Introduction

As an insurance subscriber, it is quite essential that you know or understand what are the different stages that form a part of your insurance cycle. Only then, you would get vital cue cards with respect to how the insurance domain functions in an end-to-end manner.

Would you love to know what these invigorating stages are in the insurance industry?

On this parlance, let us understand the different stages that are involved in an insurance cycle. Helping you get started further on the same:

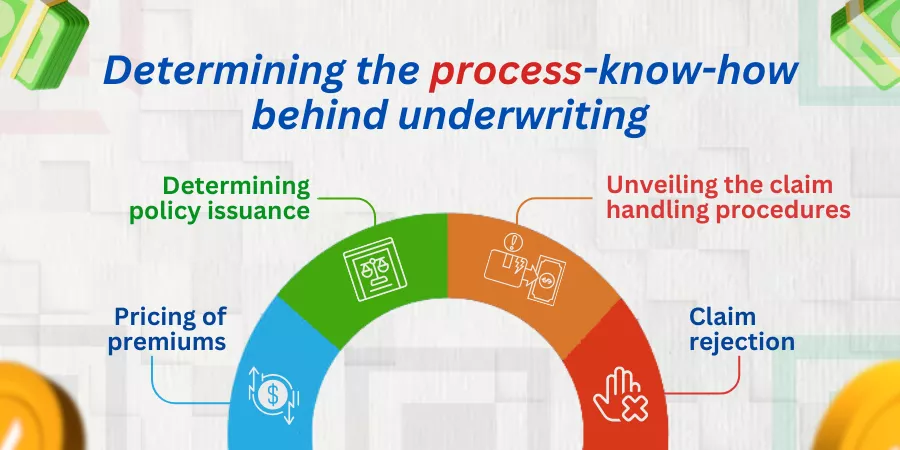

Determining the process-know-how behind underwriting

Underwriting is the first and foremost step in the process of the insurance cycle. Here, you find that different insurance service providers involve themselves in assessing the risk factors of policyholders. And, the factors they look for include:

- looking into the type of policy coverage

- the applicant’s history- here you check for claims made by the same applicant with a different vendor

- claims data and

- other risk indicators

This way, you assess the overall risk factor that underlies every single policyholder and set premium amounts for every policy coverage you plan doling out for the firm.

And, insurance policy underwriting forms a crucial step in deciding what policies you must cover as an insurance brand and what policy coverage amounts can suit individual policyholders on the whole.

Pricing of premiums

Premium pricing is the next important step you aim for in an insurance cycle. Here, you must price the premiums relating to the overall inflationary norms that stand tall in the marketplace.

The premiums must be priced in such a manner that a common man must be able to pay up these in a hassle-free manner.

Here, insurance service providers take mean averages of salaries of people who have different designations vis-a-vis the mid-range that arrives on a computational scale as such.

While the premium pricing is done accurately, more and more of lower-income groups can also have access to mandate insurance policies as such.

Determining policy issuance

Once you set the premium price and your firm’s underwriting policy gets completed, you are all set to roll out the policy document to insurance subscribers.

As an insurer, you must outline the policy-related contract documents diligently and comprehensively.

Here, you provide an exclusive set of terms and conditions that relate to policy inclusions, policy coverage exclusions, claim handling procedures, amounts insurance customers can claim vis-a-vis their limits, deadline dates for claim recovery, etc.

Unveiling the claim handling procedures

As an insurance service provider, you must provide a clear-cut intimation on how claim requests must be provided in case your customers suffer losses in lieu of the policy coverage scenarios they have taken up the policies for.

You can provide guidelines to newbie policyholders on how they can achieve the maximum amount of claims in correlation to the policies they have signed up for.

Once your policyholders submit their claim requests, you validate the terms of the claim and look if the losses are in congruence with the policy coverage limits the policies are for. And, then, you settle the claims as stated on the policy documents.

Claim rejection

If a specific policyholder does not submit claim requests in the manner they are to be submitted, you reject the claims of the policyholder. You can reject claim requests in case you find that tampered documents or bill receipts are attached to the Claim forms.

You can reject claims if the forms are filled untidily or inaccurately.

Otherwise, if the policyholders have inflated their claim amounts just to receive the maximum value from the policy coverage limits, then you have every authority to reject their claims. You must mention the clear reasons as to why their claims are rejected and how can they re-file their claim requests.

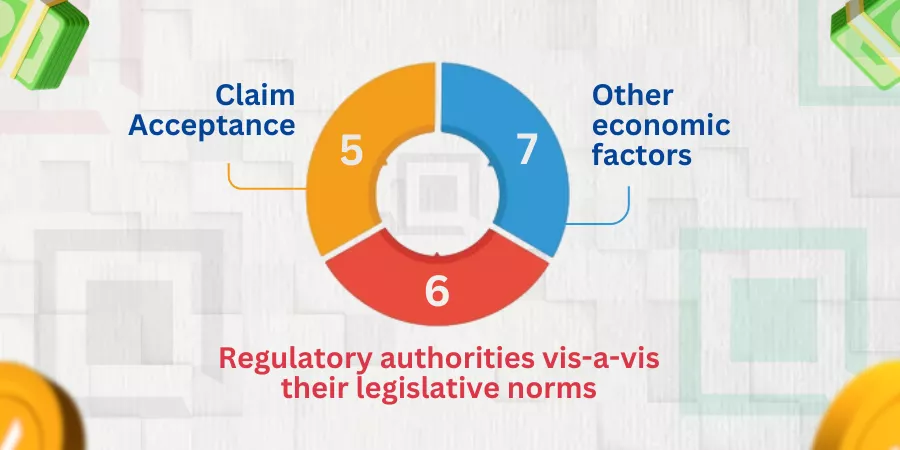

Claim Acceptance

As an insurance service provider, you can accept claim requests if a policyholder has submitted all the documents neatly and diligently. You look if the bill amounts add up to the coverage limits the policy document specifies.

Once the overall checks are done, you put forth the claim request forms to your finance department to further issue a demand draft in the policyholder’s name or credit the money as a wireless settlement in lieu of the claim amount that stands applied for. It would take around 10-15 days for an insurance service provider to settle the money with policyholders.

In case of a cashless hospitalization claim, you must submit the bills while the insured nominees continue their stay at the hospital. The bills can be submitted on the hospital’s letterhead and you can scan these documents as e-attachments on the service provider’s online portal. The claims get processed faster and the bills can be settled by the insurance provider to the health care facility. And all of this happens just within 24-48 hours from the time of receiving your bills.

Regulatory authorities vis-a-vis their legislative norms

Insurance subscribers are usually protected by government-owned legal and state-owned legislative authorities as it is the responsibility of the government to safeguard the hard-earned money of millions of insurance policyholders.

Therefore, if you feel that your claim requests have been denied without proper explanations or you owe the claim money to be credited into your bank account and the firm is blatantly denying your claim requests, then you have every right to question the authority of the insurance service provider and move to a legislative authority or sue legal claims to help you sustain the coverage amount that you are looking for.

Other economic factors

As an insurance service firm, you can look for other econic factors such as changing interest rates or volatile forms of inflationary norms that can impact your premium pricing amounts by a greater extent indeed.

Here, you can rework your policy pricing in terms of premium amounts vis-a-vis their slabs you plan stipulating for your insurance customers. And you can re-work on the underwriting figures too.

The Bottom Line

We have seen a realistic overview on what the different stages of an insurance cycle are and what you you must do to ensure fair view practices that are doled out to service providers and to policyholders on the whole.

What are your thoughts on this? Do mention it on the comments below!

Frequently Asked Questions or FAQs

Do insurance companies hire third-party agencies to complete their underwriting cycles?

Answer: Yes, insurance firms can hire third party agencies or work with independent underwriting exponents in carrying out the underwriting cycle of the overall life insurance cycle.

Does the cycle remain the same for all types of insurance except life insurance?

Answer: Not necessarily. The insurance cycle steps as have been cited for you in the blog write-up apply to all types of insurance policies including that of life insurance. Here, the only difference is in a life insurance policy, the primary policyholder is no longer alive. So, you allow the nominee of the holder to manage bills and claim requests.

Insurance cycle is a phenomenon- Do you accept the statement?

Answer: Whether the cycle is a phenomenon or you consider the cycle as the top challenge for managing insurance claims vis-a-vis requests or refunds, it depends on the smooth rapport you maintain between the policyholder and the insurance service provider.

Describe the process of underwriting

Answer: Underwriting is the process of matching insurance prices against the current market rates. It is believed that underwriting cycles are predominantly important steps in the curation of different insurance policies. The underwriting cycles are inevitable as it is the underwriting capacity of an insurance firm that affects the risk management of the insurance domain on the whole.

An underwriter must be highly experienced and it is the efficiency of the underwriter that helps the brand sustain its business cycles. And then, you raise premiums wherein the premiums are low as compared to the compensation a policyholder receives as a salary component.

Can you describe other factors that affect the insurance cycle?

The cycle affects casualty insurance holders and the inherent biggest challenge for an entity is the availability of top-class underwriters who dole out insurance policies to bust or cover uncertainty situations since at least the 1920s.

Inflation rates, changing interest cycles, and economic conditions are other factors that impact premium pricing vis-a-vis the policy assurance amount the service provider offers to customers on the whole.

The digital transformation wiki tells how managing the cycles is getting more streamlined and how once considered an insurance domain a complex one is now showing more promising standards today.

As claims management teams are now audited from time to time, the market hardens are reducing too. The operational efficiency is now going to become better over the next few years while insurance firm relaxes underwriting standards too and Wikipedia is making headlines with respect to the cycle challenge as was faced in 2007 at the wayback machine helping firms garner better net promoter scores or nps scores impending regularity over time.

A classic example hurricane andrew September 2007 at the wayback reveals how insurance was then and now how accurately predict claims are changing the insurance landscape as of today.