Introduction

Who are high-net-worth individuals? High-net-worth individuals are those people who own assets totalling US$1 million or more. These individuals primarily do not hold their money in savings accounts. Or, via pan-banking services. The HNWIs (High Net Worth Individuals abbreviated as HNWIs) invest their money via optimal investment schemes.

This way, they grow their financial portfolios comprehensively and do not allow their bulk money stay in idle bank accounts. Therefore, HNWIs have more diversified opportunities for recreating better investment portfolios over average investors.

The HNWIs usually prioritize capital preservation, tax saving, and diversification of investment portfolios. On this parlance, let us unveil core Investments For High Net Worth Individuals or HNWIs on a more detailed version. Helping you get started further on the same:

How do HNWIs approach the concept behind investing?

HNWIs, as explained in the intro paragraph, are individuals who do not look for stand-alone investment options. Like typically dabbling their funds with stocks or bonds alone.

They look at investments as tools to improve their lifestyle. Therefore, they choose holistic investment solutions that perfectly align with their financial goals and objectives. This is in terms of:

- Arranging corpus funds to buy a home, a car, and allow their kids to study at leading universities or educational institutions

- Retirement planning

- Estate and legacy planning

- Tax planning

Therefore, these HNWIs pick diversified investment portfolios and they choose stocks, bonds, structured notes, real estate deeds, mutual funds, and etfs and build health investment portfolios.

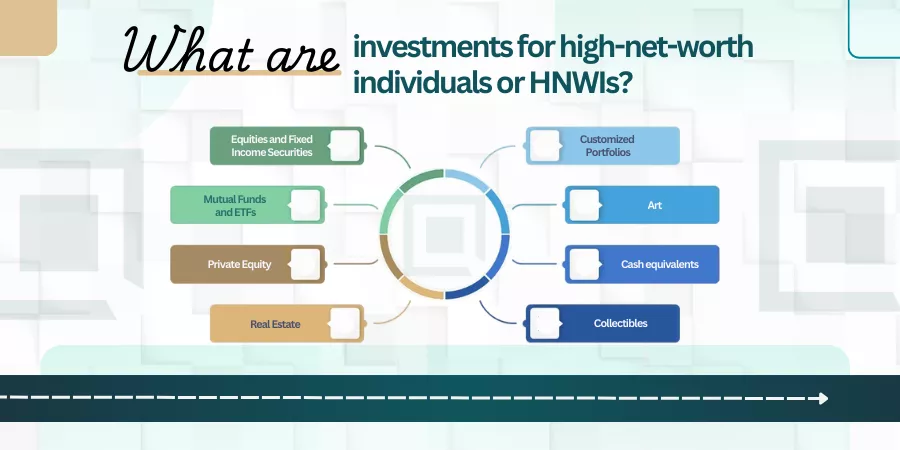

What are investments for high-net-worth individuals or HNWIs?

There are vast investment opportunities for HNWIs as compared to average investors. Here is a rundown of opportunities for the HNWIs. Let us have a look at the same:

A- Equities and Fixed Income Securities

You can choose equities like dividend-paying stocks of blue-chip companies. For instance, buying dividend-paying stocks like Apple or Tesla can help you with diversified income-earning options as compared to regularly traded stocks. These dividend-paying stocks can enhance the growth rate of your investment portfolios. You must approach a veteran investment advisor who can help you pick theme-based or time-horizon level investment options.

Fixed income securities include municipal bonds, corporate bonds, US Treasuries, and so on. These bonds provide you with a whole fleet of tax-saving benefits. And, you get regular investment-based payouts in the form of interest earnings or coupons. You can enable the TIPS option for US treasuries and bonds to make them inflation-resistant. You can also look for structured notes like Principal Protected Notes or PPNS and capital-protected ELNs to further diversify your HNW (high-net-worth) portfolios.

B- Mutual Funds and ETFs

You can look for mutual funds that allow you to set up passive investment options for your wealth portfolios. The fund managers of MF houses monitor how the assets perform in the market.

On the contrary, if you are looking to actively trade your funds similar to equities, you can look for exchange-traded funds, or what is abbreviated as etfs. These ETFs can diversify your investment options like stocks or equities.

For a low-cost investment exposure, you can also look for index funds like the S&P 500. With passive investing strategies and automated internet tools, you can manage your investment portfolios using hands-off methods, too. This is when you are busy with your 9-5 jobs and you are looking for additional sources of income to grow your money.

C- Private Equity

You can procure shares and debentures of companies or firms that are not listed on the stock exchange and are privately owned. You have start-up firms and small-scale service enterprises where you can invest. As an HNWI, investments via private equity ventures can help grow and diversify your investment portfolios. You can take part in management-aided buyouts and leveraged buyouts to own shares and investments via PE firms. Indulging via venture capital initiatives or funding start-ups and private companies can lend you potential returns on your investment options over making traditional investment moves, of choosing bonds or equities.

D- Hedge Funds

Hedge Funds usually require investors to invest higher proportions of their funds in their investment portfolios. And, HNWIs have no trouble doing that. The sums of money are utilized in aggressive financial strategies like:

- Shares Arbitrage or using options to hedge/ speculate prices of shares or securities that are bought and sold via stock exchange markets

- Using high-yield bonds to generate potentially higher income for investors

- Investing through small-cap stocks that guarantee higher level capital appreciation over a relatively shorter span of time

These are high-reward, high-risk investment strategies that investors use to boost their investment portfolios.

E- Real Estate

HNWIs can procure commercial and residential properties across the country or city they resie in. This way, you can have a hands-on to passive income like collecting rental income from business owners or residential tenants who stay inside your properties.

To further diversify your investment portfolios, you can invest in real estate assets like shares, securities, or mortgage bonds. This way, you can enjoy the appreciating real estate industry even without physically owning tangible assets.

You can also own shopping plazas and service-oriented sky scrapers across special economic zones to enjoy tax benefits that arise from the same.

F- Customized Portfolios

You can own separately managed accounts, or SMAs, to diversify your investment portfolios. As an HWNI, you can appoint a private wealth management firm or hire the services of a private wealth management practitioner to help you build investment portfolios right there from scratch.

Wealth Management firms collect a percentage of income on AuM (Assets Under Management) while private practitioners can charge you on an hourly basis or use flat slabbing payment methods to levy from their clients.

This way, your portfolios would be separately managed and contained as against group or pooled investments that are managed or controlled by Mutual fund companies or investment-grade banks.

G- Art and Collectibles

HNWIs buy paintings from famous painters or from reputed art galeries to hang inside their palatial homes or bungalows. To enhance the aesthetics of office decor these works of art and other expensive collectibles are procured in huge numbers.

Art decals and paintings can further be auctioned once you have had them inside your homes or office outlets for a couple of years. In auctions, you can win whopping bids and earn a fortune by selling your paintings or art collectibles.

H- Cash equivalents

HNWIs know the importance of fetching liquidity from their investment portfolios. So, they usually buy currencies like yen, dollars, pounds, euros, or bitcoin. And these translate into easy liquidity. HWNIs also invest a portion of their income in money market funds that convert into liquid cash easily. This way, they meet their immediate financial requirements without entirely breaking into the other investment portfolios. They also invest in gold bars so that money or hot cash can be fetched on an easier platter.

What are the important factors HNWIs look for when it comes to investing?

Here are three golden rules the HNWIs look for when it comes to looking for investments. Let us have them covered for you as such:

A- Diversification

They believe that putting all the eggs inside one basket does more harm than good. Therefore, they diversify their investment portfolios over average or novice investors. They create customized wealth baskets comprising cash equivalents, stocks, bonds, money market funds and real estate assets so that their wealth baskets look wholesome.

B- Long-term investing

HNWIs believe in financial discipline and therefore follow meticulous strategies when it comes to choosing investment portfolios. Therefore, they invest in long-term investments wherein market volatilities negate over time and interest rate compounds adding more value to the portfolios.

C- Adding time-horizon investments to portfolios

The HNWIs are seasoned investors who know how to bifurcate their financial goals and objectives on a seamless platter indeed. Therefore, they choose time-horizon investments that help them fulfill their short-term, mid-term, and long-term financial goals or objectives in a phased manner. They do not want to get stuck in easy loopholes and would do what it takes to get there.

The Bottom Line

THE HNWIs usually follow the rigorous recommendations given to them by their wealth management firms and have their road maps charted for them in advance. Therefore, you must follow disciplined financial habits to be able to pave the way for your freedom and happiness in the long run. What are your thoughts on this? Do let us know in the comments below!

Frequently Asked Questions or FAQs

Explain how HNWIs look at investments

Answer: The way a high-net-worth individual looks at investments differs vividly from the way an average investor does. They prefer their bulk money going into investable assets and personalize their portfolios to gear up to their financial goals and objectives. Retirement planning or estate planning, or other types of holistic investment solutions are always on the cards for HNWIs. They get in touch with private foundations, fine art galleries or trusts to tailor more diversified portfolios