Islamic investments. Friendly profit-sharing partnership ventures are known as Mudarabah Investments in the Islamic parlance.

B- Asset-backed Investments

When you own assets like properties, offices, oil manufacturing hubs, and so on, you can count on tangible or measurable real-time assets. When you deal with real estate ventures, you have asset-backed investments that are considered Halal or Islamic-friendly in nature. Asset-backed investments are also known as Musharakha according to Islamic parlance.

C- Sukuk bonds

Intra-day trading derivatives like stocks, shares, etfs, mutual funds, and other traditional investments are considered Haramic as an excessive level of gambling or elements of uncertainty go into the making, while these investment options are curated by Fund houses and Investment firms.

You can look for Sukuk Bonds or Islamic bonds that allow fair profit sharing on asset-backed investments and repay your capital once the bonds are up for redemption.

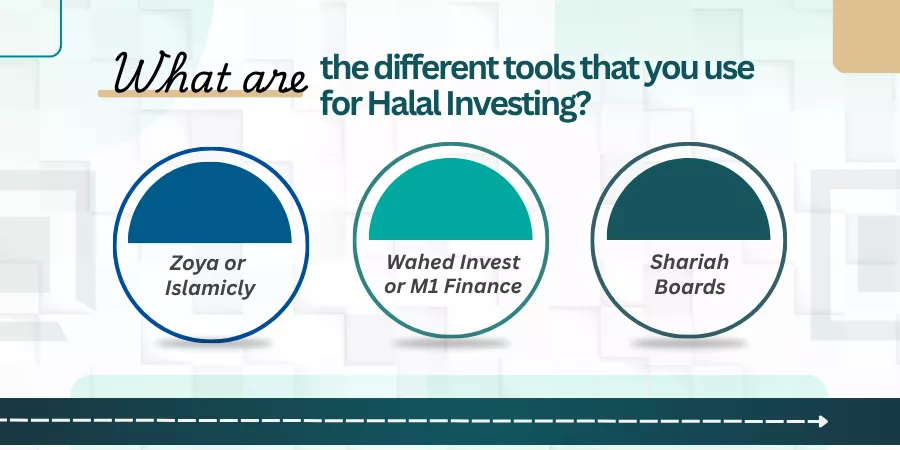

What are the different tools that you use for Halal Investing?

These are the different tools that are utilized for a fair degree of compliance with Halal investing. Let us have a rundown on the same:

A- Zoya or Islamicly

These are specialized apps that screen investments into traditional investments that are usually used for trading or other investment purposes, from investment options that are purely Shariah-compliant in nature.

B- Wahed Invest or M1 Finance (With Filters)

Have you heard of automated investment portfolios? Then, you can install the configured software offered by Wahed Invest or M1 Finance that looks for portfolios that are Halal-friendly in nature. In a nutshell, these firms provide robo-advisors that also recommend Halal investments to Islamic investors.

C- Shariah Boards

You must sign up with Investment Houses or Fund companies that comply with Shariah investment themes to get your portfolios curated from end-to-end. The Shariah boards usually approve of your investment portfolios only if your derivatives or asset classes comply with Islamic conventions of investing.

What are the commonly found drawbacks of choosing Halal Investments?

These are the commonly found pitfalls or drawbacks that are prevalent while dealing with Halal Investments. Let us have a rundown on the same:

A- Quite challenging to choose the right investments that are considered Halal

How much ever careful you are, a speck on the piece of white paper might spoil your chances when it comes to choosing Islamic investments. These are specialized investment options that are perfectly curated, keeping Islamic Financial principles in mind.

Therefore, investors have to carefully choose Halal Investment options from the regularly traded investments like Stock trading, Mutual funds or ETFs. In a nutshell, choosing the right Investments that are Halal can be quite challenging and complex for investors on the whole.

B- Ignoring requirements might be recommended here

Halal investments might offer marginal sums of interest or profit earnings amongst generic subscribers or retail investors. It is recommended that these earnings be given away for charity if you do not want to own interest payouts, as you are an Islamic investor who abides by Islamic laws in dealing with investments and financial derivatives.

C- Following investment trends can amount to you going Haramic with investments

When you have financial contingencies at your disposal, you might invest through insurance, etfs, or stock markets to build your investment portfolios that are considered Haramic, as most of the traditional investment options work on:

- Interest payouts to investors- Riba

- Speculation of the hard-earned finances of investors or Meyser

- Uncertainty over emotional contingencies or Gharar

This is primarily due to market volatility like rising or falling prices of shares or economic downturns like declaration of outbreak of a pandemic situation like Covid 19 or recession that swept the US economy way back in 2008 when investment biggies like the Lehmann Brothers and Meriyl Lynch filed for their bankruptcy or insolvency redenring several investments and structured notes issued by them penniless. The investors were swept clean of their capital investments. In this scenario, you fall victim even if you have fairly traded your portfolios using Islamic conventions.

The Bottom Line

You can choose Islamic-friendly investments when you approach Investment houses that specialize in the curation of Islamic-friendly investment products. You must read the offer documents before you sign up for any kind of investment plan. What are your thoughts on this? Do mention it in the comments below!

Frequently Asked Questions or FAQs

Explain the types of investment income that are considered Haram for Muslims.

Answer: Interest earnings/ Riba and investment portfolios that make money betting on uncertainty (Gharar) or excessive gambling (Meyser) are considered Haram for Muslim investors.

For instance, investing in stocks relies on market uncertainty with respect to rising or falling prices and pay interest earnings or dividend coupons to investors for assuming market risks and therefore does not comply with Islamic parlance of investing. Halal investing allows investing in companies that comply with Shariah-laws while investment structures are curated.

Explain ethical business practices for Islamic investors.

When investment portfolios do not involve interest money or deal with gambling or betting activities, then these investments follow the ethical principles of Islamic conventions. The share of profits is distributed in an equitable manner amongst Islamic investors.

Interest-based income, exploitative activities like adult entertainment or manufacturing industries of pork products are considered Haram investments for Islamic investors on the whole.