Introduction

As an investor who is new to the world of investing, there are a whole new lot of options that the investment world throws light into. With technological advances, the financial landscape is also turning into a phenomenal paradigm indeed.

You have bonds or Govt-backed mortgages that may have fixed rates of return. Here, you may just have to park your funds into these bonds for 10/15 or 25 years and therefore investors get a limited market exposure here.

The equities may require investors to have a better hold over risk handling owing to the volatility that is involved in buying or selling direct investment shares in the market. With varying dividend options, this can get a tad tricky as well.

The third main investing option is getting in touch with hybrid notes. The notes are popularly known as structured notes or structured products.

The note has a debt component with an underlying asset added to it. You may have underlying assets like shares, credit notes, high-paying stocks, or currencies to name a few.

Attractive options are added by product issuers to make the notes more yield-enhancing. For instance, buffer spreads or barrier limits added to notes can provide downside protection against the investor’s capital investment.

The issuers get the notes autocalled, once the said prices are reached against the purchase or strike prices the assets were valued at, in the beginning. Likewise, there are several methodologies or techniques you can adapt to as an investor wanting to maximize your returns with investment.

On this note, let us deep dive into how to hedge autocallable notes and make your investment option a more viable one. Shall we get started on this?

What are autocallable notes- Meaning and conceptualization explained

Autocallable notes are investing instruments that are traded frequently. This is because the structure of the note is investor-friendly and non-decisive.

These are short-term investments that can be auto-called by product issuers as and when the final price points of underlying assets that the notes are linked to reach the par or above-value price points that are also known as strike prices or initial purchase prices of the referenced assets.

And, the preset barrier limits provide downside protection to investors against losing the entire value of their principal investment. Therefore, once the value of assets breaches the preset barriers, the notes are automatically redeemed.

The maturity period of these notes is not fixed. The notes can be auto-called on observation dates before the expiry of the notes.

The investor may receive the principal payments and coupon payouts depending on how the asset has performed throughout the term of the note.

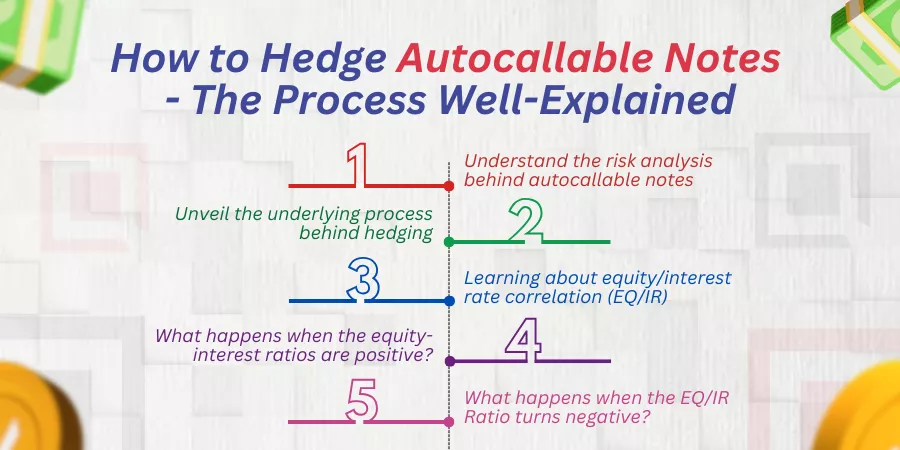

How to hedge autocallable notes- The process well-explained

Hedging follows a typical process on the investing scale. You have a typical protocol on how to hedge autocallable notes. Helping you with pointers for a better level of understanding:

Understand the risk analysis behind autocallable notes

As an investor, when you want to make alterations to your trading instrument, you must understand the overall consequences of your actions. Similarly, understanding the risk analysis behind autocallable notes is the groundwork or homework you must perform as an investor.

You can create a cheat sheet for your structured plan and see if you can visualize how autocallable payoffs happen. You consider each block as the barrier of stock going down or hiking against the initial barriers as set on coupons.

You can keep adding observation dates to similar how the notes may work out for you. This process can help you diligently track your moves indeed.

Unveil the underlying process behind hedging

Hedging of autocallable notes is a process wherein the investor or the seller sells some of his coupon bonds to buy extras of the other version.

To make your understanding simpler, this is how the process technically works. For instance, you as a seller have a couple of five-year zero-coupon bonds under your autocallable notes portfolio. However, you feel that the interest-bearing component works better across two-year zero-coupon bonds.

Therefore, when you sell what you possess/own to procure another variant of the same investment portfolio, the process is known as hedging.

Learning about equity/interest rate correlation (EQ/IR)

You must understand how the ratios between equity and interest rates differ from one observation period to another. Say, for instance, the five-year zero coupon bonds have underlying assets wherein the stocks have to potential to reach 110% of the initial price and the timed observation period here spans over two years. Here once the two years are done, the stocks are auto-called, and therefore autocallable notes mature.

On the contrary, when the seller or the investor buys two-year coupon bonds over the proceeds he receives on selling the five-year coupon bonds, the process is known as delta hedging as the seller hedges between two-year and five-year zero coupon bonds to alter his interest exposure.

In a nutshell, by learning how the equity between stocks works in correlation to the stocks you own, hedging becomes a more feasible option to help you get better yields over your investment trades before the expiry of the trading period.

What happens when the equity-interest ratios are positive?

You must understand the fact that the EQ/IR (Equity-Interest) ratios can be positive or turn out negative.

Let us assume a scenario wherein the EQ/IR ratios are positive:

Here, the equity increases, and therefore we can find a positive probability of the underlying stocks hiking up over this point in time. So, there is a higher possibility of the notes being auto-called before the term of the investment.

The seller hedges his five-year zero coupon bonds to buy more two-year zero coupon bonds to reduce his period or tenor of the investment portfolio. While this happens, the investor or the seller might incur losses over pre-redemption or pre-selling his procurement of five-year bonds in favor of purchasing two-year bonds.

Here, the interest rate increases through the hedging process as the automated coupons keep accumulating for the entire two-year period. Therefore, with a favorable EQ/IR scenario, the returns on investment increase significantly.

What happens when the EQ/IR Ratio turns negative?

Here, when the equity increases, the interest rates fall. This is a probability with the negative EQ/IR scenario. While this happens, the prices of bonds can increase.

The investor hedges his five-year bonds to make instant profits from the sale process. At the same time, he buys the procurement of two-year bonds at increased prices. The net profits increase as the equity increases and the EQ/IR correlation is negative.

The Bottom Line

You must understand that hedging autocallable notes is a yield-enhancing strategy that must be carried out precisely after knowing the prevalent market conditions across your index or contingent assets to which the notes are linked. The liquidity on hedging funds can decrease the value of rally spreads, which the assets are subject to.

A first-time investor can get in touch with a wealth management firm online or across a retail establishment to have a clearer picture of how investment plans work.

A thorough risk profiling ratio is arrived at after computing the risk tolerance potential of every potential investor. You must also read the terms and conditions of the offer document carefully before you sign in on the dotted lines.

What are your thoughts on this? Do let us know in the comments below!