Introduction

There is a mixed bag of opinions when deciding whether insurance is a wise investment option or is just a wasteful remittance of premiums over a prolonged period of time.

However, you can make wise investment options using insurance

Because you get coverage over a fire accident or enjoy cashless hospitalization if you have applied for a fire accident policy for your business outlets. Or, you have availed a comprehensive medical policy that covers the medical expenses of your family members in case of medical emergencies.

On this parlance, let us discuss more detailed insights entailing the blog topic- ‘Is Insurance A Waste Of Money’. Helping you get started here:

Why Is Insurance Worth It?

Here are the top reasons that let you understand why insurance is worth it. Let us have a run-down into the pointers that are connected with the same:

Risk Mitigation

Insurance is a calamity-protecting product that acts as a safeguarding umbrella potentially covering unforeseen circumstances. These are:

- Impending illnesses that might require hospitalization

- Accidents

- Property damage and

- Other liability claims

For instance, if you have a medical emergency and do not own medical insurance, the bills might run into thousands of dollars breaking into your bank account.

A relevant insurance product therefore helps you transfer your larger risk to the insurer. When you shell out relatively smaller premiums on a periodic scale, you can safeguard yourself from bigger calamities that stand unforeseen. You can approach a financial adviser to help you understand your insurance needs better.

Offers financial security

Insurance offers a great deal of financial security to family members and protects kith and kin even against irreversible grieving scenarios like the potential death of a primary breadwinner.

For instance, a life assurance policy offers a sizeable amount of money in case the individual has life insurance or a life assurance policy affiliated under his name. The policy assurance amount is sent as a demand draft or a cheque against the nominee’s account and the latter can encash the same to lead normal lives after the untimely demise of the family’s head or the primary breadwinner.

Similarly, in case the primary breadwinner meets with an accident leading to a permanent disability, the insurance can cover a portion of his disability or medical care expenses without the need for you to break into your savings account. Don’t you all agree?

Legal and contractual requirements

Legal or contractual requirements create compulsions for you to take insurance policies. For instance, you may have to apply for a car insurance and accidental coverage policy the moment you buy yourself a brand-new car. Here, you comply with legal requirements to apply for this type of insurance.

Similarly, when you sign up with an employment firm, you take up Employment insurance or a group insurance program, and the premium amounts shall stay deducted from your salary accounts. Here, you get into a contractual requirement laid out by your employer and you take up Employee Group Insurance or Employee Group Assurance policies on the whole. However, you must also go through privacy policy or agreement copies before you start signing in on the dotted lines.

Peace of Mind

When you sign up for a comprehensive medical policy or any other useful coverage wherein unforeseen events or incidents might most likely turn you around, the insurance policies keep you safeguarded against these deadly scenarios without which you may have to spend sleepless nights inside your garage or shed. Therefore, insurance policies provide you the freedom against unexpected turn of events giving you peace of mind even during adverse scenarios.

Asset Protection

When you sign up for comprehensive insurance policies, you can protect your assets against damage. These assets include your cars, properties, or your business outlets.

For instance, property-related insurance protects your properties against wear and tear. When you spend on your home repairs or refurbishment expenses, you get a coverage amount if you have property insurance in lieu of the same.

Similarly, a fire accident policy protects you against damages arising due to an outbreak of fire at your factory outlets. You can claim for damages if you have a fire accident policy in lieu of the same.

Likewise, a car insurance policy helps you receive damages for the car accident if the other driver is proven at fault. The other counterpart’s insurance company pays you damages against car repairs or repainting expenses.

Health Insurance and Preventive care

Comprehensive health care policies help you avail cashless hospitalization at leading hospitals or health care units the insurance companies have a tie-up with. This way, you get health care if you have been paying premium amounts for comprehensive health care policies.

Similarly, certain policies provide you with coverage for early detection of diseases like Cancer or Diabetes. Here, you can detect diseases earlier and pave the way for you or your family member’s preventive care so that these diseases do not progress into more severe stages later down the line.

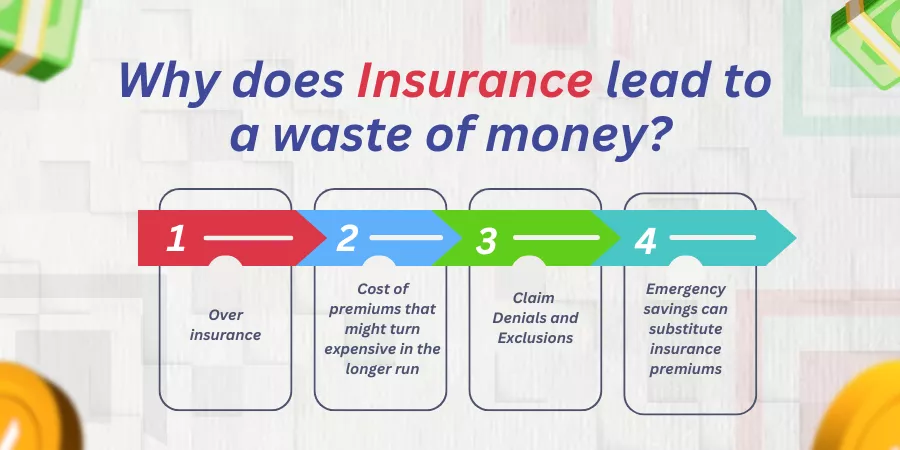

Why does Insurance lead to a waste of money?

Here are exclusive reasons why insurance policies might lead to a potential loss of money for policyholders. The run-down of pointers follows:

Over insurance

You might end up paying unnecessary insurance premiums you no longer need or make use of.

For instance, when you take up an insurance policy for low-value or less valuable items, you do not justify the costs of premiums to maintain these items. Here, purchasing newer stuff appears cheaper than paying premiums to maintain these low-value products.

Similarly, when you pay a higher coverage premium over what you can afford for your car insurance and accidents never happen, then it is a waste of money in terms of premium remittance.

Cost of premiums that might turn expensive in the longer run

If you have been paying out insurance premiums for a number of policies like health, auto, and home, then the premiums might turn more expensive than what you can typically afford. And, when you keep paying the premium amounts and never end up making claims, then the premium amounts that you have been paying up so far add to no value at all.

This is because these policies have not yet been put to use at all. Similarly, car insurance premiums may not fetch you an actual payout from the service provider unless and until your car has met with an accident and the other driver is at fault.

In a nutshell, the personal circumstances you suffer must exactly mimic the conditions as stated on your insurance policies to allow you to be eligible to receive the payouts.

Suggested Reads: Is Insurance an asset or a liability?

Claim Denials and Exclusions

It is a known fact that insurance policies comprise complicated terms and conditions that are hard to understand. Therefore, even if you have been paying premium amounts regularly, your policy claims might get rejected due to certain technicalities or misinterpreted policy wordings as such.

At the same time, some insurance providers may reject your claim documents as the stated proforma on your claim documents might not be included in your policy documents. In other words, your claim reasons may not cover policy inclusions.

For instance, in a health insurance policy or a medical policy, there might be exclusions for certain types of treatments. You might also have your car insurance company that might not pay you with damages to the car happening on account of a natural disaster or so. The policy inclusions or exclusions therefore differ from one insurance provider to another.

Emergency savings can substitute insurance premiums

If you have already been maintaining a personal savings or emergency blanket account to cover car repairs, health, and home refurbishments, then these savings can help you contemplate unforeseen circumstances that an insurance service provider does justice to.

This way, you can make payments from your savings account or provide out-of-pocket expenses via your emergency blanket accounts rather than paying for premium subscriptions that merely add to your ongoing maintenance expenses.

Lack of Use

When you have been paying insurance premiums for quite a number of years for your car, home, or life but have not faced loss of life, or damage to property or cars, then these premium amounts could be a wasted sum of money after all. Therefore, insurance can be an utter waste of money to those of you who live relatively safer lives and have not experienced illnesses, material losses, or accidents on the whole.

Investment alternatives

Some investors argue that instead of paying insurance premiums, one could invest via equities, stocks, or bonds that could garner far better returns on investments. Therefore, when you save enough money via building diversified investments or wealth baskets, you could create much more wealth that could gear you up to face medical emergencies, home refurbishments, or spending your money on dream vacays.

Risk Tolerance

Some of the investors have higher risk tolerance. It means they have the potential to face financial setbacks. In this case, insurance might be a great choice indeed. On the contrary, if you have a lower level of risk tolerance, then insurance might not be that much of a viable option per se.

This is mainly because insurance claims take a longer time to process. And, you may not get 100% of your claims or the money you have suffered over damages due to fire, property loss, etc.

Therefore, insurance is meant for those of you who can face financial setbacks and receive part of your claims from insurance service providers and is not meant for highly risk-averse or fragile investors.

The under-insured must learn to manage their finances so that they pay for insurance premiums and also receive the actuals while they make a claim with insurance service providers.

How do you strike a neat balance between the two scenarios we have discussed so far?

Up until now, we have discussed how insurance proves useful for most of you. At the same time, we have also discussed scenarios as to how constant remittance of insurance premiums leads to wasteful or unutilized expenditure after all.

Now is the time, to balance both scenarios equally and derive a conclusion as to how insurance can be utilized optimally and not land you over a wasteful money syndrome.

Let us have a run-down of pointers connected with the same:

Do the right kind of research

You must do the right kind of research before you zero in on a particular insurance provider. Look for what the firm offers you. Do they provide you with customized solutions that can help you get a reasonable value of money over the kind of premiums you dole out to the insurance service provider?

Or, do they hype up fancy schemes just to lure you with wasteful policies that you may no longer use? Performing in-depth research may help you make a well-informed decision as to selecting the right insurance policy that genuinely takes care of you and your family members on the whole.

Bundle up insurance policies to make things easier

When you have to pay for auto, life, car, and home insurance, it leads to adding up too much paperwork. And, at the same time, you may have to dispense insurance premiums for multiple accounts. Therefore, look for insurance providers that can help you bundle up two or three policies into one customized policy. This way, your paperwork is reduced and you may just have to pay insurance premium for one comprehensive policy.

Knowing the net premium amounts beforehand also helps you fund them in a more streamlined manner indeed.

The Bottom Line

In a nutshell, one can fairly conclude that insurance is not an absolute waste of money. You must analyze the personal circumstances you are in.

Then, you must weigh the pros and cons of your family setup before you evaluate your contingencies. And, if one person is covering an insurance premium for the entire family then you need not worry about taking a personalized policy under your name.

Likewise, you analyze the pros and cons of the ground realities you are in and then make well-informed decisions as to whether you want to buy an insurance policy or not.

What are your thoughts on this? Do let us know in the comments below!