Are you approaching retirement age with no savings in the bank? Here’s an alarming fact: nearly half of adults aged 55 to 66 have zero dollars saved for retirement, according to a U.S. Census Bureau report from 2022.

This blog post will guide you through strategic steps and smart decisions that can help build a financial cushion, even if your golden years are just around the corner. Read on to navigate this challenging yet achievable quest toward a peaceful retirement life.

Key takeaways

● To retire without a nest egg, make every dollar count. Spend less and save more.

● Downsizing your life helps you save. This may mean selling big things like homes or cars.

● Look for ways to lower health costs. Try healthy living, use Medicare or Medicaid, and find cheap medical plans.

● Social Security is important when you retire. It can add to your income.

● Getting help from a money expert is good. They can guide you on how best to plan for retirement.

● Always pay off debts fast. Use smart steps like paying cash only and setting aside part of your salary each month for debt payments.

● Start saving now even if it feels late. Boost the amount you save; use workplace plans and good timing.

● Hire a financial expert if you need help in planning out your budgeting strategies properly.

Strategies for Retiring Without a Nest Egg

One of the most common bits of advice from financial professionals is to start saving as early as you can. That’s absolutely true. But what if you didn’t and are now approaching retirement with little or nothing in savings? The reality is that it’s not likely to be easy. You’re going to need to find ways to save more now, increase your income in retirement, and/or reduce your retirement expenses. So to retire without a nest egg, you must learn to make every dollar count by saving meticulously and cutting unnecessary costs. A frugal lifestyle often involves downsizing your home or relocating to an area with lower living expenses.

Trading equity for income through methods like selling property or getting a reverse mortgage can supplement your retirement fund. These strategies involve smart budgeting and prioritizing financial choices that support a sustainable post-retirement lifestyle.

Making Every Dollar Count

You need to be wise with your retirement dollars. Spend less and save more. Buy only what you need. Cut costs where you can. Luxuries like fancy meals or pricey personal trainers are things to stop buying.

Start using a budget app like Ramsey+ EveryDollar Budget App to help keep track of your spending and saving goals. Pay off any high-cost debts first. You may even think of using a low-interest loan or card for this purpose since it’s an option available for refinancing high-interest debt.

Downsizing Lifestyle

Living small can lead to big savings. This is the idea behind the downsizing lifestyle. It’s about cutting back on things you don’t need and focusing on what truly matters. You might decide to sell your large house and move into a smaller one.

You could also trade in your expensive car for a cheaper model.

Cutting down costs doesn’t end with property and cars though. Smaller items matter too! From giving up fancy dinners to not having regular manicures, every dollar saved helps boost retirement savings.

Living a frugal lifestyle may seem tough at first but it gets easier with time as you set new spending priorities.

Relocating with Savings in Mind

Moving to a new place can save you money. Pick a cheaper market or retirement community. You will spend less on lifestyle costs like housing and transportation. Selling your house may also help, giving you extra cash in retirement.

But be smart when choosing the location. Look for places that have lower property taxes and subsidized rent options to cut your spending even more.

Trading Equity for Income

Selling your home can help you retire with no savings. You may have a lot of money tied up in your house. This is called equity. You can turn this equity into income by selling your house.

Use the cash from the sale to live on or invest for more income. Be sure to pick a less costly place to live after you sell your house. This way, you save even more money.

Optimizing Your Health Care Savings

Saving on health care is a big part of planning for retirement. There are many programs to help you save on medicine and doctor visits. Look into Medicare or Medicaid. These programs can lower your bill at the doctor’s office.

Another option is Pharmaceutical assistance programs, where drug prices are reduced.

Cutting costs in health care can also be done by staying healthy. Regular check-ups can catch problems before they become bigger and cost more money later on. Eating right and exercising often will keep you fit and avoid disease down the line too.

A healthy lifestyle now will save money when it’s time to retire.

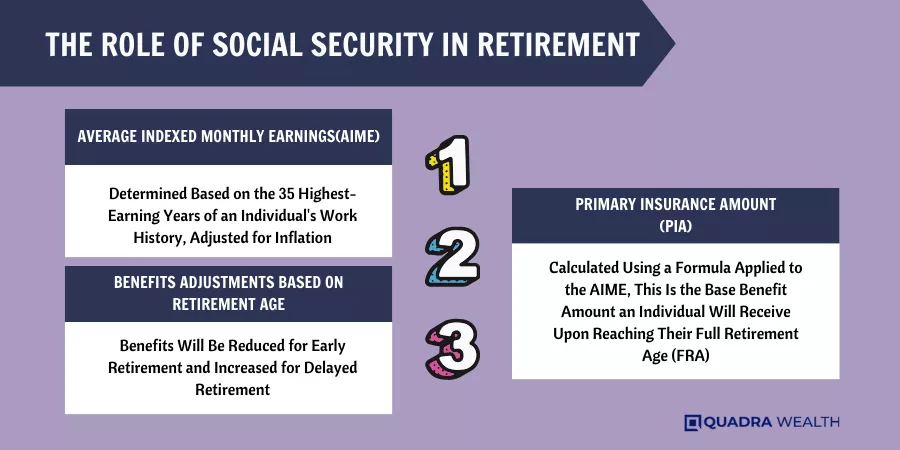

The Role of Social Security in Retirement

Social Security benefits are a key part of most retirement plans. You can start getting Social Security benefits as early as age 62. But, waiting past that age will get you more money each month.

If you wait until age 70 to take your benefits, your monthly payment will be the highest it can be.

Some people might also work part-time in retirement for extra cash and to stay busy. Work monthly income plus additional income from Social Security could result in a good standard of living. Home equity is another way to boost your income if cash is low.

A reverse mortgage lets you tap into home value while still living there.

Importance of Professional Financial Assistance

Getting help from a financial advisor is key. They are experts in money matters. They can guide you on how to save and invest wisely for your retirement. A good advisor will look at your cash flow, debts, and assets.

They use this info to make a custom investment plan for you.

Their job is not just about money plans. They also consider risks that may hurt your savings goal. For example, they think about things like health costs in the future or changes in taxes.

With their advice, you know what steps to take towards retiring with no savings.

Also, talking to an expert can give peace of mind too! Just imagine having someone who knows all about money working with you every step of the way! So be sure to find a good financial advisor if you want secure and worry-free golden years.

Making Up for Lost Time in Retirement Savings

It’s never too late to save for retirement date – discover how to take full advantage of 401(k) contributions, eliminate debts, and prioritize your savings in this section. Don’t stop here; read on for valuable insights and strategies.

Taking Advantage of 401(k)

Use your 401(k) well. Put more money in it if you have not been doing so. In 2023, the IRS says you can put $22,500 into it. If you are 50 years old or older, you can add an extra $7,500.

This is big news! Why? The money gets to grow without taxes touching it if you use a traditional IRA and a Roth account too. So start now – every dollar makes a big difference for your future.

Eliminating Debts

Paying off debt is a key step to retire in five years with no savings. Here are some ways to do it:

- Stop using credit cards: Don’t build up more debt. Pay in cash or use debit cards.

- Make a list of all debts: Know how much you owe and the interest rates.

- Pay off the smallest debts first: This can give you a sense of progress.

- Set aside money for paying debts: Use part of your income each month.

- Find ways to make more money: You can take on an additional job or sell stuff you don’t need.

- Cut costs in other areas: Lower your bills and stop buying things you don’t need.

- Talk to the people you owe money to: They may let you pay less if you explain your plan.

- Seek help from a financial advisor or coach if needed: They can give expert advice on how best to pay off your debts.

Prioritizing Retirement Savings

Making retirement savings a top goal is key. Here are ways to do it right.

- Boost your saving rate: Save as much as you can and aim for a high rate.

- Use workplace plans: This includes options like 401(k) or 403(b). The IRS lets you give $22,500 to this in 2023.

- Think about age: If you’re 50 or older, you can put in an extra $7,500.

- Choose the right account: Traditional IRAs and 401(k)s delay tax time. But Roth accounts grow and won’t be taxed later.

- Get expert advice: A certified financial planner (CFP) can guide you to make sound choices.

- Pay off debt: Try to clear any credit card balance or other debts before retirement.

- Cut costs now: Live a frugal lifestyle and downsize if needed to save more for your retirement fund.

Investing in Professional Financial Help

You may need help to plan your money. A financial expert can guide you. They know a lot about savings and investing. This person can look at your money details. They see how much cash comes in and goes out each month.

An expert also looks at what you own and owe, called assets and liabilities. They see your net worth or the value of what you own minus what you owe. With these insights, they can make a plan for your retirement fund.

It might seem costly to hire an expert but it could be worth it. These professionals have deep knowledge of finances and retirement plans that most people do not have.

Conclusion

Retiring in five years with no savings is a tough task, but it’s doable. Use your money wisely and live a simpler life to save more. Get help from an expert to create the best plan for you.

Don’t forget that Social Security can help too! You have what it takes to make this dream come true.

FAQs

Yes, it’s a big challenge, but you can retire with no savings. You need smart acts like cutting costs, making savvy investments, or maybe working part-time.

Fidelity offers tools such as the Social Security calculator and expert financial advice to help you understand your retirement income options from pensions and annuities.

Quick savings may come from downsizing your home or finding less costly housing. Refinancing debt or using programs that save on health care expenses also helps.

SmartAsset provides a financial advisor matching tool that can pair you with experts who provide guidance based on your risk profile and pre-retirement income needs.

One option is to delay taking retirement benefits like social security or pulling funds from individual retirement accounts (IRA) until necessary; this allows those holdings to continue gaining value.

Yes! A behavioral scientist might say frugality leads to smart spending in retirement. Moreover, a trained Money Coach might suggest actionable budget strategies around fixed living expenses like transportation costs.